Many people believe that options trading is the most versatile and flexible form of trading, and rightfully so. Although it is considered a risky strategy, it is an excellent way for traders to leverage their purchasing powers and use sophisticated techniques to get the necessary edge in the competitive trading arena.

And this is why knowing options strategies could be such a vital tool for every trader. Options strategies can be used in any market, and if used correctly, they arguably can be the most lucrative form of trading. At the same time, learning options trading can be quite challenging for new traders. You must know the structure of options, how to analyze options Greeks, and ultimately, how to trade the markets using options strategies.

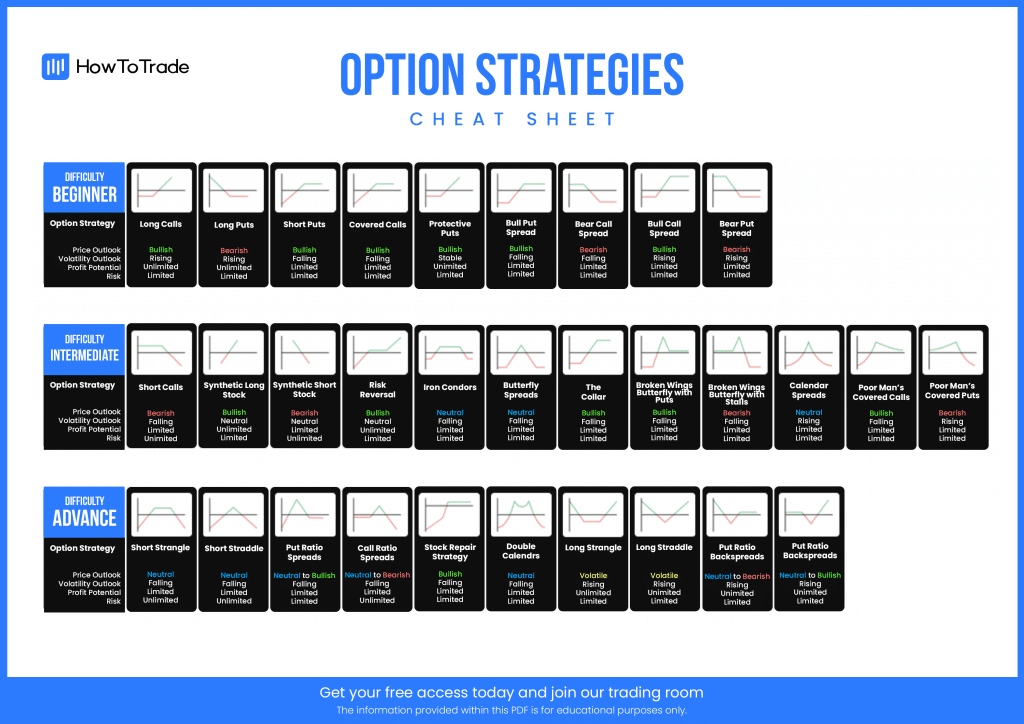

To start, you must have a cheat sheet to understand how they work and how to trade options strategies. Even the most experienced options traders still use a cheat sheet to get the perfect visualization of each options strategy. This is what this page is all about. Let’s start.

Table of Contents

Table of Contents

Options Strategies Cheat Sheet PDF Download

Here, you can find our options trading strategies PDF free download.

Options Strategies Cheat Sheet PDF [Download]

What Are Options Strategies?

Option trading strategies simply refer to a combination of buying and selling various options contracts to minimize risk and maximize returns. Unlike the traditional method of buying and selling assets directly, trading options strategies have an entirely different approach to trading.

In essence, options are derivative financial assets that enable investors to profit from price fluctuations in the underlying assets. As such, there are many benefits to trading options rather than the underlying security. First, options are less expensive than buying the underlying asset. When you buy an option, you pay the premium only, which is the total amount a trader must pay to purchase an options contract.

Second, options are often used to hedge a position against risks (not only by traders and investors). For example, if you own a factory and receive your payment in foreign currency, you can hedge the total value of the payment you will receive by purchasing an option contract. In a way, options are similar to buying insurance.

Also, one of the main advantages of options trading is the ability to limit your loss. This can be done using most options trading strategies. For example, a trader can utilize the bull call spread strategy that consists of one long call option contract with a lower strike price and another short call with a higher strike price.

This way, the trader knows in advance the maximum loss and profit that can be made in a particular trade. Or, you can use the bear call spread strategy that consists of selling a call option contract and buying a call option contract at a higher strike price. This options strategy enables you to profit from a decline in the underlying asset’s price but with limited risk.

Finally, options can deliver higher returns due to the high volatility they have. As options are derivative financial instruments, they tend to fluctuate drastically, which makes options an ideal financial asset for day traders and long-term investors.

However, before making any options trade, you must familiarize yourself with the options structure and how they work. Let’s sum it up in a few key points:

Options Basics – Key Things for Traders to Know

Options Basics – Key Things for Traders to Know

- Unlike buying and selling the asset outright, an option contract gives the buyer the right, but not the obligation, to buy (call options) or sell (put options) the underlying asset at a specific price and with an expiration date.

