- Trading coaching is a tailored form of professional education and guidance for trading.

- A coach offers insights, strategies, support, and mentorship to increase chances of success.

- Trading coaching includes private mentorship, a trading room, online courses, webinars and seminars, and trading communities and forums.

- Factors such as instructor credibility, course content & structure should be considered when selecting a program along with paper trading & developing a plan to maximize performance.

Trading, like any other profession, requires knowledge, time, and commitment. For some reason, many newbie traders believe they can enter the market and make money from day one. Well, it just doesn’t work that way. To become a successful trader, you must learn trading basics and listen to someone who has already mastered trading.

On that note, let me share an insight from my trading mentor. The first thing he said to me is that trading is much like being an accountant, a lawyer, and even a doctor – meaning you need to learn the basics and invest around six months to one year until you reach the point where you understand what’s going on in the markets. Trading is just like any other high-demanding profession.

But luckily, with proper guidance and resources, you can master the skills needed to excel in this lucrative market. How to start? In this ultimate guide, we’ll reveal the best ways to start learning to trade so you can confidently navigate the ever-changing financial landscape.

This guide covers everything you need to know about trading coaching. By the end of this page, you’ll know your options and how to choose the suitable trading coaching method for you. Let’s start.

Table of Contents

Table of Contents

What is Trading Coaching?

As the name suggests, trading coaching is a tailored form of professional education and guidance that empowers traders to develop their knowledge and skills in trading forex, stocks, options, futures, indices, and other financial instruments. By leveraging the expertise of seasoned traders, aspiring traders can learn how to trade more effectively and efficiently.

Various types of trading coaching are available, such as private mentors, trading rooms, online courses, webinars and seminars, and trading communities and forums – all of these to help you learn how to trade financial assets. Each type of coaching offers its unique benefits and learning experiences, catering to the diverse needs of traders.

Why Should You Use a Trading Coach?

Absolutely. However, it also depends on your personality. Some people are self-taught, while others need support and guidance. Regardless, a trading coach can certainly help you find the right way, especially for beginners. Utilizing a trading coach can be a game-changer to a successful trading journey. As experts in financial markets, trading coaches offer valuable insights into market trends, potential opportunities, and trading pitfalls to avoid. They can help you develop effective trading strategies tailored to your goals and risk tolerance, increasing your chances of trading success.

Moreover, a trading coach provides support and accountability, fostering a disciplined and structured approach to trading. Learning from their wealth of experience can help you navigate the complexities of the market and avoid costly mistakes. This mentorship can be particularly beneficial for novice traders who are just starting their trading journey.

It’s essential to find a reputable trading coach or course that aligns with your needs and goals. Keep in mind that expensive trading courses may not always guarantee better results. Carefully research the available options, read reviews, and select a trading coaching program that offers the best value for money.

Types of Trading Coaching

Now, let’s delve deeper into the different types of trading coaching available, each with its unique advantages and learning experiences. In this section, we will explore private mentors, trading rooms, online courses, webinars and seminars, and trading communities and forums to help you determine the best approach for your trading education journey.

1. Private Mentor

A private mentor is an experienced trader who provides personalized guidance and advice to help you develop your trading skills. Engaging a private mentor can accelerate your learning process, sustain your motivation, and grant you access to valuable online resources and insights that may not be readily available elsewhere. In a way, a trading private mentor should be your Alfred Pennyworth – the one that walks you through the difficult process of becoming a consistently profitable trader.

Private mentorship can come in different forms, including trading rooms, online courses, webinars, and seminars, as well as trading communities and forums. When selecting a private mentor, consider factors such as the instructor’s credibility, course content and structure, cost-benefit ratio, and reviews and testimonials.

Remember that a good mentor can be the guiding force that propels your trading career forward. The only downside is that hiring a private mentor could be expensive and may require a few meetings before deciding if you have a match.

