- ChoCh is a crucial concept in trading that signifies the initial shift in order flow within a financial market, often serving as a signal for potential reversals.

- A trader can rely on ChoCh signals across various timeframes to gauge market direction, from a major shift in trends on higher timeframes to short-term shifts in order flow on lower timeframes.

- Different forex trading styles, such as price action traders and indicator-based traders, can incorporate ChoCh into their strategies to identify market trends and entry opportunities.

- At first glance it might not seem like much, but ChoCh can be one of your best trading strategies if used rightly.

You’ve probably heard the forex trading mantra that “the trend is your friend.” But we know trends don’t last forever. So, where does the trend stop being your friend? And how do you make the switch immediately? That’s where Change of Character (ChoCh) comes in.

Used in the Wychoff trading model and now adopted by traders using different trading styles, ChoCh helps traders to identify a sign of weakness in a prevailing trend while also preparing them for a reversal.

This blog post will explore the Change of Characters and how you can use them to improve your trading investment portfolio. Let’s dive right in!

Table of Contents

Table of Contents

- What is the Change of Character in Trading?

- How to Use ChoCh in Trading

- How to Identify Change of Character

- The Change of Character Trading Strategy

- Change of Character Trading Strategy Free PDF Download

- What are the Benefits and Limitations of Change of Character in Trading?

- Conclusion

- Frequently Asked Questions

What is the Change of Character in Trading?

One of the key concepts that successful traders in the highly volatile forex market often use to gain insights into potential reversals is the “Change of Character” (ChoCh).

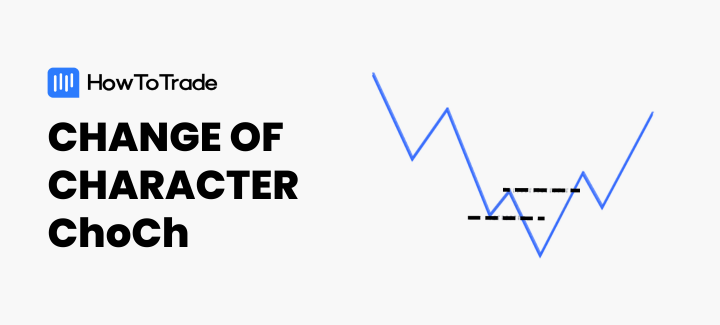

A Change of Character, abbreviated as ChoCh, is a smart money concept that signifies the initial shift in order flow in the financial markets. This structural shift occurs when a minor demand or supply zone fails to hold, indicating a potential shift in market trend. It is often a potential signal for a short-term or even long-term reversal of assets, equities, or currencies.

Ultimately, ChoCh is a valuable trend reversal pattern for traders seeking to identify moments when the market’s typical behavior transforms. It’s akin to noticing the subtle signs of a changing wind direction before a storm.

Change of Character vs Break of Structure

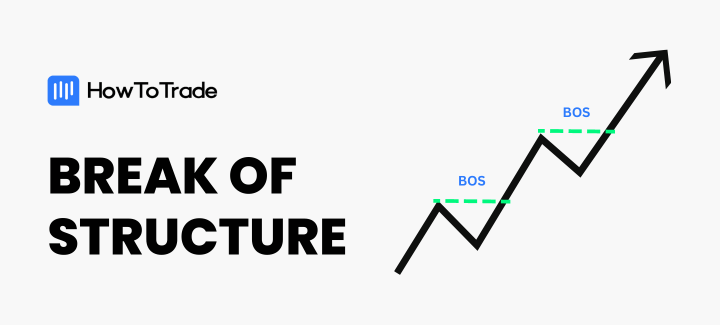

A concept often confused with a change of character is the break of structure, but the difference between these two is quite distinct.

A change of character happens when the market is about to shift direction. If we were in a bullish trend, you would see a change of character forming as a break from the most recent low to the downside. We call this a bearish ChoCh. And in a bearish trend, ChoCh appears as a break from the previous high to the upside. This is called a bullish ChoCh.

A break of structure, on the other hand, signifies that a current trend is just about to continue. You’ll see it in a bullish trend as a break from the most recent high to the upside; and in a bearish trend as a break from the most recent low to the downside.

Check out this video to learn more about Choch trading:

How to Use ChoCh in Trading

Change of Character is fractal. That is, it appears on any trading instrument and on any timeframe. As a result, this gives it a wide range of uses. But ultimately, these many uses boil down to two main categories:

- Higher Timeframe ChoCh.

- Lower Timeframe ChoCh.

Using ChoCh in higher timeframes means looking at the big picture. It helps traders gauge the broader market trend direction and anticipate potential significant reversals. By recognizing a ChoCh transition, you can better align your positions with the prevailing market sentiment.

