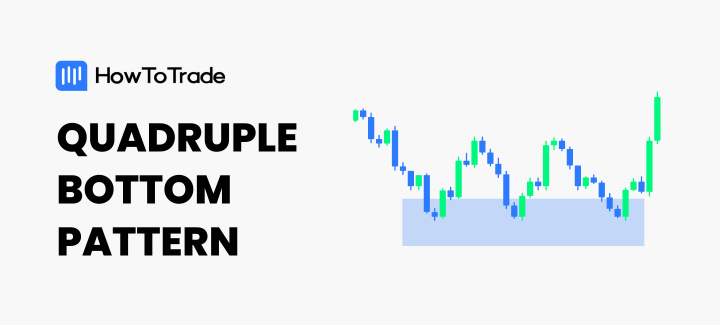

- The quadruple bottom is a chart pattern that appears when price keep coming to “test” a certain support level four times.

- The pattern is characterized by four attempts to break a support level following an upward breakout of a resistance level.

- The key benefit of the the quadruple bottom is its high accuracy rate, although does not appear frequently on price charts.

Have you ever heard the saying that goes like this, “The more, the merrier”? Well, you can say that is true in some cases when it comes to technical analysis—especially when it comes to bottom patterns.

If chart patterns are your thing, chances are you already know about double and triple-bottom patterns, but what about quadruple-bottom patterns? This is a chart pattern with a high accuracy rate due to the failure to break a certain support level. So, let’s take a sneak peek into what you’ll learn in this article:

- What exactly is the Quadruple Bottom Pattern all about?

- How to Identify it on the chart

- How to trade it when you see it

Table of Contents

Table of Contents

What is the Quadruple Bottom Pattern?

Similar to the double and the triple bottom pattern, the quadruple bottom pattern happens when the price keeps coming to “test” a certain support level four times. This support level now acts as a reliable floor for a price to jump from. When the price fails to break the support level for the fourth time, a buying signal is given.

One thing to note about this pattern is that with every bounce off this level comes a significant buying interest and also a reluctance for the price to drop below that support level.

In short, here’s how the quadruple bottom pattern works:

- First Bottom: Price declines to a support level and bounces back up. This typically happens following a downtrend.

- Second Bottom: After a rally, the price returns to the same support level and bounces again.

- Third Bottom: The pattern repeats, reinforcing the strength of the support.

- Fourth Bottom: The price dips to the support level one last time before making a decisive move upwards.

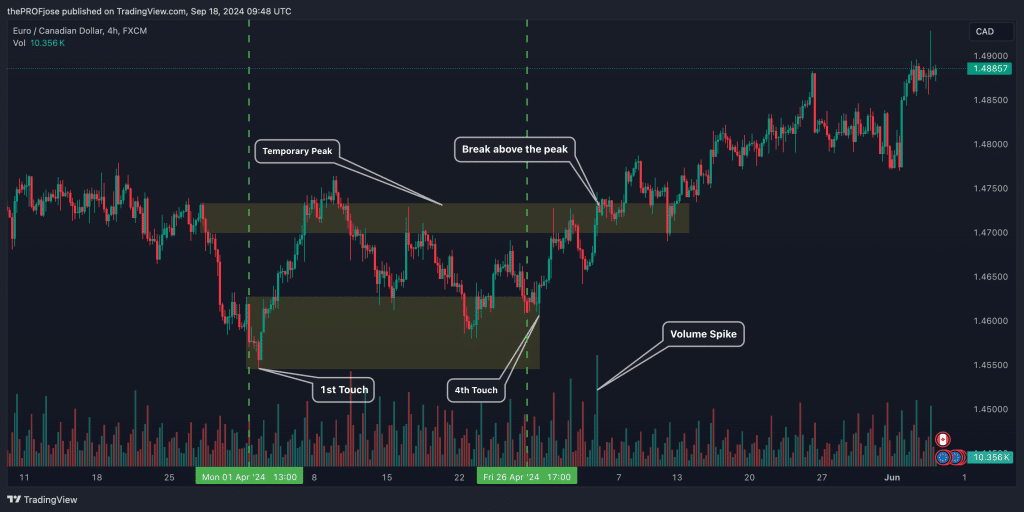

On the chart below, the pattern looks like a series of “V” shapes aligned at the same price level. They are more like a strong defense line where buyers consistently step in.

Usually, the quadruple bottom pattern appears after the price enters a phase of consolidation after a consistent downtrend. In this consolidation phase, both buyers and sellers are not in full control and prices tend to range for some time. This is often the perfect place to find the quadruple bottom pattern.

