- Momentum trading is a strategy that capitalizes on the continuation of existing market trends, exploiting price movements in the direction they are already heading.

- This trading style thrives on market volatility, utilizing technical indicators like the Relative Strength Index (RSI), Moving Averages, and the Stochastic Oscillator to gauge market price trends and momentum

- Some popular momentum trading techniques include trading with the ADX indicator, spotting hidden divergences, and trading pullbacks and breakouts.

- While potentially lucrative, momentum trading demands high vigilance, swift action, and robust risk management, making it more suitable for traders comfortable with rapid market changes and short-term strategies.

It’s not a secret that knowing how to ride the momentum in trading is a key part of being a successful trader. In fact, instead of “buying low and selling high,” certain financial giants such as Richard Driehaus believe it is easier to make money by “buying high and selling higher,” thus popularizing momentum trading strategies.

In short, momentum trading strategies help you to recognize and follow the trend. So, in this article, we will cover everything you need to get started trading these strategies. We will also show you three different momentum strategies to take your trading skills to the next level.

Table of Contents

Table of Contents

What is Momentum in Trading?

Momentum trading in the financial markets refers to a strategy where traders capitalize on the current direction of instrument prices, riding the wave of market trends to earn profits. This approach relies on the principle that assets that are moving in a particular direction are likely to continue moving in that direction for a certain period.

However, even though it’s sound nice, riding the momentum is not that easy. It’s a skill that you might naturally have or one that you need to master. I mean, we pretty much know that some of the best traders in the world are those who know how to catch the wave and ride the momentum. Surprisingly, these traders often have a losing-win-rate ratio, because they know how to catch this one big trade while losing most of the trades. It’s a skill and one that is hard to master.

Crucially, one of the backbones of momentum trading is recognizing and leveraging volatility in the market. Volatility, in this context, represents the extent of price fluctuations of an asset. Momentum trading strategies usually target short-term market movements, making them versatile enough to align with various trading styles, from day trading to longer-term position trading. The key is to identify the asset of interest, devise a strategy based on technical analysis and indicators, and then execute trades in live markets.

At this point, you may be tempted to think that momentum trading strategies are merely another technical analysis method, but nothing can be further from the truth. Instead, it’s about focusing on the main body of the price movement and leveraging market psychology and herd mentality, which drive prices in a certain direction. As a matter of fact, it’s a theory. Not everyone can be momentum traders, but those who succeed in doing so get a very useful tool to make profits in the markets.

Top Indicators and Tools for Momentum Trading Strategies

When it comes to momentum trading strategies, the effective use of technical indicators and tools is crucial for identifying and capitalizing on market trends. Here are the top indicators momentum traders use from time to time:

Moving Average Convergence Divergence (MACD)

The MACD indicator compares a longer exponential moving average (EMA) with a shorter-term EMA to produce the MACD line, followed by a histogram and a signal line. The crossover of the signal line and the histogram is generally seen as an indicator of a shift in the market’s momentum, which could signal a change in the price trend.

Moreover, momentum traders interpret a certain MACD condition as an indicator of a strong market trend. When the MACD line is above or below the signal line, and the histogram bar shows a strong market trend., traders can interpret that as a signal for a trend continuation. As seen in the chart above, the trend is likely to continue when the blue line crosses above the orange line and the bars are above the zero level of the histogram, and vice versa in a downtrend.

