- Intraday trading refers to a trading technique where traders buy and sell assets on the same trading day.

- The goal of intraday trading is to generate profits from short-term price movements in the market – all on the same trading day.

- Some of the top intraday trading strategies include trading the news, range trading, breakout trading, volume trading, and the double moving average crossover strategy.

Getting started with intraday trading doesn’t have to be overwhelming. After all, you only need a computer (or even a mobile phone), a stable internet connection, and a reliable trading account.

But, it’s not so easy, right? The real challenge is knowing when and how to place your trades. With so much information out there, it’s easy to feel unsure. But here’s the truth: you don’t need to master every trading strategy to get started. Instead, focusing on just a few of the best intraday trading strategies can lead you to success.

This guide will explain five of the most popular intraday trading strategies and provide essential tips for making the most of your trading day.

Before you jump into the rest of this article, here are the major things we’ll be covering:

- What is intraday trading, and how does it differ from other trading styles?

- Key components of a successful intraday trading strategy.

- The importance of asset selection and trade timing.

- Overview of five top intraday trading strategies to explore.

- Practical tips for managing risk and maximizing profits in intraday trading.

Table of Contents

Table of Contents

What is Intraday Trading?

Whenever you place a trade, either buying or selling financial instruments within the same trading session, that’s called intraday trading. It could be day trading or scalping – either way, if you open and close a position on the same day, that’s an intraday trade.

In this type of trading style, you only have one goal: capitalize on small price moves and generate significant profits from market volatility. Unlike long-term investing, you can execute intraday trades within minutes or hours.

The idea of intraday trading is different – intraday traders must develop a consistent technique at which they can generate profits at the end of a predefined period. Much like poker or tennis, not every day could be profitable; however, the ultimate goal of day traders is to learn how to achieve a positive P&L at the end of the week/month/year.

For beginners, the key is to develop a consistent and effective trading strategy that gives you an edge over the market in the long term. So, if you will ever stand a chance at making it big in intraday trading, you’ll have to master trading opportunities quickly and execute with precision.

Key Components of an Intraday Trading Strategy

So, let’s break down the key components of a solid trading strategy that’ll help you make confident trading decisions and navigate the markets like a pro.

1. Asset Selection

The first thing you need to figure out is what to trade. The truth is, that not all assets are created equal. For intraday trading, you want to focus on assets that have high liquidity and significant price movement. Why? Because these assets provide more trading opportunities and make it easier to get in and out of trades quickly without much slippage. Further, when trading illiquid assets, you may find yourself entering a position, but then you cannot get out.

Stocks, currencies, or commodities with high trading volume are your best bet. Simply put, picking the right assets makes your life as an intraday trader a whole lot easier and increases your chances of success.

2. Market Analysis

A successful trading strategy stands on having a solid edge over the market. Technical analysis is your bread and butter—it’s how you figure out where prices might go next using historical data, charts, and technical indicators. The goal is to develop a clear and repeatable approach to market entries and exits.

It is also highly important to follow the news and read market analyses from trading experts. We suggest visiting the HowToTrade daily market analysis to get daily updates and analysis.

3. Risk Management

Here’s the deal—no matter how good you are, you will have losing trades. The key to being profitable in the long run is managing those losses properly. Risk management is all about protecting your capital. Use stop-loss orders to prevent small losses from turning into huge losses that can wipe out your account. For that matter, we suggest using our TrackATrader trading tool, which can help you to automatically monitor and analyze all of your trades.

Another part of intraday risk management is controlling how much of your capital you risk per trade. A good rule of thumb is to never risk more than 1-2% of your trading capital on a single trade. That way, even if you hit a losing streak, you’ll still have enough left to keep going. You should also focus on maintaining a favorable risk-reward ratio—say, risking $1 to make $3. This way, you don’t need to win all the time to stay profitable.

4. Trading Plan and Entry/Exit Rules

Without a plan, you’re just gambling. A trading plan is your blueprint—it tells you when to get in when to get out, and how to manage your trades. Think of it like this: every trade you take should have a clear set of rules, whether it’s about entering the market when the price breaks a resistance level or exiting when an indicator signals a reversal.

Entry rules help you decide when to pull the trigger. For example, you might decide to enter when the price moves above a certain moving average with a strong volume. Exit rules are equally crucial, whether it’s taking profits when the price hits a specific level or setting a trailing stop to lock in gains as the price moves in your favor. Having predefined rules takes the guesswork and emotion out of trading.

