Every trader needs to backtest a trading strategy before implementing it in live markets. Without a doubt, an effective automated backtesting system will help you enter the markets with a tested and successful trading strategy without risking your capital.

To help you understand how backtesting works, on this page, we’ll explain what you need to know before you define your forex strategy. We’ll also show you how to back-test forex trading strategies automatically and manually.

Table of Contents

Table of Contents

- What is Backtesting in Forex Trading?

- Why Is It Important to Backtest Forex Trading Strategies?

- How to Backtest Forex Trading Strategies – Step-by-Step Guide

- How to Backtest Forex Trading Strategy on Metatrader 4 (VIDEO)

- How to Backtest Your Trading Strategy in Metatrader 5 (MT5) in 4 Steps

- How to Backtest Your Trading Strategy with TradingView and a Spreadsheet in 3 Steps

- How to Backtest Your Trading Strategy Using FXReplay Backtesting Tool

- Top 6 Golden Rules for Backtesting Your Trading Strategy

- What are the Benefits and Limitations of Backtesting?

- Backtesting Vs. Forward Testing

- How Many Times Should I Backtest My Trading Strategy?

- Where Can I Backtest My Trading Strategy for Free?

- How Do You Manually Backtest a Trading Strategy?

- The Bottom Line

What is Backtesting in Forex Trading?

Backtesting in trading is simulating the process of trading while using a set of rules over previous price data to see how much money would have been made or lost if a trader had followed the same strategy.

Backtesting is essentially a retroactive test where a trader enters a set of rules like a currency pair, timeframe, and technical indicators. Then, the automated backtesting trading system can analyze the tick data and show what would have happened if you had chosen the strategy.

There are three ways in which you can backtest your forex strategies: manual, automated, or coded, and replay backtesting. Either way, all methods have the same goal and principle – to help a trader determine whether the strategy is profitable.

For forex traders, automated and manual backtesting evaluates the effectiveness of a trading system before implementing it in the live markets and risking real capital. Moreover, it gives forex traders the confidence to stick to it when their strategy does not appear to be working (while others doubt their strategy, especially during a drawdown).

Why Is It Important to Backtest Forex Trading Strategies?

Did you know that 78% of traders don’t backtest their trading strategy? And did you know that this is one of the main reasons why most traders fail? And it makes sense, right?

So, calling backtesting anything less than necessary would be an understatement. Like any other action in life, you would want to test your forex trading strategy in a demo account mode before you apply it in the forex market. Knowing how to backtest a trading strategy will simply help you improve your future performance when trading CFDs and forex.

Backtesting is absolutely crucial for your long-term trading success, especially if you are a beginner forex trader. Only through backtesting can one learn the ins and outs of their strategy, determine which forex trading strategies are profitable, and eliminate those doomed to fail. And at the end of the day, nobody wants to chase shadows in the market.

The idea of backtesting is pretty simple: If a particular strategy has proved profitable under past market conditions, it will likely be profitable in the long run. By testing a trading strategy, you can know its profit probability, risks, and the right market conditions beforehand.

How to Backtest Forex Trading Strategy in Metatrader 4 (MT4) in 5 Effective Steps

