Japanese Candlestick Patterns [Cheat Sheet]

You completed ‘em all mate! Like an absolute LEGEND that you are. But legend doesn’t mean robot, and we completely understand that it is near impossible to memorize all Japanese candlestick patterns within a couple of days.

That’s why you need a cheat sheet. Trust us, people of all professions use cheat sheets – programmers, doctors, chefs, students, and many more. And traders are no different. Many beginner and professional traders use notes and cheat sheets to memorize chart patterns, technical indicators, and strategies and get the necessary motivation to succeed in trading. So, on this page, we provide a free downloadable Japanese candlestick cheat sheet.

Types of Chart Patterns

So first, let’s take a quick recap of all the Japanese candlestick patterns we have learned so far in the previous lessons. Remember, in this lesson, we have categorized chart patterns based on single, dual, or triple candle patterns; however, if you prefer to use a different format of chart patterns cheat sheet (reversal and continuations), you can download our chart pattern cheat sheet and our advanced candlestick patterns cheat sheet.

That said, here are the chart patterns we have covered in the previous lessons by category:

Single Candlestick Patterns

In this course, we have learned the following single Candlestick patterns:

Spinning tops, Marobuzu (green Marubozu and red Marubozu), Doji candlesticks (Long-legged Doji, Four Price Doji, dragonfly Doji, and Gravestone Doji). Hammer bullish engulfing pattern and hanging man bearish pattern, and inverted hammer bullish engulfing pattern and shooting star bearish candle pattern.

To learn about other single-candle patterns, we suggest you visit this page.

Dual Candlestick Patterns

The Dual Candlestick patterns learned in this course include the Bullish momentum engulfing candlestick pattern, the bearish engulfing candlestick pattern, and tweezer Japanese candlesticks (a Tweezer bottom green candle, a Tweezer top red candlestick).

Triple Candlestick Patterns

All three candle formations on a chart covered in the previous lessons, including the Evening star bearish candlestick pattern and morning star green candlestick pattern, Three White Soldiers pattern, Three Black Crows pattern, and Three Inside Up and Down candlestick patterns.

Take note that you can visit our chart patterns hub and learn about each chart pattern, including the structure of each pattern, examples, and strategies.

HowToTrade Japanese Candlestick Cheat Sheet

So, as we mentioned, memorizing these different patterns can be a challenging task. After all, many of these candlestick patterns have two identical candlesticks, but they signal the exact opposite. And, while in most cases, candlestick patterns mainly indicate a trend reversal, you need to remember that many of these patterns could also be interpreted as continuation patterns.

Nonetheless, that’s why, as always, How To Trade got your back! In this beginner’s guide, we have prepared a Japanese candlestick cheat sheet that will help you easily identify what kind of candlestick pattern you are looking for whenever you are trading in foreign exchange markets.

Below, you can find our free-to-download Japanese candlestick cheat sheet that you can use whenever you start trading currencies.

