- The Andrew’s Pitchfork trading strategy, developed by Alan Andrews, is popular trading method that involves the use of the Pitchfork technical analysis indicator.

- The indicator, which is made of three trendlines, helps traders identify dynamic support and resistance levesl.

- Like all indicators and trading strategies, it is recommended to use the Pitchfork indicator in combination with other technical analysis tools.

Developed by Alan Andrews, the Andrew Pitchfork trading strategy is a popular trading technique that involves the use of the Andrew Pitchfork technical analysis indicator. The indicator, which is made of parallel trend lines, can help traders identify protracted market swings.

On this page, you’ll learn:

- What the Andrew’s Pitchfork indicator is

- How to properly draw the indicator

- The rules and guidelines for using the Andrew’s Pitchfork’s trading strategy

- How to use the Andrew’s Pitchfork trading stratgey

Table of Contents

Table of Contents

- What is the Andrew’s Pitchfork Trading Strategy?

- Drawing the Andrew’s Pitchfork Indicators – Step-by-Step Tutorial

- Trading Rules for the Andrew’s Pitchfork Trading Strategy

- How to Use the Andrew’s Pitchfork Indicator – Setup and Best Settings

- 4 Ways to Trade Using Andrew’s Pitchfork Trading Strategy

- The Free Andrew’s Pitchfork Trading Strategy PDF

- Summary – Does the Andrew’s Pitchfork Strategy Work?

What is the Andrew’s Pitchfork Trading Strategy?

Andrew’s Pitchfork Trading Strategy is based on a technical analysis tool developed by Alan Andrews, a retired MIT thermodynamics professor who invented many trading strategies during the 60s and 70s. It is rooted in the concept of median line studies and provides traders with a structured method for forecasting market trends and potential price movements.

Andrews based his methodology on the principle that market prices tend to gravitate towards the median line approximately 80% of the time, with the remaining 20% accounted for by more volatile fluctuations. This foundational belief underscores the effectiveness of Andrew’s Pitchfork in identifying the underlying, longer-term trend of a market despite the noise created by short-term price movements.

Technically, the Pitchfork trend channel technical indicator is made of three trend lines—the upper trend line, the median line, and the lower line. These three parallel trend lines create dynamic support and resistance levels, which allow traders to trade ranging or trending markets. The name is derived from the indicator’s shape of… a pitchfork.

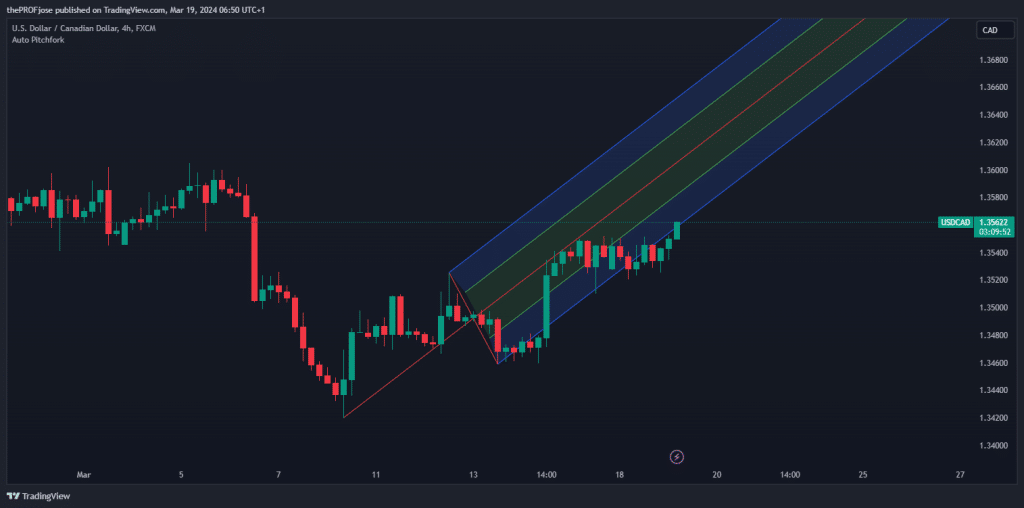

As you can see, the Andrews Pitchfork indicator facilitates drawing a price channel that mirrors the market’s trending direction. The tool is versatile across various trading platforms, though its composition may vary.

