- The Kuwaiti Dinar is the strongest currency in the world today

- While the Kuwaiti Dinar is the strongest, the US Dollar is the most powerful

- The strength of a currency is determined by how much of another currency it can be exchanged for

There are 180 fiat currencies in the world used in 195 countries. But which of those currencies is the strongest? Not the most powerful, the most traded, or even the most impactful—the strongest!

Here, on this page, we’ll explore the top contenders for the “strongest currency” title and shed light on the forces determining how much one unit of currency buys you in another.

In this piece, you’ll learn:

- The top 10 strongest currencies in the world

- What makes a currency strong and

- How a currency is priced

Table of Contents

Table of Contents

The 10 Strongest Currencies in the World

The following are the strongest currencies in the world:

| Position | Currency | Symbol | Country |

| 1. | Kuwaiti Dinar | KWD | Kuwait |

| 2. | Bahraini Dinar | (BHD) | Bahrain |

| 3. | Omani Rial | OMR | Oman |

| 4. | Jordanian Dinar | JOD | Jordan |

| 5. | British Pound | GBP | United Kingdom |

| 6. | Gibraltar Pound | GIP | Gibraltar |

| 7. | Cayman Islands Dollar | KYD | Cayman Islands |

| 8. | Swiss Franc | CHF | Swiss Franc |

| 9. | Euro | EUR | Europe (Continent) |

| 10. | US Dollar | USD | United States |

1. Kuwaiti Dinar (KWD)

The Kuwaiti Dinar is the most valuable currency in the world in 2025. This dominance stems from a potent one-two punch. Kuwait boasts vast reserves of oil, a lucrative source of export income. But more importantly, Kuwait has a responsible government that manages this wealth effectively. This careful stewardship translates into a stable and prosperous economy, solidifying the KWD’s position at the top.

2. Bahraini Dinar (BHD)

Following closely behind the KWD is its neighbor, the Bahraini Dinar. Like Kuwait, Bahrain benefits from a rich oil endowment and a government committed to sound economic policies. This synergy between resource wealth and responsible management keeps the BHD strong.

3. Omani Rial (OMR)

Rounding out the top three is the Rial, the national currency of Oman. While Oman is another oil-rich nation, its strategy for currency strength differs. The OMR is pegged to a basket of strong currencies, including the USD. This tactic essentially ties the OMR’s value to a group of already powerful currencies, ensuring its own stability and strength.

4. Jordanian Dinar (JOD)

The Jordanian Dinar emerges as a strong contender, buoyed by Jordan’s stable economy and prudent monetary policies. With a pegged exchange rate regime and strong fiscal discipline, the JOD retains its strength and purchasing power.

5. British Pound (GBP)

The Pound Sterling, the official currency of the United Kingdom, might not be the strongest on the list, but its historical weight is undeniable. As the world’s oldest continuously used currency, the GBP carries a legacy of global trade dominance. Additionally, the UK’s sizable and diversified economy contributes to the value of the British Pound Sterling.

6. Gibraltar Pound (GIP)

Gibraltar, a British Overseas Territory, uses the Gibraltar Pound (GIP), which is pegged to the British Pound (GBP). This close association allows the GIP to inherit much of the GBP’s strength and stability. Additionally, Gibraltar’s thriving tourist industry and financial sector contribute to the GIP.

7. Cayman Islands Dollar (KYD)

The Cayman Islands, a renowned offshore financial center, might surprise some on this list. However, the KYD is pegged to the USD, inheriting much of its strength from this global powerhouse. This pegging strategy ensures the KYD remains stable and valuable.

8. Swiss Franc (CHF)

Switzerland’s reputation for neutrality, political stability, and economic prudence makes the Swiss Franc a haven for investors during global turmoil. When economic anxieties rise, investors flock to the CHF, seeking safety. This surge in demand drives up the Franc’s value.

9. Euro (EUR)

The Euro, the European Union’s shared currency, represents the combined economic force of a powerful bloc. The EU boasts a significant share of global trade, being the second largest reserve currency after the United States Dollar. While the Eurozone has faced challenges, its overall economic weight keeps it a major player.

10. US Dollar (USD)

The US Dollar continues to reign supreme as the world’s primary reserve currency, underpinned by the strength of the US economy. The USD remains unrivaled with its vast consumer market, technological innovation, and dominant role in international trade.

Remember, currency strength is a dynamic concept influenced by global events. However, these top contenders consistently demonstrate underlying strengths that make them the heavyweights of the foreign exchange market.