In general, this pattern suggests that selling pressure is waning. Each time the price hits the support level, sellers have fewer resources to push it lower, while buyers become more confident in that price point.

You might wonder, “How is this different from double or triple bottoms?” Well, the answer is in the name of each pattern; however, let’s briefly discuss some of the key differences between these patterns.

- Double Bottom: Features only two touches at the support level. While this is the most common pattern of all, it can sometimes give false signals due to its simplicity.

- Triple Bottom: The triple bottom chart pattern involves three touches and it comes in different styles. While some may look like a head and shoulders pattern, there are several others like the descending triple bottom breakdown where each low is lower than the previous one. This pattern is considered more reliable than the double bottom because the repeated tests of support add credibility.

- Quadruple Bottom: With four touches, this pattern is rarer but signals an even stronger support level. The quadruple bottom pattern is built on a price action philosophy: “The more times a support level is tested without breaking, the more significant it becomes.” Therefore, it is known for its accuracy in predicting future price movements.

Similar to the double and the triple bottom pattern, the quadruple bottom pattern happens when price keep coming to “test” a certain support level four times. This support level now acts as a reliable floor for a price to jump from. When the price fails to break the support level for the fourth time, a buying signal is given.

How to Identify the Quadruple Bottom Pattern

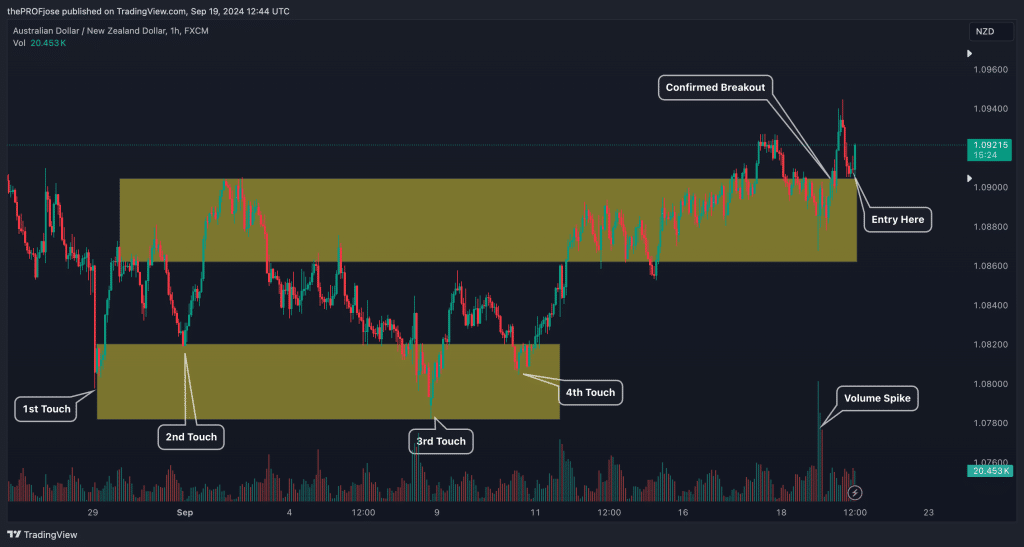

The main feature in the quadruple bottom pattern is that it has four distinct lows that consistently hit a key support level. What this does is to show that buyers are willing to push the price up from that key level.

