- Trend trading, also known as trend following, is a strategy that involves identifying and profiting from prevailing market trends. It revolves around riding these trends for as long as possible.

- The Turtle trading experiment, led by Richard Dennis in the 1980s, showcased the potential of trend trading. It taught inexperienced traders his trend-following system, resulting in remarkable profits, some of them becoming prominent figures in the trading world.

- Trend traders use various tools and indicators, such as moving averages, the Golden Cross and Death Cross signals, trend lines, and momentum indicators like RSI, MACD, and Stochastic Oscillator.

Have you ever heard the trading mantra: “The trend is your friend?” How true is this? How can you make it work for your trading success? What makes trend trading not just a strategy but also a philosophy?

In this article, we will share everything you need to know about the trend trading strategy. We will also show you how to use it on the market. So, let’s get to it.

Table of Contents

Table of Contents

- What is the Trend Trading Strategy?/a>

- What are the Best Tools and Indicators for the Trend Trading Strategy

- How do you Trade Trends?

- What are the Trend Trading Strategy Pros and Cons?

- Why is Trend Trading an Effective Technique to Trade Financial Markets?

- Can you make money trading the trend?

- Is trend trading a good strategy for beginners?

- Is trend trading more profitable for long-term traders?

What is the Trend Trading Strategy?

Trend trading, also known as trend following, is a trading strategy that forms the bedrock of many successful traders’ portfolios. The trading style revolves around the simple yet powerful concept of identifying and capitalizing on the prevailing direction of market trends. Traders using this strategy meticulously analyze financial markets to detect trends that can lead to profitable opportunities.

Once a trend has been discerned, a trend trader can spring into action. Their primary goal? To ride the trend for as long as possible.

When an uptrend is identified, for instance, traders often enter into long positions, anticipating further price appreciation. Conversely, when a downtrend is confirmed, they may opt for short positions, positioning themselves to profit from falling prices.

Further, based on the trend trading theory, the market is rarely trending. When it does, a trend trader must identify and capture this trend movement and ride the wave for as long as possible.

The Turtle Trading Experiment

The history of trend trading would only be complete by mentioning the legendary Turtle trading experiment of the 1980s that popularized the technique. Spearheaded by the visionary commodities trader Richard Dennis, this experiment aimed to prove that trading skills could be taught and anyone could become a successful trader.

Dennis selected a group of inexperienced traders, affectionately called the “Turtles,” and imparted his trend-following system to them. This system relied heavily on technical analysis, encompassing a variety of technical indicators and rigorous risk management techniques. The outcome was nothing short of remarkable.

While precise figures are elusive, some sources suggest that the Turtle traders collectively amassed over $100 million in profits. Several Turtles, including Jerry Parker, who founded Chesapeake Capital, and Paul Rabar, who established Rabar Market Research, became titans of the trading world, generating staggering returns for their clients using the trend trading strategy.

What are the Different Types of Trends?

Understanding the various types of trends is crucial for trend traders. Here’s a brief overview:

- Secular Trends: These are long-term trends spanning years or even decades, typically driven by structural shifts in the economy or demographic changes.

- Primary Trends: Lasting for months to a few years, primary trends are often influenced by shifts in the business cycle or significant political and economic events.

- Secondary Trends: Shorter in duration, spanning weeks to a few months, shifts in investor sentiment or technical factors often trigger secondary trends.

- Intermediate Trends: These trends extend from days to a few weeks and are typically driven by changes in supply and demand for specific assets or fluctuations in market volatility.

- Minor Trends: Lasting just a few days, minor trends are the focus of day traders and swing traders. News events and changes in market trading activity frequently influence them.

What are the Best Tools and Indicators for the Trend Trading Strategy?

Trend traders use various tools to make their analysis more accurate and seamless. The following are the most popular ones.

Moving Averages

Moving averages (MAs) are one of the major tools in trend trading. These indicators provide traders with valuable insights into the average price of an asset over a specified period. The core idea behind MAs is to smoothen out price fluctuations, making it easier to identify trends.

Generally, moving averages are a broad concept, and there are various to use. One effective method is identifying the moving average crossover – “Golden Cross” and “Death Cross” signals.

The Golden Cross is a bullish technical signal in which a short-term moving average, such as the 50-day moving average, crosses above a longer-term moving average, typically the 200-day moving average. This crossover suggests a potential uptrend in the market and is seen as a buy signal by traders and investors.

The Death Cross, conversely, is a bearish technical signal occurring when a short-term moving average, like the 50-day moving average, crosses below a longer-term moving average, typically the 200-day moving average. This crossover indicates a possible downtrend and is considered a sell signal by traders and investors.

There are other trading strategies involving moving averages. For instance, there’s the triple moving average crossover strategy, 8, 13, 21 EMA strategy, and so many more. However, one common thing with all moving average trading strategies is that they all involve some form of crossover.