Check out our daily forex market analysis page for insights about leading FX pairs.

What Makes a Currency Strong?

Now that you know the top 10 strongest currencies, have you asked yourself what makes a currency strong? Why is the US dollar at the bottom of the list and the Kuwaiti Dinar at the top? Factors like interest rates and political stability are some of those that affect the strength of a currency. In addition to those, these are other factors that affect the strength of a currency:

1. Economic Stability

Picture a country with a thriving economy—low unemployment, steady GDP growth, and controlled inflation. Such stability breeds confidence in the currency, attracting investors seeking stable returns on their investments. Therefore, robust economic fundamentals are fundamental in determining a currency’s strength.

2. Interest Rates

Central banks play a pivotal role in setting interest rates, which in turn affect currency value. Higher interest rates generally attract foreign investors looking for better returns on their investments. Consequently, the currencies of countries with relatively higher interest rates tend to be stronger.

3. Political Stability

Political turmoil can have a significant impact on a currency’s value. Investors prefer countries with stable political climates and consistent government policies, as they offer a sense of security. Political instability often leads to uncertainty and can weaken a currency.

4. Foreign Exchange Reserves

A country’s foreign exchange reserves act as a buffer against external shocks and speculative attacks on its currency. Countries with substantial reserves have the capacity to intervene in the foreign exchange market to stabilize their currency’s value, enhancing investor confidence.

5. Trade Balance

A positive trade balance, where exports exceed imports, can contribute to currency strength. When a country exports more than it imports, there is a higher demand for its currency, boosting its value in the foreign exchange market.

6. Currency Intervention

Some countries actively manage their currency’s value through interventions in the foreign exchange market. By buying or selling their currency, central banks can influence its exchange rate relative to other currencies.

7. Global Importance

The status of a currency as a global reserve currency is a testament to its strength and stability. Currencies like the US dollar, Euro, British pound, Japanese yen, and Swiss franc are widely used in international transactions, reflecting the economic prowess of their respective countries.

8. Market Sentiment and Speculation

Market sentiment and speculative activities can have short-term effects on currency values. Factors such as geopolitical tensions, economic data releases, and investor sentiment can lead to fluctuations in currency markets.

How Are Currency Pairs Priced?

Like any good or service in a market economy, a currency’s value is dictated by supply and demand. Here’s how it applies:

- The value of a currency rises when its demand rises: When demand for a particular currency goes up, it means more people want to use it. This could be due to factors like a strong economy in the issuing country, political stability, or even safe-haven status during global uncertainties. As demand increases, the price (exchange rate) of that currency goes up in relation to other currencies.

- The value of a currency drops when its supply rises: On the flip side, if there’s a sudden abundance of a particular currency in the market (perhaps due to a government printing more money), it becomes less scarce. This decrease in scarcity can lead to a decrease in the currency’s price compared to others.

The foreign exchange markets, or forex markets, are markets where a foreign currency is exchanged and priced against another. This means that the exchange rate of a currency pair is influenced by the fundamentals of two economies – one against the other.

The Most Powerful vs. the Strongest Currency in the World

There’s a lot of talk about “powerful” currencies and “strong” currencies. These terms get tossed around, but they don’t exactly mean the same thing.

A powerful currency is like the kingpin of international trade. It’s the most traded currency in the world. Think of the US Dollar (USD)—it’s a heavyweight in global transactions and a common reserve currency held by many central banks. This dominance makes it powerful, but it doesn’t necessarily make it the strongest.

The title of strongest currency goes to the currency that packs the most punch in terms of its exchange rate. In simpler terms, it’s the one that buys you the most units of another currency. So, even though the USD might be a global player, the strongest currency might be the one that gets you the most USD for your buck (or whatever currency you have in your pocket). And, as of 2025, it is the Kuwaiti Dinar.