- There are two different types of options – call and put. Each option contract has a premium (the price), strike price, and the expiration date.

- Options are categorized into three types – into the money, at the money, and out of the money. Each type refers to the options strike price in relation to the underlying asset price.

- Options are derivative products; thus, their value derives from the change in the underlying asset price.

Types of Options Strategies

In general, there are more than 450 options strategies traders can deploy. These option combinations create enormous flexibility for traders and long-term investors, enabling them to trade the markets differently.

But there is no need to know all the strategies. You can start with some of the most effective and easy-to-implement strategies and continue growing from there. In our options strategies cheat sheet, you can see some of the most widely used options trading strategies.

An Example of How Options Strategies Work

Now that you understand the basics of options and are equipped with our options strategies cheat sheet, we will show an example of how an options strategy works. Let’s take an example of a simple long-call option strategy.

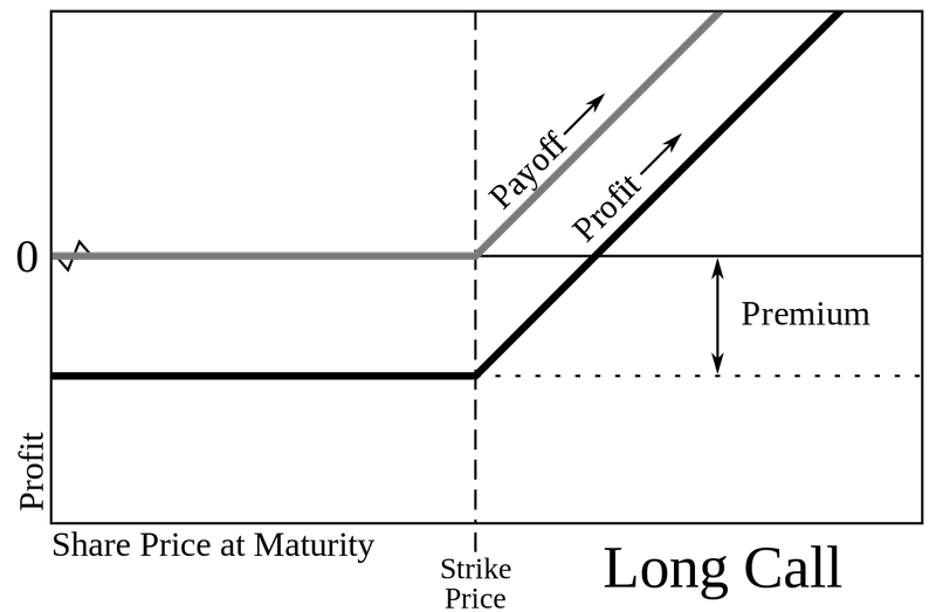

So, let’s say you want to buy Tesla stocks, but the cost to buy the shares directly is too expensive, and you prefer to make this purchase through options trading. Now, Tesla stock is trading at $210 per share (as of mid-February 2023), and you believe it will be trading soon above $220. You check different expiration dates, and the March $220 contract’s premium cost is $10.65. Meaning the strike price is $220 (out of the money), and the expiration date is March 16. This is a long call option, which looks like this:

The total price you are required to pay for this transaction is $10.65 x 100 = $1065 – which is the maximum amount you can lose. That is because a stock option contract allows you to buy (or sell) 100 shares.

Now, let’s assume that you are in the right direction in terms of predicting the stock share price. Tesla’s share price spiked and is currently trading at $222 per share, which means that the option value is now worth $21, as it’s coming close to the expiration date. Since it is now trading above $220, it simply means that the option is now in the money. Therefore, your profit is ($21-$10.65) x 100 = 1035. As you can see, you doubled your initial investment, something that is nearly impossible when you trade the underlying asset with the same investment size.

Of course, you will retain your money if Tesla’s share price is trading below $220 at the expiration date. And that is why options trading is risky compared to buying the underlying asset. You have a limited time until the expiration date; therefore, time is becoming crucial.

Nonetheless, many day traders use options trading to capture minor price fluctuations. You are not obligated to hold the options contract until the expiration date. Some traders use options strategies for day and scalp trading. You can buy an option contract and sell it after one minute.

Over to You

To sum up, options trading is one of the most flexible and powerful ways to trade financial assets. And fortunately, options are available on almost every type of market – indices, stocks, forex, commodities, etc.

Indeed, it is not the easiest strategy for beginners and is presumably among the most complicated and risky techniques to trade financial assets. Having said that, options trading can be very lucrative over the long term, and those who master this technique are often successful active traders and long-term investors.

If you are keen to take this route, we suggest you read one of our recommended options trading books, download our Options Greeks cheat sheet, and our options strategies cheat sheet above to practice options strategies on a demo account before you risk your capital.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.