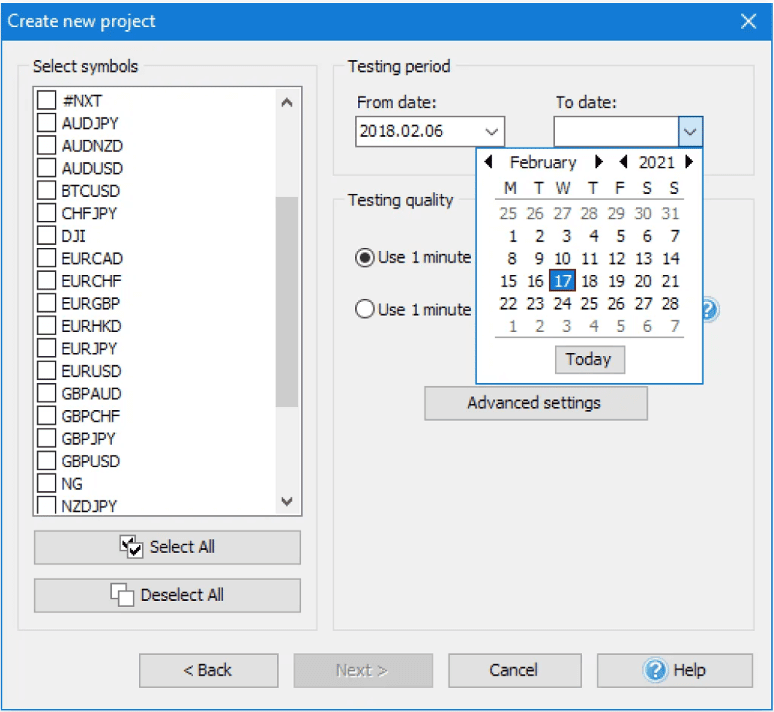

Now, you want to know how to backtest your trading strategy before you utilize it in live markets. Below, we’ll show five easy steps you need to follow to backtest your trading strategy on the MetaTrader trading platform.

Step 1: Set the Parameters

First, you need to open the strategy tester in the MT4 trading platform. You can do it by clicking Ctrl+R, and the feature will automatically open. Otherwise, you can navigate to View and scroll down to Strategy Tester.

Next, define the currency pair, the time frame, and the period you want to use. We have attached a screenshot so you can see what it looks like.

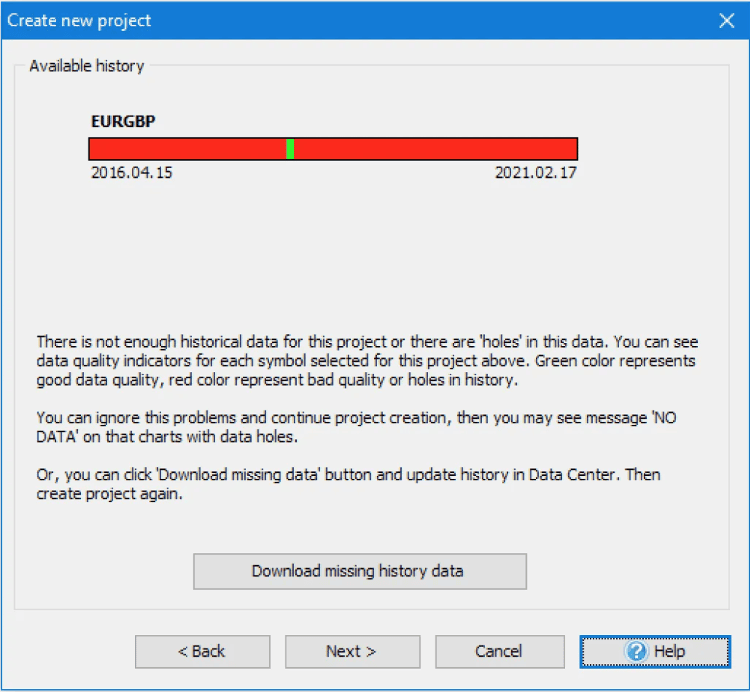

Step 2: Access Previous Data

Next, you will access your previous data with the option to download them.

