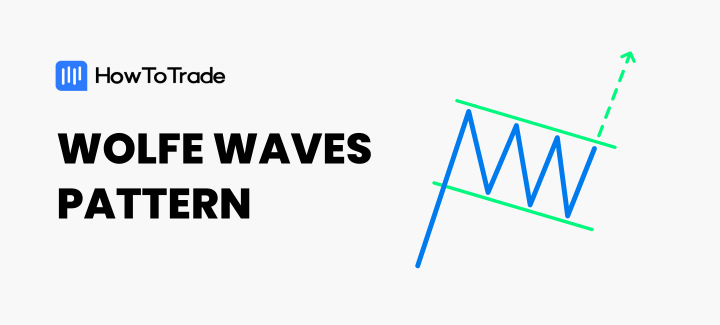

- The Wolfe Wave is a five-point geometric chart pattern pattern used to predict price reversals and establish clear target levels in trading. It happens in a series of five waves, with the fifth being the one you’re aiming to trade.

- Identifying a valid Wolfe Wave requires some experience and strict adherence to its rules to avoid false interpretations.

- While powerful, the Wolfe Wave is time-consuming to analyze and susceptible to false signals in volatile market conditions.

The Wolfe Wave is a fascinating and potentially profitable pattern for those who master its nuances. It’s a way to catch trend reversals using five waves of price movements.

This piece thoroughly explores the Wolfe Wave, from its definition and mechanics to strategies and real-world examples. We hope that you get a comprehensive understanding of this powerful trading tool when you’re done reading it.

Table of Contents

Table of Contents

What is the Wolfe Wave Chart Pattern?

The Wolfe Wave is a naturally occurring trading pattern that reflects the market’s inherent rhythm of supply and demand. Developed by Bill Wolfe, this pattern is often seen in all freely traded markets, including forex, stocks, and commodities. It comprises five distinct points that create a wave-like structure, offering clues about future price movements.

The Wolfe Wave is rooted in price action and is not dependent on any technical indicators. Its primary purpose is forecasting price reversals and establishing targets with remarkable precision. You can use the Wolfe Wave to anticipate underlying equilibrium price points where market prices tend to stabilize after a period of volatility.

How Do You Identify the Wolfe Wave Pattern?

The Wolfe Wave identifies a series of price movements that adhere to a specific wave formation. Here’s how the pattern typically unfolds:

- Points 1 to 2 (First Wave): This marks the initial price movement in the market, creating the first leg of the wave.

- Points 2 to 3 (Second Wave): A reversal occurs, forming the second leg in the opposite direction.

- Points 3 to 4 (Third Wave): A smaller reversal in the direction of the first wave develops, laying the groundwork for the wave’s apex.

- Points 4 to 5 (Fourth Wave): The final wave completes the formation, usually extending beyond Point 3. Ideally, the third and fourth waves must remain in the channel created by the first and second waves. However, there are times when this rule is not followed. In such scenarios, you’ll need experience with the chart to spot the false move from the real Wolfe wave chart pattern.

- The Fifth Wave: This is the wave you’re attempting to ride. And if you play your cards right, it is usually a reversal wave, and your price target will be the intersection between the price and the extension of a straight line that connects Points 1 and 4.

The chart above is a typical example of a bullish Wolfe Wave pattern. Bearish Wolfe Wave patterns are similar, but they predict a potential downward movement after a series of upward-sloped waves.

The key feature of the Wolfe Wave is the identification of the “Entry zone” (Point 5), where traders can anticipate a breakout or reversal. Connecting Points 1 and 4 with a trendline and extending it to meet Point 5 creates the Profit Line or Target Line. This line indicates where the price is likely headed, offering a clear target for traders.

Harmonic Patterns, just like Wolfe Waves, also have uncanny ways of prediction price movements using geometry. You can check them out here:

The Wolfe Wave Trading Strategy

The Wolfe Wave strategy is powerful for predicting price reversals and identifying potential profit opportunities. It combines the precision of geometric patterns with practical risk management. Here’s a step-by-step guide to trading financial assets using the bullish Wolfe Wave pattern:

1. Recognize the Wolfe Wave Pattern

Locate the five-point structure on a price chart. Ensure that Points 1 through 5 follow the Wolfe Wave formation rules. Point 5, located in the entry zone, typically overshoots the trendline connecting Points 1 and 3, signaling a potential reversal.

2. Validate the Entry Zone

The Entry zone at Point 5 is crucial for determining your entry point. Look for candlestick signals that suggest an imminent reversal, such as engulfing patterns or pin bars. Increased trading volume near this zone further strengthens the pattern’s reliability. It also helps if there are support and resistance levels at your Point 5, so that the price has another reason to reverse.

3. Draw the Target Line

Using Points 1 and 4, create a trendline and extend it beyond Point 5. This target line is a roadmap for the price’s expected movement post-reversal, offering a logical point to exit the trade.

4. Plan and Execute Your Entry

Once confirmation signals align, enter the trade near Point 5. This ensures you enter as close to the reversal point as possible, maximizing the potential reward.

5. Set Stop-Loss and Take-Profit Levels

Position your stop-loss just beyond Point 5 to protect against false breakouts. Place your take-profit along the target line or slightly before it to secure gains without overexposure to market reversals.

