- Institutional trading involves large entities like banks and pension funds that strategically analyse trends, make calculated moves, and trade in massive volumes, influencing market prices.

- The success of institutional trading relies on a foundation built on principles like the long-term perspective, meticulous risk management, leveraging information through extensive data sets, and employing advanced technology and algorithms for precision in execution.

- Retail traders can utilise the institutional trading strategy by conducting extensive market research, looking for IPOs, penny stocks, companies with strong balance sheets, commodities with high demand and supply, and FX carry trades.

Ever since the smart money concept (SMC) trading methodology hit the mainstream, retail traders have been curious about institutional trading. And since most trading strategies claim to trade like institutions, why don’t we explore what these institutional trading strategies are once and for all?

So, in this article, we’re diving into their world, learning their tricks, and showing how you can use their wisdom to navigate the market like a pro.

Table of Contents

Table of Contents

What Does Institutional Trading Mean?

Forget the Wall Street whispers and stock market myths. Let’s break down institutional trading, the big players behind market movements.

Institutional trading is the main driver of financial markets around the world. Mostly done by professional traders who work for large institutions, institutional trading is the act of buying and selling securities on behalf of large hedge funds and financial institutions to make profits. Think of them as investment powerhouses like banks and pension funds. But they don’t just buy and sell stocks and other financial instruments; they analyze trends and geopolitical events, make calculated moves, and trade in massive volumes that can influence prices. However, they’re not reckless. They usually spread out these big trades to avoid causing market mayhem.

Unlike retail traders, these giants have access to special tools and deals, often unavailable to us, that get them better prices and even let them nudge the market a bit. Such tools include the Bloomberg Terminal, a list of auctions, and connections to politicians and financial leaders. They play the long game, focusing on strategies that work over years, not days.

So, what does this mean for us? Understanding their moves can help us navigate the market with more grace. We can borrow their focus on the long term, learn from their risk management, and craft our investment journeys, one informed step at a time. The idea is to think like an institutional investor rather than as a retail trader. As such, you are trying to see the big picture, looking for stocks, commodities, and other securities that have growth potential.

Pillars of Institutional Trading

The success of institutional trading hinges on a sturdy foundation built upon several key pillars. These principles guide their every move, shaping their decisions and ensuring long-term stability amidst the inevitable ups and downs of the market. Let’s delve into these core elements:

1. The Long View

Unlike retail investors, who are often drawn to short-term gains, institutions take a decidedly long-term perspective. Their horizons stretch across months, years, and even decades, allowing them to weather temporary fluctuations and capitalize on enduring trends. This patient approach enables them to invest in assets with long-term growth potential, fostering a more stable and sustainable portfolio.

Even when they are engaged in short-term trades, their decisions are based on a long-term market view. For example, an institutional day trader can get in and out of many positions in a day, but usually, the decisions are based on a fundamental factor that may influence the asset’s price over the long run.

2. Risk Management

Every investment carries inherent risk, and institutions meticulously manage it. They employ sophisticated diversification strategies, spreading their holdings across various asset classes and sectors to mitigate the impact of potential losses in any area. Risk management tools like portfolio optimization and value-at-risk analysis also help them quantify and monitor risk exposure, ensuring informed decision-making.

For instance, large financial institutions and mutual funds often use techniques such as options trading strategies to hedge their positions. They also buy fixed-income assets to generate a fixed annual return, regardless of their portfolio performance.

3. Information is Power

Institutions possess an arsenal of resources to gain the coveted information edge in today’s information-rich environment. They leverage vast data sets, cutting-edge analytics tools, and teams of expert researchers to glean insights from economic reports, company filings, and even social media sentiment. This data-driven approach fuels their investment decisions, allowing them to anticipate market shifts and identify undervalued opportunities before the crowd catches on.

For retail traders, acquiring these tools is often impossible, partly because these are not accessible for individual investors or they are simply very expensive. Yet, many retail traders who have the budget and are keen to follow the steps of institutional trading invest more to get the resources needed to get fast information and sophisticated trading platforms.

