- Swing trading is a short-term strategy that involves buying or selling financial assets, usually for a period of two to five days.

- Swing traders often use technical and fundamental analysis as well as other tools such as chart patterns and technical indicators to identify medium-term trading opportunities.

- The swing trading strategy stands between three popular trading styles: day and scalp trading and position trading.

Swing trading in the forex markets involves buying and selling FX currency pairs where the duration between entry and exit position is typically around two to five days. It is arguably the most convenient trading strategy of all, as it generally can be combined with another daytime job, and it does not involve sitting in front of the computer for most of the time.

If you master this trading strategy, you get the ability to trade the markets and a tool for life that will help you make passive income from trading. So, let’s learn how you can spend just 10 minutes per day looking for high-probability forex trading setups with the swing trading strategy.

Table of Contents

Table of Contents

What is the Swing Trading Strategy?

Swing trading, also known as momentum or trend trading, is a short-term strategy for a trader to buy or sell financial instruments using technical analysis tools that suggest an impending price movement. This strategy type can span any length of time, ranging from days to weeks, although most swing traders hold their positions for a period of two to five days.

In swing trading, the primary goal is to hold a position for several days so a swing forex trader can capture the “swing” of a forex asset’s price cycle. The swing trading technique differs from intraday day trading in the sense that it involves fewer trades with more research and the use of technical and fundamental analysis.

How Does the Swing Trading Strategy Work?

The swing trading strategy stands between three popular trading styles: day and scalp trading and position trading. Unlike day trading strategies, the purpose of different swing trading strategies is to capture the trend or the swing and take advantage of these medium-term price movements. Swing traders place a heavy emphasis on fundamental and technical analysis to track a currency pair or any other tradable asset and determine when a swing is likely to occur.

Typically, swing traders put a huge emphasis on the risks and rewards of a position they are about to take. For that matter, proper risk management is a powerful trading tool for swing traders. Like day traders, they will try to capture some short-medium price movements but with a longer outlook of several days. On the other hand, unlike position traders, swing traders avoid getting attached to their trades and may switch their market outlook quite often.

Let’s see an example of forex swing trading:

As you can see in the chart above, a long position was opened when the EUR/USD rose above the 1.0000 rate. This is certainly a signal for swing traders as it is a historical price that triggers many orders in the market. Additionally, the break has occurred following a double bottom or even a triple bottom pattern, which provides an extra signal to enter a trade. Indeed, following the break above 1.00, the price spiked to 1.04 in five trading days.

Does the Swing Trading Strategy Work?

Yes, the swing trading strategy is a profitable trading style. If used properly, you can certainly beat the market over time. However, to do so, you must acquire the practical tools and knowledge to ensure the success of your trading.

It is whatever you make it! But, you must first understand the concept of swing trading and the ultimate goal. For instance, swing traders pay less attention to the win/loss ratio, as opposed to day and scalp traders. Instead, their goal is to have more profit than a loss in their balance by the end of the week, month, or year. This means that one profitable trade can cover nine losing trades and vice versa.

In concept, swing traders believe that they can potentially develop a successful trading strategy with fewer trades, commissions, less screen time, and a more relaxed work-life balance. The swing strategy is suited for those who do not like the high-intensive pressure of day trading and know that their strength is in the ability to correctly analyze the markets and find profitable swing trades.

So, how does the swing strategy work? A swing trader typically follows the market sentiment closely and looks for that one FX currency trade that might provide the swing price movements that last for several days. For market research, they typically use fundamental and technical analysis and several trading tools to pre-determine the potential profit and loss.

Eventually, unlike scalp and day traders, swing traders put a lot of work into finding proper entry and exit levels, with a fixed percentage of loss and profit. They know ahead of time what their trading plan and final goal is.

As such, swing trading suits those who are patient and prefer to work with an organized trading structure and often use a trading checklist before they enter trades. Discipline and proper risk management are also crucial to success in swing trading.