5. Timing the Market

Timing is everything in intraday trading. Different parts of the trading day come with different opportunities. Typically, the session open and closing hours are the most volatile and can provide the biggest moves of the day. For beginners, it can be tempting to jump in as soon as the market opens, but often, it’s better to wait and let the market settle into a direction.

You should also be aware of the different global trading sessions—the Asian, London, and New York sessions—as they each bring unique twists to the market. For example, trading a currency pair like EUR/USD during the London session means more liquidity and movement, making it a prime time for trades.

Here are the best currency pairs to trade on each trading session:

Top Intraday Trading Strategies

Before investing your hard-earned money into trading these strategies, it’s important to understand how each approach works and what market conditions they are best suited for. This context will help you determine which strategy aligns with your trading style.

Here are the top five intraday trading strategies you can start exploring today:

1. Trading the News

For the bold at heart and those traders who have a ķnack for taking risks, trading the news might catch your fancy. News events can have a significant impact on stock prices, making this an ideal trading style for those who can act quickly.

Successfully trading the news involves monitoring major announcements such as economic data releases, earnings reports, or geopolitical developments. When news hits, the increased market volatility presents opportunities for significant profits for intraday traders.

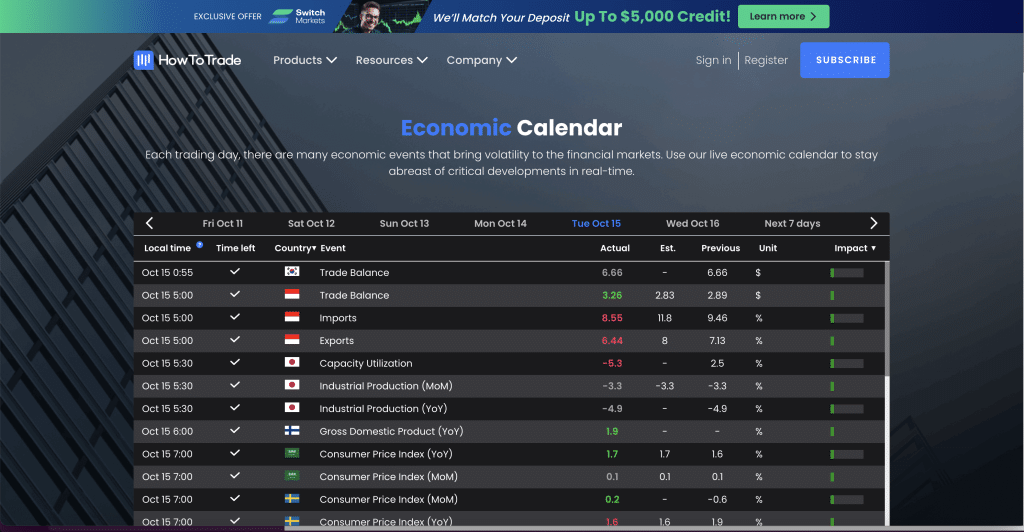

News trading is particularly effective during key economic events like central bank meetings, interest rate announcements, and employment data releases such as the Non-Farm Payrolls event. These events often lead to dramatic price moves, creating opportunities for day traders.

However, trading news can also quickly make or break your trading account. For instance, if the news release propels prices in your anticipated direction, you can make a huge profit in a snap of a finger. But when it goes against your direction, you may lose more than you planned to lose due to slippage. So, if you choose this style of trading, you must manage your risk properly and utilize a reputable VPS service to reduce latency and market slippages.

You can visit our economic calendar to stay up to date with news events.

