Needless to say, having a plan before you start trading is essential to your success as a trader. Every experienced trader will tell you that when you enter the markets, you risk your money and, more importantly, your ego and confidence in yourself.

- A well-thought-out trading plan is crucial for forex trading success, safeguarding both finances and self-confidence.

- While many traders are naturally skilled, creating a clear trading plan can still be challenging.

- Using a trading plan template can streamline your strategy and increase chances of consistent profits.

This article will help you with everything you need to know about developing a trading plan. We’ll also include a trading plan PDF, a trading plan Excel template, and a Word document that you can download and use in your trading journey.

What is included in this blog post:

What is included in this blog post:

- What is a Trading Plan Template

- Trading Plan Template FREE Downloads

- How to Build Your Own Trading Plan Template?

- 1. Set Your Trading Goals – Financially and Emotionally

- 2. Get Familiar with Trading Jargon and Analysis Methods

- 3. Develop a Trading Strategy

- 4. Set a Risk Reward Ratio

- 5. Always Learn and Grow

- 6. Make an Organized Trading Track Record

- BOONUS: Trading Plan Infographic

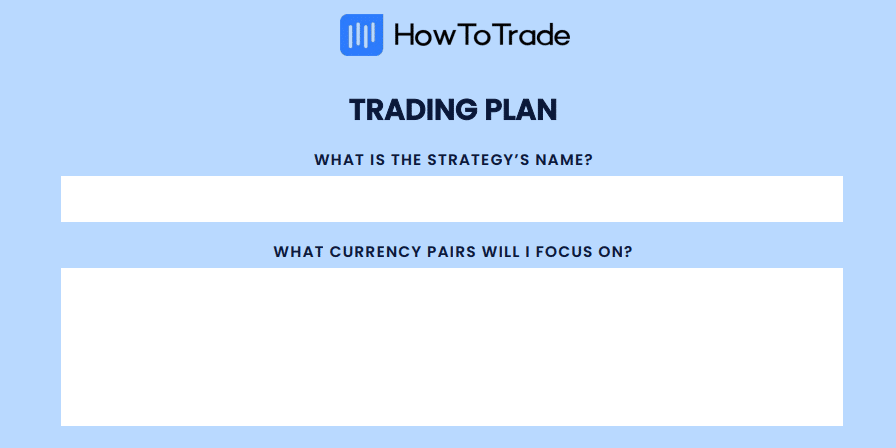

What is a Trading Plan Template?

As the name implies, a trading plan is a set of rules and guidelines that a trader follows to execute a trade. Besides that, a trading plan might include suggestions for a healthy trading daily routine and tasks, hence a trading checklist, that will help you manage your account and control your emotions.

For example, with a trading plan, you can define your:

- trading goals

- strengths and weaknesses

- risk management strategy

- trading strategy

- entry rules

- exit rules

- daily routine

- and much more

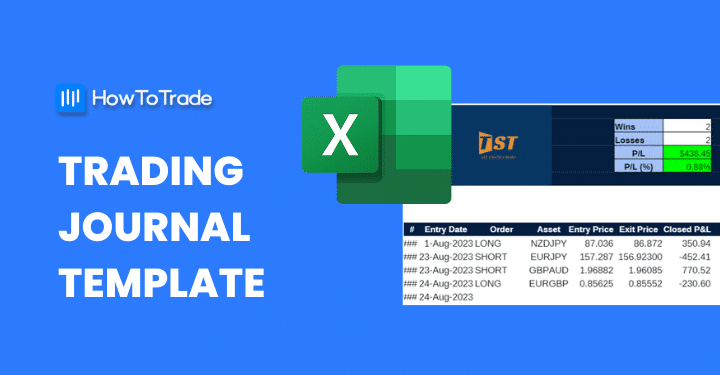

Trading Plan Template FREE Downloads

In this section, we have created free trading plans that you can use in the format of your preference.

How to Build Your Trading Plan Template in 6 Easy Steps

So, now that you understand what a forex trading plan is, you need to create a specific plan that matches your style and personality. Personally, while working as a trader in a proprietary trading firm, I remember every trader had a different method, routine, tasks, and rules.

For example, some traders like adding sticky notes on their desktops while others prefer a clean table. Some traders enter hundreds of trades in one trading day while others enter one or two trades in a day. So, it’s up to you to define your own plan and trading strategies.

