- Grid trading strategy uses a network of buy and sell stop orders at various levels around a set price, aiming to profit from natural market fluctuations.

- Once set up, the grid operates semi-automatically, reducing the manual monitoring and adjustments needed in traditional trading.

- This strategy profits from market price movements in any direction without relying on specific directional predictions.

- It includes various strategy types like Pure Trading Grid, Modified Trading Grid, and Double Grid Strategy, each suited to different market trends and volatility levels.

- The grid trading strategy offers benefits like automation, reduced risk per trade, and applicability in various conditions, but it can struggle in strong trending markets and incur higher transaction costs.

Many traders believe you have to know the direction of the market before placing a trade, but grid traders don’t think so. Upon using this strategy, in most cases, they set their stop orders and leave the trading charts, allowing the price to go wherever it wants. And surprisingly, they are often profitable.

This contrarian approach to trading has caused a divide in the trading industry, with some rooting for it and others condemning its approach to risk management. But what is the grid trading strategy, and how does it work? Let’s find out.

Table of Contents

Table of Contents

What is the Grid Trading Strategy?

The grid trading strategy in forex trading is a unique approach that capitalizes on the natural movement and volatility of the market. This strategy involves setting up a series of buy and sell stop orders at various intervals above and below a predetermined price, creating what is known as a “price grid.” The primary goal here is to profit from the regular fluctuations in price levels.

One of the key aspects of grid trading is its partial automation. Initially, a trader sets up the grid manually, defining the intervals and price points at which orders are to be placed. Once this is done (even if manually), the system operates somewhat automatically, using these predefined buy and sell orders. This method helps reduce the stress and manual effort involved in traditional trading strategies where traders must constantly monitor and adjust their positions.

In practice, grid trading does not rely on predictions of specific price movements. Instead, it takes advantage of the market’s natural price fluctuations. The strategy involves dividing the price range of an asset into several segments or grids. Buy and sell orders are set at these predetermined intervals, allowing the trader to profit from price movements in either direction. Valuable tools for identifying key grid levels can be level 2 market data and order flow analysis, where traders can visually see where there are large orders.

How Does Grid Trading Work (Trading Example)

Grid trading in Forex involves a systematic approach where buy and sell orders are placed at predetermined intervals above and below the current market price. Here’s how it typically works:

- Set a Starting Price – First, grid traders set a starting price from which they develop a grid trading system.

- Grid Configuration: The grid is defined by variables such as the distance between orders and the number of levels. This configuration can vary greatly, offering a wide range of strategic possibilities. In a traditional grid, levels are equidistant from each other.

- Placement of Orders: Buy orders are set regularly above the current market price, and sell orders are placed below it. These orders are usually configured with a take profit level equal to the distance between the grid levels, and often there is no stop loss.

- Profitability and Market Movement: The strategy’s profitability relies on the frequency with which the market price crosses these grid levels. A grid with a certain width and density of levels needs a minimum number of level crossings to be profitable. This is because the strategy must accumulate enough profits from these crossings to exceed any unrealized losses.

- Order Management: When a trade hits its Take Profit value, it is closed, and a new order is opened at the same level. This process helps to continuously engage with market movements.

- Market Conditions and Strategy Adaptation: Grid trading does not necessarily rely on market trends but on price movements, making it suitable for trending and range-bound markets. Once the grid trading works for you, the next step is to increase position sizing and find new automated grid trading techniques.

To illustrate this with a practical example, consider a scenario where the current market price of EUR/GBP is 0.86774. From the chart below, notice that we placed four orders each above and below this price with 5 Pips intervals. The take profit for each order would also be set at 5 Pips away from the entry value. This setup allows us to profit from price movements in either direction as long as the price frequently crosses the grid levels.

After we’ve set our stop orders, as shown above, several scenarios can unfold based on how the market interacts with the grid levels. Here are the possible outcomes we can expect:

- BUY Stops Triggered and Profitable: The market rises, activating buy stops reaching their take-profit levels.

- SELL Stops Triggered and Profitable: Market falls, triggering sell stops that hit their take profit levels.

- BUY Stops Triggered, but Unprofitable: The Market’s price rises, and triggers buy stops but reverses before hitting take profit, leading to losses.

- SELL Stops Triggered, but Unprofitable: Market falls, activates sell stops, but then reverses before reaching Take Profit, resulting in losses.

- Both BUY and SELL Stops Triggered and Profitable: The market fluctuates enough to activate both buy and sell stops, and each set reaches its Take Profit levels.

- Both BUY and SELL Stops Triggered, but Unprofitable: The market activates both buy and sell stops but reverses before either can reach Take Profit, causing losses.

- No Orders Triggered: The market remains stagnant or moves within a very tight range, failing to trigger preset orders.

In short, as you can see, the grid trading strategy has a unique way to crack the markets. And, once well-maintained, traders can make consistent profits not only in trending markets but also in ranging markets.

Yet, a key aspect to consider when utilizing the grid trading strategy is the costs involved in each trade. Since this strategy requires a large number of trades, choosing a low-cost online brokerage firm can be crucial to the success of this strategy.

