Ah, compounding, the mystical force that exponentially grows your earnings. When we say exponential, it means your returns on initial investment keep growing. It’s like when you plant a fruit tree, and from one seed, you have an entire tree. That’s the logic of a forex compounding plan.

We won’t spill all the beans here; let’s keep moving and discover the power of using a forex compounding plan. Before we do that, feel free to check the two free templates of a Forex compounding plan: Google Sheets and PDF.

Forex Compounding Plan PDF (Free Download)

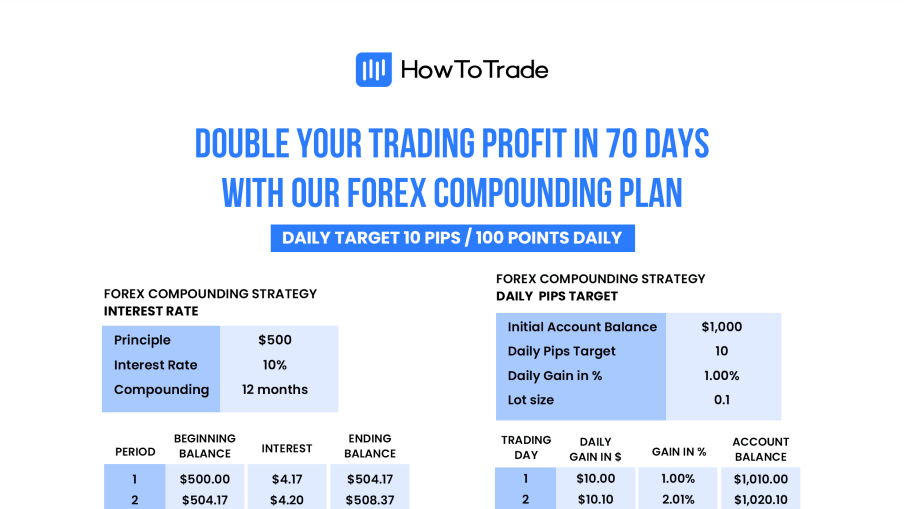

In this section, you can download our free Forex compounding trading plan PDF, which includes two Forex compounding strategies:

- Forex compounding strategy with an interest rate

- Forex compounding strategy daily pips target

FREE Forex Compounding Plan PDF

On the button below, you can download our FREE Forex Compounding Plan PDF

Forex Compounding Plan Google Sheets (FREE)

Feel free to visit the link below and make a copy from our Forex Compounding Plan Google Sheet or edit the editable fields to get estimations on your trading account balance.