Trading is a business. You should, therefore, think of wins as revenue, and losses as expenses.

Best Tools and Techniques for Forex Swing Traders

Like any other trading style, there are unique tools and techniques you can use to apply the swing trading forex strategy effectively. Let’s take a close look at some of those:

Forex Risk Management Tools

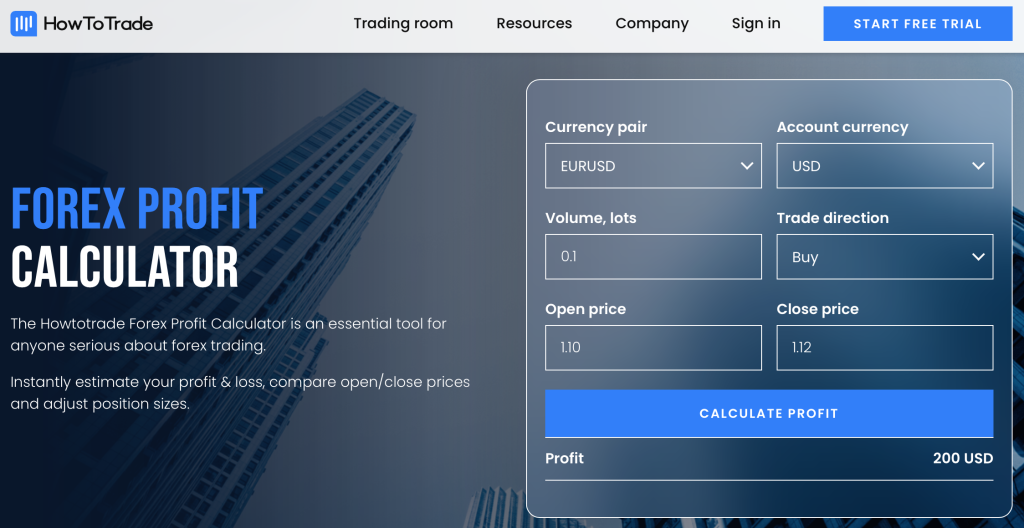

As mentioned above, swing trading is a lot about identifying those price swings and applying risk management tools. This can be done independently or with the help of various trading tools. For instance, such forex risk management tools may include the value at risk calculator, forex profit calculator, swap calculator, and lot size calculator.

For instance, as a swing trader, you can use a forex profit calculator to manage your trades by setting the exit level, whether the trade goes in your favor or against you. For example, let’s say you are about to enter a trade, buying the EUR/USD at 1.10, with a mini lot size position. For that matter, you can use the calculator to manage your position, thus setting a profit target and a stop loss based on your risk-reward ratio.

Remember, risk management is key to success in swing trading. You must know ahead of entering a position the potential risks of each trade you take. Unlike intraday trading, every swing trade you take is important, so you must be prepared for all of the scenarios. In swing trading, less is more, and your success depends mostly on using in-depth market research and proper risk management.

Technical Analysis Chart Patterns

Typically, swing traders specialize in using candlestick chart patterns to capture these short-term price movements. It is an excellent trading technique and perhaps the best swing trading strategy, especially as the vast majority of reversal and continuation patterns work very well for short-term trading movements of several days to weeks.

Therefore, swing traders pay a lot of attention to charting and repetitive chart patterns formed in market price action. For example, they often learn how to draw trend lines and trend channels, add Fibonacci support and resistance levels, and use complex harmonic chart patterns to identify market trends. Keep in mind that, unlike intraday trading strategies, swing traders have the time to analyze the market, which means they can put in the effort and time to find those trading signals. If you feel this might be your direction, we suggest downloading our chart patterns cheat sheet and our advanced chart patterns cheat sheet.

Momentum, Trend, and Volume Indicators

Undoubtedly, technical analysis indicators are an essential tool for swing traders. Whether it’s a momentum, trend, or volume indicator, each swing trading indicator may provide a valuable signal in its own context.