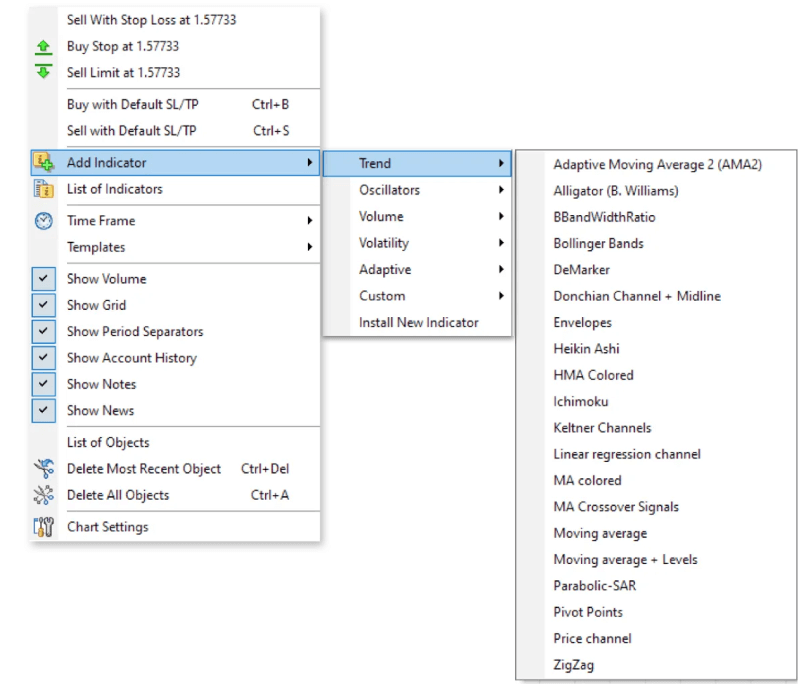

Step 3: Add Your Technical Analysis Indicators

Next, add your trading indicators. To do so, select “Add Indicator” and choose the ones you want to use for your trading strategy.

Step 4: Start Backtesting Historical Data

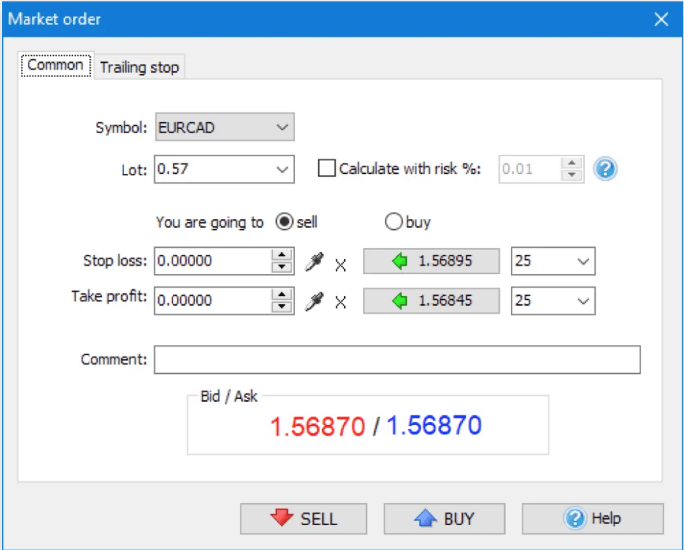

Lastly, select the suitable timeframes and click “Start Test.” The image below shows that all historical market data will play back on your screen.

Note that you can pause, rewind, and fast-forward to reach a point where your backtesting strategy indicates a trade. Once done, enter a dummy trade with stop loss and take profit levels. This will create forward testing and help you achieve the future results of your tested trading strategy.