4. Tech-Powered Precision

Gone are the days of handwritten orders and human-powered trading floors. Financial markets have changed. Institutions today rely heavily on advanced technology and algorithmic trading to execute their strategies quickly and precisely. These sophisticated algorithms analyze market data in real-time, identify optimal entry and exit points, and automate trade execution, ensuring efficiency and minimizing human error.

Difference Between Institutional Trading and Retail Trading

It must have been obvious at this point that institutional trading is quite different from retail trading, but to avoid having to take guesses, here are some of the major differences between retail and institutional trading:

| Aspect | Institutional Trading | Retail Trading |

| Investment Objectives | Long-term capital preservation and growth, aligned with specific mandates. | Diverse goals, including short-term gains, income generation, or retirement. |

| Investment Horizons | Holds assets for years or decades, capitalizing on long-term trends. | Trades with shorter timeframes, reacting to news cycles or technical signals. |

| Capital and Resources | Wields vast financial resources, accesses diverse investments, and employs advanced technology. | Operates with smaller portfolios and limited resources, requiring a more selective approach. |

| Risk Management | Utilizes complex frameworks with diversification, hedging, and advanced analytics. | May have less formalized risk management, exposing to higher risk due to emotional biases. |

| Info Access and Analysis | Leverages extensive datasets, proprietary research, and expert analysts. | Relies on publicly available information, may face limitations in complex data analysis. |

| Trading Strategies | Employs diverse strategies like fundamental analysis, technical analysis, and quantitative models. | Focuses on specific techniques like technical analysis or popular trends without the same diversification. |

| Regulation and Transparency | Operates under stricter regulations with greater activity transparency. | Faces fewer regulatory burdens but may encounter challenges accessing detailed information. |

Common Institutional Trading Strategies

Institutional investors don’t rely on just one approach. They wield a diverse arsenal of strategies, each tailored to specific market conditions and objectives. Here, we’ll cover some of the most prominent tactics:

1. Fundamental Analysis

Above all, institutions make their investment decision based on fundamental analysis and market research. Think of fundamental analysis as peering under the hood of a company. This strategy involves meticulously analyzing a company’s financial health, industry trends, and competitive landscape to assess its long-term growth potential. Institutions employing this approach dig deep into factors like:

- Financial statements: Examining income statements, balance sheets, and cash flow statements to assess profitability, solvency, and liquidity.

- Management quality: Evaluating the leadership team’s track record, vision, and execution capabilities.

- Competitive advantages: Identifying unique strengths and differentiators that give the company an edge in its market.

Delving into these fundamentals allows institutions to uncover undervalued gems with strong long-term growth prospects, a strategy known as value investing. Alternatively, they may identify high-growth companies poised for market dominance, employing a growth investing approach.

This is not something that cannot be done by a retail trader. Many retail traders are experts in fundamental analysis and market research. However, fundamental analysis also has limitations. Market sentiment and unforeseen events can disrupt even the most thorough analysis. Additionally, this approach requires significant time and expertise, making it less suited for short-term trading.

2. Technical Analysis

While fundamental analysis focuses on the company’s “engine,” technical analysis takes a different approach. This strategy involves studying historical price and volume data to identify patterns and predict future market movements. Technical analysts use a vast array of tools, including:

- Chart patterns: Recognizing recurring formations like head and shoulders or triangles that suggest potential trend reversals.

- Technical indicators: Employing mathematical formulas like moving averages, volume-weighted average price (VWAP), or relative strength index (RSI) to gauge momentum and identify overbought or oversold conditions.

Institutional traders often use technical analysis for short-term trading, capitalizing on short-term market fluctuations. They also often use key levels to determine where to place their large orders. To do that, they identify key supply and demand zones and use these levels to enter and exit large positions.

3. Quantitative Strategies

These sophisticated models employ complex statistical analysis and machine learning to identify trading opportunities and automate execution. Some prominent quantitative strategies include:

- High-frequency trading (HFT): Utilizing ultra-fast algorithms to exploit tiny price discrepancies in milliseconds.

- Statistical arbitrage: Identifying and capitalizing on mispricings across different asset classes.

- Machine learning: Training algorithms on historical data to predict future market movements.