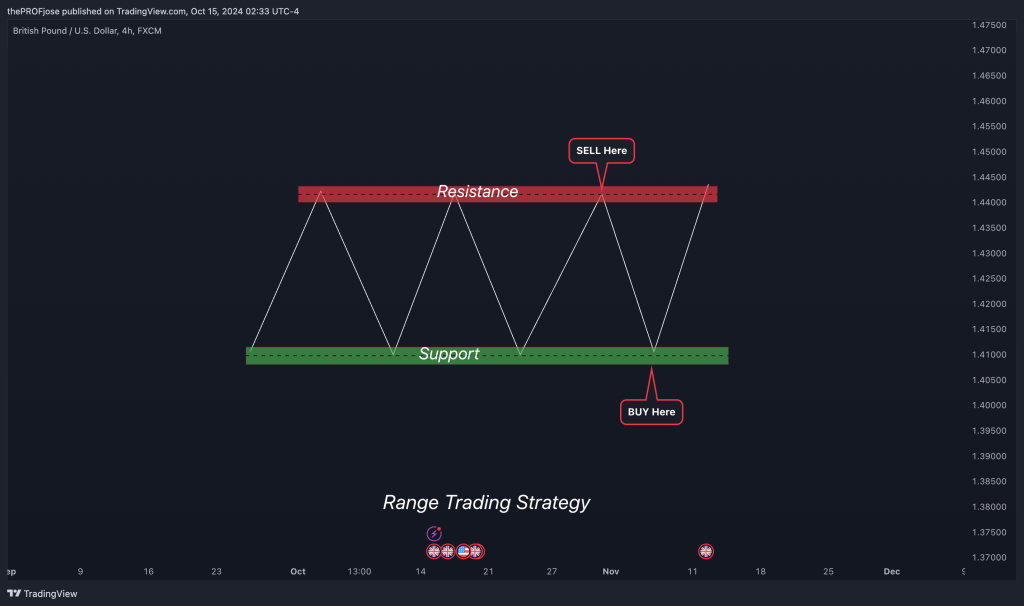

2. The Range Trading Strategy

While the phrase “the trend is your friend” is true, markets still tend to trade within a range between 20% to 30% of the time, and this makes range trading a popular intraday trading strategy.

The idea is simple – This strategy focuses on identifying support and resistance levels and buying when the price is near support while selling near resistance.

Range trading is most effective when the specific market is moving sideways, with no clear trend.

Technical indicators like the Relative Strength Index are often used to determine overbought or oversold conditions, giving traders more confluence to confirm their entry and exit decisions. For instance, an oversold RSI near a support level can signal a buying opportunity, while an overbought reading near resistance might indicate a selling point.

One of the advantages of this intraday trading strategy is the potential to make multiple trades within a defined price range. That is, as long as the price keeps trading within this range, you can keep opening trades until one of the key levels gives way and a breakout happens. But we can’t always tell when a breakout will happen. Thus, setting stop losses properly is crucial to minimize risk.

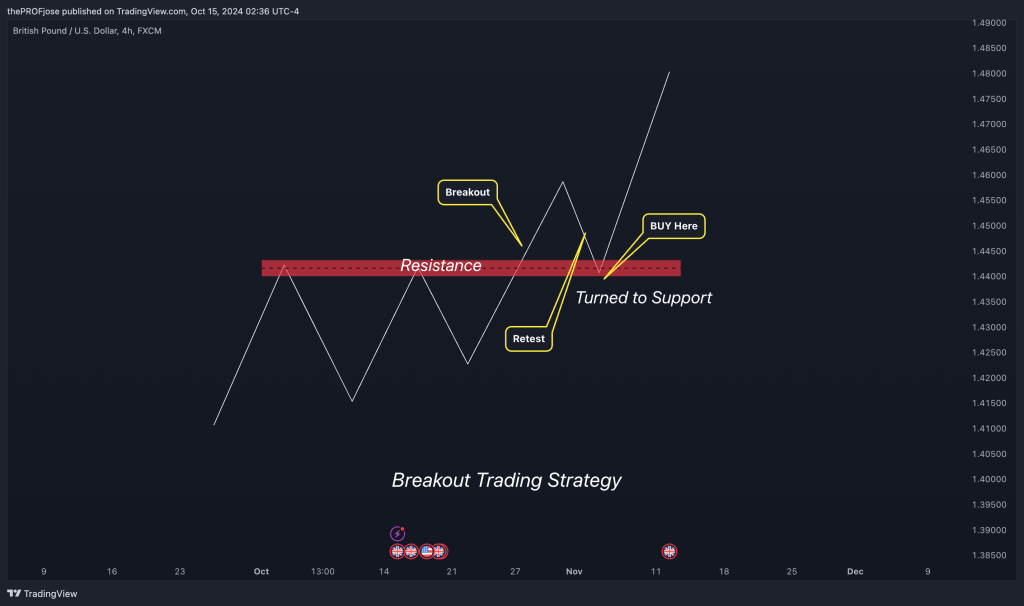

3. The Breakout Trading Strategy

The breakout trading strategy focuses on identifying key support or resistance levels and entering a trade when the price breaks through these levels. This can also be the highest level of the day or all-time price level of an asset. Either way, breakouts can lead to increased market volatility, creating opportunities for significant profits.