2. Trading Room

A trading room is a virtual or physical environment where traders gather to discuss strategies, analyze markets, and exchange ideas. Trading rooms provide an interactive and supportive learning experience, allowing you to gain insights from experienced professionals and test your trading tactics in real-time.

Examples of popular trading rooms include HowToTrade, Bulls on Wall Street, Bear Bull Traders, and Investors Underground. These platforms offer a wealth of resources, educational materials, chat rooms, and mentorship to help you hone your trading skills and make informed decisions in the market.

By participating in a trading room like HowToTrade, you can benefit from the collective wisdom and experience of other traders, accelerating your learning curve. For instance, joining our trading room will allow you to access 6-8 daily streams with our trading coaches. In there, we teach you different strategies in coaching sessions and analyze important financial data such as GDP, CPI, Non-Farm Payrolls, and central bank announcements.

3. Online Courses

Another way to learn to trade is by enrolling in an online trading course. Online courses offer a flexible and cost-effective way to learn trading at your own pace. These courses often provide a structured curriculum covering a wide range of topics, from fundamental investing to advanced trading strategies. You can find various online courses tailored to different skill levels, from beginner to advanced traders. Additionally, you can also find free trading courses to get familiar with the basics of trading.

Such courses can be used to gain essential knowledge about trading. Some of these platforms even offer an investing and trading library for further learning. By enrolling in an online course, you gain access to a wealth of knowledge and resources that can help you develop a strong foundation in trading.

Keep in mind that not all online courses are created equal. It’s essential to research the course content, instructor credibility, and reviews before committing to a particular course. Yet, with a well-rounded online course, you can build the skills and confidence needed to succeed in financial markets. For more information about HowTorTrade’s online trading course content, you can visit our Trading Academy.

4. Webinars and Seminars

Webinars and seminars are educational events where traders can learn about various trading topics from seasoned professionals. Technically, webinars are virtual events that take place online, while seminars are physical events held in person. Both formats provide opportunities for live interaction, allowing you to ask questions and gain valuable insights from experts. However, be cautious when attending free seminars, as they may sometimes include a sales pitch towards the end.

5. Trading Communities and Forums

Finally, some people feel more comfortable joining trading communities or forums where things are somehow more authentic. Trading communities and forums are online platforms that connect traders, enabling them to share ideas, discuss strategies, and learn from each other’s experiences. These platforms provide a supportive environment where you can gain insights, seek advice, and stay updated on market trends.

Generally, by participating in a trading community or forum, you can benefit from the collective wisdom and experience of other traders. This can help you develop a broader perspective on the market, refine your core trading strategies, and, ultimately, improve your trading performance. To find the best forums and trading communities, you can visit our guide on the best forums for all levels of traders.

Utilizing a trading coach can be a game-changer in your trading journey. As experts in financial markets, trading coaches offer valuable insights into market trends, potential opportunities, and trading pitfalls to avoid. They can help you develop effective trading strategies tailored to your goals and risk tolerance, increasing your chances of trading success.

Factors to Consider When Choosing a Trading Coaching Program

To ensure you make the most of your trading coaching investment, it’s crucial to consider several factors when selecting a program carefully. These factors include the credibility of the instructor, course content and structure, cost and value for money, reviews, and testimonials, and program format.

Let’s explore each factor in detail to help you make an informed decision.

Credibility of the Instructor

The instructor’s credibility plays a vital role in the effectiveness of a trading coaching program. A reputable instructor with a strong background and proven track record in the market can provide valuable insights and guidance. To assess the credibility of a trading coach, research their background and experience and read reviews and testimonials from past clients.

Further, ensure that the instructor is knowledgeable and experienced in the specific area of stock trading you are interested in learning. A credible instructor can not only help you develop effective trading strategies but also provide support and accountability, fostering a disciplined and structured approach to trading.

