The upside and downside gap three methods are three candle continuation patterns that signal the continuation of the existing trend. These two patterns are variations of the Tasuki gap candlestick patterns, though many traders consider this pattern to be more accurate due to the role of the third candle that completely closes the gap.

This post will cover everything you need to know about the gap three methods. We’ll show you how to identify the pattern, show examples, and suggest trading strategies. Read on to learn more.

Table of Contents

Table of Contents

- What is the Upside and Downside Gap Three Methods candlestick pattern?

- How to identify and use the Upside and Downside Gap Three Methods pattern in forex trading?

- pside and Downside Gap Three Methods candlestick pattern (Trading Strategy)

- The Upside and Downside Gap Three Methods pattern – Pros and cons

- Key takeaways

- Frequently Asked Questions (FAQs)

What is the Upside and Downside Gap Three Methods Candlestick Pattern?

The upside and downside gap three methods are continuation chart patterns that are made of a three-candlestick formation, much like the rising and falling three methods pattern, and the 3 bar play pattern.

The upside gap three methods chart pattern is a bullish continuation pattern that appears during an ongoing uptrend, while the downside gap three methods pattern is a bearish continuation pattern that occurs during a downward trend.

In essence, the upside and downside gap three methods patterns are a variation of the Tasuki gap pattern. However, there’s one difference between the two – While the Tasuki third candle partially closes the gap between the first two candlesticks, the third candlestick in the gap three methods closes the entire gap between the candles.

The theory behind these two classical chart patterns is that the gap represents the profit-taking mode during an existing trend before the rally continues. The pattern is confirmed as soon as the third candlestick fills the gap and then, the trend is likely to continue in the same direction.

How to Identify the Upside and Downside Gap Three Methods Pattern in Trading?

Typically, it’s pretty easy to recognize the upside and downside gap three methods pattern. Traders often use price gaps to find trading opportunities as they are a vital component of technical analysis.

For example, suppose the market is moving in a specific direction, and a price gapping occurs as a market correction, technical traders presume that the price is likely to continue moving in the previous trend’s direction once the gap is filled.

To identify the upside and downside gap three methods patterns, you need to be aware of the following characteristics of each pattern and know what the formation looks like on a Japanese candlestick price chart.

Let’s see how it works:

Identify the Upside Gap Three Methods Chart Pattern

The upside gap three methods is a bullish continuation pattern that appears during an ongoing uptrend. Simply put, it is a three-candle formation that must meet the following conditions to be valid and to provide a buying signal:

- The upside gap three methods pattern occurs during a bullish trend

- The pattern consists of three candlesticks – first and second long bullish candles with a price gap between them.

- The first candle must be longer than the second candlestick

- A third bearish candle that completely closes the gap

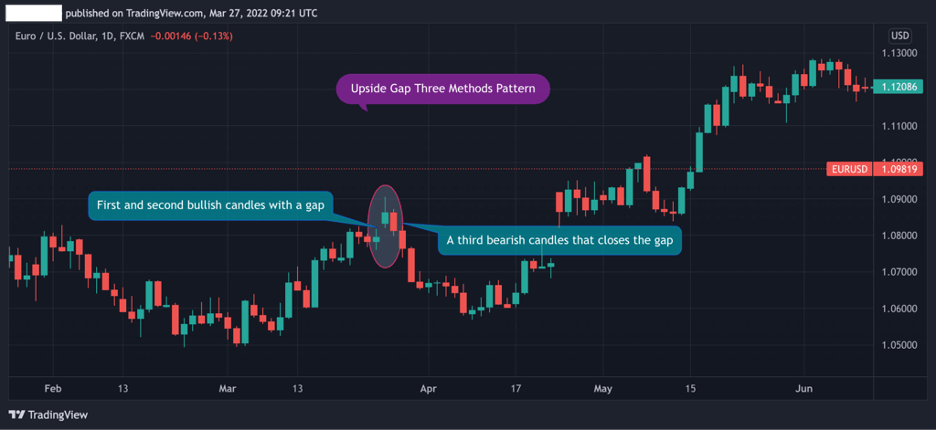

Taking the above into account, let’s see an example of the upside gap three methods pattern on a price chart:

In the EUR/USD daily chart above, the upside gap three methods chart pattern occurs during an uptrend. Though the pattern does not appear in perfect proportions, the first two candles are bullish and have a price gap between them, while the third candle is bearish and ultimately closes the gap.

Finally, when this happens, the currency pair’s price rises and the bullish trend continues.

Identify the Downside Gap Three Methods Chart Pattern

Not surprisingly, the downside gap three methods pattern has the same characteristics as the bullish version, but everything goes the other way around.

This means, the downside gap three methods formation appears during a downtrend trend and signals the continuation of a bearish trend.

Here are the characteristics of the downside gap three methods chart pattern:

- The downside gap three methods pattern occurs during a bearish trend

- The pattern consists of three candlesticks – the first and second are long bearish candles with a price gap between them.

- The first candle must be longer than the second candlestick

- A third bullish candle that completely closes the gap

The chart below shows how the three methods’ downside gap is formed on a price chart.