For instance, on the popular TradingView platform, the indicator is depicted with five parallel lines, incorporating additional nuances to the market’s potential directions. The MetaTrader 4 (MT4) platform presents a simplified version with only three lines. The central line in both variations represents the median line, which is crucial for determining the market’s expected path. Either way, the rules and trading techniques remain largely the same.

Crucially, the application of Andrews’ Pitchfork extends beyond the mere identification of a price channel. It includes trigger lines—trend lines that extend from the initial median line price point and intersect subsequent points along the pitchfork.

These trigger lines are pivotal in the strategy, indicating potential market breakouts or breakdowns. Specifically, a breakout above the upper trigger line signals an anticipation of further upside movement, while a breakdown below the lower trigger line suggests the likelihood of continued downward trends.

Drawing the Andrew’s Pitchfork Indicators (Step-by-Step Tutorial)

Following a structured process is essential to effectively drawing and utilizing Andrew’s Pitchfork Indicator in your trading strategy. This tool is widely recognized for its ability to offer insightful predictions on market trends by identifying potential support and resistance levels.&nbs

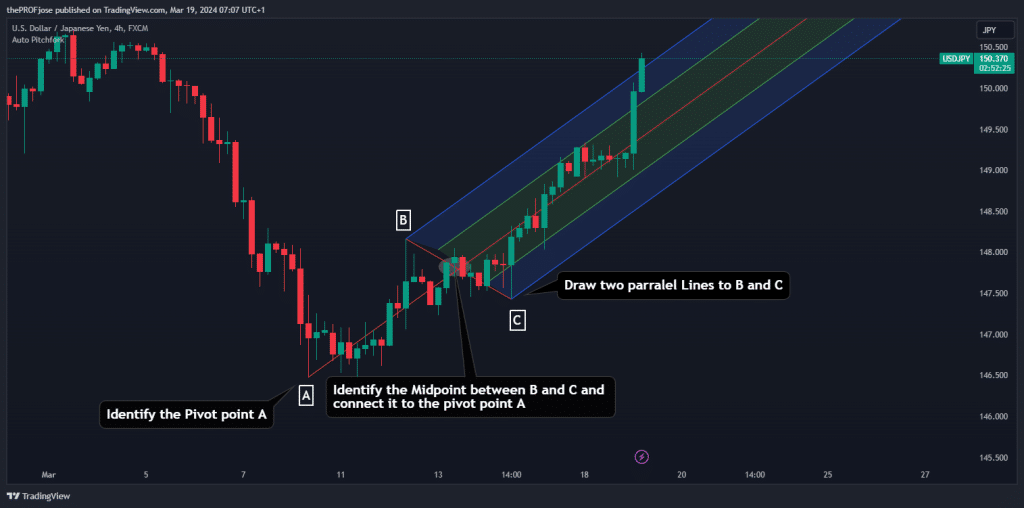

Here’s what the indicator looks like on a price chart. As you can see, there are three key points – A, B, and C. This is an essential part of Andrew’s pitchfork strategy – the market must present three price swing levels.

Taking the above into consideration, here’s a simplified step-by-step guide based on insights gathered from various financial experts:

- Identify Pivot Points: The first step involves selecting three pivotal moments on your chart, which typically include a significant low followed by a high and then another low for an uptrend (or the reverse for a downtrend).

- Drawing the Median Line: Connect the first pivot point to the midpoint between the second and third points. This line is your median, around which the pitchfork will be structured.

- Constructing the Prongs: Draw two lines parallel to the median line from the second and third pivot points. These lines create the pitchfork’s “prongs” and set the boundaries for potential support and resistance zones.

