The Diamond Bottom pattern is a reliable chart pattern that appears only once in a blue moon. With it, you can spot potential trend reversals. But traders who know how to identify and use it find it to yield good returns.

In this piece, we’ll show you:

- What the Diamond Bottom pattern is

- How to identify the pattern on your chart

- The Diamond Bottom trading strategy

- And how it differs from the Inverse Head and Shoulders pattern.

Table of Contents

Table of Contents

- What is the Diamond Bottom Chart Pattern?

- How Do You Identify the Diamond Bottom Pattern?

- The Diamond Bottom Pattern Trading Strategy

- What are the Benefits and Limitations of the Diamond Bottom Pattern?

- How is the Diamond Bottom Chart Pattern Different from Inverse Head and Shoulders?

- Wrapping Up

- Frequently Asked Questions About the Diamond Patterns

What is the Diamond Bottom Chart Pattern?

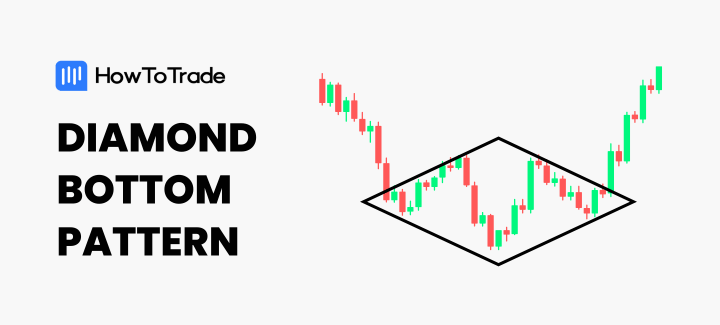

The diamond bottom chart pattern is a reversal pattern that appears at the bottom of a downtrend, suggesting that a bullish trend will likely start. It is called a diamond pattern because it takes the shape of a diamond. This technical analysis pattern often takes time to form, especially in higher timeframes, because it has to go through various phases of broadening and contracting, all during the consolidation phase.

Although the diamond bottom charge pattern is rare, it is reliable when it eventually appears. However, waiting for some confirmation before trading it is still important, just like any other chart pattern.

Similar to the diamond bottom chart pattern is the diamond top pattern, which signifies a bullish reversal instead of a bearish reversal.

How Do You Identify the Diamond Bottom Pattern?

Identifying the diamond bottom chart pattern is easy if you are patient enough. It happens in three phases, the first being the bearish movement before the pattern. This is followed closely by a gradual broadening of the price before we finally get a contracting of the price to form a diamond shape.

Let’s go into more detail about each of these phases:

1. Locate the prior bearish movement

The Diamond Button pattern only appears in the downtrend, as it signifies a reversal to the uptrend. So, it only makes sense that you try to scout for this pattern during a downtrend. After this downtrend comes the consolidation phase, which consists of the broadening and the contracting.

2. Broadening Phase

At the end of the downtrend, you begin to see the price broadening by forming higher highs and lower lows. This movement is a consolidation that suggests that there is a strong tussle for superiority going on between the bulls and the bears.

3. Contracting Phase

Soon after the broadening comes the contracting phase, still in the consolidation zone. Here, you see the price begin to form higher lows and lower highs. This happens for a while before the bulls finally take over to send the price back up, completing the diamond bottom chart pattern.

In addition to the Diamond patterns, there are many more reversal patterns out there. Check out some of them here:

The Diamond Bottom Pattern Trading Strategy

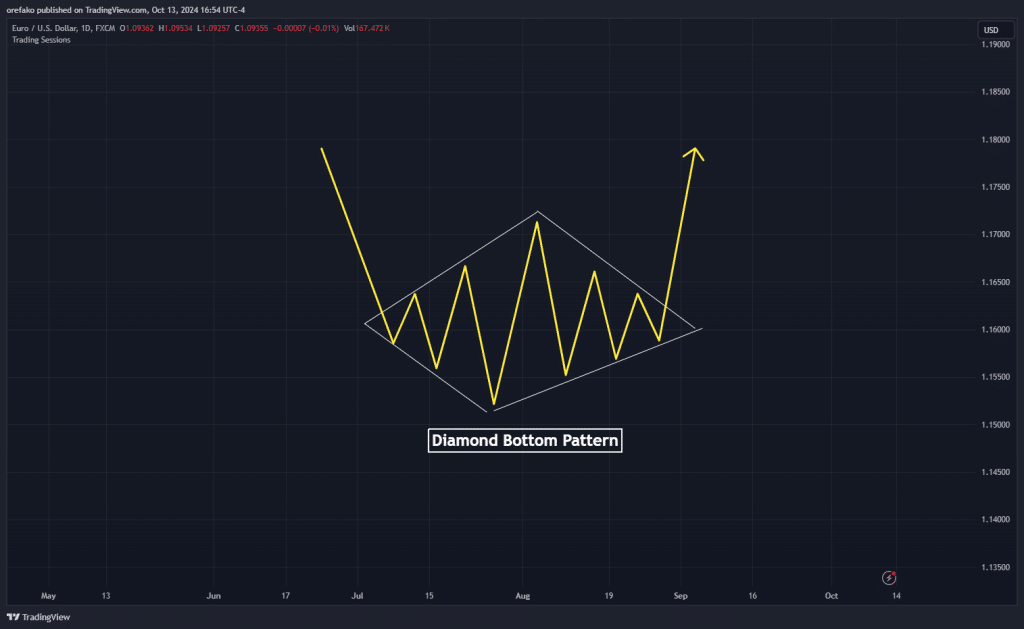

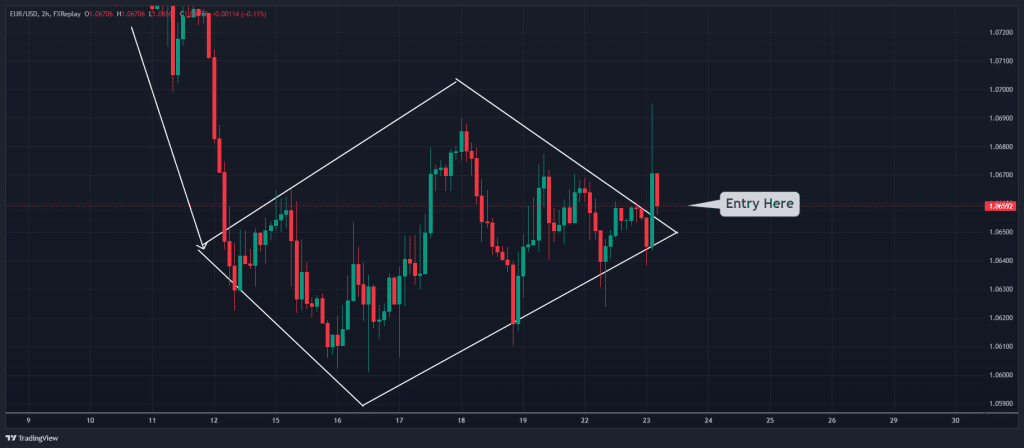

Trading the Diamond chart pattern strategy is quite easy. We’ll show you using this EURUSD chart example:

Trade Entry

Once you identify your diamond bottom pattern and ensure it is in line with the context of the higher timeframe, you can begin to anticipate your bullish breakout.

You buy when the price makes a decisive break from the edge of the diamond bottom pattern to the upside. That’s the aggressive entry method.

For the conservative method, you wait for the price to retrace to the vertice of your diamond before entering. While this method may guarantee you a better profit margin, there’s a lower likelihood that the price returns to your entry.

In our EURUSD example above, for instance, we wait for the retracement, and we get in.