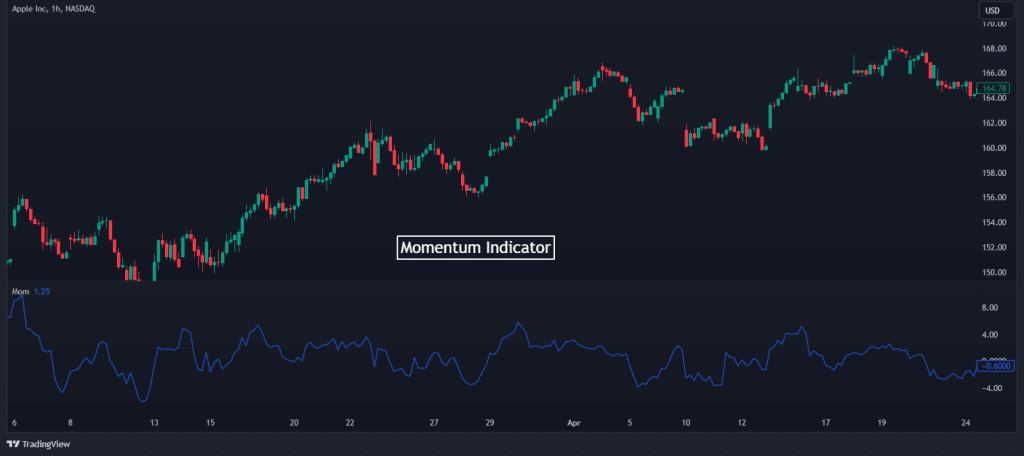

The Momentum Indicator

This indicator, often overlooked due to its simplicity, is another essential tool. It compares the last closing price with a previous one, typically from 14 periods ago (although some traders use 30 periods for smoother signals). This momentum indicator is less smoothed than others, like the Relative Strength Index (RSI), making it a more reactive momentum strategy and often providing an early signal before a price-turning point.

Mostly, traders utilize this tool for corroborating price movements rather than for direct trading signals. An upward crossing of the zero line by the indicator signifies increasing upward momentum in price, whereas a downward crossing indicates a growing downward momentum. This functionality makes the momentum indicator a vital component in the toolkit of traders, especially for confirming the direction and strength of market trends.

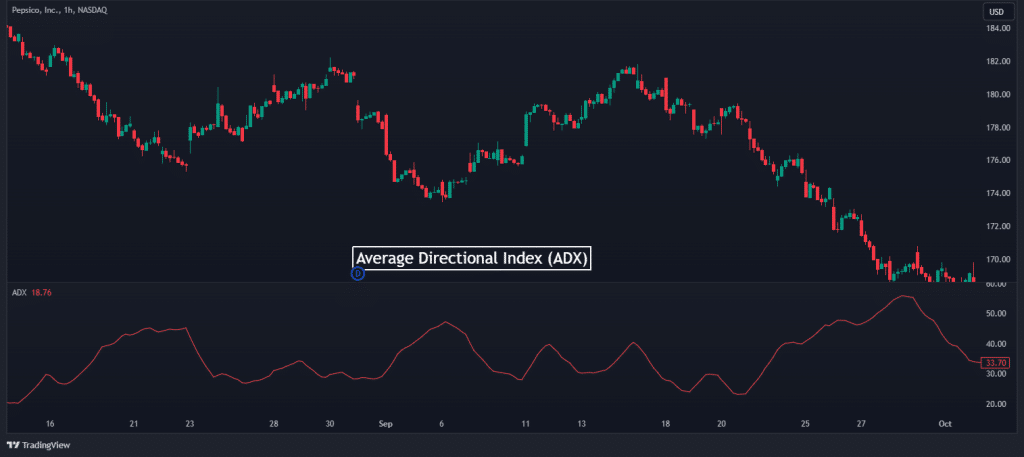

Average Directional Index (ADX)

In addition to these, the Average Directional Index (ADX) is also a valuable momentum indicator. The ADX, along with Directional Movement Index indicators – the negative directional indicator (-DI) and the positive directional indicator (+DI) – helps investors evaluate the strength and direction of a trend.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a critical tool in momentum trading, acting as an oscillator that fluctuates between zero and 100 on its scale. Its primary function is to generate buy and sell signals by identifying overbought and oversold conditions in the market. An RSI value exceeding 70 typically indicates an overbought state, suggesting a potential sell signal, whereas a value below 30 signifies an oversold condition, potentially signaling a buying opportunity.

This indicator operates on the principle that price retracements within specific levels can reveal discernible market trends. However, in momentum trading, the strategy is actually to enter and exit trades based on these trends rather than attempting to pinpoint the absolute highs and lows of the market.

