- Order blocks refer to a situation where central banks or large financial institutions accumulate large quantities of a particular asset through one big order.

- To utilize the order blocks trading strategy, it is advisable to use supply and demand levels, volume indicators, and level 2 market data.

- Ideally, the best way to use this trading technique is to naturally identify accumulation or distribution areas that are happening due to central banks and large institutions’ activity in the markets.

The order block is a unique trading concept that refers to price levels at which large institutions and investors enter the market.

This article explains order blocks in the forex market, how to identify them, and how to add the order block trading strategy to your trading arsenal.

Table of Contents

Table of Contents

- What Are Order Blocks in Forex?

- Mastering Forex Trading with Order Blocks (VIDEO)

- How To Identify Order Blocks in Trading

- Types of Order Blocks in Forex Trading

- How to Trade Order Blocks: Step-by-Step Process

- 3 Things to Consider When Using the Order Blocks Forex Trading Strategy

- Order Blocks Forex Trading Strategy PDF

- Order Blocks Forex Trading Strategy – Pros and Cons

- The Bottom Line

- Frequently Asked Questions

What Are Order Blocks in Forex?

Order blocks are supply or demand zones where large players place substantial buy and sell orders, often resulting in very large transactions and directional impulse on the chart. They are those areas where the central banks or large financial institutions accumulate large quantities of a particular asset.

The world of trading has undergone significant changes over the past few decades, with individual retail traders becoming increasingly involved in predicting price movements and understanding market dynamics. It’s a common practice for central banks and financial institutions to manipulate the markets without any individual trader being aware. While two or three decades ago, not many retail traders knew about this, let alone do anything about it, the game is quite different today.

With advanced trading platforms and tools, retail traders can now employ specialized techniques to compete with these large players. The order block, for instance, is an offshoot of this advancement. With it, retail traders can identify where institutional traders have placed their orders.

Mastering Forex Trading with Order Blocks (VIDEO)

Check our video, and in a nutshell, learn everything about order block trading in Forex and how to trade them.

How To Identify an Order Block in Trading

As we explained above, order blocks are a collection of orders made by large financial institutions, central banks, and governments. But how do you identify the levels where these orders are clustered?

Let’s see three ways to identify order blocks in trading:

1. Level 2 Market Data

If you are using level 2 market data, you might be able to identify them by seeing above-average order quantities without any significant consideration of the price. This is how central banks and large investment banks typically make their purchases – buying large amounts of the asset at a narrow range of prices.

2. Price Consolidation

Ranging or consolidating price actions can also serve as order blocks. These areas usually remain sensitive even after the price has broken out of them, so they’re still likely to cause the market to change the direction of the price approaches them once again.

3. The Root Opposing Candle Before a Break of Structure

This method of identifying an order block is common among Smart Money Concept traders. To them, an order block is the lowest candlestick or cluster of candlesticks before the price forms a new high in a bullish scenario. In a bearish scenario, the order block is the highest candlestick or cluster of candlesticks before a new low is formed.

Talking about bullish and bearish scenarios, let’s see the types of order blocks that there are

Types of Order Blocks in Forex Trading

There are three common types of order blocks, depending on how the price reacts when it comes in contact with them. They are:

- Bullish order blocks

- Bearish order blocks

- Breaker blocks

Let’s look at them in some more detail.

1. Bullish Order Blocks

A bullish order block (BuOB) is a situation where a central bank or a big financial institution accumulates large quantities of a specific currency. These serve as demand zones, so when the price returns to them, they’re likely to bounce back up.

