The Mat Hold is a five-candlestick pattern formed during an ongoing trend and represents that the market is likely to move in the same direction. The pattern can be either bullish or bearish, found in all assets and time frames, and has a high success rate when used correctly.

- The Mat Hold Candle Pattern is a bullish continuation formation that signals the potential for an ongoing uptrend after a brief consolidation.

- This pattern is typically composed of a strong bullish candle, followed by a series of small-bodied candles, and then another large bullish candle.

- Recognized for its reliability in strong trending markets, the Mat Hold Pattern is often confirmed by increased volume and can serve as a strategic entry point for traders.

In this article, we’ll discuss Mat Hold chart patterns, and help you get the necessary tools to use this pattern. Keep reading to learn more about the Mat Hold chart pattern.

Table of Contents

Table of Contents

What is the Mat Hold Candlestick Pattern?

The Mat Hold pattern is a five-candlestick formation that signals the continuation of the ongoing trend. In other words, it is a chart pattern that shows market corrections and take-profit zones before the trend continues to trade in the same direction.

The logic behind this pattern is that any trend must have a pullback, retracement, or price correction before the trend continues to move in its initial direction.

In that sense, the Mat Hold is a chart pattern that occurs when a price correction happens in the market and, therefore, it may provide the ideal entry-level during an ongoing trend. It has a similar structure as the rising and falling three methods pattern, though traders consider the Mat Hold more reliable due to the minor gap that appears after the first positive candle.

How to Identify the Mat Hold Pattern in Trading?

To identify the Mat Hold candlestick pattern, you must be aware of several crucial factors:

- The Mat Hold pattern appears during a bullish or bearish trend

- The pattern consists of five candlesticks – A bullish or bearish candle followed by three opposite candles, and another candle in the same direction as the first candle

- The last candle (in the bullish or bearish version) must close above (or below) the previous fourth candle

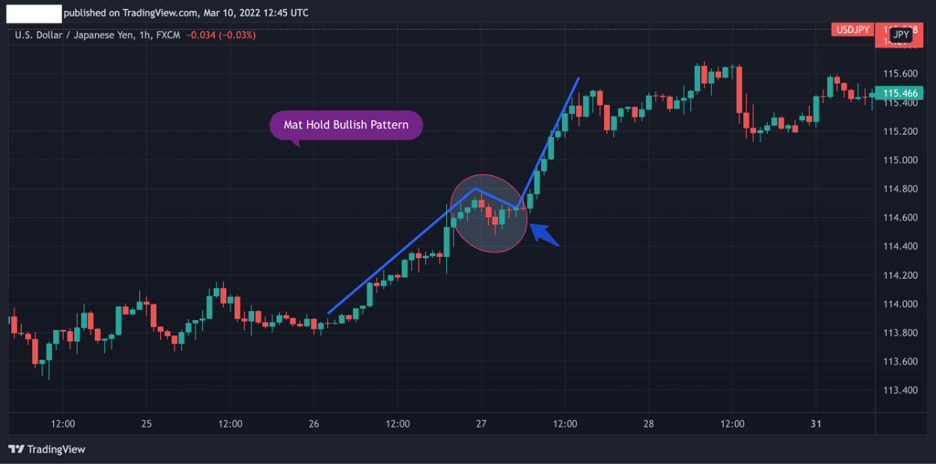

Let’s see an example of the Mat Hold pattern on a candlestick chart:

As you can see in the example above, the Mat Hold chart pattern appears during an ongoing uptrend. The three bearish candles in the middle validate that market participants in the forex market have captured gains. Once the correction is completed, a bullish fifth candle confirms the Mat Hold pattern and the bullish trend continues.

So, now that you know what the Mat Hold pattern looks like and how it works, here are the steps you need to follow to use and trade this chart pattern correctly.