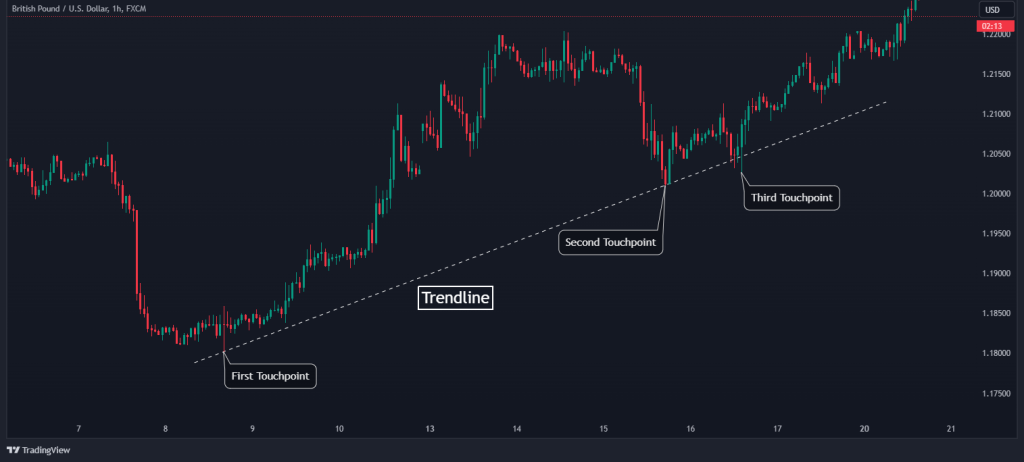

Trend Lines

Trend lines also help traders chart the course of trend price movements. These straight lines connect two or more price points on a chart, effectively outlining the direction and slope of a trend.

Trend lines serve a dual purpose for trend traders. Firstly, they act as navigational aids, providing a clear path by highlighting the direction of a trend. Secondly, trend lines can reveal potential trading opportunities when used in conjunction with other technical indicators and candlestick patterns.

For instance, a trader may be looking for a bullish chart pattern, such as a double bottom, forming in proximity to an uptrend line. This convergence can signal a surge in bullish momentum, making it a strategic point for trend traders to consider their entry.

Momentum Indicators

Momentum indicators play a vital role when gauging the strength of a trend and identifying opportune moments to enter or exit the market. These indicators provide insights into the vigor of price movements.

These are the most popular momentum indicators used in the trading industry:

Relative Strength Index (RSI): Operating on a scale from 0 to 100, the Relative Strength Index (RSI) assesses the speed and magnitude of price changes. A reading above 70 suggests an overbought condition, potentially signaling an impending reversal. Conversely, a reading below 30 indicates an oversold condition, hinting at a potential upward correction.

Moving Average Convergence Divergence (MACD): Comprising the MACD and signal lines, this trend-following momentum indicator offers critical insights. When the MACD line crosses above the signal line, it signifies a bullish trend, while a crossover below the signal line indicates a bearish trend.

Stochastic Oscillator: The stochastic oscillator scrutinizes an asset’s closing price relative to its trading range over a specified timeframe. Just like the RSI, it oscillates between 0 and 100. Trend traders employ the stochastic oscillator to identify overbought and oversold conditions, aiding in pinpointing potential reversals.

Chart Patterns

Chart patterns also offer glimpses into trends, and they can be effective tools for trend trading. For instance, the Three Black Crows and Three White Soldiers candlestick patterns are examples of continuation patterns because they tend to signal that a prevailing trend will continue. Similarly, other chart patterns, such as the High Tight Flag pattern and the ABC Correlation pattern, can suggest what trends are prevailing with rules on how to take advantage of them.

How do you Trade Trends?

Now that we have covered the most popular tools for effective trend trading strategies, here’s how to use them

Step 1: Identify a Moving Average Crossover

Whenever the 50 and 200 EMA cross, they give us a hint of the market’s direction. We know we are in a downtrend if the price is below these two indicators. On the other hand, when the price is above these two indicators, we are in an uptrend and can look for BUY opportunities.

From the GBP/USD chart above, you can see that the trend is uptrend, and bearish movements are merely corrections of the overall trend. So, as long as the price is above the two Exponential Moving Average (EMAs), you are looking to enter buy trades.

Step 2: Confirm the Trend with MACD

The MACD is used in this scenario to get extra insights into what is going on in the market. Alternatively, traders can use stochastics or the Relative strength index. However, it is not advisable to use these together as their functions are quite similar, and using them on the same chart provides no meaningful edge to the market.

From the above chart, combining the MACD indicator with the moving averages helps us to catch more entries while riding the trend. Another thing to note is how the moving average helps us to ignore the false buy and sell signals coming from the MACD.

Step 3: Apply Risk Management Techniques

Proper risk management is essential in trend trading. Since no trend lasts forever, setting our stop loss and defining our exit strategy is important. One of the most effective ways to set stop loss is to set it below the swing low (in an uptrend).