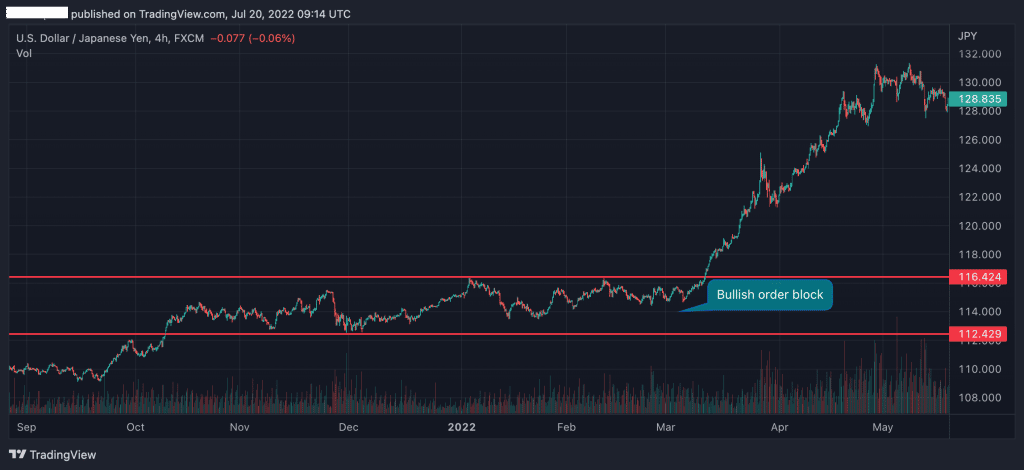

As you can see in the USD/JPY 4H chart above, the market was trading in a tight range for a long time. During this time, we can see several candles with high trading volume at which buyers accumulate the asset (the candles with high trading volume are primarily green).

2. Bearish Order Blocks

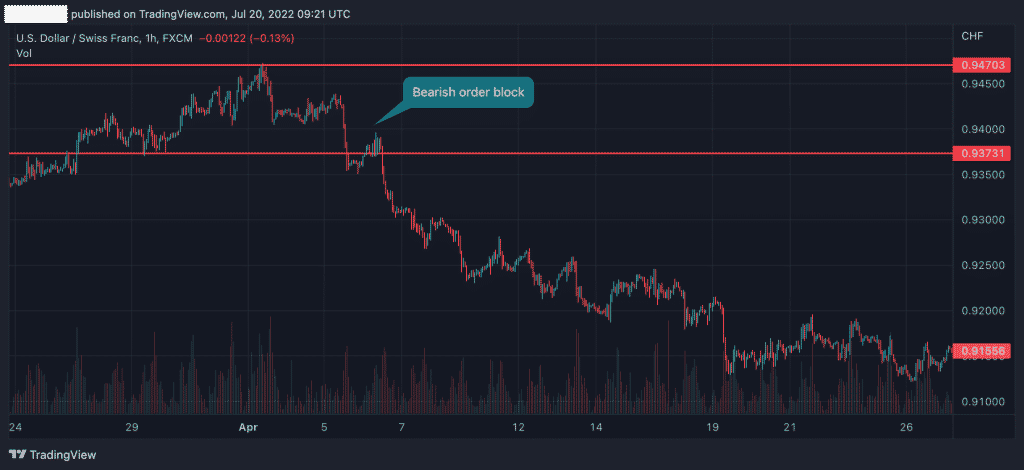

Bearish Order Blocks form at price zones where big institutions are about to sell off a pair. These price zones remain sensitive as supply zones, and the price tends to reverse if it enters these zones in the future.

The distribution area shows that a big player sells large amounts of USD and buys the Swiss Franc.

3. Breaker Blocks

What happens when an order block fails to hold or reverse the price in the expected direction? Instead, the price goes through the block like it wasn’t there. It’s completely failed, right? Wrong.

This is where breaker blocks come in. Breaker blocks are order blocks that fail to reverse the price in the expected direction but are still useful for future reversals in the opposite direction. For instance, a bullish order block is expected to reverse the price into a bullish trend. But if the price gets to the block and passes through it to the downside, this block can still be used as a breaker block. Such that if the price returns to it from the downside, it can force the price back down into a bearish trend.

So, a bullish order block can still become a bearish breaker block. Likewise, a bearish order block can become a bullish breaker block.

We have a separate piece describing Breaker Blocks and how to use them. Check it out here:

4. Rejection Blocks

A rejection block forms when the price attempts to break through a level (typically a previous high or low), but fails and closes back within or just beyond the range it broke out of. This price action structure indicates a strong rejection of the price from a certain level, often leading to a reversal or a sharp movement in the opposite direction.

Here’s a more detailed piece on what rejection blocks are and how to trade them:

How to Trade Order Blocks: Step-by-Step Process

Don’t forget that order blocks are supply or demand zones. Let’s see how to trade them here using an example of the EURUSD chart:

1. Identify your order block

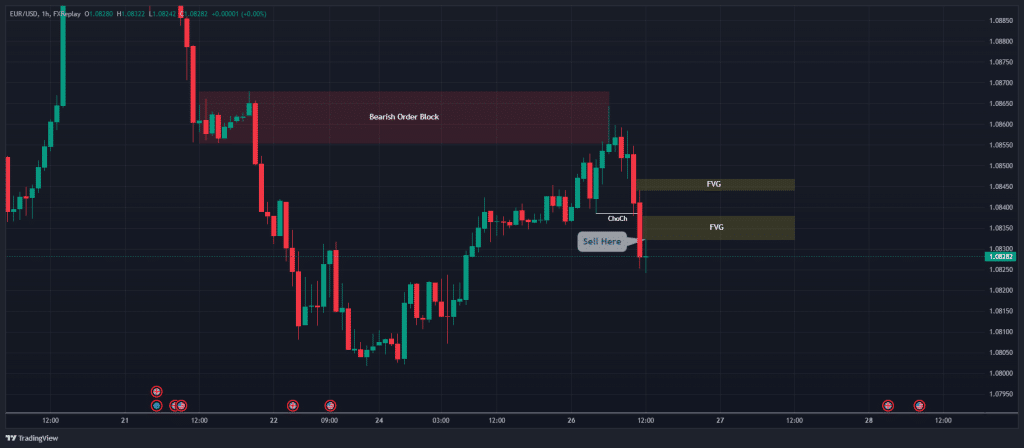

Go to any timeframe of your choice and try to determine the overall trend. Then, draw the order blocks that tally with that trend. For instance, in a bearish market, you want to mark out bearish order blocks, keeping in mind that you want the price to retrace to the bearish order block and continue its bearish run.

Similarly, you want to mark out bullish order blocks in bullish trends so that you can catch bullish trades at pullbacks to the blocks. Don’t forget. The trend is your friend. Unless you have a strong reason to think the trend will change, always trade with the trend.

In our EURUSD 1-hour price chart above, for instance, the overall trend is bearish. We then mark out the most recent order block, which formed from a brief price consolidation.

2. Wait for the price to retrace into your order block.

When the price pulls back to your order block, observe its reaction. Ideally, you want to see a clear reversal with a Change of Character (ChoCh) or a Market Structure Shift (MSS) in your expected direction. It’s also better if the Choch of MSS happens with an impulsive move (or a displacement). This impulsive move is a clear sign that the effect of the order block has kicked on, and a reversal is likely to happen next.

In our EURUSD example, we get a strong ChoCh after the price trades into the order block. This strong ChoCh is characterized by an impulsive move that leaves FVGs behind.

Finding it hard to understand the Smart Money Concepts? Try this piece that gives you a concise overview of the most common smart money concepts and how to use them:

3. Pick an entry point

If all the stars have aligned so far, you can start looking for a trade entry. After your MSS or Choch breaks with a displacement, it’s likely that there are Fair Value Gaps (FVGs) left behind. These FVGs are good entry points.

If you have multiple entry FVGs, you can pick any of them, depending on how much you’re willing to risk. For instance, if you’re sure the trade will retrace further up than the closest FVG to the price action, you can pick one farther away. Of course, this is likely to reduce your stop loss and give you more profit. However, you run the risk of the price not retracing to your farther-away FVG.

For the sake of our example, we’ll use the FVG closer to the current price action.

Confused when you see multiple FVGs? Try another trade entry method that’s relatively less subjective.

Optimal Trade Entry in ICT – What is it and How Does it Work?

4. Set our risk targets

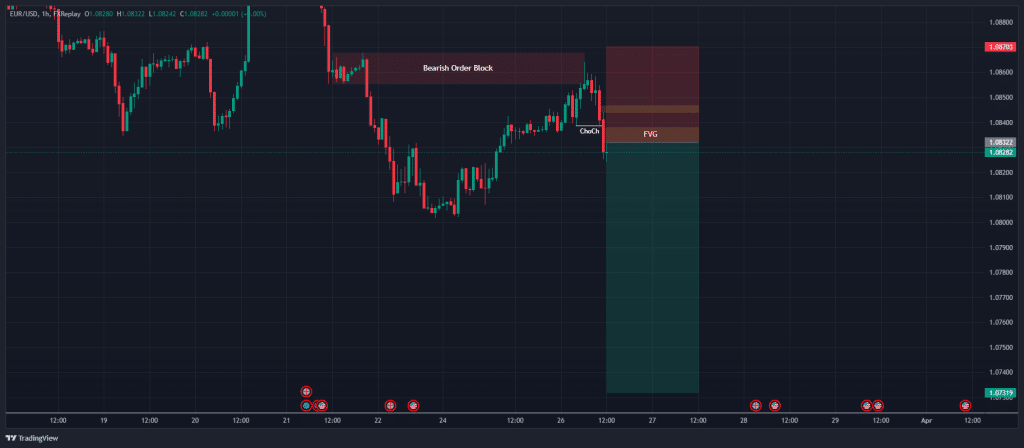

Your stop loss typically should be underneath the order block in a bullish scenario and above your order block in a bearish scenario.

