Believe it or not, options contracts have been in use for centuries to address financial issues and enable producers and farmers to hedge their crops and other goods. Historically, the first use of option contracts was in ancient Greece when traders speculated about the olive harvest.

And, as we already know, the Greeks were kind of obsessed with mathematics and philosophy. So, they invented different calculations to determine an option contract’s price sensitivity to various factors. Tricky right? But it is also very useful if you are planning to trade options.

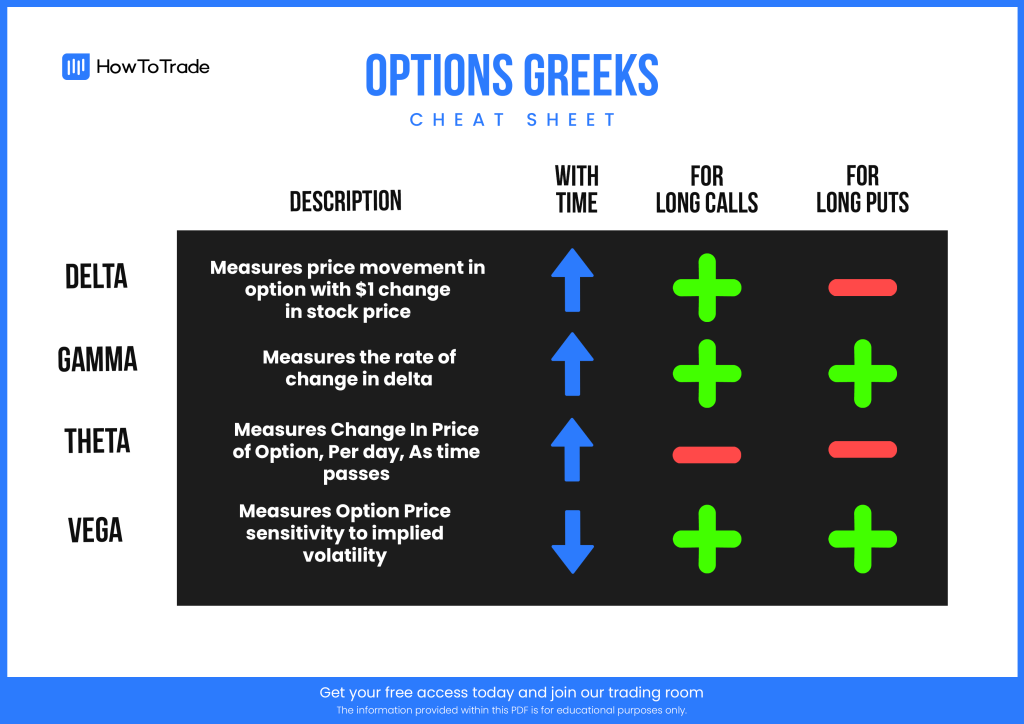

So, in this article, we will discuss the five Greeks and the importance of each one of them. We also share our free option Greeks cheat sheet so you can use it anytime.

Table of Contents

Table of Contents

Options Greeks Cheat Sheet PDF Free Download

Below, you can download our Options Greeks PDF cheat sheet. We have prepared a complete cheat sheet with everything you need to know and remember regarding the options Greek letters.

Options Greeks Cheat Sheet PDF [Download]

What Are Options Greeks?

In simple terms, options Greeks are financial calculations that measure the sensitivity of the derivative instrument’s price (the options contract) to the underlying asset. The Greeks factor in various variables such as volatility, time, the price movement of the underlying asset, and interest rates to determine how these factors might affect the option’s price.

To many investors, the Greeks are essential statistical values in making informed decisions when trading options. These numbers are usually displayed on trading platforms or financial portals online, and they have a lot of value for options traders. For example, the Theta is a statistical measure to help investors know how much the option’s value will decrease as it gets closer to the expiration date. The Delta measures the expected price movement of the option’s price concerning a change in $1 of the underlying asset’s price. This is how the Greeks work – every letter represents a specific sensitivity of the option contract to dependent variables.