- Identify a market correction during an ongoing trend (bullish or bearish ) with four candles – one first bullish or bearish candle and the following three candles in the opposite direction

- Wait for the fifth candle to close above or below the fourth candle and enter a position when the last candle is completed

- Use Fibonacci retracement levels to set entry level, stop loss, and take profit

- Use the risk-reward ratio to determine your exit points

Mat Hold Candlestick Pattern Trading Strategies with Examples

Trading the Mat Hold pattern means you are looking to join an existing trend. Hence, you are waiting for the market to retrace to get a chance to join the bandwagon without taking high risks.

As we mentioned, the Mat Hold chart pattern can appear during a bullish and bearish trend. And, since it is a continuation chart pattern, you better combine it with Fibonacci retracement levels as an extra confluence trading tool to get a better view of support and resistance levels.

Below, we will show you two trading strategies and examples a bullish Mat Hold pattern and a bearish Mat Hold pattern in combination with Fibonacci ratios.

1. Bullish Mat Hold Pattern & Fibonacci Levels

A bullish Mat Hold is a five-candlestick chart pattern that appears during an ongoing uptrend and signals that the bullish trend is about to continue. The first candle is a bullish positive candle followed by three small bearish candlesticks. The last fifth candle is a big bullish candlestick with a long body that closes above the closing price of the fourth candle (as you can see in the chart above).

Keep in mind that one of the flaws of the Mat Hold pattern is that it requires other tools to get a good entry-level placement and set stop loss and taking profit targets. For that purpose, using Fibonacci support and resistance levels could solve this problem.

As seen in the chart below, drawing Fibonacci retracements from the highest to the lowest level of the previous trend provides valuable support and resistance levels.

In this case, when identifying the Mat Hold candlestick pattern during an ongoing movement, you would be looking for the next Fibonacci level to enter a long position when the last bullish candle is completed (in our example, the 50.0% line).

Stop-loss should be placed at the 23.6% or 0.0% levels, and take profit is set at 61.8% or 78.6% Fib levels.

2. Bearish Mat Hold Pattern & Fibonacci Levels

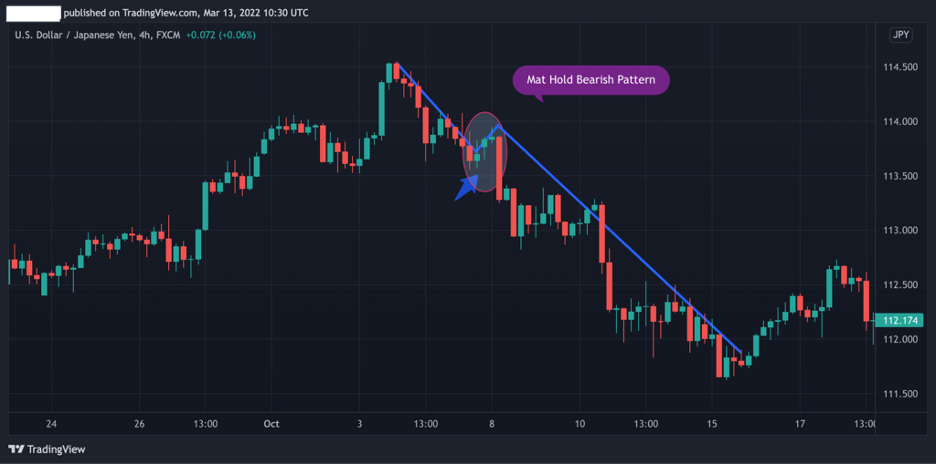

The opposite version of the Mat Hold bullish pattern is the bearish Mat Hold pattern, also known as the inverted Mat Hold pattern. This bearish pattern is made of a first bearish candle followed by three little bullish candlesticks and a fifth long negative candle that closes below the three previous candlesticks.

