In the financial markets, where every decision is a step towards profit or loss, having an edge over the market is invaluable. Now, imagine having the power to naturally spot trading opportunities others might miss, all while simplifying your strategy.

That’s where the Fair Value Gap trading strategy comes in. This strategy, used mainly by price action traders, is extremely simple yet incredibly powerful.

- Fair Value Gaps (FVGs) are powerful tools traders use to identify market imbalances and inefficiencies.

- FVGs occur when buying or selling pressure leads to significant price movements, leaving behind gaps on price charts.

- FVGs can be identified through technical analysis involving the analysis of candlestick patterns and price chart patterns.

- Traders can categorize FVGs into two types: Undervalued FVGs, where prices are lower than fair value, and Overrated FVGs, where prices are higher.

So, in this article, you will learn all you need to understand the basics of FVG and how to use it to build an effective price action trading strategy. Let’s dive right in.

Table of Contents

Table of Contents

- What is the Fair Value Gap (FVG)?

- What Causes Fair Value Gaps to Form?

- What are the Types of Fair Value Gaps?

- How Do You Identify a Fair Value Gap on a Price Chart?

- How to Trade Fair Value Gaps in 4 Simple Steps

- What are the Benefits and Limitations of Trading Fair Value Gaps?

- Fair Value Gap Trading Strategy PDF

- What are the Best Fair Value Gap Indicators?

- Why are Fair Value Gaps Important to Traders?

- Fair Value Gaps Vs. Liquidity Voids: Similarities and Differences

- What is the Difference Between Imbalance and Fair Value Gaps?

- Do Fair Value Gaps Always Get Filled?

- What is Gap Fade in Trading?

- What Makes a Fair Value Gap Invalid?

- What is the Difference Between Imbalance and Fair Value Gaps?

- Tips on Trading the Fair Value Gap

What is the Fair Value Gap (FVG)?

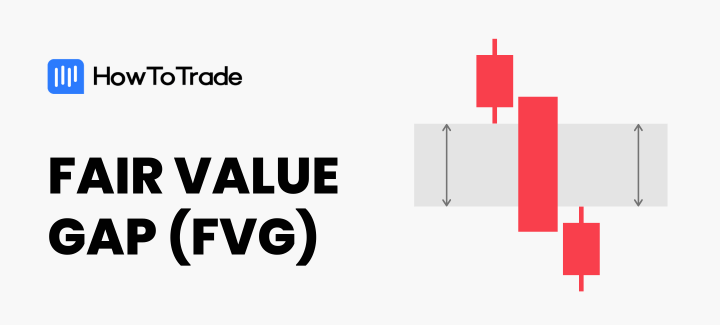

The concept of fair value gap goes by different terminologies among price action traders. Some call it imbalance, inefficiency, or liquidity void. But what exactly are these imbalances? They occur when buying and selling forces exert significant pressure, leading to substantial and rapid price movements.

On the chart, you’ll see a Fair Value Gap as a three-candlestick formation. In a bullish scenario, an FVG forms when the top wick of the first candlestick does not connect with the bottom wick of the third candlestick. Similarly, the FVG in a bearish scenario forms when the bottom wick of the first candlestick does not connect with the top wick of the third candlestick. The gap on the middle candlestick created by the wicks of the first and third candlesticks is the Fair Value Gap.

The FVG trading concept is rooted in the belief that the market naturally tends to correct itself. These price disparities or inefficiencies are not sustainable in the long term, and the market tends to gravitate back towards them before continuing in the same direction as the initial impulsive move.

What Causes Fair Value Gaps to Form?

Here are some factors that can lead to the formation of fair value gaps:

1. Sudden News Events

Unexpected news that drastically impacts market sentiment can trigger a surge in buying or selling, leaving a gap as prices jump to reflect the new information. Imagine a company announcing unexpectedly strong earnings, leading to a jump in its stock price and a gap on the chart.

2. Economic Data Releases

Important economic data releases, like interest rate changes or unemployment figures, can cause similar imbalances. If the data is a surprise, it can lead to a rapid price movement in one direction, creating a gap.