- Adjustment and Interpretation: After drawing, you may need to adjust the pitchfork to fit the market’s movement better. The aim is to use the median line as a guide for price direction, with the outer lines serving as boundaries for price action.

Andrews based his methodology on the principle that market prices tend to gravitate towards the median line approximately 80% of the time, with the remaining 20% accounted for by more volatile fluctuations. This foundational belief underscores the effectiveness of Andrew’s Pitchfork in identifying the underlying, longer-term trend of a market despite the noise created by short-term price movements.

Trading Rules for the Andrew’s Pitchfork Trading Strategy

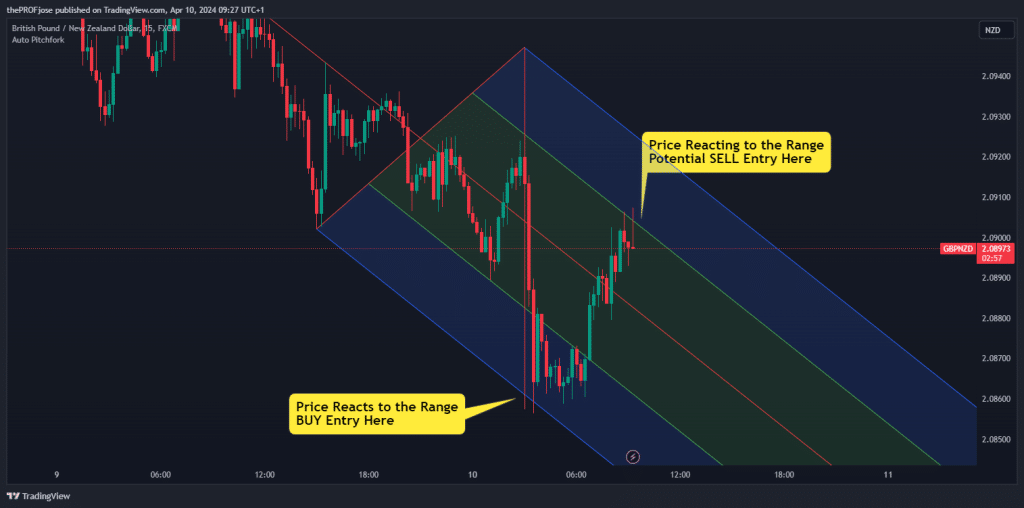

To master trading with Andrew’s Pitchfork strategy, it’s essential to grasp the set of rules that guide entry and exit points and risk management within this framework. The strategy’s core revolves around the median line, where prices tend to gravitate, and the outer lines, which act as boundaries for potential support and resistance. Here’s a condensed guide to applying these rules effectively in both long and short trades.

Long Trades:

- Identify an Uptrend: Using Andrew’s Pitchfork, draw a bull channel starting from a significant low point and then identify a major high followed by another low.

- Wait for a Retest: Look for the price to drop and retest the lower median line. No bar’s high must be below this line, signaling a potential bounce.

- Entry Point: Buy a tick above the high of a bull bar that tests but doesn’t break below the lower median line.

Short Trades:

- Identify a Downtrend: Draw a bear channel by starting from a significant high point, then identify a major low followed by another high.

- Wait for a Retest: Watch for the price to rise and test the upper median line. Ensure no bar’s low is above this line, indicating a potential rejection.

- Entry Point: Sell a tick below the low of a bear bar that tests but doesn’t break above the upper median line.

Managing Trades:

- Taking Profits: Consider taking partial profits at the median line and the remainder at the upper (for long trades) or lower (for short trades) pitchfork boundary. This strategy leverages the principle that price tends to return to the median line, allowing for profit-taking on this predictable movement.

- Stop Loss Placement: Place your stop loss below the lower pitchfork trendline for long trades, adding a buffer of 20-30 pips to safeguard against false breakouts. For short trades, reverse this placement above the upper trendline with a similar buffer.

These trading rules are founded on the observation that price action within the pitchfork structure often reveals predictable patterns of support, resistance, and trend continuation or reversal.