Forex Compounding Plan Excel Spreadsheet

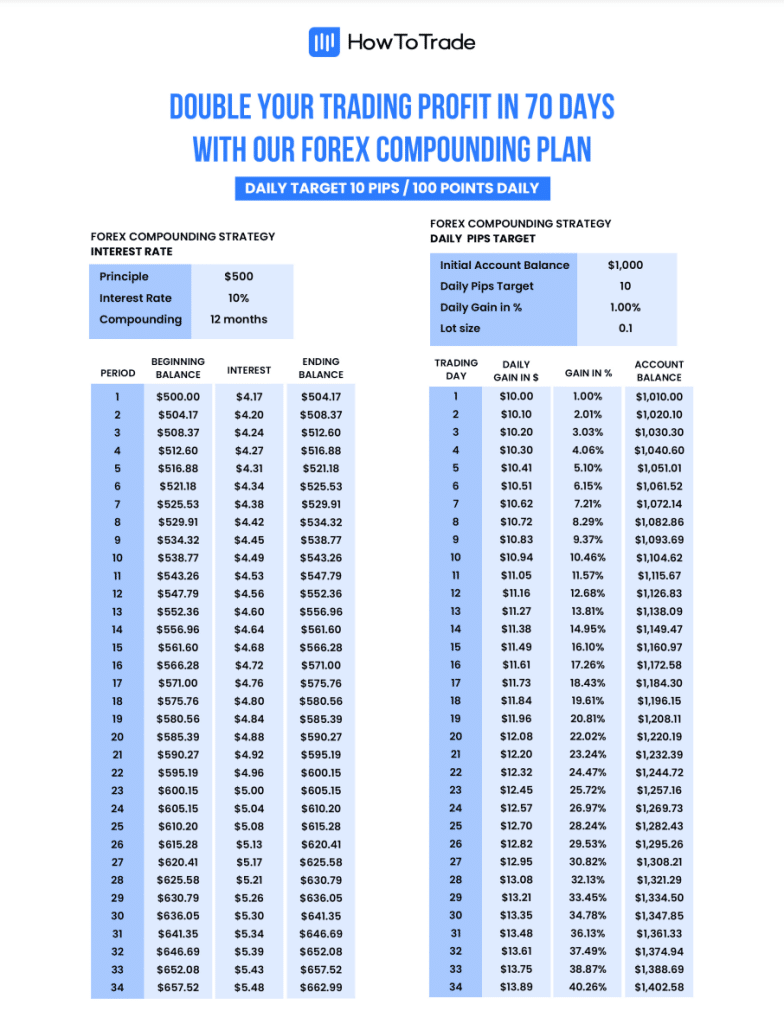

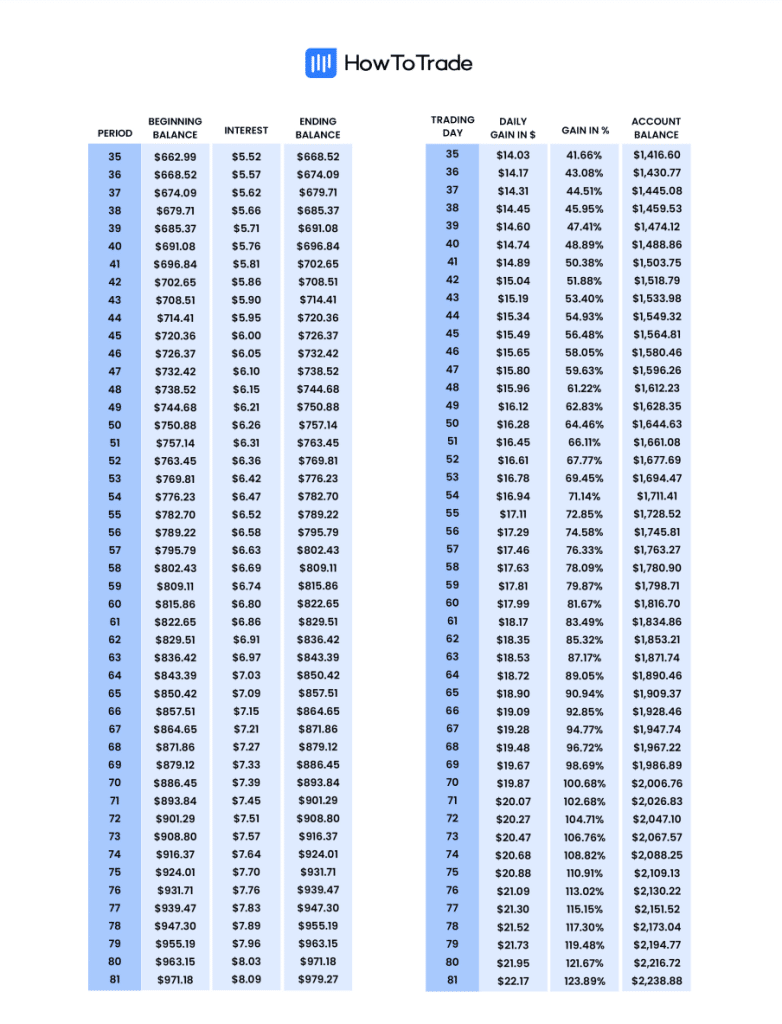

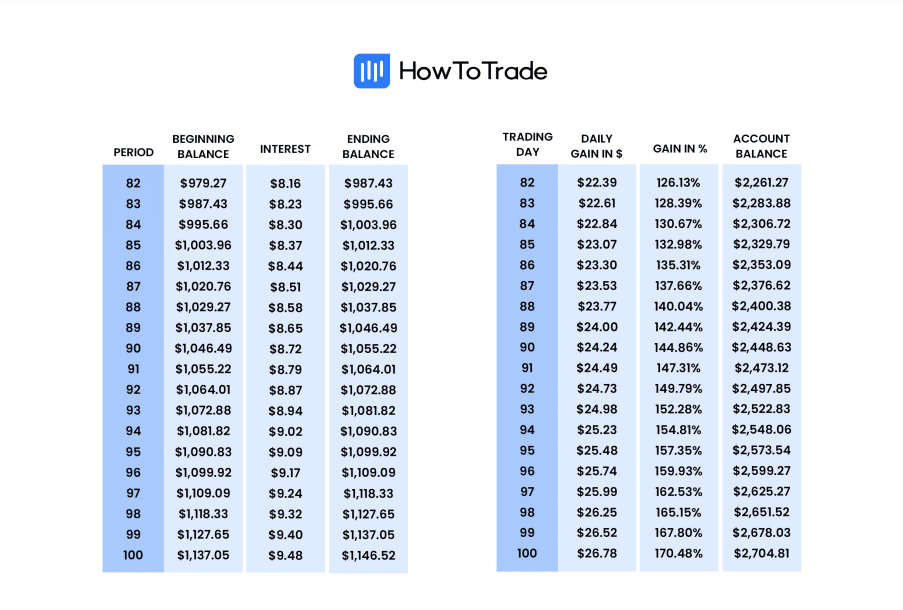

Below you can check our full forex compounding plan for 100 days in the following three images.

