- Liquidity in trading refers to the ease of buying or selling assets without affecting the price, with liquidity grabs being a strategy to exploit large order accumulations for profit.

- Key areas for liquidity grabs include psychological price levels, swing highs and lows, and consolidation breakouts, where large volumes of stop-loss orders are placed.

- The Liquidity Grab indicator aids traders in identifying areas prone to ‘stop hunting’ and helps inform strategic entry and exit points in the market.

SMC traders basically swear by four concepts: market structure, change of character, order blocks, and liquidity grab. While we’ve covered the first three concepts on our blog, understanding the fourth concept can increase your win rate almost immediately.

So, in this article, get ready to learn the following:

- What liquidity grab in trading is all about

- The differences between liquidity grabs and breaks of structure

- How to use the liquidity grab indicator the right way

- A Step-by-Step example of trading the liquidity grab trading strategy.

Table of Contents

Table of Contents

What is a Liquidity Grab in Trading?

Liquidity grab in trading refers to an unusual and extreme price movement in the markets, typically due to a high trading activity. It is a fundamental concept that affects everything from individual trades to the overall stability of financial markets. High liquidity means that there are ample buyers and sellers, which typically results in tighter spreads between the bid and ask prices. Conversely, low liquidity can lead to a more volatile market where prices may fluctuate wildly in response to large trades.

As you can see, a “liquidity grab” occurs when traders capitalize on or create scenarios where liquidity is taken from the market, often resulting in a temporary distortion of prices. This concept, particularly emphasized in Smart Money Concepts (SMC), involves the strategic placement of trades where liquidity is likely to accumulate. These areas are typically where stop-loss orders are clustered or where a significant number of traders have set their orders to enter or exit the market.

When a market reaches these points of accumulated liquidity, there is often a sharp and sudden price movement as these orders are triggered. This creates an opportunity for informed traders to anticipate and exploit these moves for potential profit. The grab itself is the event where this pent-up liquidity is ‘grabbed’ by triggering these orders, hence the term “liquidity grab.”

How to Spot Liquidity Grabs on the Charts

According to SMC, liquidity grabs usually take place in several key areas:

- Around Psychological Price Levels: These are price points that traders perceive as significant due to round numbers or historical price levels. Many traders place orders at these key levels, believing them to be strong points of support or resistance.

- Beyond Swing Highs and Lows: Swing points in price charts are where the price had previously reversed direction. Traders often place stop-loss orders just beyond these points to protect against losses in case the price moves against their initial trade direction.

- At Consolidation Breakouts or Breakdowns: During periods of consolidation, the price moves within a narrow range, building up orders on both sides of the market. A breakout or breakdown from this range can trigger these orders, resulting in a liquidity grab when traders can utilize the breakout trading strategy.

Check out our daily market analysis page for insights about leading FX pairs, global indices, and commodities.

How to Use the Liquidity Grab Indicator?

Using a liquidity grab indicator can be a game-changer in trading, providing traders with insights into where ‘stop hunting’ may occur and where large trades are likely to influence market prices significantly. The indicator helps in identifying market conditions where there is a high concentration of stop-loss orders, which, when triggered, can lead to high volatility and potential trading opportunities.

While the specifics of using such an indicator can vary depending on the trading platform or the particular indicator design, the general principle remains the same. Traders look for signs that the price is reaching a point where other traders’ stop-loss orders are set. When these are ‘hunted’ or triggered, it results in a liquidity grab, which smart concepts traders can use to enter or exit positions advantageously.

To implement liquidity grab trading strategies, traders need to:

- Identify potential liquidity pools where stop-loss orders may be clustered.

- Monitor the price movement towards these areas with the help of the liquidity grab indicator.

- Watch for sudden spikes in volume or sharp price movements, which may indicate that a liquidity grab is in progress.

- Use this information to make informed decisions about trade entries and exits, taking care not to get caught in the volatility themselves.

In sum, the Liquidity Grab indicator acts as a powerful tool for traders who want to understand and anticipate market movements better by highlighting areas of potential price manipulation or where a flurry of activity is expected due to stop orders being executed.

SMC traders have a saying that goes like this: “If you can’t spot the liquidity, you’re the liquidity.” In other words, your ability to spot and take advantage of liquidity grabs in trading can make or break your trading career.

Still not sure about Liquidity Grab trading? Hopefully, this video offers some clarification:

The Liquidity Grab Trading Strategy

As we’ve seen earlier in this article, understanding how liquidity grabs work can easily help us avoid entering trades where the masses would have entered and lose their money. But identifying it can be quite tricky.

Essentially, you must spot an area where the price gets out of a predefined order block area. That’s your signal to enter a trade since this liquidity grab provides a signal of triggered stop loss orders.

