Most beginner traders focus on the most popular instruments like FX currency pairs, stocks, and global indices at the beginning of their trading journey. They try to analyze the market and predict future movement. But there’s a strategy, a trading technique, that has an entirely different purpose. That is, the commodity spread trading strategy.

The strategy involves taking simultaneous long and short positions in related futures contracts. But how does it work, and what makes it popular among professional traders?

- Commodity spread trading is a strategy used by traders to mitigate risk and enhance profitability, involving simultaneous long and short positions in futures contracts.

- Spread trading accommodates different market conditions and trading objectives, with strategies like intra-market, inter-market/seasonal, and location spread trading.

- Starting with a futures brokerage firm provides access to various futures contracts and necessary trading tools. Trading commodity futures spreads via CFDs is another option, though it has limitations compared to trading through a futures brokerage firm.

In this comprehensive guide, we will explain everything you need to know about commodity spread trading, demystifying its complexities and providing practical examples to showcase its real-world applications.

Table of Contents

Table of Contents

Commodity Futures Spread Trading Explained

Generally speaking, traders constantly look forward to trading strategies that help them to mitigate risk and stay profitable. Commodity spread trading fits that criteria. But what is commodity futures spread trading, and what are its advantages?

Simply put, futures spread trading involves simultaneously taking a long position (buying) and a short position (selling) in related markets. For example, a commodity spread trading trade can be taking a long position on a wheat future contract and selling corn. Or short the Crude Oil June contract and buy the Crude Oil December contract. Now, why would you do that?

First, because there are many predictable trading opportunities in commodity futures spreads. For example, seasonal spreads enable traders to take advantage of seasonal patterns. In the case of oil and natural gas – when the winter arrives, winter contracts are likely to become more expensive than summer contracts. This allows traders to make some profit regardless of the market’s direction due to price discrepancies and inefficiencies between different futures contracts.

Second, trading commodity spreads are far more simplistic. Spreads are less volatile and, thus, less risky than outright futures, enabling traders to get in and out easily using level 1 or level 2 market data. Just imagine, when you are trading commodity spreads, you are essentially buying and selling the difference between two commodities, which usually falls into a predefined price gap. It is much easier than trading outright futures contracts, which can often move in any direction without any limit.

Overall, the idea of commodity spread trading is to have a balanced approach instead of placing all bets on the price of a commodity moving strictly up or down. As a former commodity futures spread day trader, I can genuinely tell you that it’s one of the best trading strategies out there. It enables one to speculate on price movements with a high level of confidence and make logical trade decisions.

Remember that commodities are the most fundamental assets in financial markets. Often, analyzing these assets is more logical than trying to analyze stocks, FX currency pairs, and indices. Not surprisingly, many prop trading firms focus on grains and other commodities spreads to help their prop traders make consistent profits over the long term.

Understanding Futures Spread Margins

Explaining what commodity spread trading is all about without mentioning futures spread margins is incomplete. A key part of trading commodity spreads is the fairly low margin requirement.

Technically, the margin requirements for spread trading are typically lower than those for conventional futures trading. This efficiency means that with the same amount of capital, a trader could enter into multiple spread trades instead of a single futures contract, amplifying their market exposure and potential for profit.

As an example, the margin requirement for a Soybean futures contract is $3,000, and for Corn futures is $1,500. However, most futures exchanges understand the low risk associated with commodity spread trading and, therefore, enable traders to open a spread trade with a low margin requirement.

So, in this case, a trader can receive a 75% margin credit from the exchange; instead of having to use a margin requirement of $4500, the initial margin for that trade would be just $1,125.

The reduced margin requirement is made possible because the nature of spread trading inherently carries less risk. Since one position hedges the other, the strategy is less susceptible to market volatility.

For example, if an unexpected event causes market disruption, the loss incurred on the long position could be offset by the gain on the short position, creating a safety net for the trader.

Advantages of Spread Trading in Futures

Although we have highlighted some of the advantages of commodity spread trading early on in the article, here are some other benefits that might help you choose to take the path to commodity spread trading strategies:

Advantages of Commodity Spread Trading

Advantages of Commodity Spread Trading

- Predictability of Price Movements: With a spread trading strategy, traders can extend their analytical timeline, freeing them from the confines of short-dated contract volatility and enabling more accurate price movement predictions.

- Lower Margin Requirements: The financial efficiency of spread trading is further highlighted by its lower margin requirements, enabling higher returns on successful trades.

- Balanced Risk: Compared to single contract trading, spreads offer a more balanced risk profile, limiting exposure and providing diverse avenues for profitability.