Setting Grid Trading on MT4

If you are using MT4, then you are probably eager to know how to set the grid trading strategy. Luckily, setting up Grid Trading on MT4 is not so complicated and involves a series of easy steps to automate trading strategies in the Forex market.

Practically, there are two ways to set grid trading on MetaTrader4/5 – manually or automatically. Let’s quickly see how this can be done:

Manual Setup

The first way to utilize grid trading on MT4 is to do it manually. To start, you must decide the order size and the interval between orders. This depends on the chosen time frame and the market’s volatility. Tools like the Average True Range Indicator can help assess market volatility.

Another thing is to decide if your goal is to profit from a trend or a range. For trending markets, place buy orders above the current price and sell orders below. This strategy involves adding long positions as the price increases, thereby increasing the likelihood of securing profits.

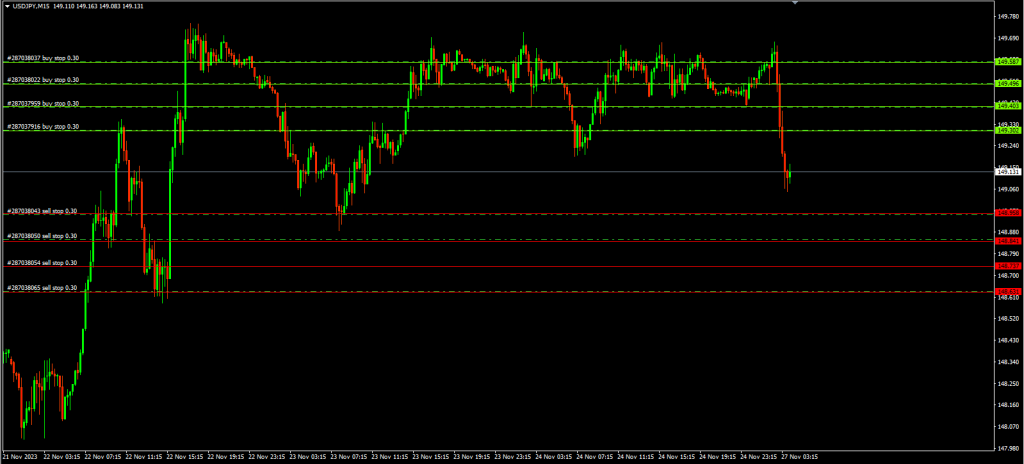

First, note that on MT4/5, you can execute trades directly on a price chart. Next, to add these stop orders to your Metatrader 4 charts, first use the horizontal line tool to map out where your buy stops and sell stops should be, then right-click on these levels and place your buy stops on the horizontal lines above the current price and your sell stops on the horizontal lines below the current price, as shown in the chart above.

Using Expert Advisors (EAs)

Another way to use grid trading on Metatrader 4 is using EAs. These tools make the whole process seamless and completely automated. Here’s what the process of using an EA looks like:

Expert Advisor Selection

Choose an appropriate Expert Advisor (EA) on a third-party vendor for grid trading on MT4/MT5. These EAs implement a fully functional grid trading strategy with understandable input parameters, making them accessible to average users.

This option requires less effort and skills in terms of programming and creating a well-defined grid trading strategy; however, it is also a huge challenge to find a proven EA.

EA Settings

The second option is to do things on your own. Input settings like trading direction, size, spacing, and lot size. For example, a basic grid might be defined by a 100-pip spacing and a 0.10 lot size for each trade, covering a range of 500 pips. The EA calculates other parameters like exposure and risk based on these inputs.

Customization Options

EAs like the Grid Trader Expert Advisor or any other grid trading bot offer options for semi-automatic grid trading, allowing traders to use features like the martingale or hedge functions and set different take profits for long and short sides.

Take into account that regardless of the option used to utilize the grid trading strategy, you must backtest your strategy on a demo account before deploying it on a real account. That’s a key step for testing whether the strategy is profitable, and many traders spend several weeks or months before they go live with the chosen strategy.

The grid trading strategy involves setting up a series of buy and sell stop orders at various intervals above and below a predetermined price, creating what is known as a “price grid.” The primary goal here is to profit from the regular fluctuations in price levels.

Types of Grid Trading Strategies

Grid trading in Forex involves various systematic trading strategies designed to leverage market movements effectively. Understanding these types can help traders optimize their approach.

Let’s take a closer look at some of the most popular and effective grid trading strategies:

1. Modified Trading Grid

The modified grid considers the market’s current direction; thus, it is a form of the trend trading strategy. Traders using this grid consider factors such as technical indicators or fundamental analysis to determine their directional bias. This type is designed to capitalize on trending markets, making it more dynamic than the pure trading grid.

2. Average True Range & Grid Trading Strategy

This strategy utilizes the Average True Range (ATR) indicator to measure market volatility before setting up a Forex Grid system. It helps understand the range of price movements and set up a grid that can adapt to these fluctuations. This ATR grid trading strategy is particularly useful in markets with variable volatility.