It’s crucial to understand, however, that the RSI’s indication of overbought or oversold conditions does not inherently mean an imminent trend reversal. For instance, the RSI may remain in an overbought zone for an extended period without a corresponding trend reversal. Hence, it’s advisable to use the RSI in conjunction with other technical indicators to gain a more comprehensive view of the market conditions. This approach enhances the accuracy and reliability of trading decisions based on the RSI.

Moving Averages (MAs)

MAs are vital in any trading strategy, including the momentum strategy. This is because they help in spotting emerging trends by smoothing out price fluctuations over a specified period. While not directly indicative of momentum, moving averages are instrumental in helping traders determine if a market is confined within a range or exhibiting a clear trend.

For instance, let’s consider a scenario where a chart incorporates three distinct moving averages: 13-day, 50-day, and 100-day. When these moving averages align closely with the shortest-term MA at the top and the longest-term MA at the bottom, it suggests a strong, potentially accelerating trend in the market. For that matter, many traders use various moving averages crossover strategies such as the 9 EMA strategy or the 20 EMA strategy.

Stochastic Oscillator

This is a leading indicator that compares an asset’s closing price to its price range over a certain period. Like the RSI, the oscillator indicates overbought or oversold conditions and is useful for predicting potential price movements. It consists of two lines on a chart: the indicator line and the signal line. A crossover of these lines can signal a change in market direction.

Yet, again, to detect momentums in the markets, traders often use the crossover between the lines and the rise or fall above 80 or 20 as an indication for trend continuation rather than a reversal signal.

Top 3 Momentum Trading Strategies

Momentum traders usually have strong trading instincts to feel where the market is heading and ride the trend. But still, they often use specific momentum indicators. These indicators and tools are key in assessing the intensity of a price movement, which in turn can signal whether the trend is likely to attract more market participants and gain further momentum.

Below, we show you some of the most effective momentum trading strategies:

1. Trend Momentum with ADX

This momentum strategy uses the Average Directional Index (ADX) along with a 200-period moving average on a daily chart. The key here is to look for a rising ADX, which indicates strengthening momentum. A trade is initiated when the ADX starts trending upwards, and the asset’s price breaks through the 200-day moving average. This is a signal of potential continued momentum in the trend’s direction.

As you can see, the entry point is after these conditions are met. Once the ADX is rising and the price crosses above the 200 EMA, a signal is made. For risk management, a stop-loss is placed just below the most recent price swing. The profit target is usually set to twice the distance of the stop-loss, aiming for a 1:2 risk-reward ratio.

The use of ADX helps in distinguishing between strong and weak trends, allowing traders to make more informed decisions about entry and exit points.

2. Spotting Hidden Divergences in Price Action

This strategy utilizes the Relative Strength Index (RSI) to identify hidden divergences in price action. For those unaware, divergences in trading occur when the price of an asset moves in one direction (e.g., upwards) while the indicator (RSI in our case) moves in the opposite direction (e.g., downwards). This can indicate a trend continuation in the asset’s price.

From the chart above, we can see that the price is forming a higher high. We can then patiently wait for a bullish hidden divergence before entering a BUY trade. The stop-loss is placed just below the recent price swing, and the profit target is set at a key level that offers at least twice the risk.

It’s crucial to confirm the divergence pattern and not rely solely on the RSI. This strategy often works best in a trending market where the RSI divergence can signal a potential continuation of the current trend.