Step 5: Get a Synopsis of the Results

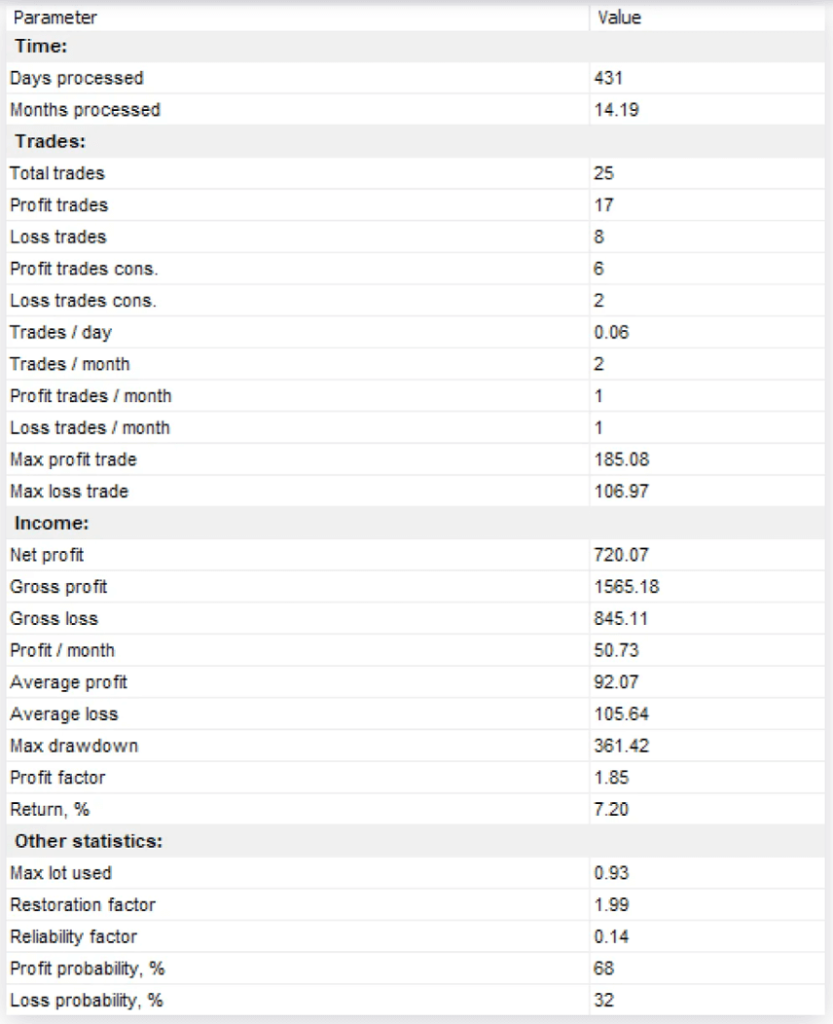

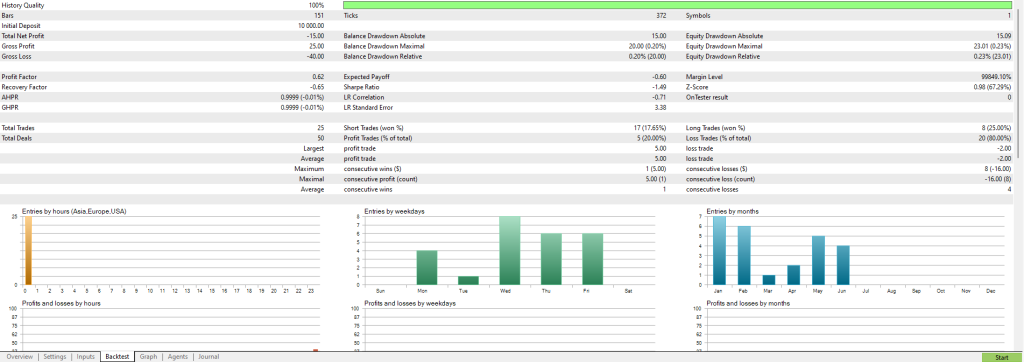

After the test, the MT4 forex strategy tester will give you a synopsis of the results. It will look similar to this.

The MT4 backtesting automated trading system will also provide a detailed breakdown with the option to paste it into your own spreadsheet. As you can see in the image above, the free backtesting software scanned the strategy in 431 days and executed 25 trades. 17 of the trades are profitable, while 8 are losing trades. Overall, the strategy has generated a net profit of 720.07 USD with a profit probability of 68%.

How to Backtest Your Forex Trading Strategy On Metatrader 4 (VIDEO)

Check our detailed video on how to backtest your Forex trading strategy on Metatrader 4 (MT4).

How to Backtest Your Trading Strategy in Metatrader 5 (MT5) in 4 Steps

For a long time, the MT4 was the most popular trading platform. It still is, but its brother, the MT5, is gradually catching up. As a result, it has become the most common alternative to the MT4. And here’s how to backtest your strategy on the MT5 trading platform:

Step 1: Prepare your Strategy’s EA

The MT5 backtests your strategy automatically, so you’ll need an Expert Advisor that your strategy has been programmed into before you can test it on the platform. But by default, the MT5 comes with some EA strategies that you can test right off the bat, and we’ll be using one of them to show you how backtesting works here.