You can then aim at significant previous highs and lows for your profit target. In our example, our target was one of the previous price action lows, and our stop loss was above the order block.

The image above shows how the trade turned out.

3 Things to Consider When Using the Order Blocks Forex Trading Strategy

Order blocks are a unique trading strategy that helps traders find a direction in the market. Usually, it allows traders to find out what financial institutions are planning to do in a particular market and better indicate the next price movement.

To successfully utilize the order block trading strategy, you should consider the following tips:

1. True Order Blocks Do Not Happen Every Day

As you can assume, finding order blocks in the markets is not something you can search for or add to your Forex trading plan.

No one knows when central banks or prominent players enter a market, and you certainly do not get any announcements that it’s about to come. Also, order blocks are not a frequently occurring phenomenon but a rarely-occurring situation.

Therefore, you cannot rely on order blocks as your trading strategy; instead, simply integrate them into your trading system and use them whenever you learn to identify order blocks in the market.

2. The Longer the Range, the Bigger the Move

Usually, during the distribution or accumulation phase, markets tend to trade sideways and move in a specific direction once the pile-up is completed. When that happens, there is one rule to keep in mind – the longer the range, the bigger the move.

For that matter, it is crucial to use the Wyckoff chart pattern and market theory. Based on this strategy, a trader enters a position once the price breaks above or below the resistance or support level, hence, utilize the breakout trading strategy.

Remember that in many cases, central banks and big institutions want to extend the range period so it would be easier for them to complete their purchase around the same level of prices and without having to deal with high volatility and trending markets.

3. Use Volume Indicators

Another crucial factor to remember when using order block trading strategies is combining volume indicators. The reason for this is that you want to find out if the accumulation period is characterized by high volume and if there is a big player that indeed accumulates the asset in the specific supply or demand zone.

As we mentioned, order blocks can seem like a ranging market, but that does not mean every range is an order block. So, to ensure the range is an order block situation, it is best to use a volume indicator to confirm that the trading volume is unusual. Some popular volume indicators include the volume price-trend indicator, the VWMA indicator, the Klinger volume oscillator indicator, and the on-balance volume indicator.

As central banks and institutions typically aim to buy or sell valuable assets that are used by ordinary people and have day-to-day uses, they must create these special orders known as “blocks”.

It’s also important to note that market volatility can cause an order block to be unreliable.

Order Blocks Forex Trading Strategy PDF

Follow the link below to access the Forex Order Blocks trading PDF strategy:

Order Blocks in Forex Trading PDF

Order Blocks Forex Trading Strategy – Pros and Cons

Pros

- Advantageous trading strategy

- Order block trading is an effective strategy, particularly in the foreign exchange market

- Help traders find out what central banks and financial institutions are doing

Cons

- Not easy to find order blocks

- Requires the use of other volume indicators

The Bottom Line

In summary, using order blocks is an excellent way to understand the main drivers of market movements. The forex market, like any other market, is heavily influenced by central banks, who often get into the market to control the value of their currencies.

But even though the order block trading strategy is an effective technique to absorb real-time market information, there is no decisive opinion about how one should implement order blocks into a trading system.

Ideally, the best solution would be to keep this trading technique in mind and use it naturally whenever you have identified accumulation or distribution areas that are happening due to central banks and large institutions’ activity in the markets.

Then, most traders enter a position when the price breaks below or above the support and resistance levels, gaining momentum from the considerable purchase made by the central bank or investment bank.

Frequently Asked Questions About Order Blocks Trading

Here are the most frequently asked questions about order blocks in forex trading:

How do order blocks work in the forex market?

Even though the forex market is decentralized, it is widely known that central banks play a significant role in “manipulating” the levels of their currencies. At the same time, central banks must ensure the stability of their currency’s exchange rate, meaning that they cannot place a big order in the market and spook other market participants.

Consequently, they place orders in blocks or several steps. For example, if a bank wants to buy 200 million British pounds versus the US dollar, it may do it in blocks of 10M, 20M, etc.

How do you know if an order block is strong?

One way to know if an order block is strong is if it leads to a break of market structure, leaving some fair value gaps behind. This usually corroborates the fact that the big banks and large financial institutions have a hand in the move. Another way to know a strong order block is if there was a liquidity sweep just before its formation or if there’s liquidity to be swept after its formation but before the price retraces into it.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.