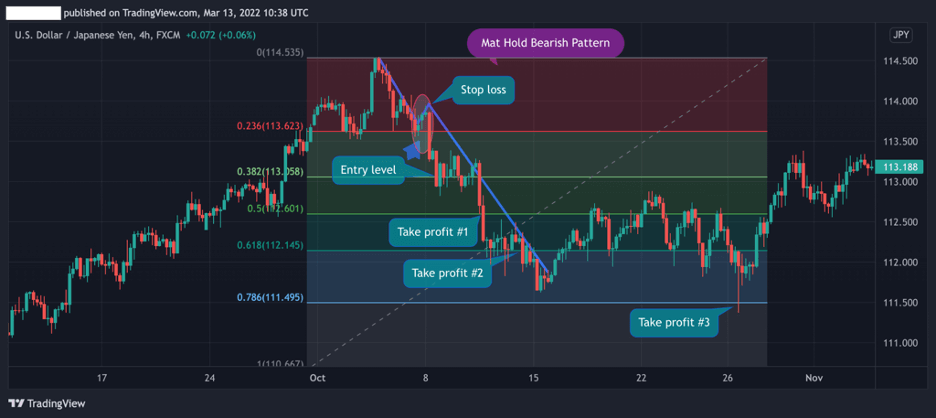

To use Fibonacci retracements when the Mat Hold bearish pattern occurs, you need to stretch the Fibonacci tool (available in most trading platforms) from the low to the high of the prior trend.

To do that, you usually need to expand the chart and find the price range of the previous price movement of the traded asset. This will help you identify support and resistance levels and know the optimal entry point, stop-loss, and take profit.

In the example above – As soon as we identified the Mat Hold pattern at the beginning of a downward trend, we can then draw Fibonacci retracements to get vital support and resistance levels.

As you can see, the 38.2% level is the ideal level for entering a short-selling position, and the target zones could be at any one of the following Fib levels.

In this case, the stop loss could be placed above the highest level of the three candles inside the Mat Hold pattern or at the highest Fibonacci level.

The Mat Hold Pattern – Pros and Cons

These are the most common pros and cons of trading the Mat Hold chart pattern:

Pros

- Accurate and reliable continuation candlestick pattern

- The Mat Hold pattern provides an excellent opportunity to join an existing trend

- Works well in combination with other technical analysis tools

Cons

- Rare chart pattern

Key Takeaways

Here are the key takeaways to keep in mind about the Mat Hold candlestick pattern:

Key Takeaways

Key Takeaways

- The Mat Hold continuation pattern is a five candlestick formation that signals the existing trend is likely to continue

- Mat Hold five candle candlestick pattern can be either bullish or bearish, depending on the market context

- To trade the Mat Hold pattern, a trader must wait until the last fifth candle is completed and closes above the previous three small candles (or below for the Inverted Mat Hold pattern)

- Setting stop loss and take profit orders requires a trader to use Fibonacci retracement levels

Frequently Asked Questions about the Mat Hold Pattern

Here are some of the most frequently asked questions about the mat hold candle pattern in forex:

Is the Mat Hold candlestick pattern accurate and reliable?

The Mat Hold is a rare continuation chart pattern that rarely forms in its classical formation. Still, it is one of the few and most accurate chart continuation patterns in technical analysis that signals traders to join an existing trend.

According to various resources online, the Mat Hold chart pattern has a success rate of somewhere between 78%-82%.

What does the Mat Hold chart pattern indicate?

A mat hold is a candlestick formation found on candlestick charts indicating a previous trend continuation. Hence, this continuation chart pattern helps traders identify a price correction during an ongoing trend and the end of the pullback.

How to trade the Mat Hold five-candle pattern?

Trading the Mat Hold chart pattern means you want to join an existing trend. In other words, the market is in retracement mode, but the trend is likely to continue when the Mat Hold pattern is completed. Therefore, the most effective way to trade the Mat Hold is to enter a position when the fifth and last candlestick is completed with a tight stop-loss order. Further, it is best to use Fibonacci levels and set the target at one of the following Fib levels for a profit target.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.