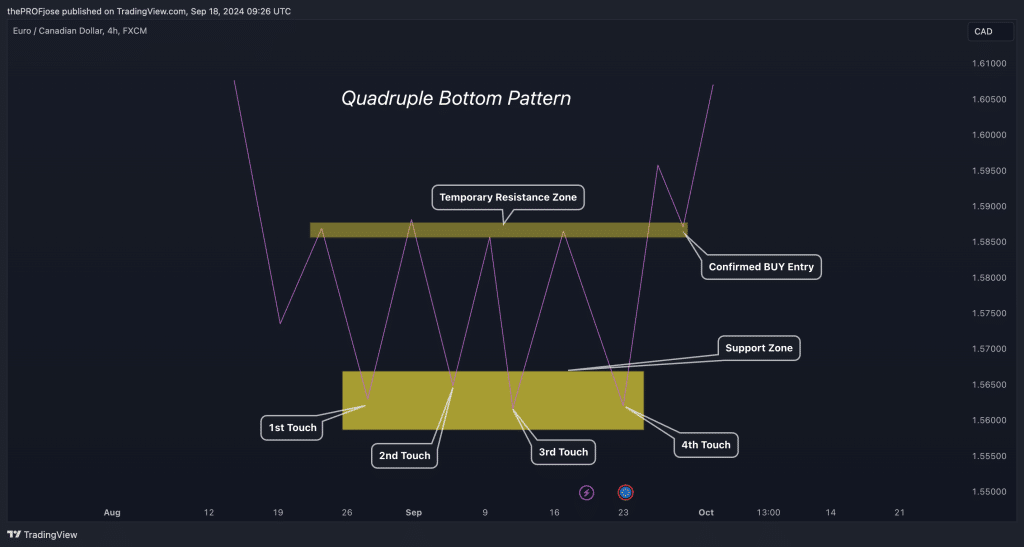

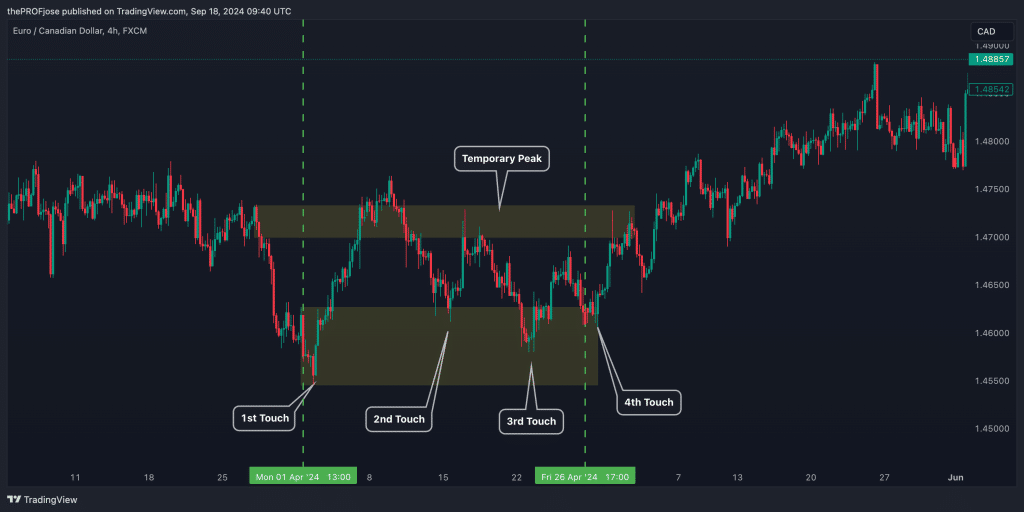

Note that finding a quadruple bottom pattern with the price hitting the exact support level is very rare. However, you might be able to find a quadruple bottom pattern with a formation of trying to push lower before rising above a key resistance level (as seen in the chart below).

These are the key elements you want to be looking out for when trying to identify the pattern:

- Four Distinct Lows Around Similar Price Levels: The market is complex, and you will most likely not find the four lows bouncing off the exact same price level. However, these lows must occur around the same price point, showing that each time sellers push the price down, buyers step in to defend the support level.

- Intervening Peaks Between the Lows: Between each low, the price will rise to create temporary peaks. These peaks form a resistance level that the price will eventually need to break to confirm the pattern. After recognizing the touched points, this is the next most important thing to look for. More on that later in the article.

Note that if you really want to filter out your trades and only take high-probability setups, you can try adding the Volume indicators to your chart. These include the Tick Volume indicator, Volume Profile indicator, or the VPT indicator.

Volume is a key factor in validating the quadruple bottom pattern. Without sufficient volume, a breakout from the pattern could be weak or short-lived.

Looking at the chart above, notice how there’s a significant volume spike as soon as the price breaks above the resistance level. This is all you need to confirm that buyers are stepping in and that the breakout is likely to be sustainable. Around that area, when the price rises to break the resistance level, following the fourth attempt to break the support level, you can utilize the breakout trading strategy.

Side note: during the formation of the pattern, you might notice decreasing volume as the price oscillates between the support and resistance levels. This is often a sign that selling pressure is diminishing, setting the stage for a breakout.

The Psychology Behind the Quadruple Bottom Pattern

It’s also crucial to understand the psychology behind the quadruple bottom pattern. Genearlly, chart patterns don’t just work because we draw lines on our trading charts. No. Like many other chart patterns, the quadruple bottom pattern presents us with a visual way to understand what’s happening behind the scenes.

So, it’s time to ask ourselves: what’s the rationale behind the quadruple bottom pattern?

When a quadruple bottom pattern starts to take shape, it signals a period of investor indecision. The market enters a consolidation phase, during which the price doesn’t make significant moves upward or downward.