How to Use the Andrew’s Pitchfork Indicator – Setup and Best Settings

Using Andrew’s Pitchfork indicators effectively requires understanding how to set them up for different trading styles, such as day trading and swing trading. Here’s how to leverage this powerful tool in various trading scenarios:

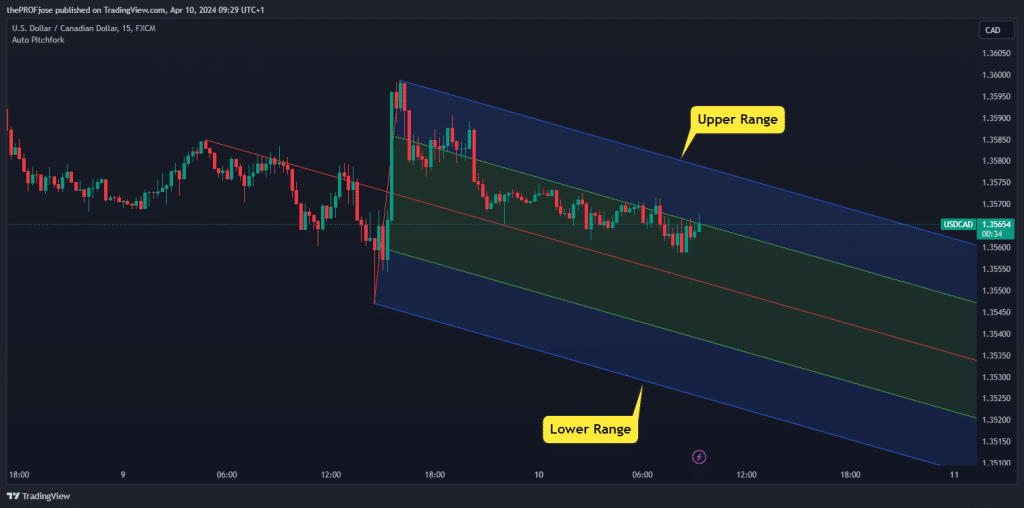

Method 1 – Ideal for Day Trading

Timeframes and Tools: Day or swing traders who utilize Andrew’s Pitchfork strategy often work with shorter timeframes like 1 hour (1h) or 15 minutes (m15). The “auto pitchfork” indicator available on TradingView can be particularly useful for this trading style. It automatically draws pitchforks on your charts, identifying potential support and resistance levels based on recent price movements.

However, note that many traders also use Pitchfork’s trend lines to capture market trends. For example, when the price moves inside the media green lines or along the blue areas, traders often use that to ride the momentum. To confirm the trend, they typically use other technical indicators.

Setup: To use the auto pitchfork for day trading, focus on adjusting the settings to capture the short-term price movements effectively. This might involve setting the pivot points more closely to reflect the rapid changes that occur within the day. Such timeframes include the 1-minute, 5-minutes, and 15-minutes.