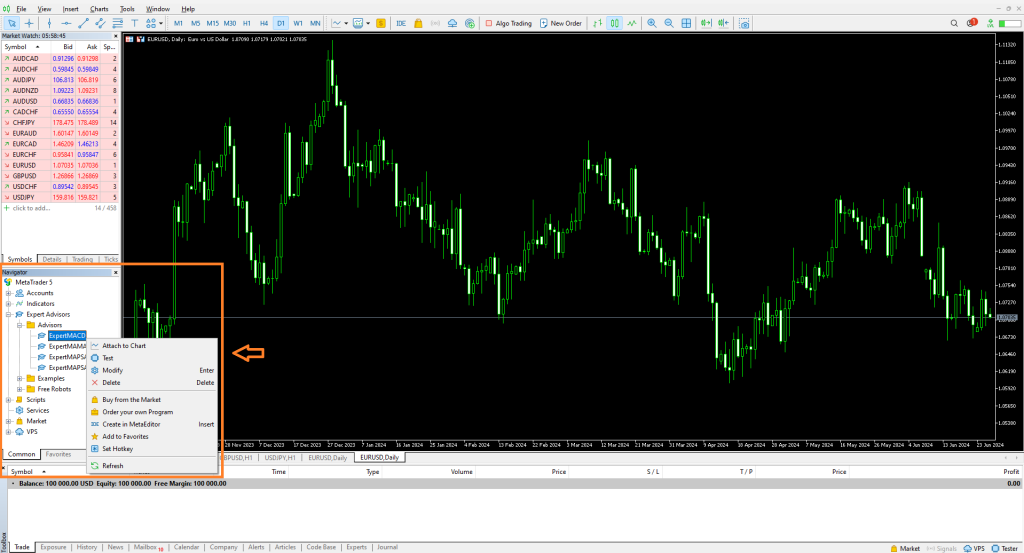

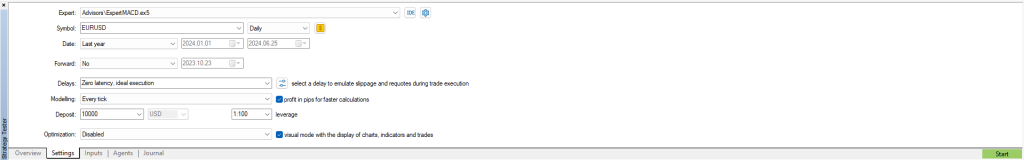

So, navigate to the “Navigator” window. If it’s not open on your chart, use the “Ctrl+N” command to toggle it. Once there, navigate to the “Expert Advisors” section, right-click any of the strategies, and choose “test.” We’ll be going for the first, “Expert MACD.”

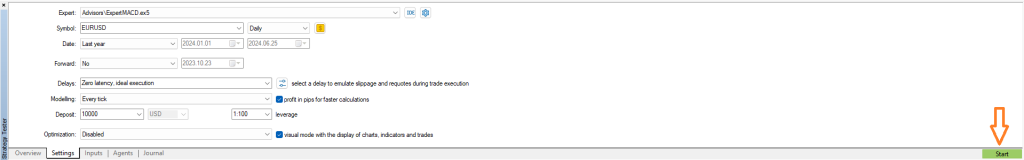

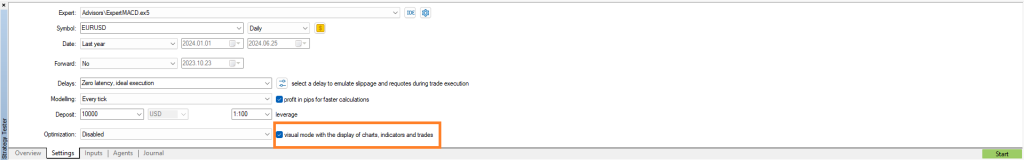

Step 2: Set your Parameters

Set your parameters in the “Strategy Tester” window at the bottom of your chart. Here, you can choose the instrument you want to test your strategy on, your backtesting range, and other details, such as forward, delays, modeling, deposit, and leverage. You can play around with all of these options.

Step 3: Start your Test

What’s next is to start your test. But before that, you can watch a simulation of what your trades may look like as the backtesting tool takes your trades. You must enable the visual mode in the parameters to see this, though.

Step 4: Get your Results

Once your backtest is over, you can review a detailed report of your strategy’s performance in the “backtest” tab at the bottom of your “Strategy Tester” window.

How to Backtest Your Trading Strategy with TradingView and a Spreadsheet in 3 Steps

In addition to the Metatrader duo, TradingView is another popular tool out there. It’s more popular as a charting tool, but it’s gradually making a strong case for itself as a trading platform. You can also use this platform to test your strategy automatically. However, you would first need to have your strategy put into a code.

