Who Participates in the Forex Market?

Just as buyers and sellers are the participants in a typical market, the forex market also has its participants. You see, the Foreign Exchange market is a world unto itself, with various players, from individual traders like you, all the way up to deep-pocketed commercial and central banks.

Depending on who you ask, there can be as many as 10 participants in the forex market. But we can put them all into five major categories.

Let’s see them:

Who Are the Forex Market Participants?

The following are the major forex market participants:

1. Commercial Banks

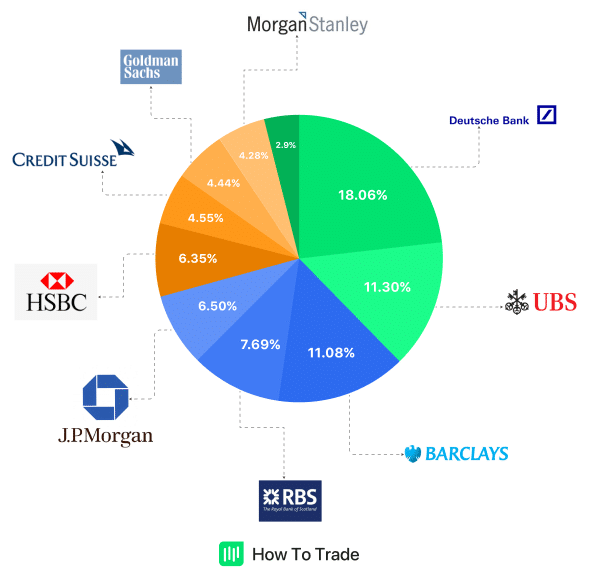

At the top of the Forex market ladder are the largest banks in the world, collectively known as the interbank market or flow monsters.

These commercial banks are responsible for most of the daily trading volume in foreign exchange transactions and include banks like Citi, JPMorgan, Barclays, Goldman Sachs, Deutsche Bank, and any other major bank you can think of. In fact, Deutsche Bank was recognized by the Euromoney FX market survey as the overall forex market leader by market share in 2022. This market share stood at 10.98%.

Commercial banks (and investment banks) take on a ridiculous amount of forex transactions each day for both their customers and themselves. And based on the supply and demand for foreign currencies, these banking giants determine the bid/ask, spread & exchange rates that we all love (and hate).

Based on the supply and demand for foreign currencies, it is these bank giants that determine the bid/ask, spread & exchange rates that we all love (and hate). Beyond that, it is a known fact that central banks also participate in the free Foreign Exchange market to control the exchange rates of their own currency and have a huge impact on different exchange rate movements.

For example, the US Federal Reserve central bank is involved in stabilizing the US currency and the interest rate parity of the US exchange rate.

2. Central Banks

In addition to commercial banks, central banks also participate in the free foreign Exchange market. They control the exchange rates of their local currencies. They have a significant impact on different exchange rate movements. And without them, there would be no currencies to trade because they control the money supply in their countries. It is in the power of central banks to prevent any financial crisis in their countries through their fiscal and monetary policies. And as you might expect, they have a strong pull on the global forex market.

For example, the US Federal Reserve is the central bank that stabilizes the US dollar and its interest rates. All of these activities by the FedReserve affect everything that happens to the US dollar and how much it’s worth compared to other currencies in the FX market.

3. Investment Managers and Hedge Funds

These people trade the forex market on behalf of individuals, foundations, and establishments with large account balances and investment portfolios. And because of the large investment funds they deal with, they often exert significant pressure on the market.

Hedge fund managers rely on the foreign exchange market to hedge against the risk of exchange rate fluctuations that may otherwise affect the companies they represent. The activities of hedge fund managers in the FX market are significant because of the large hedge funds they handle.

4. Corporations

Multinational Corporations (MNCs) are also a major participant. An MNC has branches spread across various countries, but have their headquarters in one country. They also generate a minimum of 25% of their revenue from the branches outside their headquarters. To move money around within these branches, they often have to get involved in a lot of forex transactions.

Corporations and financial institutions are also major players in the forex market. These corporations mostly participate in the foreign exchange market to do business and trade different currencies as speculative transactions.

For example, if a large US company (say Ford) is buying exclusive car parts from a different country (say Japan), they must exchange currencies, which, in this case, is US dollars for Japanese Yen when purchasing the parts. And that’s how they participate in the forex market.

5. Retail Traders

Individual retail forex traders are the smallest fish in the Forex market, representing just 5.5% of all foreign exchange transactions in 2016. But make no mistake.

Retail traders can buy and sell the same foreign currency pairs as other participants in the global Foreign exchange market. However, they have to go through a longer transaction chain to get hold of liquidity. As such, they usually don’t receive the same transaction costs as participants further up the hierarchy.

Retail traders are also unable to affect the forex markets with their trades because they are far too small to make any waves. Their role is to react to what is going on in the wider market and to position themselves accordingly.

Other Market Participants

Other participants in the forex market include governments, forex brokers, market makers, regulators, and exchange-traded funds.

All of these players, in one way or the other, play relatively significant roles in the forex market. Governments invest in the foreign exchange market, for instance, to hedge their own currency against risks of fluctuations in a currency’s exchange rate when compared to a foreign currency. Especially if that market price fluctuation might negatively affect them. Of course, they do most of these through their central banks.

A forex broker makes forex trading possible for individual forex traders through online trading platforms. Some of them are STP brokers, ECN brokers, or market makers. However, they also make trades of their own in the forex market.

- The forex market has many categories of players who participate in it.

- Retail traders like you and I are only a small percentage of these participants.

- Major banks are the biggest players by market share in the forex market

- Other participants include hedge funds, investment managers, corporations, etc.

Final words

So, now you know who the market participants are in the forex market. As you can see, the forex market is complex and is used in various forms, including global electronic trading. This is why it has become so accessible in recent years for any trader who wishes to trade currencies like the Swiss franc, the New Zealand Dollar, the Australian Dollar, the Canadian Dollar, the British Pound, the Euro, and many more.

But let’s not get ahead of ourselves. Next up, what are currency pairs in forex trading?

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."