What is Forex? Introduction For Beginners

If you’ve ever traveled to another country, the chances are you have visited a currency exchange booth and exchanged your money into the currency of the country you were visiting. If that’s you, you’ve participated in forex!

But before you embark on the forex trading journey, what exactly is forex?

What is the Forex Market?

Forex market is short for ‘foreign exchange market’ (sometimes abbreviated to just FX market). It is a global marketplace where one currency is exchanged for its equivalent value in another currency. Simply put, it’s the market where national currencies are traded.

The forex market is the most liquid and largest financial market globally, with an average daily trading volume exceeding $7.5 trillion.

All the world’s combined stock markets don’t even come close to the total turnover of the Foreign Exchange markets. Unlike other financial markets like the stocks and commodities market, Forex is a decentralized market, and currency pairs are traded worldwide. This means that there is no central location, and there are no formal exchanges where transactions take place.

What’s more? Forex is a market that rarely closes! The currency markets are open 24 hours a day and five days a week, only closing down during the weekend. So, unlike other markets like the stock and bond markets, the Forex market does NOT close at the end of each business day.

How Does the Forex Market Work?

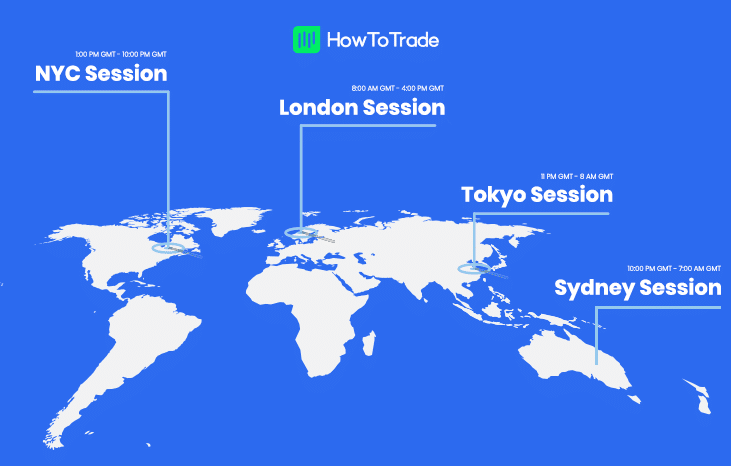

The Forex market can be broken up into four major trading sessions. The Sydney session, the Tokyo session, the London session, and the New York session. Some forex brokers and forex traders prefer to differentiate sessions by continent names. This is known as the ‘Forex 3-session system’. These sessions consist of the Asian, European, and North American sessions (Asian and Australian sessions are often combined into one).

In terms of the specifics, the Forex market opens in New Zealand on Monday morning, which is called the Sydney session. It makes no sense, but we don’t make the rules. It is open daily throughout the week until it closes on Friday at 5 p.m. EST. Other than the weekends, there are just two public holidays when the entire Forex market is closed: Christmas and New Year’s Day.

How Does Forex Trading Work?

Now that you understand how the forex market works let’s show you how forex trading works:

Forex trading can mean two things. It can mean the actual exchange of one currency for another. For instance, you want to travel to Japan from the United States. You have US Dollars on you, but they spend Yen in Japan. So, you must exchange your dollars for what it’s worth in Japanese Yen.

To know what your dollars are worth in Japanese Yen, there’s something called an exchange rate. An exchange rate is the predetermined price of one currency when compared to another. For instance, the exchange rate of USD to JPY as of the time of this writing is 151.19. This means for every dollar, you can exchange it for 151.19 Yen.

One way to put it us that you bought 151.19 JPY using 1 USD. You can also see it as selling your 1 USD to buy 151.9 JPY.

Exchange rates fluctuate a lot depending on many factors. Some of these factors include political climate, macro and microeconomics within the involved countries, monetary and fiscal policies such as interest rates, and so on.

That is one part of forex trading.

The other part of forex trading involves taking advantage of this constant price fluctuation to make a profit. Someone who does this kind of trading is called a forex trader. Traders would speculate the future value of an exchange rate between two currencies. If they’re right, they make a profit, And if they’re wrong, they make a loss.

This forex trading style involves the use of trading strategies and analysis systems to try and predict what the value of the exchange rate will be in the future. You’ll often see them staring at candlestick charts of red and green bars that have little sticks above and below them. Many even draw up a robust trading plan, doing some technical analysis, all in a bid to predict future price movements.

This second type of forex trading is most common among individuals. To start trading this way, you need to open a forex trading account with a reputable online broker in the market. A forex broker gives you access to the forex markets and enables you to place orders and execute your trades on a trading platform.

Key Takeaways

- The forex market is the over-the-counter market where currencies are traded.

- It’s open every day of the week except on weekends.

- Forex trading always cycles within three sessions: Asian, London, and New York sessions.

- Forex trading involves buying and selling one currency with another. It is the act of exchanging one currency for the other. It can also mean speculating on the future values of the exchange rates between currencies.

There you go. Your brief introduction to forex trading. Now that you know what the forex market is about, do you think trading forex could be your thing? Before you answer the question, take a look at our next lesson which talks about the forex market participants.

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."