3. Large Institutional Trades

Big trades by institutional investors can also cause FVGs. When a hedge fund or bank buys or sells a large amount of a security, it can overwhelm the existing order book and push the price up or down quickly, leaving a gap behind.

4. Market Openings or Closings

Gaps can sometimes form during times of lower liquidity, such as during market openings or closings. With fewer participants, a smaller buying or selling force can create a price jump that isn’t immediately countered.

5. Weekend Gaps

FVGs can be more frequent between Friday’s close and Monday’s open, reflecting news or events that happened over the weekend.

What are the Types of Fair Value Gaps?

Fair Value Gaps come in four distinct types, each carrying its own set of implications for traders:

1. Bearish Fair Value Gap

The bearish Fair Value Gap is formed when there is a gap between the bottom wick of the first candlestick and the top wick of the third candlestick. This gap usually forms on the body of the middle candlestick, and the individual bias of each candlestick doesn’t really matter. What matters in a bearish scenario is that a gap has formed on the middle candlestick due to the wicks of the other candlesticks not connecting.

2. Bullish Fair Value Gap

A bullish fair value gap forms when the top wick of the first candlestick does not connect with the bottom wick of the third candlestick. Once again, the individual direction of each candlestick doesn’t matter so much here. What matters the most is that there is a gap on the middle candlestick where the wicks of the first and third candlesticks have not connected.

3. Inverse Fair Value Gap

The Inverse Fair Value Gap is an FVG that became invalid from one direction but is still valuable enough to hold the price in the other direction. For instance, a bullish FVG becomes invalid when it fails to hold the price as a demand zone. But it becomes an inverse bearish FVG potentially capable of holding the price as a supply zone.

4. Implied Fair Value Gap

The Implied Fair Value Gap is also a three-candlestick formation pattern but without the gap on the middle candlestick. Hence, the name “implied FVG.” Rather, it is characterized by a larger middle candle and two relatively long wicks from the first and third candles.

The “gap” is drawn by marking out the midpoint of the wick of the first candlestick that touches the middle candlestick and the midpoint of the wick of the third candle that touches the middle candlestick. These two midpoints form our gap.

How Do You Identify a Fair Value Gap on a Price Chart?

Like most chart patterns, the most tricky part of the fair value gap strategy is identifying this unique formation on a price chart. In the case of FVGs, a three-candle pattern must appear with specific rules. Then, when this happens, the space or gap between the wicks of the first and third candles is the fair value gap.

Here is how to identify an FVG on the chart:

1. Spotting the Big Candlestick

The first step in identifying a Fair Value Gap is to look for a substantial candlestick on your price chart. This candlestick should have a significant body-to-wick ratio, ideally around 70%.

2. Analyzing Neighboring Candlesticks

Once you’ve identified the large candlestick, analyze the ones immediately preceding and following it. These neighboring candlesticks should not overlap the significant one entirely. Instead, minor overlaps may occur on the upper and lower sides of the substantial candlestick. Then, it is the gap between the wicks of neighboring candlesticks that create the fair value gap.

3. Defining the Fair Value Gap

Finally, you must define the fair value gap and draw it on your price chart. In a bearish trend, the Fair Value Gap is the price area between the previous candlestick’s low and the following candlestick’s high. This is where the imbalance in the market becomes apparent, signifying a potential trading opportunity. The same applies to a bullish trend but with the opposite conditions.

In the EUR/GBP 15-Min chart below, you can see what the fair value gap candlestick pattern looks like on a price chart. Once you notice a big candlestick with a small candle prior to it and another small candle that appears after the big candlestick, you can search for the fair value gap entry level.

How to Trade Fair Value Gaps in 4 Simple Steps

When the FVG has been identified, there are several trading strategies you can apply. For instance, some traders enter a trade expecting the markets to return to fill the gap. This is called fading the gap. Others wait for the gap to fill and then enter a trade in the direction of the initial price movement.