Quantitative strategies offer unparalleled speed and precision, allowing institutions to react to real-time market changes. However, they also involve high technological investments and complex model development, making them inaccessible to most retail investors. Additionally, algorithmic trading can contribute to market volatility and raise ethical concerns regarding fairness and market manipulation.

4. Smart Money Concepts

SMC posits that institutional players, the “smart money,” leave subtle footprints on the charts, revealing their entry and exit points. So, it’s about understanding supply and demand zones, order flow patterns, and market structure shifts to identify where the big boys are placing their bets.

Let’s see how SMC can enhance traditional technical analysis:

- Supply and Demand Zones: Instead of blindly following trend lines, SMC identifies areas of high buying (demand) and selling (supply) pressure. These zones, often marked by price reversals or failed breakouts, indicate where institutions might have stepped in or out, offering us potential entry or exit points.

- Order Flow Analysis: Beyond just price movements, SMC delves into order flow trading – the volume and direction of buy and sell orders. Identifying imbalances in order flow, like hidden buying in a downtrend, can suggest institutional accumulation, hinting at a potential reversal.

- Market Structure: SMC emphasizes understanding the overall market context, including market cycles, liquidity levels, and key support and resistance zones. This broader perspective helps us interpret technical indicators within the framework of institutional activity, avoiding false signals based on isolated chart patterns.

Note, however, that SMC isn’t a holy grail. It’s a lens through which to view technical analysis, adding a layer of institutional awareness. Combining SMC principles with traditional technical indicators, like moving averages and RSI, can provide a more holistic understanding of market movements and potentially identify high-probability trading opportunities.

How Can You Trade Like Institutional Traders?

Trading like institutional traders is tricky. Truth must be said; they have access to resources that are typically not available to retail traders, such as Bloomberg Terminal, sophisticated level 2 market data, auction market theory, and, most importantly, connections in the financial industry as well as to politicians, farmers, and industrialists.

Yet, as a retail trader, you can adopt the mindset of institutional traders. To do that, you need to find these assets with significant growth potential (or assets that can significantly lose value). Different from most retail traders, institutional traders buy and sell assets based on a solid reason; hence, they research and look for unique opportunities. They often look to buy assets at wholesale prices and sell at retail prices or search for anomalies in the market that happen due to increasing supply and demand, geopolitical events, and technological developments.

Here’s a good explanation of how institutional traders operate:

So, let’s bridge the gap between understanding institutional strategies and practically applying them to your trading decisions. Here are some actionable tips and examples of how you might be able to trade like an institutional trader:

Tip 1: Seek Opportunities in IPOs and Penny Stocks

Institutional traders often capitalize on initial public offerings (IPOs) and penny stocks with solid growth potential. These can be lucrative opportunities for retail traders to identify undervalued companies poised for rapid expansion. For instance, investing in companies like Uber or Snowflake during their IPOs could yield substantial returns if they mirror institutional strategies.

Tip 2: Focus on Companies with Strong Balance Sheets

Institutions also prioritize companies with robust financial health and solid balance sheets, which could be undervalued and, therefore, offer a great long-term trading opportunity. Retail traders can emulate this approach by conducting thorough fundamental analysis and evaluating factors such as revenue growth, profit margins, and debt levels.

Tip 3: Identify Commodities with High Demand or Supply

Certainly, this is one of the most effective strategies used by institutional traders. For those who have seen The Big Short movie, which is undoubtedly one of the best stock trading movies, this is the strategy that Michael Berry (Christian Bale) used to make one of the largest trades in history.