Course Content and Structure

The course content and structure are essential factors to consider when selecting a trading coaching program. A well-structured course should cover a wide range of topics, from fundamental analysis to advanced trading strategies, tailored to your skill level. Ensure that the course content aligns with your learning goals and provides a comprehensive curriculum to help you build a strong foundation in trading.

Additionally, consider the format and delivery method of the course. Some courses may offer live classes, pre-recorded video lessons, or a combination of both, just like HowToTrade’s Trading Academy. In short, choose a course format that best suits your learning style and schedule.

Cost and Value for Money

Cost and value for money are crucial factors to consider when selecting a trading coaching program. While some courses may be more expensive than others, it’s essential to weigh the potential benefits and outcomes against the cost. Keep in mind that expensive trading courses may not always guarantee better results. At the same time, very often, it’s best to pay more to get high-quality service.

Research various options and compare the course content, instructor credibility, and reviews to determine the best value for your investment. Some programs, such as Investors Underground, offer cost-effective membership plans, providing an opportunity to learn stock trading without breaking the bank.

Reviews and Testimonials

When selecting a trading coaching program, it’s essential to read reviews and testimonials from past clients to gain insight into the quality and effectiveness of the program. Be sure to read both positive and negative reviews to get a comprehensive understanding of the program’s strengths and weaknesses.

This will help you make an informed decision and choose a program best suited to your needs.

Trading Coaching Program Format

The format of a trading coaching program can significantly impact your learning experience. Various formats are available, including structured classes with video or online instruction, day trading courses, and swing trading courses.

Consider your learning style, schedule, and goals when choosing a program format. Some traders may prefer the interactive nature of live classes, while others may find pre-recorded video lessons more convenient and accessible. Some people also prefer ongoing trading support like a trading room or private mentorship that allows you to ask questions and get support whenever you want.

Ultimately, the best format for you will depend on your individual needs and preferences.

Practical Tips for Effective Learning and Trading Success

Regardless of the method you choose to start learning to trade, it’s crucial to incorporate practical tips and strategies into your learning journey to maximize your success in trading.

In this section, we’ll discuss some essential tips, such as practicing paper trading, developing a trading plan, continuous learning and adaptation, and tracking and analyzing performance.

1. Practice with Paper Trading

Paper trading, also known as a demo account, is perhaps the best way to get familiar with the financial market and trading. In essence, paper trading is a simulated trading method that allows you to practice buying and selling financial assets without risking any real money. This is an excellent way to familiarize yourself with the market and test your trading strategies in a risk-free environment.

Many online brokers, such as SwitchMarkets for example, offer paper trading platforms to help new traders develop their skills and gain confidence before investing real money. By practicing paper trading, you can learn from your mistakes and refine your trading strategies without jeopardizing your hard-earned money.

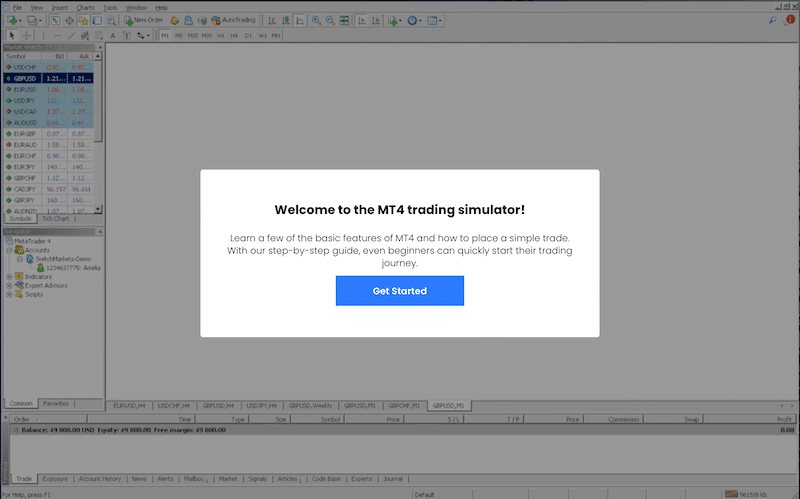

If you are keen to learn how to trade on the most popular trading platform, the MetaTrader4, visit our free online trading simulator.