Now let’s get more into forex compound trading, and why you would need a Forex compounding plan.

What is included in this blog post:

What is included in this blog post:

What is a Forex Compounding Plan?

Forex compounding is a trading strategy that involves reinvesting the profits earned from profitable trades back into the forex market. The idea of compound trading is to use the profits to generate even more over time, creating a cycle of growth that can lead to significant returns.

For example, suppose you have an initial balance of $1000 in your Forex account. Each month, you make a 5% profit from a fixed interest rate or by an average daily pips target. In the first month, your balance would be $1050; in the 12th month, your balance would be $ 1795.86.

So, you see how this magical economic force works. No wonder Albert Einstein called it the 8th wonder of the world. He said, “Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t pays it.”

Here’s how the forex compounding plan works:

- You start with a small/medium trading account size.

- As you make successful trades, your trading account will grow.

- Instead of withdrawing the profits, you reinvest them back into the market.

- Your trading account will grow exponentially as you continue to make successful trades and reinvest profits.

How to Use a Forex Compounding Calculator?

The most important aspect of the forex compound is to calculate your returns. If you wish to do that without a calculator, it can be tiring and requires a lot of effort to calculate the returns. However, if you want to try it, here’s the forex compounding interest formula.

FV = P (1 + r/n)(nt)

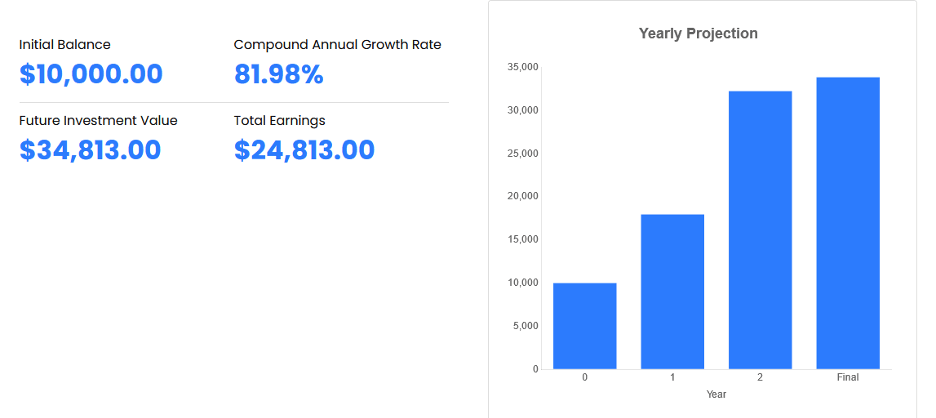

Fortunately, we have a Forex compounding calculator that can help you.

To use it, here’s what you need to do:

- First, you have to enter your starting balance. We inserted $10,000 for this example.

- Then there are years and months (though you can also use the compounding calculator for days or any other time frame). Here, you can enter the compounding period.

- Next, we have the percentage. It is where you put your returns (fixed interest rate or pips daily target). We inserted 5% as an example.

- After that, you have to choose your compounding period; hence, choose monthly or yearly.

- Finally, you have to select your account currency.

Hit the calculate profit button to have a forex compounding projection and a complete list.

Top 3 Forex Compounding Trading Strategies

Forex compounding sounds great, but you need a strategy to reap the compounding tree’s fruits in your investment portfolio. Some of these forex compounding strategies are suitable for scalping or day trading, while others work best for swing and position trading.

To help you get started, here are some of the best forex compounding trading strategies you can apply in the foreign exchange market.

1. 10/20 Pips a Day Compounding Forex Strategy

First, before you start utilizing this strategy, you must decide which currency pair you will trade. You also need to define your lot size, risk-reward ratio, and time frame (the compounding period).

So, as the name implies, the 10/20 pips-a-day forex compounding strategy is essentially a strategy in which a forex trader aims to capture 10 or 20 pips a day and increase the account balance by reinvesting each day’s profit on the following day.

The reason this strategy works is that you are not aiming to catch long-term market trends. Instead, the purpose is to collect the same amount of pips daily and reinvest your profits.

Basically, you can use any trading technique to capture 10 or 20 pips daily. It does not matter how you achieve this goal as long as you make 10 or 20 pips a day. The most important rule is to set a risk-reward ratio that works in your favor and within the specified time frame (1H, day, week, month).

Let’s see an example of how it works with the 10 pips a day forex compounding plan.