Overall, stock options Greeks are most commonly used by stock traders who need to analyze equity positions and their portfolios. However, options are available in almost any market, which means that options Greeks are also an excellent knowledge and trading tool for forex and commodity traders.

The 5 Types of Options Greeks

There are five types of options greeks; each has its own calculation and measures a different factor that might affect the price of the option. Those are:

1. Delta

Delta is a statistical measure of the sensitivity of an option contract’s price changes in relation to the underlying asset’s price changes. In other words, when you see a Delta of $0.5, it means that every change of $1 in the underlying asset of the stock price will result in a price change of $0.5 in the option’s price.

So, for example, let’s say you purchased an at-the-money at $5 per contract with a strike price of $100 and a delta of 0.5. Now, the current stock price of Amazon has increased to $101, which means your options are now ITM call options. In this scenario, the price of the stock option contract would also increase to $5.50 as the stock price increases by $1 and the Delta is 0.5. That is, in a nutshell, the meaning of Delta.

Some believe that Delta is the most important of the options Greeks. Why? Simply because it allows you to calculate the predictable changes in the option’s price based on the change in the underlying asset’s price. It is the most basic calculation and usually the first Greek letter you look at when analyzing an option’s Greek values.

2. Vega

The same as Delta represents the change in the option’s price based on the underlying asset’s price; Vega measures the sensitivity of the option’s price to changes in the underlying asset’s volatility. The more time until expiration, the larger the value of Vega.

In that sense, Vega is an excellent measurement to assess the risk of entering an option position. For example, if a put or call option contract has a vega of 0.15, then it means that for each change in percentages in volatility, the option’s price will change by $0.15.

3. Theta

Options are sensitive to time as each option contract has an expiration date. If the option price is in the money at expiration, then it has a value. Otherwise, the option is worthless.

This is where Theta comes into play. Theta helps investors to measure the option’s sensitivity to time. It is also known as time decay, which simply refers to the amount the option loses every day it gets closer to the expiration date.

4. Gamma

Gamma is perhaps the most complicated type of Greek letter. The dependent variable here is the Delta rather than the underlying asset. Gamma measures Delta’s change to the price changes of the underlying asset. So, for example, if the underlying asset price rises by $1, the Delta will change by the value of Gamma.

Now, we know that the Delta is a very important measure for options traders. The Gamma simply helps traders predict changes in the Delta of an option.

5. Rho

Rho is statistical data that measures the effect of a change in interest rates on the option’s price. Usually, Rho is not very commonly used by investors, although these days, when interest rates are rising across the world, Rho can have a huge value for long-term option investors.

The Importance of Using Options Greeks

You might wonder what’s the importance of using options Greeks. Well, in essence, Greeks are a great way to measure the risk and estimate how the price of the option might react to changes in the underlying asset. Usually, for the average beginner trader, options prices are pretty random. You do not know how different factors impact options prices; thus, managing the risk could be complicated. And that’s why the Greeks are so important in options trading.

Having said that, we must say that the Greeks are only a valuable tool for some options traders. For example, if you are using simple options trading strategies to day trade or scalp trade, then the truth is the Greeks are not necessarily a helpful tool for you.

They are, however, a precious tool if you plan to utilize more advanced options trading strategies and spreads with different strike prices. Also, if you plan to take heavy long-term positions while trading options, you must plan your trade and know the risk-reward ratio. For example, you can easily analyze your trade when you directly buy or short-sell the underlying stock. But when you trade options, the only way to effectively manage the risk is to use the Greeks.

The Greeks are based on the date, the expiration date, the current market price of the underlying asset, the strike price, and implied volatility. As a result, investors often look for anomalies in options Greeks to find good trades. Also, they use Greeks to know which option contract is the right one to hedge their portfolio with and to rebalance their portfolios if market changes have severely affected them.

Over To You

In sum, options trading is certainly more complicated than simply trading the underlying asset. Options are derivative products; thus, you need to understand how the price of options might move, the factors that affect it, and the different options strategies to use. Luckily for you, 2,000 years ago, the Greeks did a great job, and now, you can use these calculations to your benefit.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.