If you need to backtest a strategy for which you don’t have code, you can do it manually with an exciting feature on the TradingView platform: Chart Replay. While the word “manual” may make it look stressful (and it is), we believe this is a great way for beginner traders to put themselves in historical chart scenarios and react to the markets as though they were trading in real-time.

Enough talk. Here’s how to use TradingView to backtest your strategy:

Step 1: Start your chart replay

You’ll find the “Replay” button among the tabs on top of your main chart. When you select it, a blue line will appear on your chart that’ll help you choose your backtesting start date. Note that on the free version, you can only use this replay feature on timeframes higher than the daily. You’ll need to pay for a higher TradingView plan to access intraday replays.

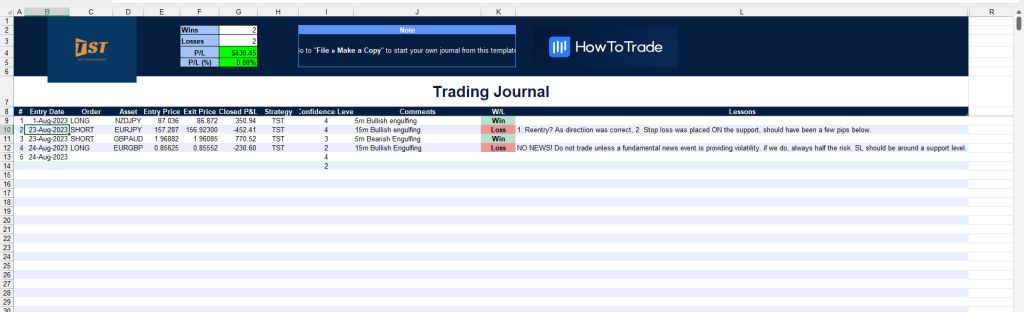

Step 2: Create your Journalling Spreadsheet

Your trade journalling spreadsheet is where you keep track of all the trades you take on your TradingView. If you need help creating a journalling spreadsheet, we have a short post that describes everything you need to know about trade journalling. That post also contains a free Excel sheet template you can use to journal your trades easily.

The free journal template helps you track the date, your bias, your trading instrument, the strategy you’re testing, and so many more. It even has a section where you can put down the lessons you learned from each trade, which can hasten your learning massively. It, however, doesn’t have a place where you can add images of your chart so that you can easily see screenshots of your chart at the time of your trades.

Thankfully, there’s an easy fix for this. Create a new column on your Excel sheet. And on your TradingView, you’ll find a camera icon at the top right corner of your chart. When you select it, you can generate and copy a link to the screenshot of your chart just as it is. You can then place it in the new column you created to hold images.

Step 3: Start playing your chart forward

Back on your TradingView, you can play your chart forward using the replay controls at the bottom of your chart. This puts you in a situation where you get to make trading decisions on the chart as though you were trading it live. Don’t forget to record your trades in your trade journal. That’s where you’ll get to review your trades and optimize them.

How to Backtest Your Trading Strategy Using FXReplay Backtesting Tool

FXReplay has quickly gained popularity among modern-day traders as one of the best backtesting tools out there. But we’ll get this right out of the way first: It isn’t a free forex backtesting software. It’s got a free 5-day trial, but beyond that, it’s paid. We should also put it out there that we do not make any money by recommending this tool. We’re not affiliated with them in any way. We have only used them and found them to be quite good.

Back to the tool, FXReplay is a sophisticated backtesting tool that puts you through the motion of taking your trades on past historical charts as though you were trading live. You can trade a simulated demo account with simulated capital. In addition, it has impressive features, such as Analytics (where it automatically tracks your trades and gives you visual overviews of your performance from various perspectives), Journal (which allows you to journal your trades as you take them right within the app), and Strategy categorization features (allowing you to see what strategies have given you the most returns and what’s cost you the most).

FXReplay is best for those who’re trading forex and indices. It offers all historical and backtest-able data on all the major currency pairs, the major indices, and them some.

We won’t be showing you how to use the software here—not because we’re too lazy to do that (definitely not!). But because the tool is actually easy to use.

Overall, it’s an excellent tool for backtesting trading strategies.

