- A trading journal is like a logbook or diary where traders and investors record their trades, strategies, and observations.

- A trading journal can significantly help you track your progress over time. By recording your trades and results, you can see how you are doing and adjust your strategies as needed.

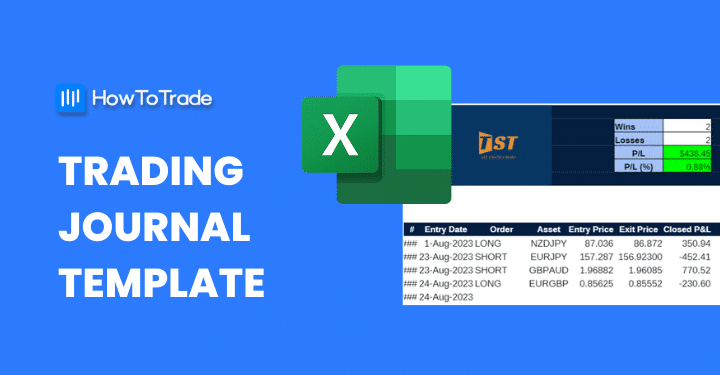

- Here, you can download our free Excel Sheet trading journal template.

Keeping a trading journal can help you significantly help you boost your trading performance. It is a simple yet effective method to analyze your trading and discover your strengths and weaknesses. But what is a trading journal, and where can you start?

Look no further than a trading journal template. With a premade template, you can focus on analyzing your trades rather than formatting your document. Plus, you can customize it to fit your unique trading style.

In this guide, we’ll talk about what a trading journal is, why it is so important, and share our free trading journal template.

What is included in this blog post:

What is included in this blog post:

Trading Journal Template – Excel Sheet Free Download

Below we have created a free-to-download trading journal template in MS Excel. You can make a copy and then add more rows depending on your trading style. You can also export this template as a Microsoft Excel trading journal template.

Excel Sheet Template – Free Download

What is a Trading Journal?

A trading journal is like a logbook or diary where traders record their trades, strategies, and observations. It’s a comprehensive record of their trading journey, including their winning and losing trades, emotions, and lessons learned. It’s a great tool for self-reflection, self-improvement, and accountability.

Simply put, a trading journal provides you with a summary of your trading performance. It’s like having Google Analytics or other data software for your trades. Many professional traders use a trading journal to analyze their trading experience and improve their trading strategies. By analyzing past trades, you can identify patterns, refine your strategy, and develop a disciplined approach to trading.

Why Do You Need a Trading Journal?

So, why do you need a trading journal? Well, trading is a hectic process that requires being entirely aware of previous trading performance. This means that to become a successful trader, you must constantly evolve and improve your trading performance. A trading journal is an excellent tool for analyzing your previous trades and learning from your successes and failures.

Trading is all about learning from the same mistakes you make and developing an organized and efficient structure. Therefore, you should create a trading checklist to start your day on the right foot, work with a trading plan template to organize your trading activity, and keep a trading journal to review all of your transactions.

So, with that in mind, here are some reasons why a trading journal is vital for success in trading.

- A trading journal helps you track your progress over time. By recording your trades and results, you can see how you are doing and adjust your strategies as needed.

- By analyzing your trades and results, you can identify patterns in your trading behavior. This can help you identify areas you need to keep and those that need to be improved. Ultimately, you may change your trading plan accordingly.

- A trading journal can help you stay disciplined by keeping you accountable for your trades. By recording your trades and emotions, you can see how your emotions can affect your trading decisions and adjust your behavior accordingly. Everyone makes mistakes, but how you learn from them counts.

- By keeping a trading journal, you can reflect on your mistakes and learn from them to avoid repeating them.