On the other hand, when analyzing lower timeframes, such as the 1-minute timeframe, traders use ChoCh to identify potential trading opportunities and also make informed decisions. This meticulous analysis allows them to spot short-term shifts in order flow, enabling them to make precise trade entries.

Ultimately, knowing how to identify ChoCh patterns equips traders with a comprehensive understanding of when market sentiment is shifting, potentially leading to reversals or significant market movements. Armed with this information, traders can adjust their strategies, manage risk, and seize profitable opportunities.

How to Identify Change of Character

You can identify Changes of Character on your charts and in various market conditions using two major methods: price action and the use of indicators.

Identifying ChoCh Using Price Action

To identify it using ordinary price movement, you need a good understanding of market structure and break of market structure.

For a ChoCh pattern to happen, there must be an established trend. A series of higher highs and lows, where the price breaks structure continuously to the upside, represents an uptrend. In contrast, a downtrend is represented by a series of lower highs and lower lows, where the price is breaking the structure to the downside.

For a ChoCh to take place in a bearish trend, we expect two things:

- The market once more breaks structure to the downside, forming another lower high and lower low.

- The market, having formed a lower low, reverses until it surpasses the most recent lower high. That is your bullish Change of Character.

Similarly, for a market in a bullish trend, we expect two things:

- The market keeps breaking structure to the upside in a series of higher highs (HH) and higher lows (HL).

- Once the market forms the last HH and reverses immediately to fall below the most recent higher low before that higher high, you have your bearish ChoCh.

An ICT concept that’s simlar to the Change of Character is the Market Structure Shift. You can learn more about it here:

Identifying Market Structure Shift in Trading (A Beginner Guide)

Identifying Change of Character Using Indicators

For traders seeking a more automated approach to detecting market structure, break of structure, and ChoCh patterns, the “Smart Money Concepts” indicator by Luxalgo offers a convenient solution. This indicator is available in both free and premium versions on TradingView, making it accessible to traders with varying budgets.

The indicator simplifies the process by seamlessly adding ChoCh to your trading strategy. Here’s how it works:

- Market Structure Analysis: The indicator automatically identifies market structure, highlighting the existing trend’s key levels, such as higher highs and higher lows in a bullish trend and lower highs and lower lows in a bearish trend.

- Break of Structure Detection: It monitors price movements and promptly signals a break of structure when it occurs. This can be a game-changer for traders who prefer a more hands-off approach to technical analysis.

- ChoCh Alerts: When the market forms a ChoCh pattern, the indicator provides alerts, ensuring that traders are promptly informed of potential reversals.

However, the downside to using an indicator is that it won’t catch all the ChoCh. So, you might miss out on some opportunities. On the flip side, however, indicators can help you catch those ChoCh that are hard to find in various market conditions. It also takes the guesswork out of the equation if you’re a newbie to the concept.

How to Trade the ChoCh Trading Strategy (2 Trading Examples)

Now that we know how to identify the ChoCh, there are different ways to trade them. Depending on your trading style, here are graphical examples of how to trade ChoCh.

Example 1: Price Action Traders

For naked chart traders, using the market structure and CHoCH can be a valuable tool to identify market trends and entry opportunities.

1. Identify a Market Structure on a Higher Timeframe

A combination of the understanding of the basic market structure. When there’s a continuous break of structure to the upside or downside, that’s a form of market structure. Significant supply and demand zones are also another form of market structure because you expect the market to react in a certain manner when it gets to those levels.

For example, in the chart of the EURUSD currency pair in the 4-hour timeframe, the market has formed a clear demand level. And once again, it approaches that same level.

There are two expectations here. The price either breaks the demand level to the downside or bounces off it. For a ChoCh to happen, we need the latter to happen. If the cases were reversed, the market would need to either go past the supply or bounce from the supply. A bounce from the supply would give an opportunity for our ChoCh to appear.

2. Descend to a Lower Time frame to Scout For Entries

The 15-minute timeframe is the perfect lower time frame pair for the 4-hour, so we head to it. We’re expecting to find a Change of Character. This is what confirms our entry.

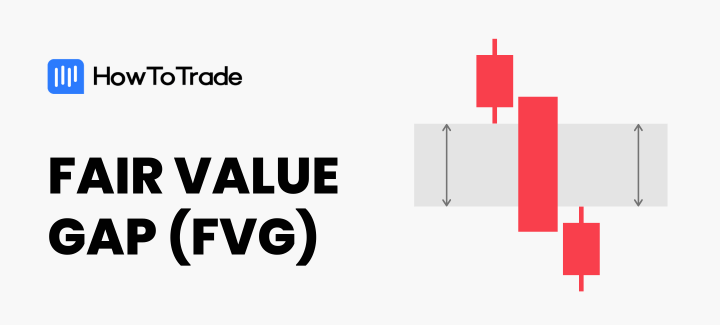

This clearly happens on our chart. Just after the price dips into the demand zone and liquidity grabs below the zone, it makes a strong U-turn that breaks the most recent swing high. It also forms a series of fair value gaps that show how aggressive the reversal is.