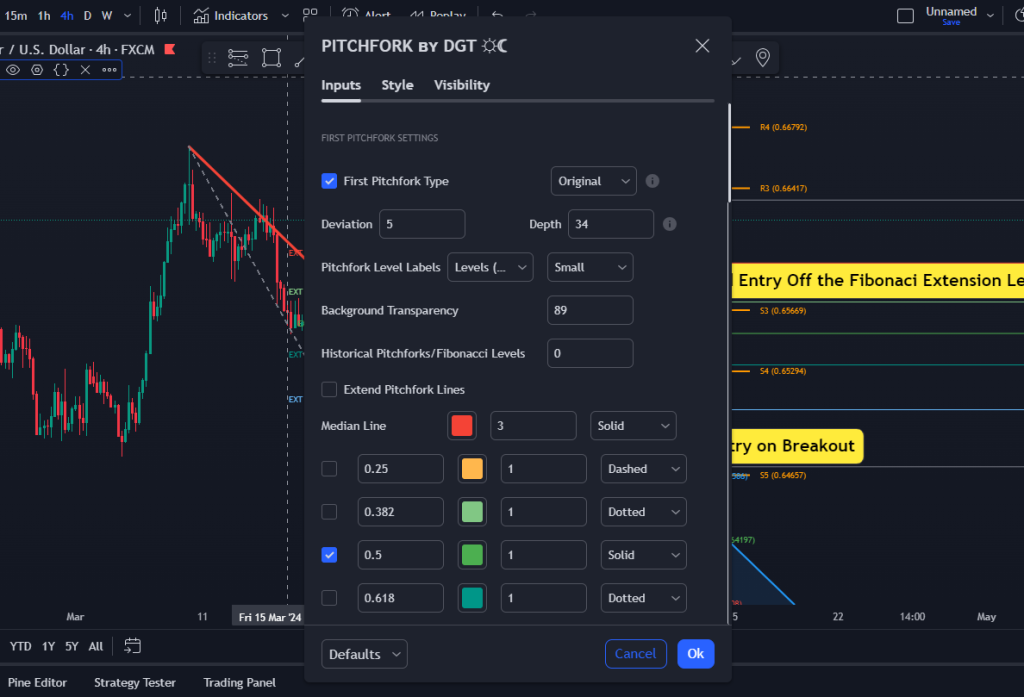

Best Settings: While the default settings can offer a good starting point, day traders might want to adjust the sensitivity of the pitchfork to ensure it aligns with the specific volatility and price action of the assets they are trading. Experimenting with different settings in a demo account can help determine what works best for your strategy.

Method 2 – Ideal for Swing Trading

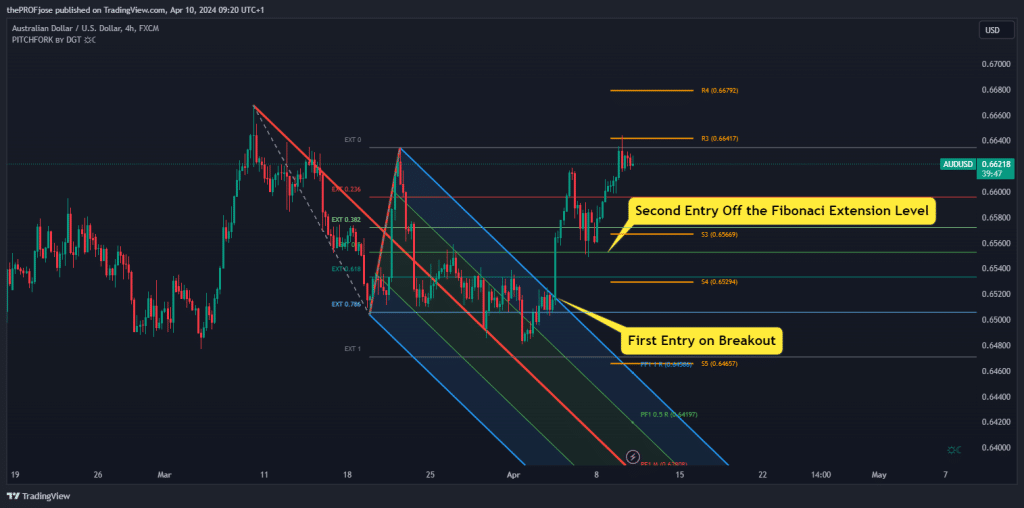

Traders can also benefit from a more comprehensive tool like the “Auto Pitchfork, Fib Retracement, and “Zig Zag” by dgtrd on TradingView. This indicator combines the pitchfork with Fibonacci retracement and extension levels and the Zig Zag pattern to offer a deeper analysis of market trends.