Top 6 Golden Rules for Backtesting Your Trading Strategy

Here are six critical tips you must follow to ensure the success of backtesting your trading strategy:

- DO NOT cheat. The automated backtesting trading system

- works to tell you whether something works or not. It is not there to prove your strategy is bulletproof.

- DO define your strategy as tightly as you can. If necessary, create a trading plan and use proper risk management tools before you start the backtesting process.

- DO NOT take one test as gospel truth. It takes a couple of trials to get it right!

- DO take your time with the analysis and include the trading costs. There is no rush!

- DO NOT be afraid to change the strategy and start again from the beginning. Even the best forex traders don’t get it right the first time!

What are the Benefits and Limitations of Backtesting?

Backtesting is the number one recommended way of seeing how your trading strategy performs. It’s the ultimate decider of whether a strategy is trash or valuable. However, it’s not without its limitations. Here are some of its benefits and limitations:

Benefits

- Backtesting helps you test the possible performance of your strategy across various market conditions.

- Thanks to your backtesting, you can continuously optimize your trading strategy until you can extract the maximum reward from the minimum amount of risk.

- Backtesting helps you build confidence in your trading strategy.

- Backtesting lets you know what you expect from a strategy so that you can plan your trading system around it.

Limitations

- Past performance is not indicative of future performance. The fact that a strategy worked well during a backtest doesn’t absolutely guarantee success on the live chart.

- While backtesting can simulate past trading conditions, it can’t simulate the feeling of trading real money in a live chart. This is where emotions and psychology can play a part in your trading that couldn’t have been captured during your backtest.

Backtesting Vs. Forward Testing

While backtesting allows you to test your strategy on past chart data, forward testing will enable you to test your trading strategy in the live market using a demo account. Both allow you to test your strategy in a risk-free environment. But that’s about where the similarities end.

Backtesting is great, but it doesn’t teach you an essential part of trading: trading psychology. Forward testing, however, does a better job at this. With backtesting, you control how quickly you want to replay your charts. In forward testing, however, you have to sit and watch with agonizing uselessness as your trade plays around in a drawdown or decides to range a few pips from your take-profit target. In these scenarios, the strength of your trading psychology will be tested. Will you give in and start moving your stop loss around or take profit too early? This brings us to our next difference.

Backtesting is faster. Forward testing moves at the pace of the live market.

Backtesting usually gives you more than enough historical data to work with. Depending on your backtesting tool, you can backtest as far back as the 2000s. However, with forward testing, unless you want to forward test a strategy for years into the future without trading your actual money, you won’t have as much wealth of data. As a result, we recommend that you only forward-test a strategy you have backtested.

How Many Times Should I Backtest My Trading Strategy?

One thorough backtesting is enough for any trading strategy. However, nothing stops you from doing multiple backtests if you need to tweak something in the trading strategy to optimize it. No rule says you have to backtest a particular number of times. So, if it takes you three backtests for you to gain confidence in your strategy or to be sure that the strategy is crap and needs to be trashed, then so be it. But generally, one thorough backtesting is enough.

Where Can I Backtest My Trading Strategy for Free?

MT4 and MT5 allow you to backtest your trading strategy for free. However, you may need to code your strategy into an Expert Advisor before using the Strategy Tester feature of these trading platforms.

You can also backtest for free on TradingView without programming your strategy into a bot (TradingView has an automated backtesting feature for trading bots, though). You’ll need to use the “Replay” feature on the platform for this. However, this feature is only free on timeframes higher than the daily. Any timeframe lower, and you’ll need to pay. Also, you’ll need to have somewhere separate to journal your trades.

How Do You Manually Backtest a Trading Strategy?

TradingView and FXReplay allow you to backtest your trading strategy manually.

The Bottom Line

Make no mistake; backtesting does not guarantee success in trading the financial markets. Some might even claim that backtesting doesn’t work for several reasons. For example, many traders unconsciously try to define a retroactive model that will work for them. But, then, in other market conditions, the same strategy might not work.

However, despite all the flaws of backtesting, learning how to backtest your trading strategy correctly can significantly help you optimize your success and gain confidence in your trading strategy before you implement it in live forex markets. Do not avoid it. It is a simple and effective tool you should implement before you activate a trading strategy in the live forex market.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.