As seen in the chart below, we use the ATR bands to get a clear picture of where the market might pause. These price levels can then be used to place buy and sell orders.

3. Gann Lines Grid Trading Strategy

This strategy aims to map potential upward or downward price trends by incorporating Gann lines, which are intersecting lines on a trading chart. These lines help identify the price’s direction tendency and act as support and resistance indicators. Understanding these trends can be crucial in developing an effective grid trading strategy.

4. Double Grid Strategy

A double or dual grid strategy involves using two types of grids simultaneously, usually a directional up grid combined with a directional down grid. In this bi-directional system, one position trades into the trend while the other opens against it. This strategy is particularly effective in choppy, volatile markets without a clear direction. It is market-neutral, meaning it doesn’t require forecasting the market’s direction. However, it’s important to note that a double grid system can return a loss if there’s a significant rally either upwards or downwards.

In sum, each of the strategies above has its unique applications and benefits, and choosing the right one depends on the trader’s market understanding, risk appetite, and trading objectives. Adapting to the market’s character and volatility can significantly enhance the effectiveness of the grid trading approach in Forex trading.

Of course, since the grid trading technique is adaptable, there are many other trading strategies that can be integrated into this unique form of trading. Nonetheless, as you can see, the idea of grid trading is always the same. In simple terms, grid trading involves placing multiple buy and sell orders at fixed intervals to capture short-term price movements. The above are just different methods to do that.

Pros and Cons of Grid Trading

Grid trading in Forex offers distinct advantages, especially in adapting to market volatility and reducing risks associated with individual trades. However, this trading strategy isn’t without its drawbacks, so let’s take a look at them.

Benefits of Grid Trading

One of the significant benefits of grid trading is its capacity to capture profits from market volatility. By placing orders at various price levels, this strategy allows traders to benefit from both upward and downward price fluctuations without needing to predict the direction of the trend.

Pros

- Grid trading can be easily automated, reducing the need for constant monitoring and decision-making, which is especially beneficial for traders who prefer a set-and-forget approach.

- By spreading the investment across multiple levels, grid trading lowers the risk of each trade instead of betting a large amount on a single entry.

- The strategy is relatively easy to understand and implement, even for traders with less experience using complex algorithms or technical indicators.

- Grid trading can be applied in various market conditions and asset classes, making it a versatile strategy for different trading environments.

Limitations of Grid Trading

In markets exhibiting strong trends, grid trading can increase exposure to losses. This occurs as the strategy might struggle to adapt quickly to a market that consistently moves in one direction, leading to consecutive losses on one side of the grid.

Cons

- Owing to the high number of trades executed, grid trading can incur substantial transaction costs, which can eat into profits.

- Grid trading requires patience to ride market waves, and premature profit-taking can lead to disproportionate losses.

- In consolidating markets, holding multiple positions for an extended period can accumulate swap fees, increasing the cost of trading.

Over to You

In sum, we’ve covered much about the grid trading strategy in this article, so let’s do a quick recap.

Contrary to what most traders are used to, the grid trading strategy offers a unique approach to semi-automatically place trades without knowing where the market is heading. It doesn’t stop there. Some traders automate this process using EAs, leaving no room for human emotions or errors. What’s more, it also enables you to stay neutral in the market without having any sentiment about the next market direction.

Now, you might think, “This might be the holy grail of trading.” No, it’s not. While it is a profitable strategy, it has limitations like incurring many trading costs and being exposed to excessive loss in a trending market.

The option of trading this strategy ultimately lies with you. You have to decide if it lines up with your trading personality or goals. Before you make a decision, backtest your trading strategy and see if it works on a demo account. If it does, go for it!

Grid Trading Strategy FAQs

Here are some frequently asked questions about the grid trading strategy:

Is grid trading legal?

Yes, grid trading is legal in many countries, particularly in Contract for Difference (CFD) trading. The legality and regulations surrounding grid trading, like any trading strategy, vary depending on the country. However, traders should always check the legality and regulations of such trading strategies in their respective countries.

How can you automate the grid trading strategy?

Automation of the grid trading strategy can be achieved through the use of Grid Bots. These bots operate 24/7, capturing trading opportunities even when the trader is not actively monitoring the markets. They execute the grid strategy with discipline and consistency, devoid of emotional biases.

What are the best currency pairs for the grid trading strategy?

Grid trading systems generally work best in ranging markets with interval buy/sell orders. Therefore, currency pairs that exhibit a good range and are less prone to long unidirectional trends are suitable. Grid traders often prefer the EUR/GBP pair due to its range-bound characteristics. The USD/JPY can also be effective, although it sometimes breaks out and trends for extended periods. The key is to identify pairs that show tendencies for long-term consolidation or range-bound movements, making them ideal for grid trading strategies.

Is grid trading profitable?

Yes, grid trading can be highly profitable when used correctly in the Forex market. It simplifies trading by eliminating the need for complex technical indicators or fundamental analysis. Instead, it focuses on setting key levels for entry and exit and letting the grid strategy unfold. However, like any trading strategy, success in grid trading depends on proper execution, risk management, and understanding of market conditions.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.