Now that we are in a profitable trade, how can we exit our position? For a BUY position, we will wait for the price to close below any of the moving averages with at least two candlesticks. For a SELL position, we simply wait for the price to close above any of the EMAs with two or more candlesticks.

What are the Benefits and Limitations of the Trend Trading Strategy?

With all their benefits, trend trading strategies have some downsides as well. Here is an overview of the pros and cons of this trading technique.

Benefits of Trend Trading Strategy

One of the primary advantages of trend trading is the potential for substantial profits. By identifying and following established trends, traders can ride the momentum of price movements in the direction of the trend. This can lead to significant gains over time, especially when trends persist for extended periods.

Clearly, this trading style can be applied to various asset classes, including stocks, currencies, commodities, and more. However, some markets tend to trend more than others. This flexibility allows traders to diversify their portfolios and reduce risk by spreading investments across different assets.

Pros

- Helps traders to ride on a trending market environment

- Objective decision making

- Diversification potential

- Reduced time commitment

Limitations of Trend Trading Strategy

Trend trading is not without its challenges. Markets can exhibit noise, leading to false signals resulting in losses. Trend traders must filter out such noise and differentiate between genuine trends and temporary fluctuations. It typically involves waiting for confirmatory signals before entering or exiting a trade. This can result in delayed responses to rapidly changing market conditions, potentially missing out on some short-term opportunities.

Cons

- Trending market is involved with market noise and volatility

- Delayed entry and exit level – finding the exact time to enter and exit can be a difficult task

- Potential for drawdowns

Why is Trend Trading an Effective Technique to Trade Financial Markets?

Trend trading is an effective financial market trading technique because the market often moves in three major trend directions: upwards, downwards, or sideways. With proper trend trading skills, traders can take advantage of two of these market directions: upward and downward.

Here are other reasons this approach is highly effective:

1. Riding the Momentum

Trend trading harnesses the power of momentum. When a financial asset is in a strong uptrend or downtrend, it tends to attract more participants, creating a self-fulfilling prophecy. This phenomenon is known as the herd behavior in financial markets. As more traders jump on the prevailing trend, it strengthens, offering ample opportunities for profitable trades.

2. Reducing Noise

One of the primary challenges traders face is separating the signal from the market noise. Trend trading simplifies this process by focusing on clear and sustained price movements. It allows traders to filter out the market’s random fluctuations, making their decision-making process more straightforward and less prone to emotional biases.

3. Historical Evidence

Historical data supports the effectiveness of trend trading. A study by Insert Research Source analyzed the performance of trend-following strategies over the past several decades. The results showed that, on average, trend traders achieved consistent returns, outperforming many other trading approaches.

4. Versatility

Trend trading is versatile and can be applied to various financial markets, including stocks, forex, commodities, and cryptocurrencies. Whether you’re a day trader or a long-term investor, you can adapt trend trading to suit your trading style.

5. Automation

In the age of technology, trend trading can also be automated using algorithmic trading systems. This allows traders to execute their trend trading strategies with precision, 24/7, without emotional interference. Automated trading systems can backtest strategies and adjust to changing market conditions, increasing their effectiveness.

6. Psychological Advantage

Trend trading also offers a psychological advantage. When traders are aligned with the trend, they are less likely to second-guess their decisions or be swayed by market noise and emotions. This mental clarity can lead to better trading outcomes.

In a nutshell, trend trading is certainly among the most effective trading strategies. As shown with the turtle experiment, almost anyone can learn how to trade profitably with this technique as long as they are ready to commit to learning and proper risk management.

Can you make money trading the trend?

You can certainly make money in trend trading. Trend trading strategies are popular in financial markets, and many traders have found success by identifying and capitalizing on them. In fact, some of the most successful and richest traders in the world are trend traders. By following the prevailing market trends and using technical analysis tools to make informed decisions, traders aim to profit from the price movements that align with these trends.

However, it’s important to note that while trend trading can be profitable, it also carries inherent risks, and not all trades will result in gains. Successful trend trading requires skill, discipline, consistency, and a thorough understanding of the strategy.

Is trend trading a good strategy for beginners?

Trend trading can be a suitable strategy for beginners as it offers a clear and systematic approach to trading, making it easier for newcomers to understand and follow. However, success in trend trading requires discipline, risk management, and the ability to analyze charts and indicators effectively.

Is trend trading more profitable for long-term traders?

Well, trend trading strategies can be profitable for both short-term and long-term traders, but the approach and goals may differ. The profitability of trend trading for either group depends on their skill, market conditions, and risk management. Long-term traders may have the advantage of potentially larger trends, but they also need patience and the ability to endure market fluctuations. Short-term traders may benefit from more frequent opportunities but must be adept at managing risk in faster-moving markets. Ultimately, the profitability of trend trading depends on the trader’s strategy and execution.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.