- Account balance – $1000

- Risk Per Trade – 1%

- Time frame – Daily

- Risk-reward ratio – 1:2

- Lot size – 0.1

Now, assuming you’ve made a profit of 20 pips, which translates to $20 on the first day, your account balance will be $ 1,020. You use the same settings the following day; however, this time, your risk per trade stands at $10.2 instead of $10.

The lot size for the second day should be 0.102. If you have another profitable day, you’ll increase your account balance by $ 20.40, meaning you’ll have $ 1,040.40. Then, guess what? You do the same thing the following day. And that is how the 10 pips a day forex compounding strategy works. Instead of withdrawing profits, you reinvest them and use the proceeds in the following period.

2. Compound Interest Trading Strategy

If you want to skip the hustle of a 10-20 pip strategy, you can look for an interest rate differential strategy. An IRD (interest rate differential) refers to the difference in interest rates between two nations’ currencies. Forex trading is also known as a carry trade strategy.

A carry trade transaction involves buying a high-interest currency and selling a low-interest currency. For instance, at the time of writing, USD is a high-interest currency, while JPY is a low-interest currency. Therefore, your profit is the interest rate differential. You will gain a fixed interest rate if you enter a long position by buying the USD/JPY. Then, at the end of the month/year, you reinvest the profits, and by doing that, you increase the size of your position.

When the currency of the high-interest-rate country rises in value, the trade works even better (which, in most cases, the high-interest rate currency strengthens vs the low-interest currency).

For instance, the USD appreciated in 2022 versus most currencies, particularly the Japanese Yen, which helped the USD/JPY pair reach new highs. In that case, if you bought the USD and sold JPY, you would have earned the interest rate differential and the upward movement of the pair. That is a compound interest rate strategy.

3. Asymmetric Compounding Strategy

If there is one strategy that can compound your growth on a fast lane, it’s asymmetric compounding. It is a powerful strategy that you don’t hear a lot about.

In forex trading, an asymmetrical strategy refers to an approach where the potential profits made from FX trades are much larger than the potential losses. Therefore, you must have a higher win rate and need consecutive trading days to make this strategy work.

How Does the Asymmetric Compound Strategy Work?

The idea is to take a trade that will generate a higher return than the risk taken. So, in a certain way, it is similar to the roulette black and red double-down strategy. It’s a great technique, and if you have the capital and learn how to utilize proper risk management, as well as use a forex trading plan template, then you are very likely to make consistent profits by employing this strategy. But, on the other hand, it is also a very risky strategy.

Asymmetrical means the reward is two, three, or four times the risk. But every time you make a profit, you increase your risk per trade.

For example, let’s say you risk 1% per trade and use a 1:2 risk-reward ratio. If you lose the trade, you risk 1% again on the next trade until you reach the starting capital level. If you make a successful trade, you gain 2% and add it to your account. On the following day, you use the initial balance and raise your risk per trade to 2%. If you have another profitable day, then you do the same, and your risk per trade would be 4%.

Here’s an example of what using this strategy may look like.

Let’s say you decide to risk 1% per trade with a 1:2 risk-reward ratio on a $1000 capital account.

- Day 1 – 1% risk per trade, 2% gained = $1020.

- Day 2 – 2% risk per trade, 4% gained = £1060.8 capital

- Day 3 – 4% risk per trade, 8% gained = £1144.8 capital

That’s what the asymmetric compounding strategy is all about. As you can see, it is an excellent risk management strategy; however, ultimately, you must make more winning trades than losing ones.

Please note that there are no strict rules governing the use of the asymmetric compounding strategy. For example, if you wish to take a safer approach, you can go back to risking 1% after three profitable trades. It’s all up to you and what level of risk you are willing to take.

Benefits and Limitations of the Forex Compounding Strategy

For some, compounding can be a godsend; for others, it can be challenging. So, let’s see the forex compounding strategy’s pros and cons.

Pros

- Compounding allows you to grow your trading account exponentially, potentially leading to significant gains over time

- A well-defined trading plan and focus on high reward-to-risk trades can help you consistently generate profits, which can be compounded over time

- Trades can use different forex compounding strategies

Cons

- Compounding can magnify gains and losses, so proper risk management is critical to avoid excessive losses

- With compounding, it takes time to generate significant results, so you must be patient and willing to wait for investments to grow

How Compounding Can Help You Grow Your Trading Account Faster

The bottom line is that the forex compounding strategy is a powerful trading technique that can help you achieve your goals. With a disciplined approach, controlled risk, and a focus on high reward-to-risk trades, compounding can be the secret ingredient for explosive growth in your compounding forex account.

To take advantage of compounding, forex traders need to have a well-defined trading plan and a focus on proper reward-to-risk trades. Additionally, the compounding trading strategy can also magnify losses, so good risk management is critical.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.