In this section, we will show how to use the second FVG trading method. So, here’s how to trade it:

1. Determine the Trend

Understanding the market sentiment plays a pivotal role in this strategy. If the price consistently forms higher and higher lows, you’re in an uptrend, and you should be looking to buy entries. Conversely, if the price is forming lower highs and lower lows, it indicates a bearish trend, and you should focus on selling entries.

Establishing the trend direction provides a fundamental framework for trading decisions. If needed, switch to higher time frames, such as 4H, daily, and weekly. Also, to identify the market’s trend, you can trend lines and trend channels.

2. Identify Supply and Demand Zones

Once you’ve determined the trend, the next step is to identify supply and demand zones or order blocks that align with that trend.

In the context of a bullish trend, pay particular attention to demand zones. These zones are areas where buying interest is strong and can potentially drive market prices higher. Conversely, in a bearish trend, you’ll want to focus on supply zones, where selling pressure may dominate.

The goal here is to pinpoint areas on the chart where significant price movements are likely to occur.

3. Use FVG to Determine the Entry Point

Next, you should identify the formation of the fair value gap. In the example below, you can see the supply zone formed by an order block closest to an FVG during a bearish trend. The reason we marked them both is for trading confluence. Theoretically, any of them will likely hold the price and send it back down. But having the two of them align makes the price more likely to reverse once it gets there.

So, you should consider entering a short position when the price closes the gap.

Remember, the presence of an FVG suggests a market imbalance that is likely to be corrected, potentially resulting in favorable price movements in your favor. Following the correction, the price is likely to move in the direction of initial price movement.

4. Set Stop Loss and Target Profit

As with any trading strategy, risk management is vital. When executing trades based on the FVG strategy, set appropriate stop loss and target profit levels. If you’re entering a trade from a supply zone, you should place your stop loss above that zone. This helps protect your capital in case the market moves against your position.

Your take-profit target should be set just above the next demand zone in the direction of your trade. This zone represents a likely point where the market could reverse, allowing you to secure your profits.

You can also keep things simple by just using a risk-to-reward ratio. 1:2 or 1:3 is just okay for a day trader. The smaller the timeframe, the bigger the likelihood of getting huge rewards for your risks. But just as much, the more likely that your levels are false. In the bigger timeframes, however, you may not get high returns for your risk, but the levels there tend to be respected more.

Check our video tutorial on how to identify and trade fair value gaps.

Fair Value Gap Trading Strategy PDF

If you need something to read on the fly about FVGs, here’s something for you:

Fair Value Gap Trading Strategy PDF

What are the Benefits and Limitations of Trading Fair Value Gaps?

While Fair Value Gaps have a lot of benefits for traders, they are not without their limitations. Let’s take a look at these:

Benefits

- Fair Value Gaps are one of the simplest Smart Money Concepts to spot and follow. It’s not subjective.

- FVGs do help traders to gauge where to get in and out of trades.

Limitations

- FVGs aren’t the trading holy grail. Regardless of whether it’s a normal FVG or an inverse FVG, it still fails. So, be careful when trading them.

- When there are multiple FVGs on the chart, it can be quite confusing which one to place your trades on.

What are the Best Fair Value Gap Indicators?

While Fair Value Gaps are quite easy to identify, you can make your analysis faster if you have an indicator that automatically marks them out on your chart.

Let’s delve into them:

FVG Indicators for TradingView

For users of TradingView, here are two FVG indicators:

1. FVG Indicator by Nephew_Sam

TradingView has a plethora of FVG indicators. However, one that clearly stands out for its simplicity and intuitiveness is the FVG indicator by Nephew_Sam. This indicator shows FVGs on your current chart that are yet to be tapped. It also has the option to overlay FVGs from other timeframes onto your current timeframe. This can come in handy for traders who use multi-timeframe analysis.

2. FVG Indicators by Lux Algo

If you want something more sophisticated, there are other FVG indicators on TradingView from LuxAlgo. They have FVGs for almost all kinds of scenarios. For instance, they have an indicator that shows you the first FVG of the trading session.

FVG Indicators for MetaTrader 4 and 5

If you’re using the MetaTrader 4 or 5 trading platform, there are also FVG indicators available.