During this time, it’s easy to notice the struggle between buyers and sellers. On one hand, sellers are trying to push prices below the level, but on the other hand, buyers are stepping in just in the nick of time to prevent such price drops. This constant struggle is what forms the four distinct lows characteristic of the quadruple bottom.

So, what’s really happening between buyers and sellers?

- Accumulation by Buyers at the Bottom: Each time the price dips to the support level, buyers see it as an opportunity to purchase at a bargain. They’re accumulating positions, expecting the price to rise in the future. This consistent buying pressure at the same level strengthens the support zone.

- Exhaustion of Selling Pressure: On the flip side, sellers are gradually running out of steam. The fact that they can’t push the price below the support level indicates exhaustion in selling pressure. They’ve tried four times and failed, which can discourage further selling.

The persistent support suggests that the market may be gearing up for a bullish move as sellers become less aggressive and buyers gain confidence.

Recognizing these signs can position you ahead of the crowd, allowing you to enter trades before the majority realizes what’s happening.

How to Trade the Quadruple Bottom Pattern

Now that you’ve got a handle on identifying the quadruple bottom pattern let’s talk about how to trade it effectively. Trading this pattern isn’t just about recognizing it on the chart; it’s about knowing when to enter, where to place your stop-loss, and how to set your profit targets. Let’s break down each of these components to help you build a solid trading strategy.

Entry Strategies

First things first—when should you enter a trade after spotting a quadruple bottom pattern?

Ideally, the most reliable entry point is after the price breaks above the resistance level formed by the intervening peaks between the lows. This breakout, which occurs following four attempts to break a key support level, indicates that buyers have gained control, and the bullish reversal is likely underway.

When this happens, you should wait for a candlestick to close above the resistance level in order to confirm the breakout. Just as shown in the example above, some traders prefer to wait for a retest of the broken resistance level (now acting as support) before entering, adding extra confirmation to the trade. This basically creates the perfect V or U shape, which normally tends to be highly predictive.

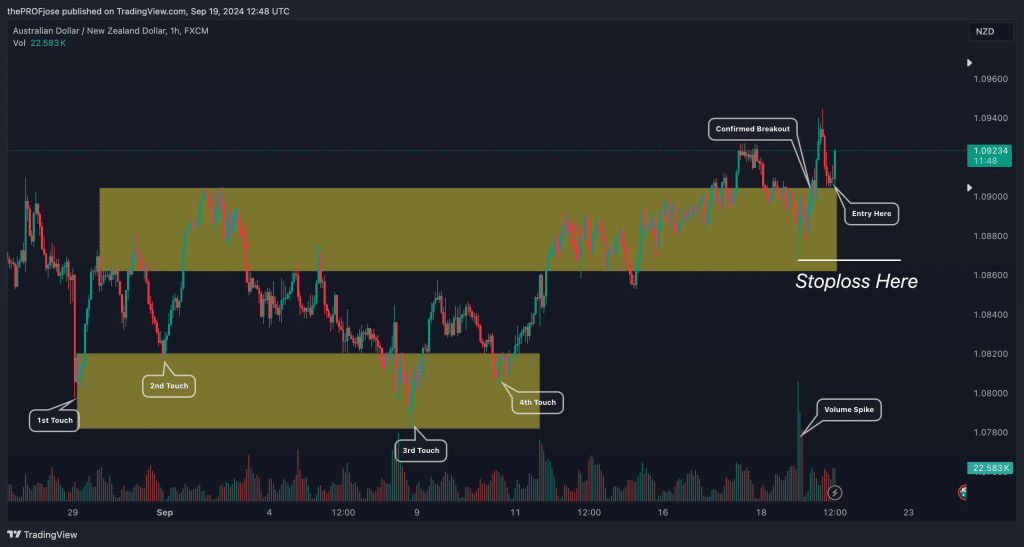

Stop-Loss Placement

A common approach to risk management is to place your stop-loss just below the most recent low of the breakout of the temporary resistance level after the quadruple bottom pattern has formed. This way, if the market reverses, you’ll limit your losses.

Determine how much you’re willing to risk on the trade, typically a small percentage of your trading capital (like 1-2%). Adjust your position size accordingly to ensure that a stop-loss hit won’t significantly dent your account.