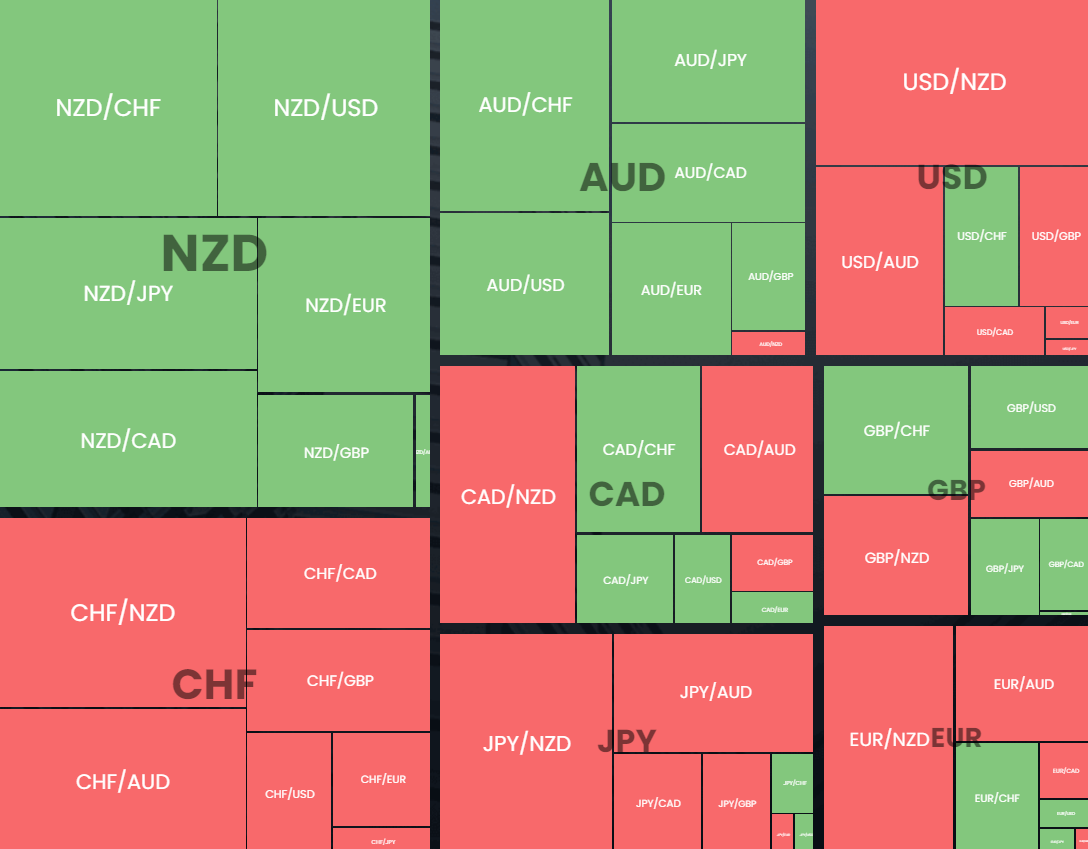

What is the HowToTrade Currency Strength Meter?

The HowToTrade Currency Strength Meter is a tool for gauging the strength of various major currencies in real-time. It shows how a currency compares to other major currencies in a daily timeframe.

This tool can be useful in trading when you want to gauge whether currencies are likely to trend upwards or downwards in the short run. Additionally, the currency strength meter is an effective tool for those who wish to utilize the asset correction trading strategy. Typically, those who use this strategy look for daily anomalies. For more information, visit our Forex Correlation Cheat Sheet page.

What is a Currency Pair in Forex?

A currency pair is the fundamental unit of trading. It represents the quotation of the exchange rate between two different currencies. For instance, EUR/USD is a currency pair, and it represents how much of the US Dollar you would need to exchange for one Euro. Similarly, the CHF/JPY is another currency pair representing how much of the Japanese Yen you would need to exchange for one Swiss Franc.

The seven major currency pairs in the world are:

- EURUSD (Euro/US Dollar)

- GBPUSD (British Pound Sterling/US Dollar)

- USDJPY (US Dollar/Japanese Yen)

- NZDUSD (New Zealand Dollar/US Dollar)

- USDCHF (US Dollar/Swiss Franc)

- USDCAD (US Dollar/Canadian Dollar)

- AUDUSD (Australian Dollar/US Dollar)

Bottom Line

With the Kuwaiti Dinar being at the top, the strongest currencies in the world are:

- Kuwaiti Dinar

- Bahraini Dinar (BHD)

- Omani Rial (OMR)

- Jordanian Dinar (JOD)

- British Pound (GBP)

- Gibraltar Pound (GIP)

- Cayman Islands Dollar (KYD)

- Swiss Franc (CHF)

- Euro (EUR)

- US Dollar (USD)

Yet, you need to remember that while the USD is not the strongest currency on the list, it is the most powerful since it is the preferred currency for international trade. As a result, it is in high demand, and many countries tend to stock the USD in their foreign reserves.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.