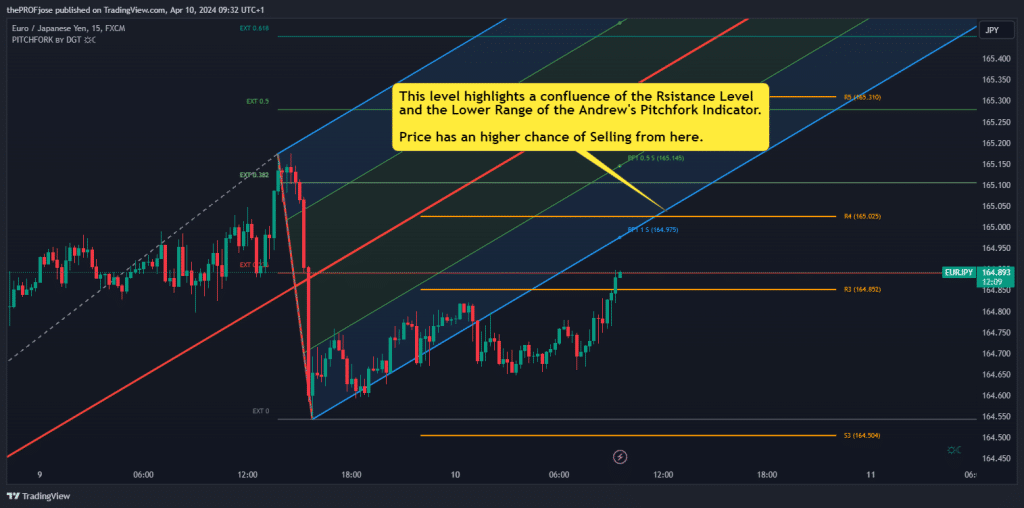

Customization: The tool allows customization of support and resistance levels, pivot points, and Fibonacci levels, making it more versatile for identifying entry and exit points over longer periods. The Fibonacci extension levels are particularly useful for swing traders as they help in scaling into trades and riding the trend for longer durations. It is also advisable to use it in conjunction with the Pivot Point technical indicator.

Timeframes: It is best utilized on daily or 4-hour timeframes, providing a broad view of the market’s direction and potential reversal points.

Best Settings: For swing trading, adjusting the settings to incorporate broader market swings is crucial. This means setting the pitchfork and Fibonacci levels to capture significant highs and lows over longer periods. The goal is to identify major trends and corrections, allowing for strategic entries and exits based on more substantial price movements.

Check out our daily market analysis page for insights about leading FX pairs, global indices, and commodities.

4 Ways to Trade Using Andrew’s Pitchfork Trading Strategy

Mastering Andrew’s Pitchfork Trading Strategy opens up many opportunities for traders to navigate the markets more effectively. By leveraging this versatile technical analysis tool, traders can enhance their ability to identify trend channels, potential reversal points, and key support and resistance levels. Here, we explore four ways to utilize Andrew’s Pitchfork strategy in your trading:

1. Establishing Trend Boundaries

The most conventional method of using Andrew’s Pitchfork’s indicator is by setting clear trend boundaries and trading accordingly. Utilizing Andrew’s Pitchfork to delineate trend boundaries involves first recognizing the primary trend direction. Once identified, the Pitchfork tool is applied to encapsulate the trend’s essence. This involves identifying pivotal price extremes and applying the correct type of Pitchfork to analyze price behavior within its bounds. This technique helps set dynamic entry points as well as profit targets, and stop-loss orders, and validate trading decisions with additional technical tools.

2. Confirming Support and Resistance Levels

The Pitchfork’s lines also serve as dynamic markers for support and resistance, identifying crucial price levels where reversals or significant price reactions may occur. This function enriches the analysis by providing a means to confirm areas of supply and demand, especially when Pitchfork’s indicator is used in combination with other tools, such as the Fibonacci Retracement tool or the pivot point tool.

3. Channel Breakouts

As a technical indicator made of bands, the Pitchfork can also be used to identify breakouts, which normally occur when the price extremely gets out of Andrew’s Pitchfork channel. Therefore, it is also an excellent indicator to use when applying the breakout trading strategy.