1. Fair Value Gap Indicator by Best-Metatrader-Indicators.com

This is another simple FVG indicator for the MT5. It plots out the gaps clearly so that you can see how the market reacts at these levels.

You can get it here: Fair Value Gap Indicator by Best-Metatrader-Indicators

2. Fair Value Gaps Indicator by Indicatorspot

This is another FVG indicator that’s easy on the eye and simply gets the job done.

You can get it here: Fair Value Gap Indicator by Indicatorspot

If you need help downloading and installing custom indicators to your MT4 and MT5, this will help:

How to Download and Install Custom Indicators to MetaTrader 4 and 5

Why are Fair Value Gaps Important to Traders?

Technical traders, especially SMC traders, love to refer to the FVG for two reasons:

- There’s a chance that the price retraces to an FVG it has created before continuing the previous trend. This way, traders can use it as a potential supply or demand zone and wait for a pullback into the FVG to join an established trend.

- FVGs, when they fail, aren’t completely useless. They form inverse Fair Value Gaps, where the other side of the FVG can still be used as a demand of supply zone. For instance, a bullish FVG can fail and become a bearish inverse FVG.

Fair Value Gaps Vs. Liquidity Voids: Similarities and Differences

A concept that’s very similar to Fair Value Gap is Liquidity Void. In fact, they both share many characteristics, but they ultimately differ in some distinct manners. You already know what FVGs are. What are liquidity voids?

Liquidity voids are gaps on the price chart that occur when the price jumps suddenly from one level to another without any significant trading activity between these two levels. If this sounds like we’re describing an FVG, that’s because we are. Both are just price gaps. They are imbalances.

However, the defining difference between them is scale. An FVG can be formed from just any three candles, as long as there’s a gap on the middle candlestick created by the tips of the first and third candlesticks not touching. A void, on the other hand, represents a larger scale. This could mean multiple FVGs. It could also mean a single FVG but with an enormous gap. You’ll often find this during high-impact news events.

What is the Difference Between Imbalance and Fair Value Gaps?

Imbalance and Fair Value Gaps are closely related concepts in trading, but they have distinct implications. Imbalance refers to the disparity between buying and selling pressures in the market, leading to significant price moves. On the other hand, Fair Value Gaps specifically pertain to the gaps formed on price charts due to these imbalances. While imbalance signifies the underlying forces at play, Fair Value Gaps are the visible outcomes of these imbalances, representing potential trading opportunities.

Do Fair Value Gaps Always Get Filled?

While the general principle is that Fair Value Gaps (FVGs) tend to get filled, it’s not an absolute rule. FVGs represent market imbalances that are expected to correct themselves over time, drawing prices back to the perceived fair value. However, external factors, market volatility, sudden shifts in sentiment, or unexpected market developments can influence whether or not a specific FVG gets filled.

Even if an FVG is going to get filled, you can’t be sure about when that will be.

What is Gap Fade in Trading?

After the formation of an FVG, a trader fades the gap by taking trades in an attempt to ride the price back into the gap with the hope of filling it. This trading technique is rooted in the idea that Fair Value Gaps, and other kinds of gaps, are imbalances in the market that’ll get filled sooner or later.

What Makes a Fair Value Gap Invalid?

A fair value gap becomes invalid when it’s not strong enough to hold the price as a support or demand. Rather, the price tears through it from one side to another. Invalid fair value gaps are not completely useless. They can still form valuable Inverse Fair Value Gaps.

Tips on Trading the Fair Value Gap

Before we go, here are some tips that will save you some frustration when you’re trading the FVG:

- FVGs, indeed, tend to get filled, but no one knows for sure when that will be. So, trade carefully.

- Don’t trade FVGs in isolation. This concept alone is not likely to change your trading life. However, many little concepts like this can add up to make you a profitable trader. Trade it in confluence with other trading concepts.

- Regardless of the direction of the FVG, the overall market trend is more likely to prevail. Keep this in mind as you trade FVGs.

- if it’s a major part of your trading strategy, you don’t have to identify fair value gaps manually. Just plaster an FVG indicator on your chart, and you’re good to go.

With that, we wish you the best.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.