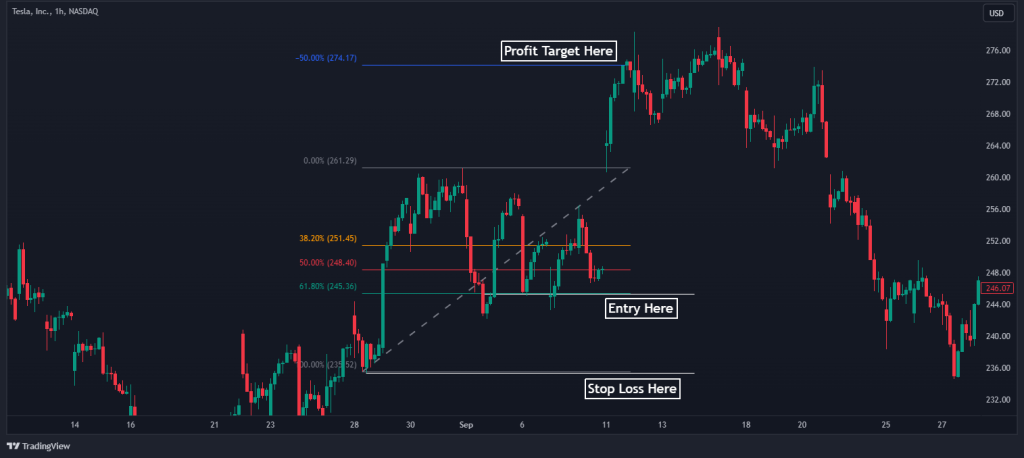

3. Day Trading Pullbacks and Breakouts

Generally, pullbacks and breakouts are a big thing in momentum trading, largely because they provide a good entry opportunity during an ongoing trend. And guess what – that’s the biggest challenge of momentum trading. To know when to join the trend and enter a trade.

So, this strategy involves entering trades after a price retracement in the direction of the primary trend. The idea is to catch the “pullback” in a trend before it resumes its main direction.

Entry is after a retracement, and positions are closed at set profit targets like daily highs/lows or Fibonacci extension levels. The stop-loss level is set based on the market opening or below the swing points. Here’s how it looks on the chart:

This strategy requires good timing and an understanding of market momentum. It’s important to choose instruments with high liquidity and to be aware of any news or events that might impact stock prices.

Each of these strategies – the pullback strategy and the breakout trading strategy – requires a different level of market analysis and understanding of technical indicators. They also demand a disciplined approach to risk management and an ability to interpret market signals accurately. It’s important to practice and become comfortable with the methods in a simulated trading environment before applying them in real trading scenarios.

The Free Momentum Trading Strategies PDF

If you need something to easily carry around and refer to when it comes to momentum trading, this PDF is for you:

The Free Momentum Trading Strategies PDF

How to Become a Good Momentum Trader?

So, how can you become a successful momentum trader? Well, some might argue that it’s a skill that cannot be taught. However, this is debatable, and many can argue the opposite – that with the right mindset, tools, and mentorship – becoming a good momentum trader is indeed possible.

The idea of this strategy is simple – Momentum trading capitalizes on the continuation of existing market trends, leveraging the inertia that drives financial markets. This approach is particularly attractive because it doesn’t require pinpoint predictions about market tops and bottoms. Instead, it focuses on catching the wave of market movements, riding the momentum already established by prevailing trends. The strength of momentum trading is in alignment with the fundamental principle of the market – that trends, once established, tend to persist.

Yet, trading this strategy comes with some set of challenges. Above all, applying proper risk management is a vital part of momentum trading. Additionally, identifying pullbacks and breakouts is another key element in becoming a momentum trader.

So, if you feel you have the skill of identifying momentums in trading, then go ahead and try it. Otherwise, if you would like to get all the necessary tools and information to become a momentum trader, then you should consider joining our trading academy, where we teach the basics and much more to build a successful trading career.

Frequently Asked Questions

Here are some frequently asked questions about the momentum trading strategies.

Do momentum trading strategies work?

Yes, momentum trading strategies have proven to be effective in various market conditions, especially in markets that exhibit strong trends. However, the success of momentum trading strategies mostly depends on the trader rather than the strategy. A momentum trader thrives in volatile and hectic markets, and has the ability to take and extend profits during trending markets.

What is the best technical analysis indicator for momentum trading?

The Relative Strength Index (RSI) is widely regarded as one of the best technical analysis indicators for momentum trading. It measures the speed and change of price movements, helping traders identify overbought or oversold conditions in a trading asset. Also, its effectiveness in different market conditions makes it a versatile tool for momentum traders.

What is the 5-minute momentum trading strategy?

The 5-minute momentum trading strategy is a popular method among day traders, focusing on short-term movements in highly liquid assets. This scalping trading strategy involves using a 5-minute chart to identify strong momentum in a stock or asset, followed by entering trades in the direction of the momentum. Traders typically use technical indicators like moving averages or RSI to confirm the momentum and set tight stop-losses to manage risk.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.