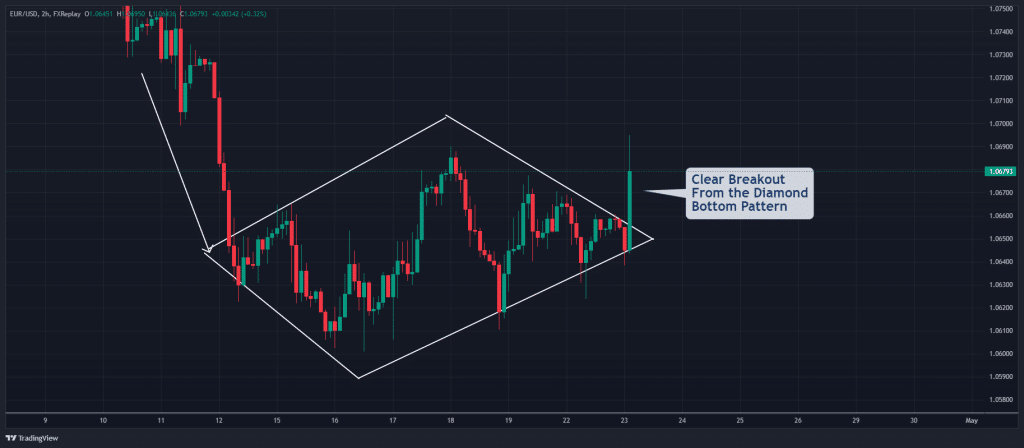

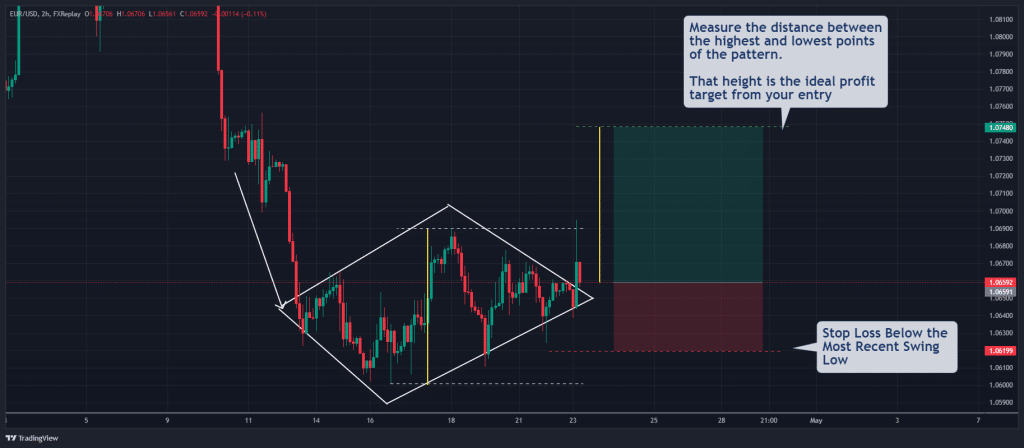

Risk Management

There is a preset way to place your stop loss and profit target with the diamond bottom strategy. Your stop loss will be at the bottom of the closest swing low to your entry. For your profit target, you measure the distance between the peak of the diamond and its bottom. That same distance will be your profit target.

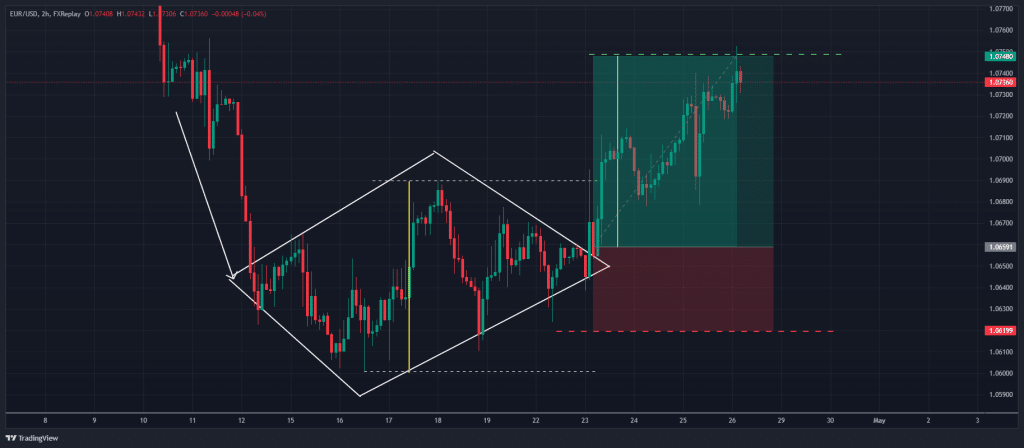

We do this in our EURUSD example, and this is the result of the trade:

What are the Benefits and Limitations of the Diamond Bottom Pattern?

