The abundance of strategies, indicators, and market analyses in the trading world can make one’s head spin. But recently, a wave of traders have ignored other strategies to focus on just one: the Inner Circle Trader (ICT) strategy.

- The ICT Trading Strategy is a comprehensive methodology that encompasses market structure analysis, liquidity zones, displacements, and other key concepts.

- One of the strategy’s notable strengths is its attempt to emulate the trading behavior of Smart Money, which comprises institutional players in the market.

- While the ICT Trading Strategy provides valuable insights, its practical application depends on a trader’s ability to execute profitable trades with discipline and execute risk management strategies effectively.

In this article, we’re going to explore how the ICT Trading Strategy works, break down its components, and answer the burning question on every trader’s mind: Does it work? So, let’s dive in.

Table of Contents

Table of Contents

- What is the ICT Trading Strategy?

- Key ICT Concepts You Need to Know About

- How to Use the ICT Trading Strategy to Predict Price Movements

- ICT Trading Strategy PDF

- ICT Trading Strategy – Benefits and Limitations

- Final Word – Is the ICT Trading Strategy Really Profitable?

- Frequently Asked Questions (FAQs)

What is the ICT Trading Strategy?

The Inner Circle Trader (ICT) Trading Strategy is a comprehensive approach to trading that is based on analyzing market structure. What sets this strategy apart is its ability to shed light on the actions of institutional traders in the market. By doing so, it equips investors with the tools to sidestep the common pitfalls associated with retail trading, such as unexpected losses.

One of the key advantages of the ICT Trading Strategy is its accessibility. Michael J. Huddleston has generously shared a wealth of knowledge on this strategy through various free resources available on YouTube. These resources serve as a valuable starting point for traders looking to understand this approach.

The ICT Trading Strategy is built on a deep understanding of market structure. In the financial market, large players and market makers often accumulate large order blocks before making significant price moves. This is especially valid in forex trading, where central banks often intervene in the market. During this accumulation phase, prices tend to hover within a correction range, often breaking short-term support and resistance levels. However, a crucial insight that the ICT method provides is the identification of the precise candle where the order flow starts.

For more information, watch our video about the ICT trading strategy.

Key ICT Concepts You Need to Know About

The ICT trading strategy is built on the following seven important components:

1. Liquidity

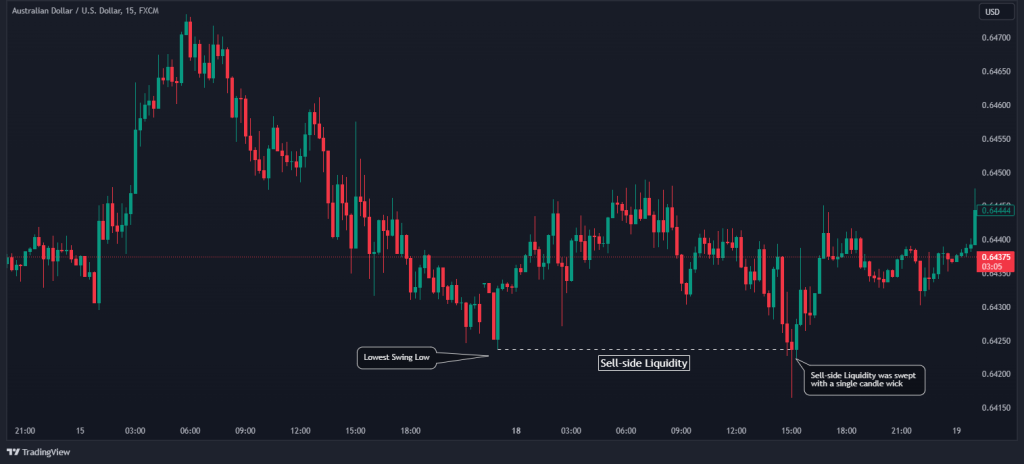

Liquidity in the ICT Trading Strategy comes in two distinct forms: buy-side and sell-side. Buy-side liquidity refers to the area on a price chart where short-selling traders are likely to have their stop orders placed. Conversely, Sell-Side Liquidity identifies the zones where bullish traders’ stop orders are concentrated.

Both Buy-Side and Sell-Side Liquidity zones are typically found at the extremes of price volatility, often near the tops and bottoms of price patterns. This is because retail traders commonly set their stop-loss orders or decide to close their positions in these areas. Liquidity plays a vital role in the ICT trading methodology, as it seeks to emulate the trading behavior of Smart Money, thus helping traders identify market structure shifts.

2. Displacement

Displacement is characterized by a sudden and forceful price movement, either upwards or downwards. On a price chart, it typically appears as a sequence of consecutive long candles with minimal wicks, all moving in the same direction.

Two key points to remember about Displacement, according to ICT, are that it often signifies a sudden surge in buying or selling pressure, frequently occurring when the price reaches a Liquidity level. Additionally, Displacement almost invariably results in two significant outcomes: a Market Structure Shift and a Fair Value Gap.