- Market-Wide Protection: In the face of unforeseen market-wide risk events or ‘black swan’ events, spread trades provide a level of protection that is hard to achieve with a long-only position.

- Resistance to Market Manipulation: Being less susceptible to the actions of market makers or prominent players, spread trades allow traders to capitalize on underlying market trends more purely.

Types of Commodity Futures Spread Trading

One of the strengths of spread trading is that it offers a variety of approaches to suit different market conditions and trading objectives. These types of commodity futures spreads do not share many characteristics besides the general idea of trading two correlated assets rather than the outright futures contract. However, each type of commodity spread trading has its market dynamics and structure.

With that in mind, here are the main types of spread trades that traders can use in the commodities market:

1. Intra Market/Seasonal Spread Trading

Often referred to as calendar or seasonal spreads, intra-market spread trading is a strategy where a trader simultaneously buys and sells futures contracts of the same commodity but with different expiration months. This approach makes sense because it capitalizes on the price differentials between contracts at varying times.

For instance, imagine a scenario where a trader buys May soybeans while concurrently selling November soybeans. The underlying belief is that the price relationship between these two contracts will shift in the trader’s favor, resulting in a profitable outcome.

To provide a concrete example, let’s consider the July-December Wheat spread. In this case, a trader would simultaneously enter into a long position for wheat futures expiring in July and a short position for those expiring in December. The trader’s profit or loss would then hinge on the price movements between these two specific contracts.

Let’s see what the spread actually looks like. To view all wheat futures contracts, you can visit CMEGroup’s wheat SRW page. So, for instance, at the time of writing, the July wheat contract’s price stands at 633.4, while the December contract is at 664.2. The spread is, therefore, 30.8.

Seasonality plays a crucial role here as well. Agricultural commodities, in particular, have pronounced seasonal patterns due to planting and harvest cycles. Traders can use these patterns to predict future price movements. A classic example would be grain such as wheat, soybean, and corn futures. The planting and harvest seasons for these crops are well-known and have a significant impact on their prices.

2. Inter Market

When we talk about inter-market spread trading, we are referring to a strategy that involves buying and selling different, yet related, commodities futures within the same contract month.

With this approach, we seek to leverage these two commodities’ relationships while exploiting predictable seasonal patterns. This relationship could be due to their complementary or substitutive nature in the market.

For instance, corn and wheat are essential grains, and while they serve different purposes, their price movements can be correlated. A trader might decide to buy corn futures and sell wheat futures if they believe corn is undervalued compared to wheat, anticipating a correction in the price relationship between these two commodities.

3. Location Spread Trading

Location spread trading takes advantage of price discrepancies between the same commodity traded in different geographical locations. Various factors contribute to these discrepancies, including transportation costs, supply and demand imbalances, and regional economic conditions.

Taking wheat as an example again, a trader might observe that wheat futures in the US are trading at a discount compared to those in Europe. This could be due to an oversupply in the US or increased European demand. In this case, buying US wheat futures and selling equivalent European wheat futures shows that the trader is betting that this price discrepancy will decrease over time, allowing them to profit from the convergence.

Another example could be domestically. Wheat is trading on the Chicago Mercantile Exchange and the Minneapolis Grain Exchange. That’s a classic location spread trading.

Crude oil presents another intriguing opportunity for location-spread trading. Different grades of crude oil are traded worldwide, and regional factors influence their prices. A trader might buy West Texas Intermediate (WTI) crude futures, which are traded in the US, and sell Brent crude futures, traded in Europe if they believe the price spread between these two grades will narrow.

As a former commodity futures spread day trader, I can genuinely tell you that it’s one of the best trading strategies out there. It enables one to speculate on price movements with a high level of confidence and make logical trade decisions.

Trading Commodity Futures Spreads – How To Get Started

So, the big question is how do you get started with the commodity spread trading strategy? It’s certainly not the most conventional way of trading the markets, and it requires some crucial steps you need to take.

First, before you start, you must choose a brokerage firm that enables you to trade commodity future spreads. Now, this can be done via a futures brokerage firm that connects you to a futures exchange, where you can get access to various futures contracts. Or, if you are on a tight budget and wish to focus on typical inter-market spreads, you can do that via a CFD brokerage firm.

So, let’s explore the two options:

Spread Trading via Futures Brokerage Firm

The most conventional and recommended way for traders to start trading commodity futures spreads is through a futures brokerage firm. There are many brokerage firms that provide direct access to futures exchanges, though keep in mind that the registration process is long and complicated, and there’s usually a high minimum deposit requirement. Additionally, the fee for getting some quotes from futures exchanges could be fairly expensive. At last, you also need to consider the fee per transaction, which is also high when compared to other markets.

