What is a CFD? Contract for Difference Explained

When you buy and sell in the forex market with an online forex broker, there isn’t any actual transfer of currency to or from your account. Also, your profit or loss is not in the currency of the currency pair you’ve traded.

How does this make sense?

This is where CFDs come in.

What is a CFD in Forex Trading?

In Forex terms, A Contract for Difference (CFD) trade is an agreement to exchange the difference in the price of the underlying currencies in a currency pair when you open your position versus when you close it.

Trading CFDs in the forex market allows you to trade a currency pair in both directions without meeting strict margin requirements. This means that you can take both long and short positions on the same currency pair without owning any of the currencies.

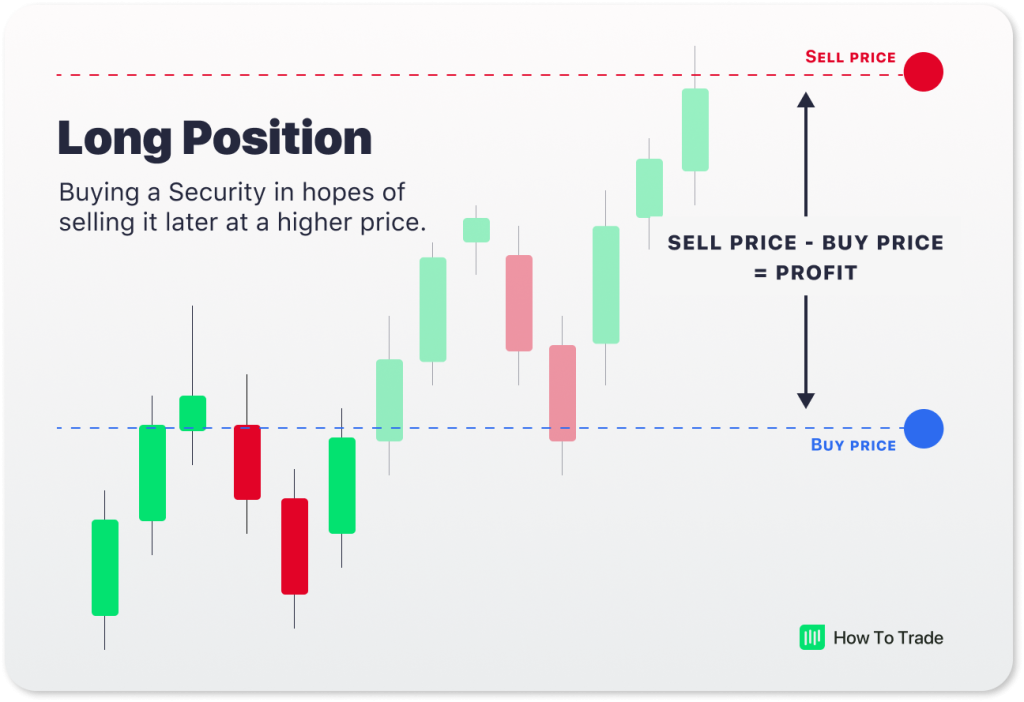

One of the key attractions of CFD trading is the high leverage CFD brokers provide, which typically falls between 2:1 and 1000:1 (depending on the asset class and the instrument). Their flexibility is another one of their most attractive features—you can trade on both rising and falling market prices. This means you can ‘go long’ if you anticipate the asset will increase in value or ‘go short’ if you expect it to decrease.

Suppose you enter a CFD contract to ‘buy’ an asset at $50 and later close the position by ‘selling’ it at $51. The $1 difference is your profit, excluding any fees or commissions.

Conversely, if you speculate that the asset’s price will fall, you could open a ‘sell’ position at $50 and then ‘buy’ to close at $51. Here, the $1 difference represents your loss.

However, the main difference between CFD trading and traditional trading is that you do not physically own the underlying asset. Instead, when you trade CFDs, you simply speculate on the price of the asset to make profits.

Fun Fact: CFDs were originally traded among financial institutions, such as banks. But in recent years, they’ve become more popular with retail investors and CFD traders because they allow you to trade without having to own any securities yourself.

What Markets Can You Trade With CFDs?

CFDs offer the opportunity to trade a vast array of financial markets, including the following:

- Stocks

- Indices

- Commodities

- Bonds

- Forex pairs

- Cryptocurrencies

- ETFs, and more.

