Many traders use stock indicators to get insights into market sentiment and supply and demand. These indicators are arguably among the most critical technical analysis tools to predict future price movements and find trading opportunities.

However, there are many stock indicators to use, and it takes time to learn what they look like and how to use them properly. The solution – stock indicators cheat sheet. So, on this page, we share our stock indicators free downloadable cheat sheet and discuss the importance of stock indicators.

Table of Contents

Table of Contents

Stock Indicators Cheat Sheet Free Download

Below, you can download for free our stock indicators PDF:

Stock Indicators Cheat Sheet PDF [Download]

What Are Stock Indicators?

Technical indicators are mathematical formulas that can be added to stock charts in order to help traders analyze price action. Based on historical data analysis and mathematical calculations, these stock indicators can provide a perspective of the supply and demand of a particular financial asset and provide traders signals for the next price movement.

A technical indicator is displayed graphically on a trading chart as an additional sub-chart (usually below the main chart) or as trend lines on the main chart. Every indicator comes with a set of rules a trader must follow to get the insights correctly. Moreover, there are different categories of indicators, so some stock traders combine them all to get a better overall picture of the markets. The different types of stock indicators include momentum, volume, volatility, and trend.

Overall, the use of indicators helps traders realize the market timing and the next price move of a financial asset. Therefore, traders use technical indicators to determine when to enter and exit trades in a particular trading session. Furthermore, technical indicators are most effective when they are integrated with technical chart patterns. Many analysts and traders believe that this combination of chart patterns and technical analysis indicators creates the perfect setup for a successful technical analysis strategy.

6 Most Popular Stock Technical Indicators

Stock traders can use a variety of stock indicators to identify future price movements. However, some indicators have proven more valuable than others. So, expectedly, these popular indicators are also widely used by many traders, which adds to their effectiveness due to the herd behavior phenomenon of traders in financial markets.

Let’s take a closer at some of the indicators that every trader must know.

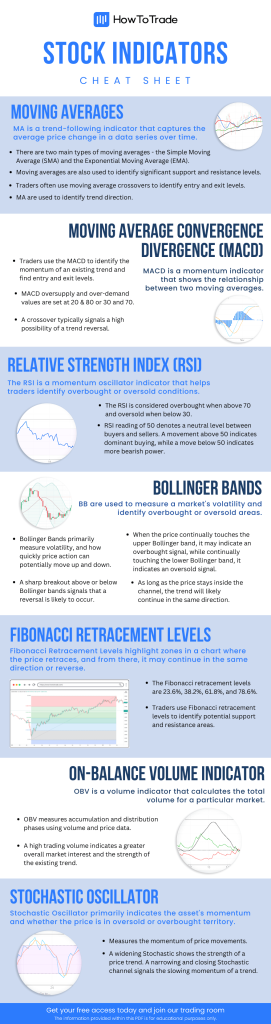

1. Moving Averages

Many traders believe that moving averages are the backbone of technical analysis. And for a good reason. If you visit forums and trading discussion sites, you’ll notice that many day traders make trading decisions based on moving averages’ crossovers. It is undoubtedly among the most effective indicators to determine the strength or weakness of a trend.

Moving averages are also used to identify significant support and resistance levels.

Moving averages are a collection of past market data points that calculate the average price over a predefined number of timeframes. Traders use the average price to determine the future price direction as they predict that the price cannot move drastically from the average price. The longer the time period of the MA, the greater the lag. The trend will likely continue if the price trades above or below the MA line. However, a trend reversal is possible when the price crosses below or above the moving average line.

It’s also important to note that there are two types of moving averages – the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The difference between the two is that the EMA applies more weight to more recent price levels.

2. Moving Average Convergence Divergence (MACD)

Moving Average Convergence Divergence, also known as the MACD indicator, is a momentum indicator that shows the relationship between two moving averages. This indicator is more detailed than the simple moving average as it merges two moving averages, fast and slow.

The MACD indicator is displayed in a sub-chart below the main chart. And much like the RSI, it has values from 0 to 100. Traders use this indicator to determine the strength of the existing trend and the possibility of a reversal when a crossover occurs between two moving averages.

3. Relative Strength Index (RSI)

The relative strength index is among the most popular technical indicators. Its simplicity makes it super effective, and even those who prefer trading naked often add the RSI indicator to their trading charts.

The RSI is a momentum oscillator with a value between 0 to 100 that helps traders identify overbought or oversold conditions. When the RSI rises above 70, the stock is in an overbought condition, and when it falls below 30, it is in an oversold condition.

4. Bollinger Bands

Bollinger bands, which John Bollinger invented in the 1980s, are another popular technical indicator used by traders to analyze market trends and volatility. Bollinger bands are three different lines drawn directly on the main price chart that present the upper and lower levels over a certain period, and the third line that shows the moving average.

These three Bollinger Bands create a channel with a moving average line in the middle of the channel. The idea is that as long as the price stays inside the channel, the trend will likely continue in the same direction. However, when the price breaks out of the channel, a correction can be made. This is because the BA indicator indicates when the market is overbought or oversold.

5. Fibonacci Retracement Levels

Fibonacci retracement levels are arguably the most commonly used technical analysis indicator among traders and investors. These levels, which are based on the famous Fibonacci sequence, highlight zones in a trading chart where the price retraces, and from there, it may continue in the same direction or reverse.

Generally, Fibonacci retracements are a very popular tool used by stock traders to identify future price movements. Traders not only draw these levels on charts but also use Fibonacci retracement calculators on different sites online to detect crucial prices to set entry and exit points, stop loss, and take profit targets.

6. On Balance Volume Indicator

The On-Balance Volume indicator is a technical analysis indicator that calculates the total volume for a particular market. As there is a strong connection between volume and volatility, the idea of this indicator is to find an increase in trade volume, which presumably will result in a sharp increase or decrease in asset price.

Simply put, the OBV measures accumulation and distribution phases using volume and price to help traders get a strong indication of buying pressure or selling pressure in the market. Whenever a trader can detect a high volume and a price movement, the movement will likely be significant.

7. Stochastic Oscillator

Finally, another popular stock indicator used by many stock traders is the stochastic momentum oscillator. The indicator also ranges from 0 to 100 and is a sub-chart that consists of two lines. By comparing the asset’s closing price to a predetermined range of previous closing prices, the Stochastic Oscillator indicates the asset’s momentum and if the price is in oversold or overbought territory. On that note, another improved version of the Stochastic Oscillator is the Stochastic RSI indicator.

Over to You

All in all, technical indicators are an excellent tool for identifying price movements. Without a doubt, indicators have shown excellent results over time, especially for predicting short-term price movements.

For beginners, it might take some time to learn how to use technical indicators. There are many combinations of stock indicators, and no two traders will work in the same way. You will have to find the indicators that work best for you and give you the highest probability of success.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.