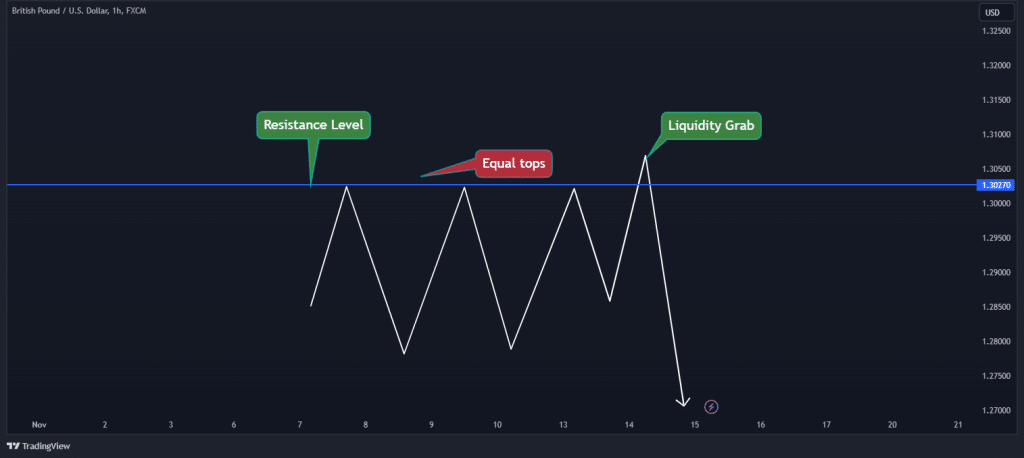

So, let’s see an example of how the liquidity grab trading strategy works in real time. For this demonstration, we use the GBP/USD currency pair.

So, the first step is to determine the trend. When there’s a series of higher highs and higher lows, we are in an uptrend, and vice versa.

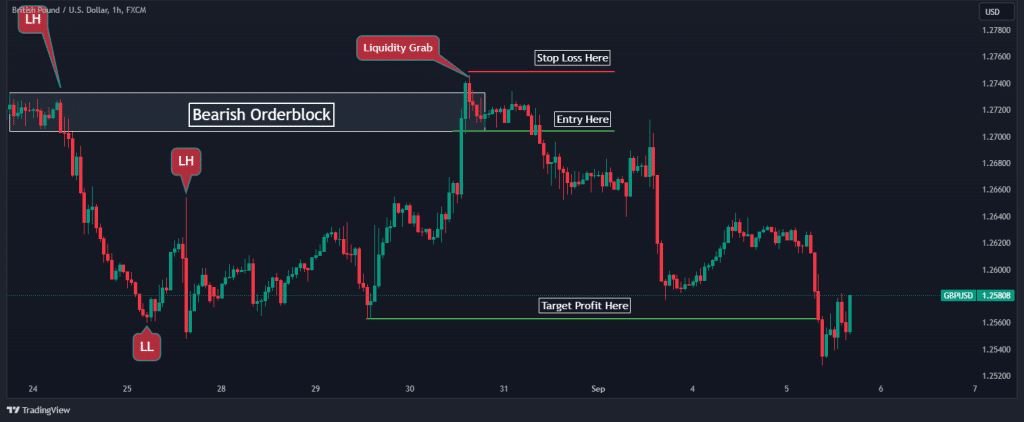

From the chart above we can see that the trend is bearish. So, we can expect the price to mitigate the bearish order block and look for a short-sell position from there.

Now, something unusual happens. The price reverses to the resistance order block area; however, instead of stopping around these levels, it breaks above, and a liquidity grab occurs.

In this case, to avoid a losing trade, we simply have to wait for the price to “hit the stops” of those who entered the trade earlier before we enter our trade. Then, when the price falls below the order block bottom line, we can safely enter a trade.

After entering the trade, we can confidently set our stop loss just above the liquidity grab and set our profit target at the next Swing low, as seen in the chart above.

Liquidity Grab Vs. Break of Structure

These two terms often create confusion for new SMC traders: Liquidity Grab and Break of Structure (BOS). While both relate to market movements and trader actions, they are fundamentally different in their occurrence and implications. So, let’s start with some basic definitions of both terms:

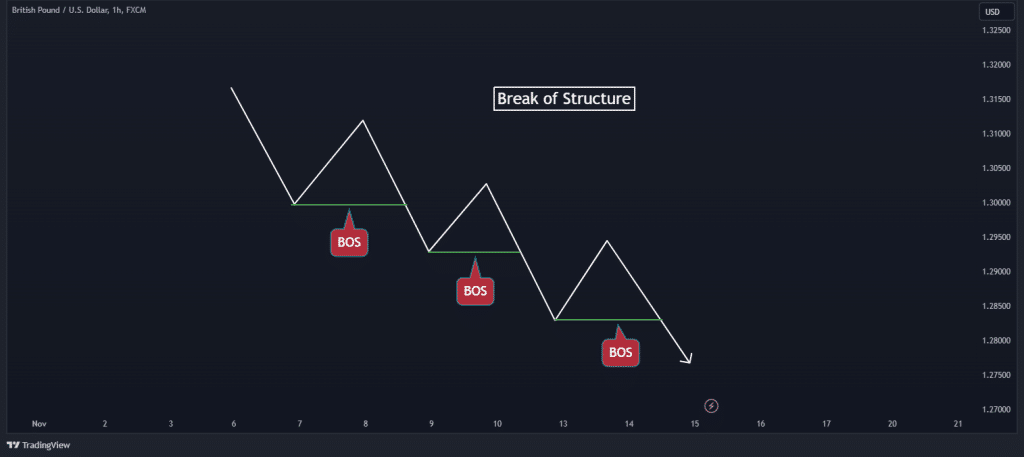

A Break of Structure is an event that signifies a shift in market momentum and is characterized by a change in price behavior. It occurs when the price forms a new ‘higher high’ on an uptrend or a new ‘lower low’ on a downtrend, without the price having to first revert to the previous low or high, respectively. In essence, it indicates the continuation of a trend.

On the other hand, a liquidity grab is a situation where there is a swift and strategic exploitation of accumulated stop orders, usually by large traders or institutions. This results in a sudden and often sharp movement in the price as these orders are executed. Unlike the gradual shift denoted by a BOS, liquidity grabs happen rapidly and are typically triggered by actions such as a large market order that reaches many stop-loss orders at once.

So, what’s the difference between these two concepts?

While BOS is indicative of a trend continuation or reversal, a liquidity grab is more about the tactical use of knowledge about order placements in the market. Traders execute liquidity grabs, knowing that the triggering of stop-loss orders will create a temporary but exploitable movement in the market. It’s similar to a feint or a bluff: the move might give the appearance of a trend but is actually a trap for unwary traders.

Here is a summary table to illustrate their differences clearly:

| Feature | Liquidity Grab | Break of Structure |

| Definition | Exploitation of clustered stop orders for price movement. | A price movement that signals a shift in market momentum by setting new price extremes. |

| Trigger | Often initiated by a significant trade reaching many stop-loss orders. | Triggered by price action forming new highs or lows in a trend. |

| Speed | Occurs suddenly and with great speed. | May happen more gradually as the trend develops. |

| Typical Participants | Large traders or institutions. | All market participants contribute to the trend. |

| Market Impact | Temporary price distortion. | Potential long-term change in the market trend. |

| Visibility in Charts | Specific candle patterns on shorter time frames. | A clear shift in the price trend on the chart. |

The Free Liquidity Grab Strategy PDF

If you need something you can easily refer to, you can download our free liquidity grab trading strategy PDF here:

The Free Liquidity Grab Strategy PDF

Final Thoughts

SMC traders have a saying that goes like this: “If you can’t spot the liquidity, you’re the liquidity.” In other words, your ability to spot and take advantage of liquidity grabs in trading can make or break your trading career. It’s all about knowing where institutional traders place their limit orders.

As you embrace this knowledge and integrate it into your trading strategy, you’re not just following a trend; you’re adopting a mindset and approach that sets you apart from the average trader. So, take this opportunity to refine your trading skills. And, if you wish to learn more about the smart money concept, you can join our trading academy, where we teach you about the SMC along with many other trading strategies.

Frequently Asked Questions About Liquidity Grab

Here are some frequently asked questions on the liquidity grab trading strategy.

What is the meaning of the liquidity grab in smart money concepts?

In Smart Money Concepts, a liquidity grab refers to a scenario where large market players induce a movement in price to trigger a cluster of stop-loss orders, aiming to benefit from the resulting price fluctuation.

What is the difference between a liquidity grab and a break of structure?

A liquidity grab is a targeted exploitation of stop-loss orders to create rapid price movements. In contrast, a break of structure refers to a significant price movement that shifts market momentum, indicating a new trend or continuation without prior reversal.

Is there a liquidity grab indicator on TradingView or MetaTrader 4/5?

Yes, there is a “Liquidity Levels MT5” technical indicator available for MetaTrader 5. This indicator assists traders in identifying potential liquidity levels by analyzing price levels, momentum, and volume. Yet, if you would like to use the liquidity grab indicator, you must learn how to download and install custom indicators on MT4/5.

What is a liquidity grab in forex trading?

A liquidity grab in the forex market is the same as in any other market. In simple terms, a liquidity grab in forex trading occurs when there is an unanticipated increase in demand for one currency versus the other. The reasons for that include economic data, news, geopolitical events, and large investments by financial institutions and governments.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.