Nonetheless, based on my knowledge and experience, there are some must-have steps you need to consider to develop a successful trading plan.

You can download our trading plan template PDF below and check the steps on how to develop your trading plan later in this article.

1. Set Your Trading Goals – Financially and Emotionally

First and foremost, you must define your trading goals. In other words, you will need to know what you plan to achieve from your trading experience.

To help yourself, ask these questions:

- Is it an additional income only? Your main income?

- Do you plan to get rich from trading?

- What is the trading capital you are willing to risk and what is your profit target?

- How many hours a day do you plan to spend on trading?

In that aspect, you’d be surprised to know that many people who become professional experienced traders do not necessarily do it to make money.

Instead, some traders do it for fun, a hobby, or a competitive game. So consider these factors as well. If this is the case for you, then you need to know it before you start trading. Maybe it can give you an advantage over other participants in the forex market.

2. Get Familiar with Trading Jargon and Analysis Methods

Before you make your first trade in the forex market, you first must understand the trading jargon and the different analysis methods.

If needed, take a quick trading course to learn how the forex or the stock market works, read articles, books, financial sites, etc. Additionally, you better explore the two methods to analyze financial assets – technical analysis and fundamental analysis.

Then, find the best way for you to analyze the markets and read Forex charts. It’s up to you to decide whether you want to use line, bar, or candlestick charts and, more importantly, what technical indicators you want to use.

Additionally, you can learn how to read popular chart patterns and use them to find trading opportunities. Once again, you have to try before you know it.

3. Develop a Trading Strategy

There are no two traders that are precisely the same. Therefore, you must find your trading strategy and trading style. This is a result of trial and error. It might take weeks or months until you get to the point where you have established a successful trading strategy, and there’s no way to escape this step.

When you make your first step in the trading world, you’ll get familiar with the different trading strategies – position trading, swing trading, day trading, and scalping trading. Moreover, you can try different strategies such as the naked trading strategy or the 5-3-1 forex trading strategy.

Keep in mind that there are many trading strategies to choose from, but you’ll have to find your unique trading style and strategy within time. For that matter, you need to use trading plans at the beginning of your journey to find the right strategy that matches your personality.

4. Set a Risk Reward Ratio

Trading risk management is a predefined strategy to minimize losses and maximize profits. A trader can use many tools and risk management rules to protect themselves from losses and effectively manage their trading account.

There’s one tool used by many traders, which is the most basic and the most effective of all – That is the risk-reward ratio.

In simple terms, a risk-reward ratio is a method to calculate the potential profit of a trade/day/week/month to a potential loss. In other words, it is a method to define your trade risk, that is how much risk you are willing in a trader, or in a day (the method is particularly for day trading).

For example, if you decide to use a risk-reward of 2:1, you are essentially willing to risk $1 for each trade to earn $2.

5. Always Learn and Grow

Trading is not like most professions. The markets always change, the technology evolves, and even the dynamic of the markets is constantly changing. Trust me, financial markets are not the same as they used to be fifteen years ago, and most likely, they will change again in the future.

I mean, the cryptocurrency market is one good example of the unpredictable nature of the trading world and financial markets.

This way or the other, you must read trading books and articles, watch trading movies and listen to trading podcasts – everything you can do to increase your knowledge. Yes, knowledge is power, but in trading, knowledge is essential.

6. Make an Organized Trading Track Record

In the final step, make sure you analyze your trading past performance and keep track of your winning and losing trades. Yes, it’s an annoying task, especially when you have a losing day.

Writing down your losing trades is a punch to your ego, but it will help you improve your performance and trading decisions in the future. By doing so, you can learn your worst-performing days of the week, hours, financial instruments, etc.

Luckily, in most retail investor accounts, you can enter your trading platform and extract your daily/weekly/monthly performance. So, in the words of Forrest Gump: “One less thing to worry about”.

BONUS: Trading Plan Action Plan Infographic

Here is an infographic with 6 action steps for your trading plan.

You can also check our blog post about using a trading journal template [free Google Sheets and Excel spreadsheets included]

Over to You

In a nutshell, every trader must have a well-defined solid trading plan. Developing an organized trading system is the first step in becoming a professional and successful trader and will increase your chances of success over the short and long term. It will also develop and keep your trading psychology in check as one of the main factors for successful trading.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.