3. Market Structure Shift

Trends are defined by higher highs and higher lows in an uptrend and lower highs and lower lows in a downtrend. A Market Structure Shift is a level on the chart where the existing trend is disrupted. In an uptrend, it is marked by a lower low, while in a downtrend, it typically occurs when a higher high is established. These shifts usually follow a Displacement.

After a price breach through a Market Structure Shift level, Inner Circle Traders begin looking for additional signals confirming a change in trend, using this level as a reference point for their trades.

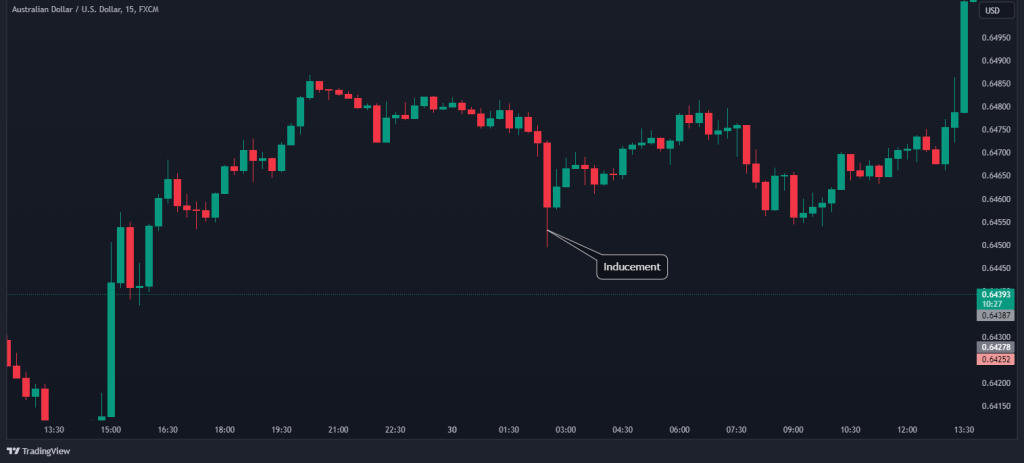

4. Inducement

Inducements are seen at the peaks of mini-counter-trends within a larger-scale trend. According to ICT, these market movements are often the result of Smart Money engaging in stop-loss hunting activities in lower time frames.

ICT traders base their strategies on the belief that once an Inducement level is reached and additional liquidity has entered the market, the price will reverse course and continue its original trend.

5. Fair Value Gap

When a liquidity level is breached and a trend reversal occurs, traders often observe a “gap” on their charts—this is referred to as a Fair Value Gap by ICT traders. Specifically, a Fair Value Gap consists of three candles, with a larger one at the center and a gap between its wicks and those of the surrounding candles.

Fair Value Gaps tend to be filled at some point in the future, and this is the concept that ICT traders leverage when setting their orders.

6. Optimal Trade Entry

After an Inducement triggers a Displacement, which subsequently results in a Market Structure Shift and a Fair Value Gap, ICT traders use Fibonacci levels to pinpoint their Optimal Trade Entry points before executing trades. These entry points typically fall within the range of 61.8% to 78.6% retracement of an expansion range.

7. Balanced Price Range

A Balanced Price Range is defined by two Fair Value Gaps created by two Displacements of opposite directions occurring in a short period. During a Balanced Price Range, prices often fluctuate within a range, repeatedly testing the extremes in both directions, with the aim of filling both Fair Value Gaps. ICT traders actively engage with market volatility, anticipating that the price is likely to resume its original trend once the limits of the Balanced Price Range are breached.

How to Use the ICT Trading Strategy to Predict Price Movements

The ICT trading strategy contains different setups, from the simplest to the most complicated. Since trading doesn’t have to be complicated, we will explain one of the simplest and the most effective techniques of the ICT trading setups: the Liquidity Sweep Strategy.

The core principle of the Liquidity Sweep Strategy is in the interplay between sell-side and buy-side liquidity. When sell-side liquidity is swiftly cleared out through a liquidity sweep, it sets the stage for the price to gravitate toward the buy-side liquidity, aligning with its prevailing direction. This, in turn, often triggers a significant shift in market sentiment.

Unlike some other ICT setups that require patience for price mitigation or the identification of demand and supply zones, the Liquidity Sweep Strategy operates on a more immediate timeline. Trades are executed promptly upon the recognition of valid bullish or bearish liquidity sweep patterns in the market. Now, let’s see how this trading technique works:

Step 1: Spot a Valid Single Candle Liquidity Sweep Pattern on HTF

To initiate this strategy, it’s crucial to identify a valid single candle liquidity sweep pattern on the higher time frame (HTF). In a bullish context, this pattern is shown as a single candle that sweeps out liquidity below the previous low just before a sudden and significant upward movement. Importantly, the price must clear the liquidity below the lowest point of the previous structure using only one candle body or wick.

The validity of this pattern hinges on the subsequent candle after the sweep. It should neither exceed nor close below the sweep candle; otherwise, the setup becomes invalid. The opposite holds for a bearish liquidity sweep pattern.

