- A breaker block is a failed order block causing a significant shift in market liquidity and structure, signaling future market movements.

- It is based on market algorithms’ search for liquidity.

- Once identified, a breaker block acts as a new level of support or resistance. Traders use breaker blocks to predict and strategize market movements, setting stop losses based on these predictions.

Order blocks are special market conditions that occur when institutional traders place large orders in the market. But what happens to order blocks after they “fail”? Do they become useless? Well, they don’t. In fact, they present us with zones that, if properly understood, can be stand-alone, profitable market analysis tools, also known as breaker blocks.

In this article, we will discuss everything you need to understand about the breaker block trading strategy.

Table of Contents

Table of Contents

- What is a Breaker Block Forex?

- How to Use Breaker Blocks in Trading?

- How to Trade the Breaker Block Trading Strategy?

- Benefits and Limitations of Breaker Block Trading

- Breaker Block Trading PDF

- What’s the Difference Between a Breaker Block and an Order Block?

- What is the Difference Between a Breaker Block and a Mitigation Block?

- What is the Best Time Frame for Forex Breaker Blocks?

- Is the Breaker Block Trading Strategy Good or Bad?

What is a Breaker Block in Forex?

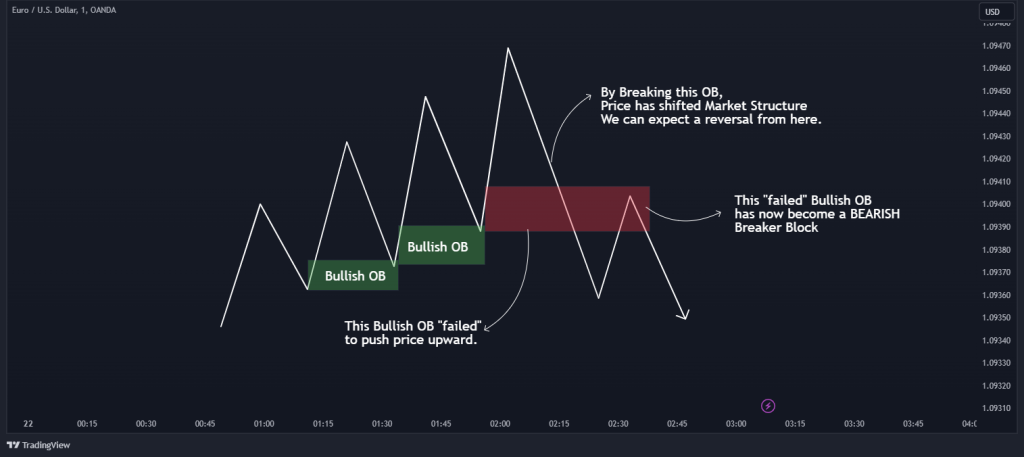

A breaker block, as described by the Inner Circle Trader (ICT), is essentially a failed order block that results in a significant shift in market liquidity. This shift can change the market structure from bullish to bearish or vice versa. When an order block fails, it not only alters the immediate market outlook but also serves as a potent indicator for future market movements.

The principle underlying the breaker block concept revolves around the constant search for liquidity by market algorithms. Traders typically identify these order blocks and make predictions about market movements. A bullish breaker block is anticipated to drive prices up, while a bearish breaker block is expected to do the opposite. Consequently, traders set their stop losses accordingly, below the level in bullish scenarios and above in bearish ones.

However, market makers and smart money traders often exploit these situations, triggering stop losses and pushing the market in the opposite direction by creating a liquidity grab. This is where the concept of breaker blocks becomes particularly relevant.

In terms of market strategy, a breaker block, once identified as a failed order block, assumes a new role. It starts acting as a level of support or resistance or, as others will call it, demand or supply. This transformation is critical:

- When it fails, bullish order blocks become bearish breaker blocks, serving as potential resistance or supply zones.

- A failed bearish order block turns into a bullish breaker block serving as a potential support or demand zone.

This role reversal is central to understanding how breaker blocks can be used to predict and strategize in forex trading.

Opposite from order blocks, where traders use this price level where institutional traders buy or sell the assets in large quantities, a breaker block simply means this pressure of smart money has ended. Perhaps the perfect example of this is the famous trade made by one of the richest forex traders in the world, George Soros. In 1992, Soros made a profit of $1 billion by taking a position in the British Pound against the Bank of England. That’s a classic case of a breaker block.

However, it’s important to differentiate a breaker block in practical trading from the breaker block in a trading exchange context, where it’s a price level set by the exchange that, upon being reached, triggers a circuit breaker mechanism. This mechanism temporarily halts trading to prevent significant market volatility or crashes.

Learn more about how Breaker Blocks trading in this video:

How to Use Breaker Blocks in Trading?

Like many other trading concepts, using breaker blocks in trading can be confusing. So, the big question is how do you use breaker blocks in trading.

Here’s a step-by-step guide on how to utilize breaker blocks in trading:

1. Identify a Market Structure Shift

The first step in using breaker blocks effectively is to identify when the market structure has shifted. This involves analyzing market structure shifts and price movements to understand whether the market has broken an order block in the opposite direction. Recognizing the trend change sets the stage for identifying potential breaker blocks that align with the new market dynamics.