As swing traders aim to profit from these mini trends that arise between a swing high and swing low (and vice versa), they must identify new trend momentums. And for that matter, they use indicators.

Some of the most commonly used swing trading indicators include the following:

- Relative Strength Index (RSI)

- Moving Averages

- Stochastic Oscillator

- Bollinger Bands

- Volume Indicator

- Moving Average Convergence Divergence (MACD)

Fundamental Analysis

Swing traders often put their hearts into a particular trade based on fundamental analysis. This could be market news, interest rate decisions, economic data releases, or a tweet from Elon Musk.

And there’s a reason for swing traders to take a position based on fundamental analysis. Given the fact that news plays such an essential role in financial markets these days, taking positions based on new market development can be a smart strategy. Having said that, no matter how significant the implication of the economic data or news release is, you should always back up your trade with another indicator or any other confluence trading tool.

Since financial markets tend to be forward-looking in their behavior, every piece of information that comes out might be old news immediately after the release.

In concept, swing traders believe that they can potentially develop a successful trading strategy with fewer trades, commissions, less screen time, and a more relaxed work-life balance.

Becoming a Swing Trader – Pros and Cons

Here are the main pros and cons of becoming a forex swing trader:

Pros

- Swing trading can be combined with a daytime job

- It requires less time commitment than scalp and day trading

- Less trading commission and costs

- Stress level is much less compared to intraday trading

- If appropriately used, swing trading can be a highly profitable trading strategy

Cons

- Swing traders must deal with an overnight risk

- It requires a lot of market research and analysis

- Swing traders may miss some long-term traders in favor of capturing medium-term trends

- Swing trading might be less exciting than scalp and day trading

How to Start Swing Trading

The swing trading strategy is ideal for anyone who wants to trade currency pairs in the forex market. It is the sweet spot between day and scalp trading and a long-term investing approach. It is also the ideal trading method for those who want to trade part-time when they have a full-time job.

If you feel swing trading is the right for you and want to start forex swing trading, then HowToTrade is what you’ve been looking for. By the time you finish, you will know exactly what swing trading is and how to make consistent profits in the markets.

The powerful swing trading forex strategy you’re about to learn with us uses simple yet powerful price action and candlestick patterns. It outlines clear entry and exit rules and is suitable for beginners and more advanced traders. You’ll learn how to effectively manage your risk, use technical indicators to find trading opportunities and find strong momentum price swings that last for several days to weeks. We’ll also show you how to use the smart money concept strategy to swing trades. These SMC techniques include the break of structure, the change of character, and the fair value gap.

Frequently Asked Questions (FAQs)

Here are some of the most common questions when it comes to swing trading strategies:

How can I learn swing trading?

Swing trading is a skill that must be developed with guidance, time, knowledge, and training. If you want to learn how to swing trade, you must first understand the basics of this trading strategy and how to make profits out of it. You can start by reading one of our most recommended swing trading books and visiting our guide on the 10 best swing trading podcasts.

How long should you hold a swing trade?

Typically, swing forex traders hold positions for shorter periods, anywhere from one to five days, trying to capture a significant price swing movement. However, some swing traders hold swing trades for several weeks until the price reaches their pre-planned exit levels. Generally, although there are strict rules to applying the swing trading strategy, there is an additional element of sensing the market and making smart decisions to extend your profitable trades and effectively manage your swing positions.

What are the main benefits of the swing trading strategy?

The most notable benefit of forex swing trading strategies is the minimal time commitment. Unlike with day and scalp trading strategies, there is no need to monitor your screen constantly. In fact, you can combine swing trading with a full-time job, checking your positions for several minutes a day.

Another key benefit of the swing strategy is the flexibility of capital management. When you swing trade, you do not have to lock your funds for a long period of time (like the position trading strategy). Instead, you can easily get in and out of positions and use your trading capital wisely. Finally, swing trading has a more significant profit potential than day and scalp trading strategies (although there is a bigger loss potential as well).

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.