Breakouts from the Pitchfork channels indicate significant price movements. A bullish breakout above the upper parallel line suggests upward momentum, whereas a bearish breakout below the lower line signals downward momentum. To ascertain the validity of a breakout, incorporating other indicators and waiting for confirmatory signals post-breakout is advisable to mitigate the risk of false signals.

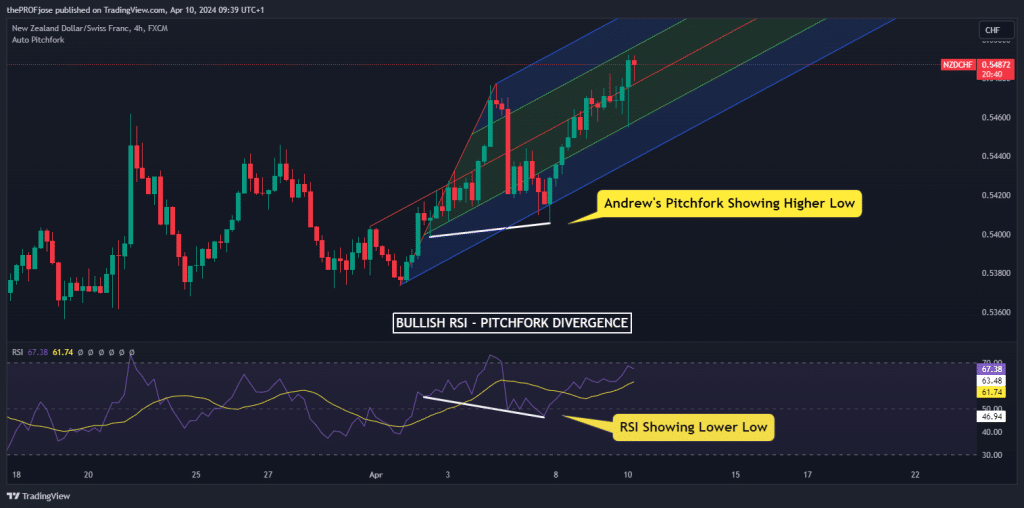

4. Divergence Confirmation

Finally, the Pitchfork can also be crucial in identifying potential trend reversals through divergence analysis with a technical oscillator, like the RSI. When price action reaches one of the Pitchfork lines while exhibiting divergence, it may signal an impending reversal, adding a layer of confirmation to divergence trading strategies.

The Free Andrew’s Pitchfork Trading Strategy PDF

Here, we have a PDF about Andrew’s Pitchfork trading strategy that can be downloaded for free. It’ll come in handy should you need something quick to refer to concerning the strategy:

Andrew’s Pitchfork Trading Strategy Free PDF Download

Does the Andrew’s Pitchfork Strategy Work?

In sum, Andrew’s Pitchfork strategy, with its roots in the principles of trend lines and median lines, is a tool that has garnered attention for its unique approach to market analysis. Its effectiveness is anchored in its ability to highlight potential trend channels, key support and resistance levels, and possible reversal points through a structure that is both visual and adaptable to various market conditions.

Critically, the strategy’s success hinges on accurately identifying pivot points from which the Pitchfork is drawn. This initial step is crucial as it sets the foundation for the trend lines that will guide the trader’s decisions. We can also say that the Pitchfork strategy works much more effectively in trending markets rather than ranging markets, where it can offer clear indications of price boundaries and potential breakout points.

Clearly, like all trading strategies, its effectiveness is not absolute and can vary across different market conditions, asset classes, and, most importantly, the trader’s trading style. From my personal experience, you can meet traders who use random indicators that are not very popular, and somehow, they have managed to create their own profitable trading system. So, if it works, then it works. There are no rules in trading – if something works for you, then you should continue using it.

So, does the Andrew’s Pitchfork strategy work? Absolutely. It is an excellent technical analysis indicator that can be developed into a comprehensive trading strategy, especially when used in combination of other tools and techniques. And, if it’s well mastered, it certainly can provide plenty of trade opportunities.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.