2. Identifying the Breaker Block

A breaker block is essentially a failed order block that signals a shift in market momentum. It is usually identified after a strong price movement, where the market fails to sustain its direction and creates a reversal pattern. This failed order block now assumes an opposite role after the trend has changed, similar to how support levels tend to become resistance levels after the price has breached these levels.

3. Expecting Price Return to the Breaker Block

Once a breaker block is identified, the next expectation is for the price to return to this level. This retest of the breaker block is a crucial phase. A return to the breaker block often signals a consolidation phase before the market decides its next move.

4. Waiting for Confirmation and Entering a Position

Before taking any position, it’s essential to wait for confirmation within the breaker block. Confirmation can come in various forms, such as a specific candlestick pattern, a change of character at the breaker block level, or other technical indicators aligning with the expected move. Once confirmation is received, traders can confidently enter a position that aligns with the new market trend, whether it’s going long or short.

How to Trade the Breaker Block Trading Strategy?

Trading the breaker block strategy is pretty straightforward. Here, we’re going to put together the whole concept to analyze the USOil chart in the 15-minute timeframe.

First, as you can see in the Crude Oil chart below, you must identify an area on a price chart where large order blocks appear.

Notice from the USOil chart above that there is already a market structure shift. Earlier, the price was creating a series of higher highs and higher lows, but suddenly, the price broke below the higher low to form a lower low, indicating a potential trend change. So, what that means is simply that we are now looking to sell the asset.

As mentioned earlier in this article, after a market structure shift, we can expect the failed bullish order block to begin acting as our bearish breaker blocks. So, we can now expect the price to return to our newly formed breaker block.

As shown in the chart above, once the price enters into our breaker block, we don’t just open a position straight away; we wait for a bearish candle to form before we enter into a sell position.

Finally, let’s talk about risk management: depending on how well you are trained with this trading strategy, your win rate will vary. However, you can almost stay profitable by a minimum of 3 risk-reward profit targets. For stop-loss placements, you can shove your stop loss above the candlestick formation when you’re in a sell trade and below the candlestick pattern in a buy position.

Check out our daily market analysis page for insights about leading FX pairs, global indices, and commodities.

Benefits and Limitations of Breaker Block Trading

The breaker block trading concept can be a valuable tool in the hands of the right trader. However, it’s not without its limitations. Let’s take a look at some of the potential strengths and weaknesses of the smart money trading concept:

Benefits

- Although breaker blocks are failed order blocks, they are still very valuable in predicting the next price direction.

- Breaker blocks give traders insights into what the market makers are doing with an asset.

- It appears in every financial market, including stocks, forex, and futures.

Limitations

- Not all breaker blocks are genuine. Some are simply there to lure traders into trades that end up getting stopped out.

- Not all breaker blocks get respected. In other words, it is common for the price to go past a breaker block as it it weren’t there.

Breaker Block Trading PDF

Here you can download our free Breaker Block trading strategy PDF:

What’s the Difference Between a Breaker Block and an Order Block?

Order Blocks form as the last candle (bearish for bullish OB, bullish for bearish OB) before a sharp price impulse, acting as demand (bullish OB) or supply (bearish OB). Traders use OBs to enter trades in the direction of the anticipated trend, buying at bullish OBs or selling at bearish OBs on retest, with stop losses placed just beyond the block and targets at liquidity levels or favorable risk-reward ratios.

Breaker Blocks emerge when an order block fails, marked by price breaking through the OB’s high (for bearish OB) or low (for bullish OB), often after a liquidity sweep that traps traders. This failure signals a market structure shift, transforming the failed OB into a new demand (bullish BB) or supply (bearish BB). Traders enter positions on the retest of these zones, buying at bullish BBs or selling at bearish BBs, with stop losses placed beyond the block and targets set at the next liquidity pool or swing point.

What is the Difference Between a Breaker Block and a Mitigation Block?

The main difference between a breaker block and a mitigation block is that a breaker block creates a higher high before the order block that forms the breaker block is broken, while a mitigation block fails to break above the swing high before breaking the low.

What is the Best Time Frame for Forex Breaker Blocks?

The ideal timeframe for trading breaker blocks in Forex depends on the trader’s strategy and goals. Some traders also use multiple timeframe analyses to confirm trends and identify optimal entry points.

Is the Breaker Block Trading Strategy Good or Bad?

The breaker block strategy is only as good or bad as the trader using it. Many traders have found some form of trading consistency using it, while others would rather steer clear of it. This is because, like other trading strategies, it doesn’t always work.

In addition to breaker blocks and order blocks, other important smart money concepts are fair value gaps and optimal trade entry. Learn how to use them:

Fair Value Gap Trading Strategy (FVG) – A Complete Guide

Optimal Trade Entry in ICT – What Is It and How Does It Work?

Bottom Line

The breaker block is a valuable technical analysis tool if used correctly. However, it is merely one concept among many other ICT concepts. So, we do not recommend that you use it in isolation. Rather, combine it with other Smart Money Concepts, use it in conjunction with other technical indicators and chart patterns, and build a solid trading system around it.

This is the beauty of confluence in trading, where many concepts come together to form a complete trading system.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.