However, if you marked out your market structure on a 15-minute chart, you can go down to the 5-minute or 1-minute chart to scout your ChoCh.

3. Trade Entry

Your Change of Character pattern has formed. A point of reversal has been confirmed. What’s left now is how to get into the trade.

One way to do that is to enter a trade immediately after there’s a change of Character. That is the aggressive entry, however. Another way to get in a trade is to mark out the fair value gap that showed up while the market was pushing for the reversal. Place your limit orders at its upper edge (for bullish trades) or the lower edge (for bearish trades).

Continuing with our chart, you can take your aggressive entry on the break of the most recent swing high. Otherwise, wait for the price to return to the fair value gap where your Buy Limit order is waiting.

4. Stop Loss and Take Profit

In any of the execution methods, place your stop loss behind the last swing low (in an uptrend) or above the swing high (in a downtrend).

Setting your target profit can be done in a couple of ways. For example, you can target a fixed risk-reward ratio, target the swing high (in an uptrend) or the swing low (in a downtrend), or you can place your target profit at the next opposite order block. It is advisable to choose only one of these methods and stick to it.

Following the processes, the chart above is an example of what your trade would look like on a 1:2 risk-reward. It’s important, though, to not get over-excited and jump into a live account. Instead, start trading a demo account and backtest as far back as you can before trading it live.

Example 2: Indicator Traders

If you use different types of Indicators, incorporating CHoCH into your trading plan can reduce your losses and help you enter reversals early. Here’s an example of how to use ChoCh with RSI.

1. Look for an Overbought or Oversold Asset

Using the RSI in the 1-hour timeframe, you can easily scan through different assets and choose the one that is either overbought or oversold.

An overbought asset shows that the buyers are exhausted and the sellers are about to reverse the price. Hence, we will be looking for a sell opportunity. Conversely, an oversold market shows that the market is preparing to reverse to the upside.

2. Wait for a ChoCh

Once you’ve identified an overbought or oversold asset, it’s time to wait for a ChoCh on that asset. For an overbought asset, you wait for a bearish ChoCh.

Once you’ve identified that a ChoCh has formed, you can enter the trade immediately.

3. Setting Stop-loss and Exit

Setting your stop-loss is straightforward. For a SELL trade, simply set your stop loss above the swing high and just below the swing low if you are in a BUY trade.

To exit a trade, the best way is to check the RSI. You are to hold a SELL trade till it reaches an oversold level on the RSI before you exit the trade. Similarly, you can exit a BUY trade when the RSI shows that the asset is overbought.

Change of Character Trading Strategy Free PDF Download

Here’s a free change of character trading strategy PDF:

Change of Character PDF

What are the Benefits and Limitations of Change of Character in Trading?

Benefits

- A well-identified ChoCh can give traders a heads-up on a potential trend reversal before it happens in full force.

- ChoCh relies on analyzing price movements and volume, which are core aspects of any market.

- The concept of ChoCh can be applied to various markets, including forex, stock market, and cryptocurrencies, making it a versatile tool for diverse traders.

Limitations

- Not every ChoCh will lead to a successful trend reversal. The market can be volatile, and sometimes price movements might just be temporary fluctuations.

- While ChoCh can provide initial clues, it’s often recommended to use it in conjunction with other technical indicators or confirmation signals like trendlines or chart patterns before making a trade..

Over To You

The Change of Character (CHoCH) pattern is a great trend reversal confirmation tool. It’s important to note that there are also false ChoCh moves, where the price changes character, only to reverse once again to the initial trend. And that’s why you should always use every pattern in confluence with other tools.

Frequently Asked Questions About Change of Character

Here are some frequently asked questions on ChoCh trading:

What is the significance of Change of Character (ChoCh) in trading?

ChoCh is a critical concept in trading that shows potential shifts in order flow and serves as a signal for potential market reversals. It helps traders anticipate changes in market sentiment.

Is ChoCh applicable to all financial instruments?

While most traders use it on the forex market, ChoCh is not limited to forex markets alone. It can be applied to a wide range of financial market charts, including stocks, commodities, and cryptocurrencies. Its effectiveness is more related to the trader’s ability to interpret and apply ChoCh signals within the context of their chosen market rather than being limited to specific assets or markets.

Are there automated tools available to detect ChoCh patterns in trading?

Yes, traders can use tools like the “Smart Money Concepts” indicator by Luxalgo for automated ChoCh detection. This indicator simplifies market structure analysis, identifies breaks in structure, and provides timely ChoCh alerts, making it accessible to traders with varying budgets.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.