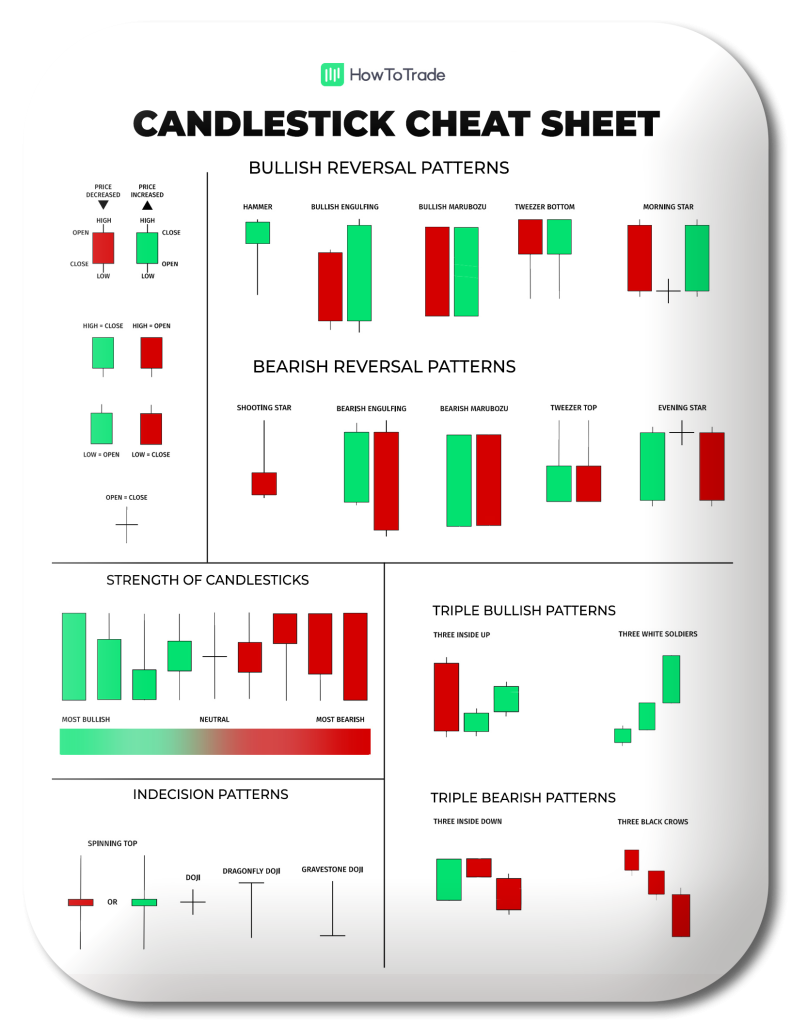

As you can see, this cheat sheet page will help you remember and identify the different patterns we mentioned throughout this Japanese Candlestick Chart Pattern course. We have also organized the cheat sheet so it would be easier for you to get a better visualization of everything you need to know in order to master technical analysis and candlestick patterns techniques on a price chart.

First, on the left side of our cheat sheet, we explain the basics of a candlestick pattern – the meaning of green candle and red candle, and the candle’s body. This will help you determine the market sentiment and know if the asset you are trading is in a bullish momentum or in a bear market.

In the main body of the cheat sheet, we organized it so you can quickly view bullish candlestick patterns and bearish candlestick patterns. For the bullish candlestick patterns – a hammer bullish engulfing candlestick pattern, bullish Marabozu candlestick pattern, Tweezer bottom candlestick pattern, and morning Star bullish candlestick pattern. For the bearish candlestick patterns – shooting star candlestick pattern, bearish engulfing candlestick pattern, bearish Marabozu candlestick pattern, Tweezer top candlestick pattern, and evening star candlestick pattern.

What’s more? At the bottom of the cheat sheet, you can see all the triple bullish patterns we have mentioned in this course – the Triple Inside Up candlestick pattern and the Three White Soldiers candlestick pattern. In the same section, you can get an overview of triple bearish patterns – The three Inside Down candlestick pattern and the Three Black Crows candlestick pattern.

Finally, in our Japanese candlestick Cheat Sheet, you can also get an overview of the strength of candlesticks (long body candlestick pattern, short body candlestick patterns, and neutral candlestick pattern). Also, you can use the 5 indecision Japanese candlestick patterns that include a spinning top bullish candle and bearish candle and a Doji candlestick pattern.

How to Identify a Candlestick Pattern in Forex Trading

Go ahead and bookmark this page. Ultimately, this cheat sheet will help identify a candlestick pattern, especially at the beginning of your currency trading journey. Or, if you’re like me and prefer to have things on paper, you can click to download the print version here. Many technical traders, like myself, usually print useful information and stick it to the computer screen. This way, you can always use this Japanese candlestick cheat sheet and identify a candlestick pattern by taking a quick look at our cheat sheet until identifying these patterns will come naturally to you.

Good luck with your currency trading, and remember, practice makes perfect! Meanwhile, you can join our trading academy, where you can access a wide range of trading video lessons, our trading room, and daily live streams.

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."