Step 2: Zoom Into the Lower Time Frame and Look for a CHoCH

After the liquidity sweep with a single candlestick, the next step is to switch to a lower time frame (LTF) and patiently await a change of character pattern (CHoCH). This pattern signifies a confirmation of a shift in market structure on the entry time frame.

With this confirmation in hand, traders can then proceed to set their limit orders either on the newly identified order block or the fair valued gap. The choice between these two entry points is entirely at the discretion of the trader. Some may prefer to backtest and choose the one that resonates best with their trading style. Alternatively, a combined approach can be employed, treating the fair valued gap and order block as a single zone and placing the entry at its midpoint.

Step 3: Setting Stop Loss and Target Profit

When implementing the Liquidity Sweep Strategy in an uptrend, it’s advisable to place the stop loss below the order block. Conversely, in a downtrend, position the stop loss above the order block. Always leave a buffer for spread when determining your stop loss to mitigate any adverse slippage.

As for setting the target profit, look to place it at the next opposite swing point in the price movement. This provides a clear objective and helps you lock in gains when the market moves in your favor.

The Inner Circle Trader (ICT) Trading Strategy is a comprehensive approach to trading that is based on analyzing market structure. What sets this strategy apart is its ability to shed light on the actions of institutional traders in the market.

ICT Trading Strategy PDF

If you need a PDF that describes how to trade the Inner Circle Trading Strategy, here’s one for you:

ICT Trading Strategy PDF Free Download

ICT Trading Strategy – Benefits and Limitations

Like most things, using the inner circle trading strategy has its benefits and limitations. Let’s delve into the pros and cons of the ICT strategy:

Pros

- ICT enables traders to incorporate SMC concepts into their trading decisions. This makes ICT not only a technical analysis strategy but also a full trading theory that can be applied to any trading style.

- If well-mastered, the ICT can be used as a standalone trading strategy.

- The ICT trading strategy has a high win rate, according to those who used the strategy.

Cons

- The ICT trading technique could be quite complicated for some traders, especially beginners.

- It requires time to learn each concept and patience to use these concepts in trading.

- Using the ICT method can limit trade opportunities since traders must identify specific market conditions to enter and exit trades.

Final Word – Is the ICT Trading Strategy Really Profitable?

As we draw this exploration of the ICT Trading Strategy to a close, the burning question remains: Is the ICT Trading Strategy truly profitable? Well, it all depends on how one applies the strategy. You can look at the ICT strategy as a theory that plays a huge role in understanding market dynamics.

One of the key strengths of the ICT Trading Strategy is its attempt to mimic the trading behavior of Smart Money, hence, the institutional players in the market. By strategically positioning orders at levels where retail traders’ stop-loss orders cluster, this strategy increases the likelihood of order fulfillment. So, overall, this insight into Smart Money’s moves can be a significant advantage for traders.

It’s essential to acknowledge that trading always carries risks, and losses are a part of the game. The ICT Trading Strategy is no exception. Success with this strategy requires a solid understanding of its concepts, disciplined execution, risk management, and continuous learning.

So, to answer the question, yes, the ICT Trading Strategy can indeed be profitable, but success lies in the hands of the trader who wields it.

Frequently Asked Questions About the ICT Trading Strategy

Here are some frequently asked questions on the ICT trading strategy:

What is the ICT trading method?

The ICT trading method is a comprehensive approach to trading in the financial markets developed by Michael J. Huddleston. It is based on analyzing market structure and identifying key concepts such as liquidity zones, displacements, and so on. This methodology aims to help traders gain insights into market behavior, particularly the actions of institutional players (Smart Money), and make well-informed trading decisions by leveraging this understanding.

How effective is ICT trading?

The effectiveness of ICT trading largely depends on the trader’s ability to understand and apply the methodology’s principles correctly. When executed skillfully, the ICT trading strategy has been reported to be profitable by traders who have embraced its concepts. However, it’s essential to recognize that no trading strategy is foolproof, and success is not guaranteed in every trade.

Are ICT and SMC the same?

No, ICT (Inner Circle Trader) and SMC (Smart Money Concepts) are not the same, but they are closely related. ICT trading is a methodology developed by Michael J. Huddleston that aims to emulate Smart Money’s trading behavior and involves analyzing market structure and key concepts.

The SMC trading strategy, on the other hand, specifically refers to the trading concepts and strategies associated with understanding and following Smart Money’s movements in the financial markets. While ICT incorporates SMC principles, they are distinct in that ICT is the broader framework that encompasses Smart Money Concepts as part of its strategy.

How can you learn ICT trading?

To learn ICT trading, you can start by accessing the wealth of educational resources provided by Michael J. Huddleston himself. He has shared valuable insights and tutorials on ICT trading through online platforms, including YouTube. Studying these resources can provide you with a foundational understanding of the methodology. Additionally, consider joining online trading communities or forums where ICT traders share their experiences and insights.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.