6. Monitor and Adjust

As the price progresses toward the target line, manage the trade by trailing your stop-loss. This approach locks in profits while giving the trade room to breathe.

The Free Wolfe Wave Pattern PDF

If you need a free Wolfe Wave trading pattern PDF to take around with you, we’ve got you covered:

What are the Benefits and Limitations of the Wolfe Wave Pattern?

The Wolfe Wave trading pattern is a favorite among seasoned traders because it can predict precise market movements. However, like any chart pattern, it has strengths and weaknesses. Let’s explore the benefits and limitations of the Wolfe Wave through a structured breakdown.

Benefits of the Wolfe Wave Pattern

The Wolfe Wave stands out for its unique advantages, particularly for those who value precise forecasting and flexibility in trading different markets. For instance, trading Wolfe Wave’s precise geometry allows you to accurately predict reversals and future price movements. This ability to help you catch reversals gives you an edge ahead of other traders coming late to the trend.

Another thing the chart pattern has going for it, just like most chart patterns, is that it works well across various markets, including forex, stocks, and commodities. Not only that but also how it can be applied to multiple timeframes, making it a universal tool for traders.

Also, while the Wolfe Wave may not have the clearest trade entry point, it has a predefined target, which provides a definitive price projection. This way, you can set realistic take-profit levels.

Limitations of the Wolfe Wave Pattern

While powerful, the Wolfe Wave has limitations that can pose challenges for traders, particularly those new to the pattern.

First on its list of limitations is that recognizing a valid Wolfe Wave requires experience, as the pattern’s accuracy depends on strict adherence to its rules. Also, some traders may identify the pattern incorrectly due to its reliance on visual judgment, leading to false trades.

Add that to the fact that an ideal Wolfe Wave chart pattern doesn’t appear on the chart. As a result, novice traders may see simple market structure movements and wrongly tag it the Wolfe Wave.

Secondly, the whole premise of trading Wolfe Waves is based on trying to catch the end of trends. And for novice traders, you might as well be trying to catch a falling knife.

Another potential limitation is that volatile price movements near the entry zone can create false signals, causing premature trade entries.

Finally, the Wolfe Wave, just like most chart patterns, is not to be used in isolation. You must support it with additional trading indicators, chart patterns, or strategies.

Wolfe Waves Frequently Asked Questions

The following are some of the most frequently asked questions about the Wolfe Wave.

How Accurate is the Wolfe Wave?

The Wolfe Wave is highly accurate, especially when correctly identified and validated. Traders often achieve precise entry and exit points by adhering to its structure and leveraging the target line. However, market conditions, such as low liquidity or sudden news events, can impact its reliability. Success with the Wolfe Wave depends on the trader’s ability to combine it with other forms of analysis, like support and resistance or candlestick patterns.

What is the Difference Between the Wolfe Wave and the Elliott Wave?

While both Wolfe Wave and Elliott Wave are based on wave theory, they differ significantly in their approach and application. Wolfe Wave uses a specific five-point structure to predict price reversals and targets. It is a standalone pattern that relies solely on price action. Conversely, the Elliott Wave encompasses a broader theory of market cycles and waves, categorized into impulsive and corrective waves. It often involves more complexity and requires additional tools like Fibonacci retracements. The Wolfe Wave is simpler and more practical for immediate trading opportunities, while the Elliott Wave offers a broader framework for understanding market trends.

Is there a Wolfe Wave Indicator?

There are Wolfe Wave indicators all around, especially on TradingView. One such is the LuxAlo Wolf Wave Detector, which you can easily use for free on the trading platform.

And if you’re on other trading platforms, such as MT4 and MT5, you can easily look online for Wolfe Wave Indicators. We’re sure you’ll find one that suits your needs.

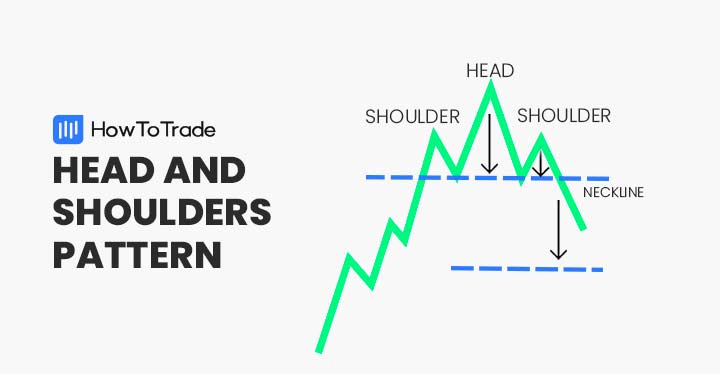

What is the Most Successful Pattern in Forex?

The success of a forex trading pattern depends on the trader’s skill, strategy, and market conditions. While the Wolfe Wave is highly effective, other patterns like the Head and Shoulders, Double Tops/Bottoms, and Bullish/Bearish Flags also rank among the most successful. Each pattern has unique advantages, and the best choice depends on the trader’s style and objectives. The Wolfe Wave, with its precision and versatility, is a favorite among those who prefer a structured and methodical approach.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.