One such platform, for example, is TradeStation, which is a very popular futures platform that comes with comprehensive services and robust trading tools. When you opt for a platform like TradeStation, you gain access to various futures contracts, including different spread options.

As a trader on these platforms, you can navigate different commodities, analyze price movements, and execute spread trades in one place. The platforms are designed to provide traders with the necessary data, charts, and analytical tools required to make informed decisions.

Spread Trading via Contracts for Difference (CFDs)

Besides trading through a futures brokerage firm, traders can also delve into commodity futures spreads via CFDs. CFDs, also known as Contracts for Difference, are financial derivatives that allow traders to speculate on the price movements of assets without actually owning the underlying asset.

However, it is crucial to understand the limitations of trading commodity futures spreads through CFDs. Unlike trading through a futures brokerage firm, CFD brokerage firms generally only allow traders to trade the closest contract, which means that while inter-market spread trades are possible, trading seasonal and location spreads becomes impossible.

For instance, if a trader wishes to engage in seasonal spread trading, they would need access to futures contracts that may expire months, or even years, in the future. With CFDs, this is not always possible, as they typically offer exposure to the nearest expiration date. As a result, while CFDs can be a viable option for certain types of spread trades, they may not offer the full flexibility required for more complex strategies.

Examples of Commodity Spread Trading

Commodity spread trading is a versatile strategy that can be applied across various commodities and market conditions. Now, let’s see some practical examples of how this strategy works in real-world scenarios.

Example 1: Seasonal Spread in Corn

Seasonal commodity spreads take advantage of predictable patterns at certain times of the year. Personally, I can tell you that trading seasonal commodity spreads is one of the best ways to trade financial assets.

