Types of Forex Orders – All You Need To Know

In the foreign exchange market, to place a trade, you need to make an order. It’s how you instruct your broker to enter or exit a trade on your behalf. However, the days of calling your broker on the phone are over. Now, you need to do everything independently, including placing market orders in the forex market. That’s right, welcome to the modern world.

And because you get to do everything yourself, you must be familiar with the different types of forex orders. That’s what this lesson will teach you.

What’s an Order in Forex?

An order in forex is an instruction a trader gives their broker through a trading platform to open a trade for them. Orders often constitute what currency pair you want to trade (buy or sell), your position size, and the price at which you want to open your trade. An order may also contain the price at which the trader wants to exit the trade.

These orders are important because without them, there’s no way to make a trade with a forex broker. And beyond trade executions, orders are also there to help forex traders manage trades.

As we discuss the order types below, we’ll also show you practical situations where they can be useful.

Forex Order Types

There are nine major types of forex orders that traders use to manage and execute their trades. While these may vary between different brokers, there are some basic order types that all brokers accept.

These orders fall into three categories:

- Market orders: An order that must be immediately executed at the exact price and time of initiating that order. These include buy and sell orders.

- Pending orders: Orders to be executed at a later time and at the price you specify. These include buy limit, sell limit, buy stop, and sell stop orders.

- Trade Exit orders: These orders get you out of trades. They include take profit and stop loss orders.

Let’s take a deeper look at each of these order types.

What is a Market Order?

A market order is an order to buy or sell at the current market price. It is the most straightforward order to get instant market execution. You click the “buy” or “sell” button, and your order gets executed immediately.

Let’s assume the bid price for the EUR/USD currency pair is 1.1920, and the ask price is 1.1922. If you wanted to buy EUR/USD at market price, then it would be sold to you at the price level of 1.1922. And if you wanted to sell EUR/USD at market price, you’d do it at 11.1920. That’s just how ask and bid prices work in forex.

It is important to note that depending on Forex market conditions, there may be a difference between the price you selected and the final price that is executed on your trading platform. This is known as slippage.

The same thing goes for a sell order. You enter the trade at the current trading price.

What are Pending Orders

Pending orders are those that you want your broker to execute at a later time when the price reaches your specified price. That’s why they’re called pending orders. Once you execute them, the order gets approved by the broker, but you won’t get in a trade immediately. But immediately after the price of your currency pair reaches the price you specified in your pending order, your order gets executed.

There are four reasons you may want to set a pending order.

- You want to buy when the price rises to a certain level.

- You want to sell when the price falls to a certain level.

Those first two are called stop orders.

- You want to buy when the price falls to a certain level.

- You want to sell when the price rises to a certain level.

The last two are called limit orders. And for each of these scenarios, there is an order type:

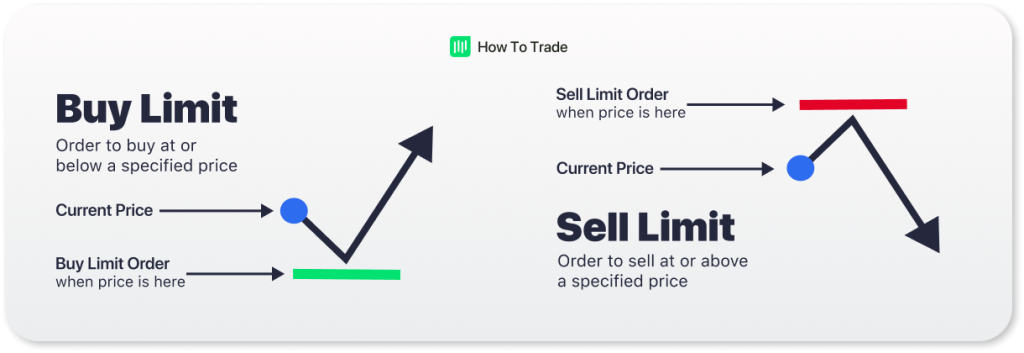

1. Buy Limit Order

A buy-limit order is an instruction to your broker to place you in a long position when the price of your currency pair falls to a certain level. The idea behind this order is simple. Typically, you expect the price to rise when you buy. But just before the price rises, you anticipate a temporary price drop. Your buy-limit order comes in here. It allows you to buy at that lower price.

Assume you’re watching the EURUSD pair. Its current price is 1.1200. The price is currently falling and approaching a support level of 1.1100. You believe that once the price hits this support level, it will bounce back to 1.300. What you want to do in this situation is to set a buy-limit order. This buy-limit order will put you in trade once the price drops to your limit price of 1.1100.

A buy-limit order is like saying, “Hey, broker, I want to buy this currency pair once it falls to a certain price level. I won’t be around for long to constantly monitor the market, though. So here’s my buy-limit order. Buy the pair for me when the price reaches my desired price level.”

2. Sell Limit Order

A sell-stop order is an instruction to your broker to sell you a currency pair when its price rises to a certain price level. Ideally, you want the price to fall to a lower price when you sell a currency pair. But before that lower price drop, the price might have to rise to a certain level (could be a resistance level), and you want to catch the trade at that higher price level. That is where your sell limit order comes into play.

Returning to our EURUSD example, the current price of EURUSD is 1.1100, and it’s rising steadily. However, you expect that the steady rise will only be temporary just before a huge fall ensues. So you set a sell limit order at 1.1200. This means you expect the price to rise to specified limit price of 1.1200 before the broker executes your order.