Unlike futures contracts, Contracts for Difference don’t have an expiration date. They are renewed at the close of each trading day, and traders can keep their CFD positions open indefinitely. Well, for as long as there’s enough margin in their account to support the CFD position.

In CFD accounts, there are also very few fees charged for trading CFDs (other than the overnight fee), and many CFD providers don’t charge any commission or fees when entering or exiting a trade. Instead, the CFD platform makes money by having the trader pay the buy and sell spread. To buy, a trader pays the asking price, and to sell/short, the CFD trader must take the bid price. This is one of the main reasons why CFD trading has become such a popular form of trading for beginner and experienced traders.

In terms of what affects the prices of CFDs – it is essentially the price movement of the underlying assets. Keep in mind that a CFD contract is a derivative contract that is known as the exchange product. In other words, this means that you are speculating the opening and closing prices in a CFD trade versus another trader or, usually, versus the CFD provider.

For example, crude oil CFD prices are mainly driven by supply and demand or seasonality. Business or company-specific factors, such as earnings or acquisitions, can determine the prices of equity CFDs. Fundamental factors, such as economic growth, inflation, interest rates, geopolitical tension, monetary policy expectations, and environmental factors, influence price movements in the Forex market.

So, when you trade CFDs, you technically need to analyze the underlying asset price, the same as when trading the chosen asset on a traditional trading platform and physically owning the underlying asset.

How Does CFD Trading Work?

To better understand how CFDs work, let’s paint a picture.

Reports suggest a sluggish U.S. job market, and you predict the upcoming Non-farm Payrolls will disappoint, falling short of what analysts forecast. With this information, you anticipate a decline in the strength of the U.S. dollar relative to the British pound.

Seizing the moment, you decide to enter a CFD trade by going long (buying) one CFD on the GBP/USD currency pair at an exchange rate of 1.3100.

Good news: your market forecast proves accurate—Non-farm Payrolls data is weak, weakening the U.S. dollar. Consequently, GBP/USD rates soar to 1.3180/1.3182. You opt to exit your position at 1.3180, netting an 80-pip increase. This translates to a profit of $80 on your trade.

The rule here is straightforward: the higher the GBP/USD exchange rate rises after you go long, the larger your profit will be. But here’s the catch. CFDs are leveraged trading products, which means that when you are trading CFDs, the potential of your profits is significantly higher and the chances of losing money rapidly.

For instance, what would have happened if the non-farm payroll data had come in better than you expected?

If the US dollar had strengthened against the pound, sending GBB/USD lower, and you decided to close your CFD trade at the closing price of 1.3050, you’d face a $50 loss.

Remember, all forms of trading involve risk. Dealing with derivatives like CFD contracts and margin trading can be even trickier for newbie traders due to the high risk of high-leverage trading. But if you plan to open a CFD trading account and trade CFDs, the smart thing is to take your time and develop an investment strategy that works for you. You’re on your way to expanding your trading basket and skillset. Don’t rush things, and make sure you complete our trading academy before you start placing any CFD trades.

Should You Trade CFDs?

Certainly, there’s a debate that revolves around the concept of CFDs. Unlike investing in the stock and futures markets, CFDs have no value other than allowing users to speculate on the prices of the underlying assets. Nonetheless, for the average Joe trader, CFD trading is much easier and more flexible than trading stocks and commodities outright. It is the ideal way for traders to access nearly all financial markets and most financial assets in global markets through a CFD trading account.

This flexibility is why most people trade CFDs.

In comparison to other forms of trading, some of the benefits of CFD trading include low initial deposit, high leverage ratio, low trading costs, and the ability to take long and short positions without having to meet strict margin requirements. So, if you are planning to trade FX currency pairs and get access to other financial instruments and top trading platforms, CFD trading might be the best solution for you.

Key Takeaways

- A CFD in forex is a financial contract between you and a CFD provider to exchange the difference between the opening on the closing price of a currency pair.

- CFDs allow you to speculate the rising and falling of currency pair exchange rates without actually owning the underlying currencies in the pair. They simply offer you trading opportunities from market moves and nothing more.

- Apart from forex, other markets that offer financial instruments for CFD trading include stock, indices, commodities, bonds, forex pairs, cryptocurrencies, ETFs, and more.

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."