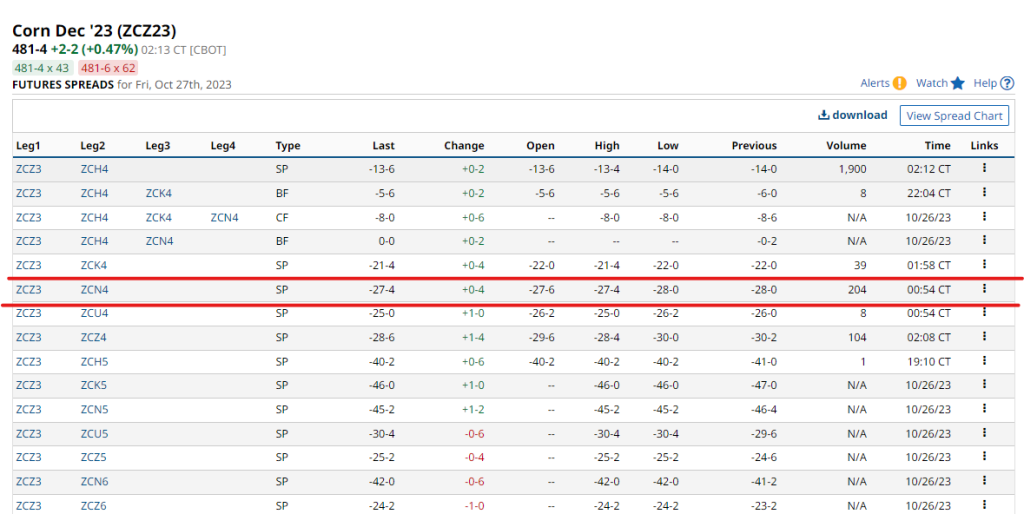

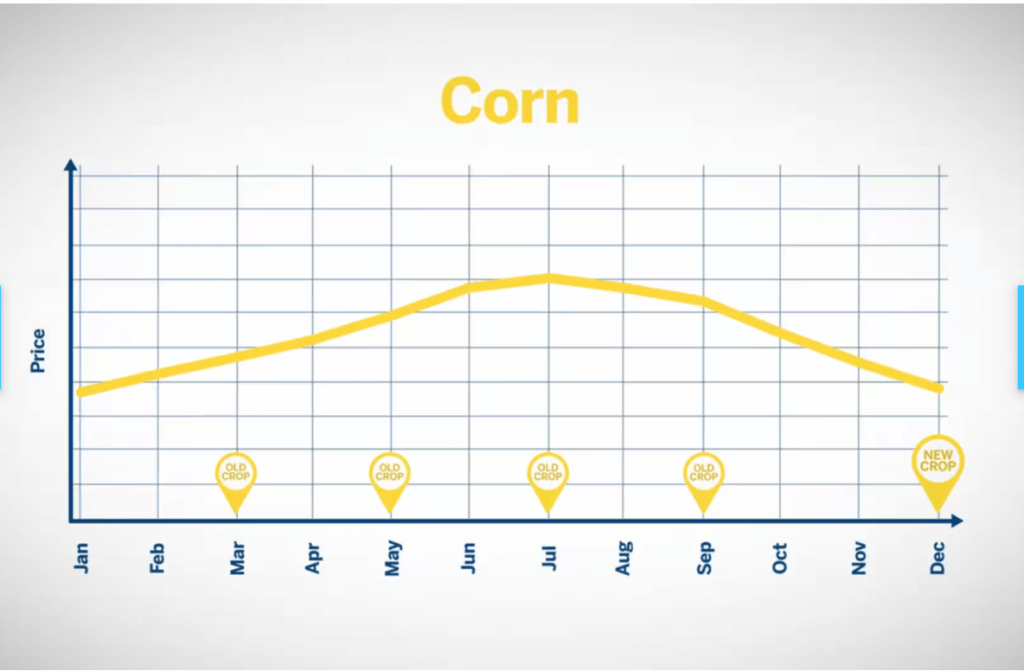

One classic example is the corn July-December spread. During this period, corn prices may exhibit specific trends due to the crop’s planting and harvest cycles.

July: This contract often represents the peak of the planting season when uncertainty about the final yield is highest. Prices might be more volatile due to weather conditions and early crop reports.

December: The harvest is typically complete by December, and the market has a clearer supply picture. Prices might stabilize, reflecting the actual crop yield.

Note that finding commodity spread quotes online is quite a challenging task. However, if you wish to do that, you can visit Barchart and look for the spread you are looking for only after you learn the symbol of each contract month.

By initiating a spread trade, buying July corn and selling December corn, traders can potentially profit from the narrowing or widening price difference between these two contracts, depending on how the season progresses.

And, of course, you always need for seasonality patterns.

As you can see, when it comes to corn, July and December are two of the most striking seasonal months. On average, corn prices tend to rise around July due to the uncertainty around new crop production in December. From that point, corn prices tend to decline since the harvest appears to be around analyst expectations (which is usually the case unless disruptions are caused by weather).

Example 2: Location Spread in Crude Oil (Brent/WTI Spread)

Location spreads capitalize on price discrepancies between the same commodity delivered in different locations. Some examples include wheat, which is traded in the Chicago and Minneapolis exchange, or gold, traded on CME or ICE.

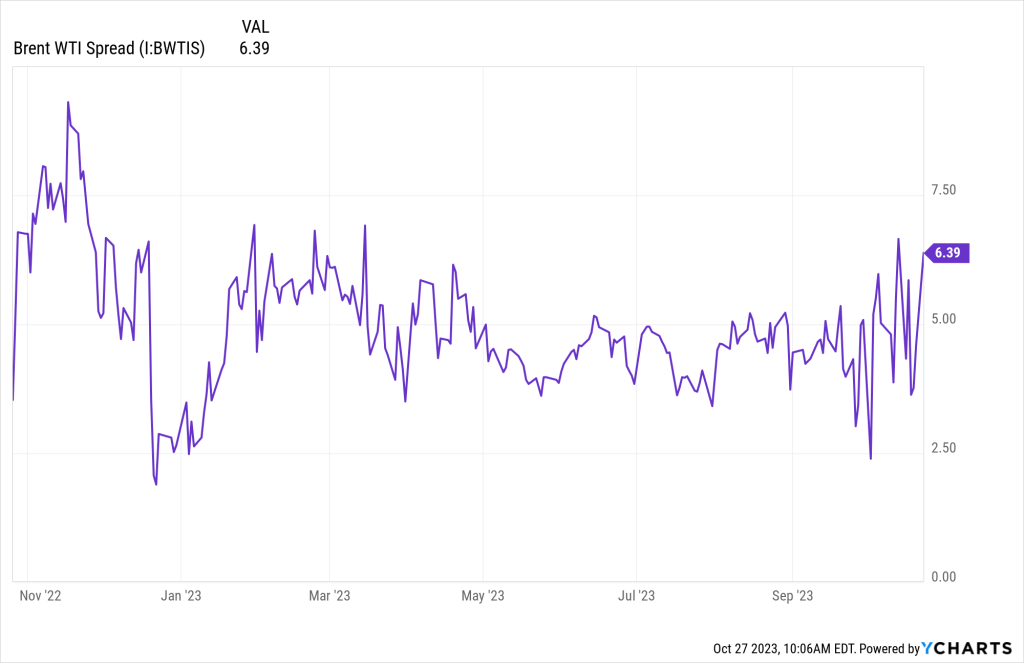

A prime example is the spread between Brent crude oil and West Texas Intermediate (WTI) crude oil.