2. Develop a Trading Plan

Having a plan is a crucial part of trading. A trading plan is a comprehensive set of rules and guidelines that dictate your trading decisions, including when to buy, sell, and hold stocks. Developing a trading plan can help you stay disciplined, manage risk, and make more informed decisions. It is also advisable to use a trading checklist before you start your trading day.

Your trading plan should include your trading goals, risk management strategies, and specific trading rules based on your preferred trading style (such as day trading or swing trading). By following a well-defined trading plan, you can minimize emotional decision-making and improve your overall trading performance.

To do so, we suggest you download our Trading Plan Template, Trading Journal Template, and Forex Compounding Plan PDF.

3. Continuous Learning and Adaptation

Continuous learning and adaptation are crucial in the ever-changing world of trading. Staying informed of the latest news, trends, and strategies will help you to make informed decisions and capitalize on opportunities as they arise.

Utilize various resources, such as trading tools, trading coaching programs, online courses, webinars, and trading communities, to continuously expand your knowledge and adapt to new market conditions. Remember that trading is an ongoing learning process, and staying up-to-date with the latest information is vital for long-term success.

4. Track and Analyze Performance

Tracking and analyzing your trading performance is essential for identifying areas of improvement and optimization. This involves monitoring various metrics, such as win rate, average profit/loss, and risk management, to gain insights into your strengths and weaknesses. For that matter, you must use a Trading Journal Template.

Leverage various tools and metrics, such as profit factor, Sharpe ratio, and drawdown, to track and measure your performance. By regularly reviewing your trading performance, you can make data-driven adjustments to your trading strategies and improve your overall trading success.

A trading room is a virtual or physical environment where traders gather to discuss strategies, analyze markets, and exchange ideas. Trading rooms provide an interactive and supportive learning experience, allowing you to gain insights from experienced professionals and test your trading tactics in real time.

Final Thoughts

In conclusion, the journey to master trading is an exciting and challenging one. By leveraging various trading coaching options, such as private mentors, trading rooms, online courses, webinars, and trading communities, you can accelerate your learning and maximize your trading success.

You must also consider factors such as instructor credibility, course content, cost, and program format when selecting a trading coaching program. Lastly, don’t forget to practice paper trading, develop a trading plan, continuously learn and adapt, and track your performance to ensure long-term success in the market.

Here, at HowToTrade, we provide all the tools you need to succeed in trading. Those include a trading room with 6-8 daily live streams, a trading academy, the best trading coaches, and lots of trading resources and tools.

Frequently Asked Questions (FAQs)

Here are some of the most frequently asked questions about trading coaching.

What is the best way to learn to trade?

The best way to learn to trade is to open a demo account, join a live trading room, read top trading books and articles on the subject, find a mentor or friend to learn with, study successful investors, follow the market closely, and explore seminars, online courses, or live classes.

With the right guidance and knowledge, you can become a successful trader.

How can a beginner learn to trade?

As a beginner, you can learn trading by taking advantage of the many free resources available. You can start by opening a trading account, setting a budget, learning the basics of market analysis, downloading cheat sheets, reading books on advanced technical analysis, and practicing with a free market trading simulator. You should decide on the market you wish to focus on, whether you want to trade stocks, forex, options, etc.

Additionally, you should be familiar with investment strategies, investigate before investing, know when to trade, and always have an exit strategy. Finally, explore the best online stock trading courses to get further help in becoming a successful trader.

How do professional traders learn to trade?

Learning to trade can seem like a daunting task; however, it is possible to learn from experienced professionals. Professional traders may offer their knowledge through books, websites, and personal mentorship, so one should look to them as a source of wisdom to become a successful trader.

With dedication and effort, trading can be a viable career path.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.