Breakout trading works well in both bull and bear market conditions, but it’s important to confirm breakouts with high volume. High trading volume supports the momentum of the price move, whereas low-volume breakouts might indicate a false signal. To confirm a breakout, traders often use volume indicators or look for a retest and strong candlestick chart patterns.

Successful breakout market strategy execution involves setting stop losses close to the breakout level to limit potential losses. Breakout trading is particularly effective during high market activity, such as the early trading hours or during major economic announcements.

4. The Volume Trading Strategy

Volume plays a crucial role in intraday trading, as it helps traders gauge the strength of a price move. We’ve partially mentioned how you can use volume indicators to confirm a breakout earlier. However, volume trading can also be used as a standalone strategy – the volume trading strategy.

The volume trading strategy is about analyzing market volume to determine if a price trend is likely to continue. Increased volume often signifies strong buying or selling interest, which can indicate the continuation of a price move.

Volume analysis is a valuable tool for spotting reversals or trend changes. If an asset enters a demand or supply zone on high volume, chances are that that zone will be respected. Moreover, combining volume with other technical indicators, such as moving averages or pivot point strategy, can help traders refine their entry and exit points.

All in all, volume trading is a very simple yet effective technique for intraday trading.

5. The Double Moving Average Crossover Strategy

One of the most effective intraday trading strategies is the double moving average crossover strategy, which involves using two moving averages—typically a short-term and a long-term moving average—to determine potential buy or sell signals.

How does this strategy work? When the short-term moving average crosses above the longer-term moving average, it indicates a potential buying opportunity. Conversely, when it crosses below, it signals a potential sell trade.

This strategy focuses on identifying trends early, allowing traders to capitalize on the momentum trading strategy. It is particularly helpful for beginners due to its simplicity and clear buy and sell signals. However, traders should be cautious of false signals, particularly in choppy markets.

To reduce the risk of false signals, many intraday traders use additional technical indicators like the Average Directional Index (ADX) to confirm the strength of a trend before entering a trade.

The Free Intraday Trading Strategies PDF

If you need a free PDF on the best intraday trading strategies to take around with you, we’ve got you covered:

Tips for Successful Intraday Trading

Intraday trading requires proper planning, discipline, and risk-oriented strategies to manage market risk effectively.

Here are some basic useful tips to succeed in this field:

- Use a Stop Loss: Setting a stop loss is essential for effective risk management. It ensures that you have a predefined exit strategy, helping you minimize losses and protect your trading account.

- Find High-Volume Assets: Volatile assets with high volume offer more opportunities for significant price moves. It’s crucial to choose assets that align with your risk tolerance and trading goals.

- Follow the Economic Calendar: Tracking economic events can help you anticipate potential price swings. Major releases, such as GDP data or interest rate decisions, can lead to increased market volatility, providing opportunities for day traders.

- Use Technical Indicators Wisely: Focus on a few key technical indicators that complement your trading plan, such as the Moving Average Convergence Divergence (MACD) or RSI. Overloading indicators can lead to confusion and analysis paralysis.

- Manage Your Emotions: Market volatility can be an emotional rollercoaster. A successful day trading approach involves sticking to a well-defined trading plan and maintaining discipline, regardless of winning or losing trades.

- Track Your Trades: Keeping track of your trades helps you analyze what works and what doesn’t. Consider using tools like TrackATrader to monitor your performance and make informed decisions for future trades.

Is Intraday Trading Highly Rewarding?

Intraday trading can be incredibly rewarding, but it’s not for the faint of heart. Many would say that it’s among the most difficult professions to survive in since it requires much time and effort. So, why are so many people drawn to day trading? Well, most likely because it is a highly rewarding and scalable profession. And, it could be fun.

Above all, you need discipline, effective risk management, and a strategy that gives you an edge. The strategies we’ve covered here—trading the news, range trading, breakout trading, volume trading, and the double-moving average crossover strategy—are all designed to help you make the most of the opportunities intraday trading offers. These can help you start your journey as an intraday trader.

But remember, the magic doesn’t lie solely in the strategies themselves—it’s about having the right mindset. Start small, follow your plan, and keep refining your edge as you gain experience. We can assure you that if you stay consistent with what you’ve learned, you can find success in intraday trading.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.