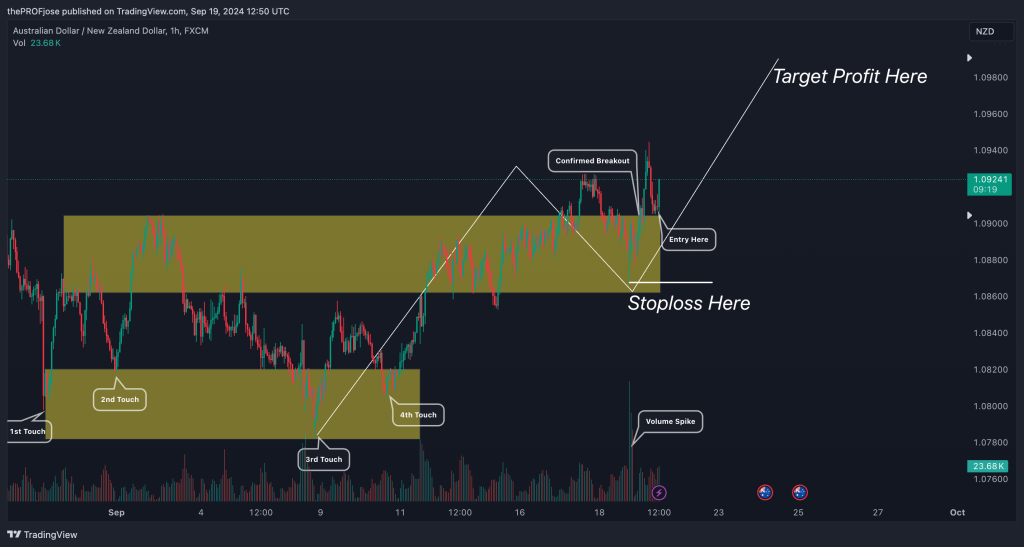

Profit Targets

Setting realistic profit targets is just as important as managing your risks. One of the best methods to do this is to measure the height of the pattern—from the support level to the resistance level—and add that distance to the breakout point. This gives you a projected price target based on the pattern’s size.

Here’s how we used it for the same trade:

Another way to go about this is to look left on your chart to identify previous resistance levels. These areas can serve as potential profit targets since the price may struggle to move past these points without some pullback.

The Quadruple Bottom Pattern – Pros and Cons

When it comes to trading patterns, knowing the advantages and drawbacks can make all the difference in your decision-making process. The quadruple bottom pattern is a powerful tool, but like any strategy, it has its upsides and downsides. Let’s dive into the pros and cons so you can make an informed choice.

Pros

- Provides a strong indication of a solid support level

- High potential for significant trend reversals

- Provides clear entry and exit points upon confirmation

- Can be applied across various markets and time frames

- Favorable risk-to-reward ratio when trading the breakout

- Reflects strong market consensus on price floor

Cons

- Rarity of the pattern in markets

- Possibility of false breakouts and whipsaws

- Requires patience due to extended formation period

- Less effective in highly volatile or illiquid markets

Key Takeaways

Key Takeaways

Key Takeaways

- The quadruple bottom pattern is a bullish reversal pattern where the price tests the same support level four times without breaking below it, signaling strong buying interest and a potential upward move.

- Key features include four similar lows at the same price level, intervening peaks forming a resistance line and a significant increase in volume upon a breakout above this resistance.

- The pattern reflects seller exhaustion and buyer accumulation, leading to a shift in market momentum from indecision to a bullish trend.

- Enter trades after confirming a breakout above resistance, place stop-loss orders just below the support level, and set profit targets based on the pattern’s height or previous resistance areas.

- The pattern offers strong support identification and high reversal potential but is rare and can produce false breakouts, requiring patience and volume confirmation for effective trading.

Frequently Asked Questions

To help solidify your understanding and boost your confidence in trading this pattern, let’s tackle some of the most frequently asked questions.

What time frames work best for trading this pattern?

The pattern can be found in various time frames, but higher time frames like 4-hour, daily, and weekly charts often offer more reliable signals. Longer time frames tend to filter out market noise, providing clearer patterns and stronger confirmations.

How do I confirm a breakout from the quadruple bottom?

Look for a strong price move above the established resistance level accompanied by increased volume. Volume confirmation adds credibility to the breakout, indicating heightened market interest and a higher likelihood of a sustained upward move. For that matter, since volume is key in determining the strength of the upward move, you might want to consider using the volume trading strategy when identifying the quadruple bottom pattern.

Can the quadruple bottom pattern be used in all markets?

Yes, the quadruple bottom pattern can be applied across various markets, including stocks, forex, commodities, and cryptocurrencies. However, always consider the specific market dynamics and liquidity when trading this pattern.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.