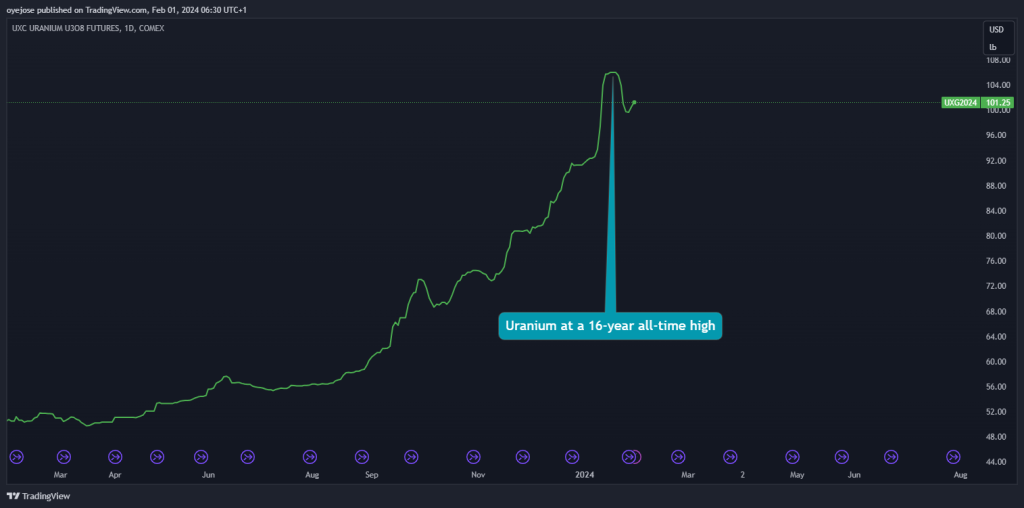

Institutional traders often monitor commodities and other assets experiencing increased demand due to various factors, such as supply shortages or geopolitical events. For example, in 2022, Aluminum saw a surge in demand following a power crunch in China, presenting a lucrative opportunity for investors. Similarly, Uranium is currently at a 16-year high due to growing interest in nuclear energy, making it an attractive commodity to watch.

Moreover, institutional traders can buy grains such as wheat, corn, and soybeans in times of drought or sell them when there’s an oversupply in the markets. They also follow petroleum products like oil, natural gas, and heating oil, which are highly affected by weather and geopolitical events.

Practically, these opportunities are less available to retail traders since they do not have access to expensive information data software; however, with solid market research, retail traders can also find profitable trades by identifying behind-the-scenes developments that are related to a particular asset.

Tip 4: Explore Forex Carry Trades

In the forex market, institutional traders often engage in carry trades, exploiting interest rate differentials between currencies to generate returns. For example, financial institutions closely monitor interest rate announcements and expectations to determine when to buy high-interest-rate currency and sell a low-interest-rate currency.

Retail traders can follow suit by considering carry trades between currencies like the USD and the Japanese Yen. This strategy involves borrowing funds in a low-interest-rate currency (e.g., JPY) to invest in a higher-yielding currency (e.g., USD), profiting from the interest rate differential. As a retail trader, you can follow central banks’ meetings and monitor the FedWatch tool, which helps in predicting probabilities of rate hikes or cuts.

Tip 5: Visit Online Forums to Get First-Hand Information

Being an institution trader in one of the largest financial banks and investment companies can give you a huge advantage in the market. Yet, you need to do the best with what you have. And sometimes, it’s not so bad, as evident from the GameStop short squeeze story in 2021. Nowadays, with the vast amount of information available online, you can get valuable tips on popular financial forums. However, you should be careful when you navigate around these forums. Don’t take random recommendations as a trade signal. If you find an interesting comment or suggestion, do your research to back it up and make a smart investment decision.

Reminder: Replicating institutional strategies directly might not be feasible, but understanding their core principles and adapting them to your circumstances can empower you to make wiser investment decisions and chart your own path toward financial success.

Can Retail Investors Learn the Institutional Trading Strategy?

While it’s tempting to replicate institutional trading success, the reality is more nuanced. Directly mirroring their complex strategies may not be feasible or optimal for most retail investors. Institutional trading is not a trading strategy, per se, but rather a mindset or a way to analyze the markets. In that aspect, my trading mentor once told me: “If you want to succeed in trading as a retail trader, you must swim like a fish and think like a shark.”

So, if you are keen to learn more about institutional trading, you should certainly watch trading movies and documentaries, read trading books about successful institutional traders, and watch videos online. You can also dig into the Smart Money Concept trading strategy, which has a strong focus on how to follow smart money, a synonym for institutional money.

And, of course, you can also join our Trading Academy and meet our trading coaches, who have vast experience in the financial sector and capital markets.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.