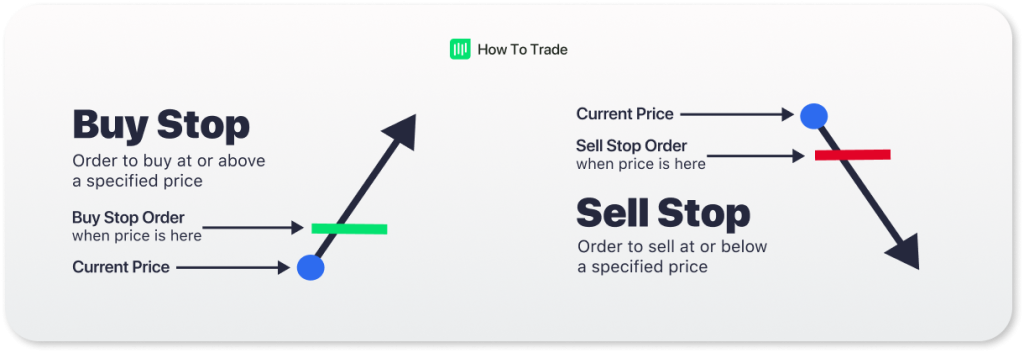

3. Buy Stop Order

A buy-stop order is an instruction to your broker to open a position for you when the price of a currency pair rises to a certain level.

Assume the price of a currency pair is currently rising. However, you anticipate that there may be obstacles at various price levels above the current price that may cause the price to reverse and fall. But if it can overcome those challenging price levels, you expect the price to keep going high. It is in situations like this you want to place a buy-stop order.

So, imagine the price of USDJPY is currently at 150.35 and steadily rising. You think there’s a case for it to rise even further to 170.25, but there’s a catch. There’s a huge resistance level at the 160.43 price level. If the price can push through this resistance level, though, you believe USDJPY will easily go all the way to the 170.25 target. So, you set your Buy Stop order slightly above the resistance level. This way, when the price rises to that level, you want to enter a buy trade and ride the USDJPY pair until it hits your target.

4. Sell Stop Order

A Sell stop order is an instruction to your broker to sell a currency pair when the price falls to a certain level. The idea behind a sell stop is similar to the buy stop, but only in the opposite direction.

For instance, you believe the price of a currency pair will continue to fall. But before that, you expect it to hit a temporary obstacle before resuming its fall. What you do in this instance is to set a sell-stop order.

Trade Exit Orders

These types of orders are slightly different from the order types above. This is simply because the types above are orders to get you into a trade. Whereas a trade exit order gets you out of the trade.

There are three major order types here:

- Take Profit order

- Stop Loss order

- Trailing Stop order

1. Take Profit Order

A take-profit order gets you out of winning trades. It’s the instruction to your broker that whenever the price hits a certain profit target, you want to exit that trade.

But why would you want to exit a winning trade, you may ask? Because the price will not go in your favor for all eternity. That’s the nature of the forex market. Prices rise and fall all the time. And you want to exit your trades at the best possible price and protect profits before it reverses against you.

2. Stop Loss Order

A stop-loss order gets you out of losing trades. It’s your way of telling the broker that if the market moves against your direction, they should help you limit losses at a certain price. Otherwise, if the trade continues to go against you, you may lose all your money.

For example, you went long (buy) EURUSD at 1.1950. To limit your maximum loss, you set a stop-loss order at 1.1920. This means if you were dead wrong and EURUSD dropped to 1.1920 instead of moving up, your trading platform would automatically close out your position for a 30-pip loss.

Remember, losing is a part of forex trading, and a small loss is better than a big loss! Use stop-loss orders when trading the forex markets to mitigate your losses. Take them on the chin and move on. In fact, some brokers wouldn’t allow you to keep trades open without setting a stop loss.

3. Trailing Stop Order

Sometimes, you’re winning a trade, and you expect the price to keep going high. But you don’t have an idea where it might reverse. This scenario is where you might want to use a trailing stop order.

A trailing stop order is your instruction to your broker that if the price keeps going in your direction (either up or down), you want your trailing stop order to keep trailing the price by a certain distance. If the price keeps going in your direction, the trailing stop order continues to go in that direction while maintaining the distance. But if the price starts to reverse, your trailing stop remains where it is until the price hits it.

Let’s assume you’re in a EURUSD short position. The price is falling, and you’re already in profit. However, you’re unsure how long the price will continue to fall before reversing, and you want to maximize profits.

What you can do is set a trailing stop order to trail the price by a certain number of pips, say 5 pips. This way, your trailing stop order will be above the current price by 5 pips. And as long as the price keeps falling, the trailing stop will be 5 pips above the current price. But the moment the price starts reversing, your trailing stop will not reverse with it. Rather, it’ll remain at its position until the market reaches it to close out your trade.

Key takeaways

- An order in forex is an instruction to your forex broker to buy or sell your currency pair on your behalf. It’s what gets you into a trade.

- A forex order would usually contain the currency pair you intend to trade, your position size, your entry price, and your exit price.

- There are three categories of order types in forex: market orders, pending orders, and exit orders.

- Market orders get you instant execution on your trades. Pending orders get you in trades at a later time and price. Exit orders get you out of trades.

- All the order types are buy, sell, buy stop, sell stop, buy limit, sell limit, take profit, stop loss, and trailing stop.

Wrapping Up

You need to know the different types of forex orders and how to implement them in your fx trading strategy, regardless of whether you use fundamental or technical analysis (or both). The are the basic tools for your risk management in forex, and you just can’t do without them. Successful trading revolves around them, not just your trading strategies.

That’s a lot of terms we covered today! But don’t worry if things seem complicated; it gets easier with practice! Within a couple of weeks, you will be setting your own limit orders on your trading platform with one eye closed! In the meantime, feel free to download the cheat sheet below to help you along the road.

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."