Brent Crude: Sourced from the North Sea, its price is influenced by international factors and is often higher than other benchmarks.

WTI Crude: Produced in the U.S., its price reflects domestic production and demand dynamics.

Trading the Brent/WTI spread involves taking a position in Brent and an opposing position in WTI, aiming to profit from price differences between the two. This spread is highly affected by political developments, weather, and transportation.

Example 3: Inter-Market Spread in Corn and Soybean (Synthetic Spread)

Another example of commodity spread trading is the inter-market, which can be done synthetically on any trading platform, including CFDs. Intra-market spreads involve trading two different yet related, commodities. Some examples include crude oil and natural gas, wheat and corn, silver and gold, and many others. For trading-related commodities, we suggest you visit our asset correlation trading strategy guide.

A prime example is the relationship between corn and soybean, two major agricultural products.

Creating a synthetic spread involves understanding the price relationship between these two commodities and taking positions to capitalize on expected movements in that relationship.

So, let’s assume soybean is currently trading at 1294 while corn is trading at 481. The spread, or the price difference between soybean and corn, can be calculated as:

Spread = Soybean Price – Corn Price

Spread = 1294 – 481 = 813

This number, 813, represents the spread between soybean and corn.

To create a synthetic spread, a trader would take positions in both soybean and corn futures. If the trader expects the spread to widen (i.e., soybean prices to increase relative to corn prices or corn prices to decrease relative to soybean prices), they would go long on soybean futures and short on corn futures. Conversely, if the trader expects the spread to narrow (i.e., corn prices to increase relative to soybean prices or soybean prices to decrease relative to corn prices), they would go short on soybean futures and long on corn futures.

Creating a synthetic spread helps traders gain exposure to the relative price movements of corn and soybean, potentially profiting from changes in the agricultural landscape without taking a directional bet on either commodity. This strategy requires a deep understanding of the factors influencing both markets and a keen eye for recognizing trends and shifts in the spread.

For instance, let’s say the projections of corn’s harvest are less optimistic than soybeans. In that case, corn’s price is likely to rise while soybean price is predicted to fall, stay the same, or rise at a lower rate than corn. If so, the soybean/corn spread is likely to fall; hence, you should short-sell soybeans and buy corn.

Final Word – Why Commodity Spread Trading is the Best Way to Trade the Markets

As we have explored throughout this guide, commodity spread trading helps traders take simultaneous long and short positions in related futures contracts, unlocking the ability to profit from price discrepancies, seasonal patterns, all while enjoying the benefits of lower margin requirements.

Those who are familiar with commodity spread trading certainly will push you in that direction and for many good reasons. Arguably, commodity futures spread trading is among the best trading strategies to focus on.

But why stop at understanding? The real magic unfolds when knowledge is put into action. If you have the budget and you are serious about trading, you should explore this option. And, if you need help taking the first steps, we at HowToTrade are here to help you do that.

Frequently Asked Questions about the Commodity Spread Trading

Here are some frequently asked questions about Commodity Futures spread trading:

What is the time spread in commodity trading?

A time spread in commodity trading, also known as a calendar spread, involves taking a long position in one futures contract and a short position in another futures contract of the same commodity but with different expiration dates. This strategy seeks to capitalize on changes in the price relationship between the two contracts over time.

How can I learn about commodity spread trading?

You can learn about commodity spread trading through various resources, including online courses, trading forums, books written by experienced traders, and educational content provided by brokerage platforms.

What is spread trading in bonds?

Spread trading in bonds involves taking opposing positions in different bonds to capitalize on changes in the price differential or yield spread between them. This could include bonds with different maturities, credit ratings, or issuers. Traders use this strategy to hedge risk or to profit from expected changes in the yield curve or credit conditions.

What are the key advantages of the seasonal commodity spread trading strategy?

The seasonal commodity spread trading strategy leverages predictable patterns in commodity prices, significantly mitigating risk and lowering volatility compared to outright positions. By simultaneously taking opposing positions in related futures contracts, traders can capitalize on changes in price relationships over time, making their capital usage more efficient and opening up diverse avenues for profitability.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.