The Diamond Bottom pattern has some things going for it. For instance, it is a strong reversal pattern. Traders who recognize it early can capitalize on the trend reversal. Also, the structure of the pattern provides clear areas for entering and exiting trades. This way, any trader can easily trade it regardless of their trading experience.

Another benefit of the Diamond pattern is that once the breakout happens, the subsequent price movement can be strong and quick, offering traders good profit potential over a relatively short period. In our EURUSD example from the previous section, the price continued to rally long after we hit our profit target.

On the flip side, however, the rarity of the pattern makes it challenging to consistently find and trade it. Another potential downside is that the exact shape and size of the diamond can be subjective, leading to differing interpretations among traders. So, while we may only be forming a new lower high, some traders may see it as a breakout.

How is the Diamond Bottom Chart Pattern Different from Inverse Head and Shoulders?

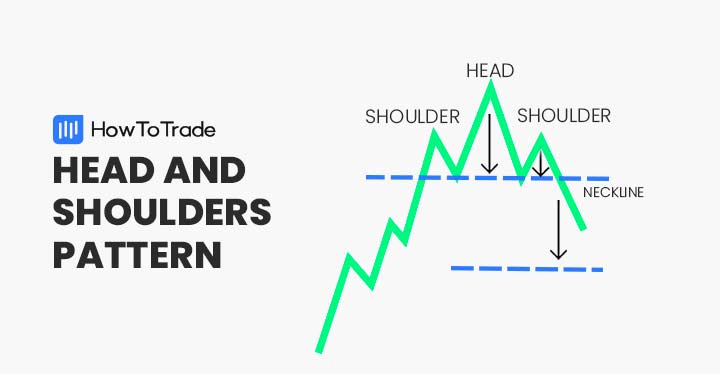

The Inverse Head and Shoulders pattern resembles the Diamond Bottom pattern. It could even be a type of the Diamond Bottom pattern because of how it looks. However, the Diamond Bottom pattern is not restricted to three bottoms, like the Heads and Shoulders. Instead, it can have multiple lows and highs and last for as long as needed.

Wrapping Up

The Diamond Bottom pattern makes up for its rarity by being reliable on the price chart. Because it’s one of those patterns that come with their trade entry and exit rules, trading it can be relatively easy for beginners. However, it’s not without its dangers. For instance, false breakouts are quite common with the pattern. And what may simply be the formation of a new lower high can look like a breakout to inexperienced traders.

Frequently Asked Questions About the Diamond Patterns

Here are answers to some of the frequently asked questions about the Diamond Bottom and Diamond Top chart patterns:

Is a diamond pattern bullish or bearish?

The Diamond Top, or the bearish diamond chart pattern, is a bearish pattern that appears at the top of bullish trends and indicates that the price will likely reverse to the uptrend. The Diamond Bottom pattern, on the other hand, is a bullish pattern that indicates that a downtrend is coming to an end and an uptrend is beginning.

How do you take profit in diamond pattern trading?

To take profit using the diamond pattern trading strategy, you measure the distance between the highest peak of the diamond and its lowest bottom. This same distance will be your profit target from our trade entry.

How to draw a diamond pattern in trading?

You identify the diamond pattern at trend tops and bottoms. The first thing you’ll notice is the sideways broadening of the price. In other words, you begin to see lower lows and higher highs. Once you see these, draw a trend line connecting the lower lows and another trend line connecting the higher highs.

Next, the price will enter a contraction phase where the lows are getting shallower, and the highs are getting deeper. Once again, draw a trend line connecting the lower highs and another trend line connecting the higher lows.

After doing these, you will have diamond formation.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.