As you can see, the pattern appears during a downtrend with two bearish candlesticks and a gap between the first and second candles. Next, the third candle is bullish and completely closes the price gap. Then, as the pattern is confirmed and valid, the bearish trend continues.

How to Trade the Upside and Downside Gap Three Methods Pattern (Trading Strategy)

There are no special tricks when trading the gap three methods patterns. Since the upside and downside gap three methods are continuation chart patterns, you are looking to enter a position in the direction of the prior trend.

Still, we must mention that the gap three methods candlestick patterns are not as reliable as other chart patterns. Therefore, you better use other technical indicators that might help you to confirm the continuation of the previous chart pattern and find the ideal entry point. Moreover, you need to identify stop loss and take profit levels.

So, in this section, we’ll show you how to use and trade the gap three methods patterns.

1. Upside Gap Three Methods Pattern & Fibonacci Levels

Since the Upside Gap Three Methods is a bullish trend continuation candle pattern, you want to find the right entry point to enter a long position.

Some traders often enter a position immediately when the gap is completed; however, there is a high risk in this trading strategy as the price may continue falling following the completion of the gap.

With that in mind, we think the best tool to combine with any continuation chart pattern is the Fibonacci support and resistance retracement tool. Why? Because the challenge in joining an ongoing trend is to find the right entry point and stop the loss level.

For that matter, Fibonacci retracement can help you identify support and resistance levels if you know how to use it correctly. On that note, if you want to learn how to add Fibonacci levels, we suggest you visit our guide on how to use the Fibonacci retracement tool.

As seen in the example below, we use a straightforward method to establish these support and resistance levels. Basically, all you need to do is extend the price chart and find the last price swing’s lowest and highest price levels.

As you can see, when you draw Fibonacci retracements, you get a sequence of support and resistance levels that help you in planning your trade. In our example, the entry level is at the 78.6% Fibonacci level, stop loss is located at the 100% Fib level, and TP could be placed at any of the following Fib levels.

2. Downside Gap Three Methods Pattern & Fibonacci Levels

In theory, trading the downside gap three methods pattern means you are looking to enter a short-selling position as soon as the third candle closes the gap between the first and second candle.

However, this is certainly not the best way to use this pattern, and you need to add another technical analysis tool to find an appropriate entry point.

As mentioned, Fibonacci retracement and extensions are tool that helps traders establish support and resistance levels and are particularly efficient when trading continuation patterns.

So, in the chart below, we drew Fibonacci retracement lines from the lowest to the highest level of the previous price swing. Ironically, the price level at which the downside gap three methods pattern forms is also the lowest level of the previous price swing. Therefore, it is an ideal entry point once the price breaks below this level.

For a take-profit target, we had to use Fibonacci extensions. In that case, as you can, we placed the first TP target at the 50% Fib line and the second TP at 0%.

The Upside and Downside Gap Three Methods Pattern – Pros and Cons

These are the most common pros and cons of trading the upside and downside gap three methods pattern:

Pros

- Easy to recognize and trade

- Works well with Fibonacci retracement levels

Cons

- The pattern does not occur frequently

- The gap three methods is not a highly reliable chart pattern

- Rarely appears in perfect form

Key Takeaways

Here are the key points to remember when trading the gap three methods candlestick patterns:

Key Points to Take Away

Key Points to Take Away

- The upside and downside gap three methods are continuation candlestick patterns that appear during an ongoing trend and indicate that the trend is likely to continue

- The upside gap three methods pattern consists of three candles – first and second bullish candles with a gap between them, and a third bearish candle that closes the gap

- The methods downside gap pattern consists of three candles – first and second bearish candles with a gap between them, and a third bullish candle that closes the gap

- The gap three methods patterns indicate that the trend is likely to continue and provide an entry signal once the third candle is completed and closes the gap

- When trading the gap three methods pattern, we suggest you use Fibonacci retracements to spot an entry point, stop loss and take profit

Frequently Asked Questions (FAQs)

Here are some of the most frequently asked questions about the upside and downside gap three methods patterns in forex:

What is gap trading, and how is it related to the upside & downside gap three methods patterns?

Gap trading is a situation where there is no trading activity in a certain period of time on candlestick charts and the price gaps from the previous close (could be on any timeframe). When this happens, traders exploit this opportunity to buy or sell the asset, as gaps tend to be filled in most cases.

How to trade the upside and downside gap three methods chart patterns?

The gap three methods patterns are not frequently occurring chart patterns; however, whenever you identify these three candle formations, you need to enter a position in the same direction of the primary market trend. Further, due to the complexity of this type of chart pattern, it is vital to draw Fibonacci levels from the highest to lowest levels of the previous wave movement and wait for another candle following the third candle to close above or below the price of the third candlestick.

Are gap three methods reliable chart patterns?

Compared to other candlestick patterns, the upside and downside gap three methods patterns are not the most accurate and reliable. Also, there’s a catch with trading this pattern as usually, you’ll start the trade at a loss. Therefore, this pattern should be treated as an additional indicator rather than a leading indicator. In addition, it is best to use other tools like Fibonacci retracements to confirm the continuation of the primary trend and find the right stop loss level.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.