How Does Forex Leverage Work?

There used to be a time when only the rich could trade forex because the capital requirement was huge. The minimum was $50,000. But not many retail traders had this much money lying around then. Not even now.

And this is where leverage comes into play. It’s the market makers’ way of making the forex market open to everyone with minimal trading capital.

In this lesson, we’ll describe leverage and everything you need to know about it. We’ll also show you how leverage, despite the massive edge it gives the trader, can also be the end of the trader.

What is Leverage in Forex?

In Foreign Exchange markets and financial markets in general, leveraged trading is defined as using borrowed money from a forex broker to increase earning potential.

Simply put, leverage trading (also known as margin trading) is essentially borrowed money provided by a Forex broker to get involved in potentially high-profit trades in the forex market without having to invest vast swathes of your own capital.

When you use $50,000 for a $50,000 investment, this is called 1:1 leverage or no leverage. Unfortunately, not many forex traders have $50,000 to trade with. But fortunately, forex trading is not leveraged 1:1. You’re leveraged anywhere from 3:1 all the way up to a forex leverage ratio of 1000:1.

Fun fact: Forex trading was traditionally reserved for society’s elite who could afford to come up with large amounts of capital and required a high initial investment. Traditionally, $50,000 had to be invested as a starting trading capital.

How Does Leverage Work in Forex Trading

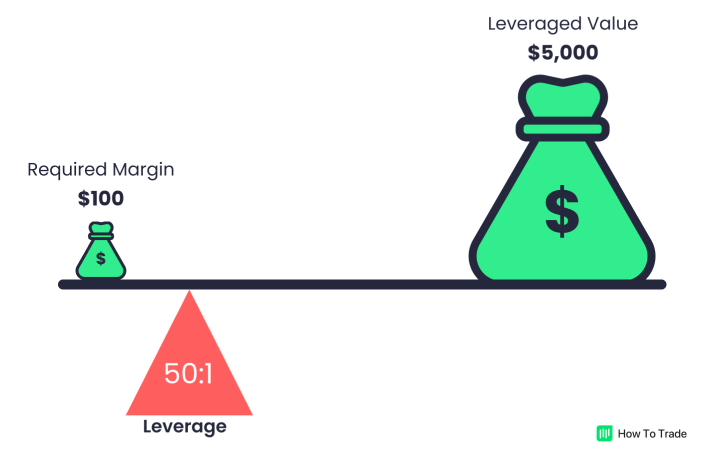

Let’s take 100:1 leverage as an example. A forex leverage ratio of 100:1 means you can trade a notional value 100 times greater than the capital in your trading account. So now, you simply have more money in your trading account to leverage your currency trading.

To control a $50,000 position size, for instance, your forex broker will set aside $500 from your account and lend you the remaining $49,500. So, if your $50,000 trade makes a profit of 1%, you have $500. And just like that, you get a 100% profit on your own $500.

Sweet, eh?

But with great power comes great responsibility. If you lose $500 instead on the $50,000 trade, that’s all of your $500 investment gone. And that’s why they say leverage is a double-edged sword.

Let’s take the GBP/USD currency pair with a quote of 1.2700/12703 as an example. From the last lesson about forex ask-bid spread, you know that the bid price is 1.2700, and the ask price is 1.2703.

Without leverage in forex trading, opening a one lot size sell trade (100,000 units) would require a trader to invest around $127,000. Using a leverage level of 500:1, we can dramatically reduce the capital needed. We can use a simple formula to calculate leverage and work out the amount of invested capital needed:

You only need $254 instead of the $127,000 it would have originally cost you.

Keep in mind, however, that although leverage is mainly associated with forex trading, many online brokers also enable traders to use leverage when trading CFDs. This means that not only you can use leverage when trading the forex markets but also when trading CFDs such as commodities, stocks, indices, ETFs, and cryptocurrencies. The maximum leverage ratios vary depending on the market and instrument traded. Usually, traders can adjust the leverage level directly on the broker’s trading platform.

How Do Forex Traders Use Leverage?

In addition to knowing how leverage works in forex, it is also essential to know when to use it.

First, Don’t get fooled by the favorite selling point of many forex brokers – high leverage ratios. Yes, you can make a huge killing using tremendous leverage in forex trading, and it certainly increases your potential profits in the Foreign Exchange market. But, you should also know that you could easily be killed by enormous leverage provided by forex brokers as well. In the words of many forex traders and professional traders- leverage is a double-edged sword.

What do we mean by that?

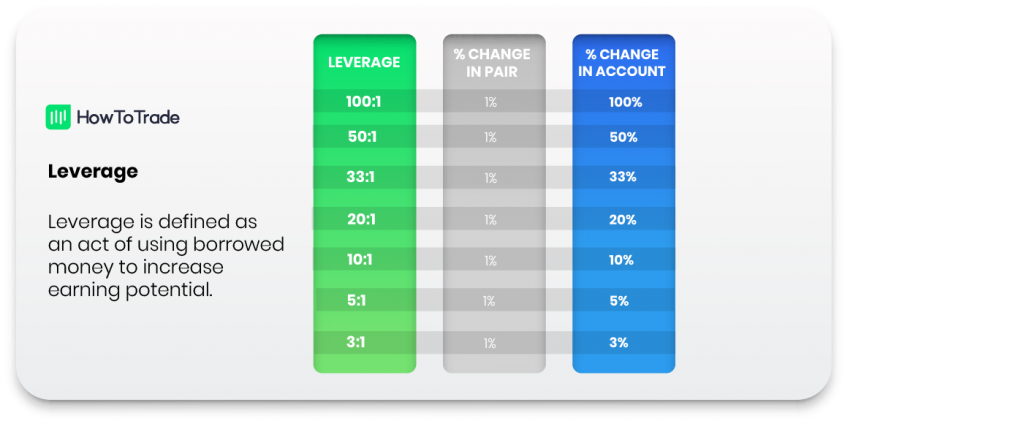

When leverage works in forex trading, it significantly magnifies your profits. Your head gets BIG, and you think you’re the greatest forex trader ever. But there’s a catch. But when you trade forex, leverage can also work against you. If your trade moves in the opposite direction, leverage will amplify your losses, causing you to lose money rapidly.

Here’s a chart of how much your account balance changes if prices move depending on your leverage.

Our advice? When you make your first steps in the forex market, be realistic in your expectations, and don’t start forex trading with real money and the maximum leverage your forex broker provides. Many forex traders set a relatively low optimal leverage ratio to control their brokerage account and reduce the high risk of trading with high forex leverage ratios.

Play it safe. Protect your capital. And even if you decide to use a low leverage ratio, you must ensure you use key risk management tools and be alert to a margin call on your trading platform.

- Leverage is the use of borrowed money from a forex broker to increase earning potential.

- If a broker offers leverage of 1:500, it will provide you with 500 times your capital to trade with.

- Leverage can help increase your earning potential, but also cause you to lose just as much.

In partnership with our recommended partner

Wait!

"Join our Trade Together program and interact with us in real-time as we trade the markets together."