How to Use a Trading Journal in 7 Simple Steps

Now that we have discussed the importance of using a trading journal let’s dive into how you should use it effectively. Here are some steps you can take to make the most out of your trading journal:

1. Record All of Your Trades

The first step in using a trading journal is to record your trades. This includes the asset, date, time, entry and exit prices, position size, and any notes or comments about the trade. If needed, you can also use the history tab, navigate to your trading log (or trade log) on your trading platform, and extract the market data directly to your trading journal.

2. Analyze your Trades

Once you have recorded your trades, it is time to analyze them. First, look for patterns in your trades, such as which strategies are working well and which are not. You should also analyze the time of a trading day at which your trading strategy had the best performance.

Analyze your winning and losing trades and check if you have had a positive trading performance. Doing so lets you determine if you are a trader that relies on a successful winning rate, meaning you have a positive win-to-loss rate. Or, perhaps you are a trader who aims for one big trade that covers most of your losing trades and beyond that.

3. Identify Your Strengths and Weaknesses

Based on your analysis, identify your strengths and weaknesses as a trader. For example, do you tend to hold on to losing trades for too long? Do you struggle with discipline? Do you overtrade? Understanding your strengths and weaknesses can help you adjust your trading plan and improve your trading performance.

4. Set Goals and Make a Plan

After identifying your strengths and weaknesses, you should set goals and plan to achieve them. This may involve changing your trading strategies, setting stricter risk management rules, or working on your emotional control. If needed, you can go back to using the 5-3-1 trading strategy to regain your trading confidence.

5. Review Your Trading Journal Regularly

Reviewing your trading journal regularly to track your progress and adjust your plan as needed is essential. Set aside time each week or month to review your trades and update your plan. Remember that you might not be able to do the same thing every day, so you must adapt to new market conditions and evolve.

6. Use It to Track Emotions

In addition to tracking your trades, use your trading journal to track and analyze your emotions. Record how you were feeling before, during, and after each trade. This can help you identify patterns in your emotional responses and adjust your behavior.

In trading, one trade can often change the whole mindset for better or worse. So use this one trade or day to improve yourself. For instance, if you had a trade that got you into a tilt, try to avoid it next time. You can learn how to get over a trader’s block and do whatever you can to develop a positive mindset. On the other hand, if there was a successful trade or a day that boosted your confidence, use it next time to ride the momentum.

7. Make It a Habit

Using a trading journal effectively requires consistency and commitment. Make it a habit to record every trade and review your journal regularly. The more consistent you are, your trading journal will be more valuable. Eventually, you might enjoy it, especially if you slowly become a profitable trader.

What Should Be Included in a Trading Journal?

Finding trading journal templates can be demanding as you may have to find templates that suit your needs.

Generally, trading journals consist of the following:

1. Trade Information

- Date and time of trade

- Symbol or instrument traded

- Long or short positions

- Entry price

- Exit price

- Total profit or loss

- Trade size (number of lots)

2. Trading Strategy

- A brief description of the trading strategy used

- Any indicators or technical analysis used

- Reason for entering the trade

- Stop loss and take profit levels

3. Emotions and Behavior

- How were you feeling before, during, and after the trade?

- Any emotional triggers that may have affected your decision-making?

- Any distractions or external factors that may have affected your trading?

- Any mistakes or lessons learned from the trade?

4. Comments and Notes

- Any additional comments or notes about the trade

- Market conditions at the time of the trade

- Any news or events that may have affected the market at the time of your trade

To become a successful trader, you must constantly evolve and improve your trading performance. And a trading journal is an excellent tool for analyzing your previous trades and learning from your successes and failures.

Benefits of a Trading Journal

To sum up, keeping a trade journal can help you track your trading activity and, ultimately, increase your profits. After a while, you’ll notice how a trading journal will assist you in learning from your mistakes, improving your decision-making process, stay disciplined, and track your progress as a trader.

If you decide to use one, all you need to do is download our Excel Sheet trading journal template above and add your trading data. This will eventually become the key to your growth as a trader. We also suggest you visit our cheat sheets page and download any of the cheat sheet files that can help you execute your trading plan.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.