If you have been long enough in the markets, then you have most likely heard about short squeeze – a rare trading phenomenon that can create huge spikes in a stock price. Historically, there are plenty of stories about the biggest short squeezes in history, with the most recent being the famous GameStop short squeeze in 2021.

This leads us to the next question: How can you find short-squeeze stocks? How do you analyze a stock to find a large number of short-interest positions? When to buy a short-squeeze stock? And can you even predict a short squeeze?

- A short squeeze is a rare phenomenon in financial markets that occurs when a security moves sharply higher after short-sellers are forced to exit their positions.

- Various factors can trigger a short squeeze, including positive company news, better-than-expected earnings results, margin calls, a new partnership or a deal, or technical analysis indicators.

- To spot a short squeeze, traders must follow the short interest percentage, short interest ratio, trading volume, and the company’s news and updates.

- There are various ways to find short-squeeze stocks, including short-squeeze scanners.

Here’s what we cover on this page:

Table of Contents

Table of Contents

Short Squeeze Explained

So, what is a short squeeze, and how does it even work?

Before we begin, let’s quickly explain what short-selling means. In trading, shorting a stock means an investor takes a position with the expectation that the stock price will fall.

But how can you sell a stock that you do not own? So, technically, a trader borrows the securities from a brokerage firm and sells the shares to another market participant. Then, a trader closes the position by buying back the stocks and sending them back to the broker. By doing that, traders can not only buy stocks but also sell stocks, betting that the stock price will go down.

However, no worries, in real life, things are far less complicated since everything is done behind a screen. Essentially, you simply click on a Sell button, and then the Buy button, and the magic is done – You are short-selling a stock.

Quite surprisingly, short selling is not a new thing in the markets. It is believed that the first practice of a short-selling transaction occurred in 1609, although, legally, it was approved by the SEC in 1938.

Now, let’s go back to the short squeeze.

So, let’s imagine there’s a company called X, and it has 1000 shares in the stock market. Initially, the company is stable and successful; therefore, the short interest percentage, which represents the percentage of shorted stock, is only 10%, meaning short-sellers sold 100 shares.

But then, the company lost momentum, and the short interest increased to 70%. Obviously, the higher the stock short-interest percentage, the greater the negative sentiment.

For a while, the stock continued to trade in negative sentiment, but then, something happened. A bullish catalyst that triggers the squeeze. It could be a comment from the CEO about the company’s growth, a positive earnings report, a new deal, a discussion on Reddit or any other financial forum, or anything else that might positively affect the share price. Either way, when this happens, all short-sellers immediately close their positions, and guess what? The stock is skyrocketing. That is a short squeeze.

The higher the stock short-interest percentage, the greater the negative sentiment.

Short Squeeze Example – What Does a Short Squeeze Look Like?

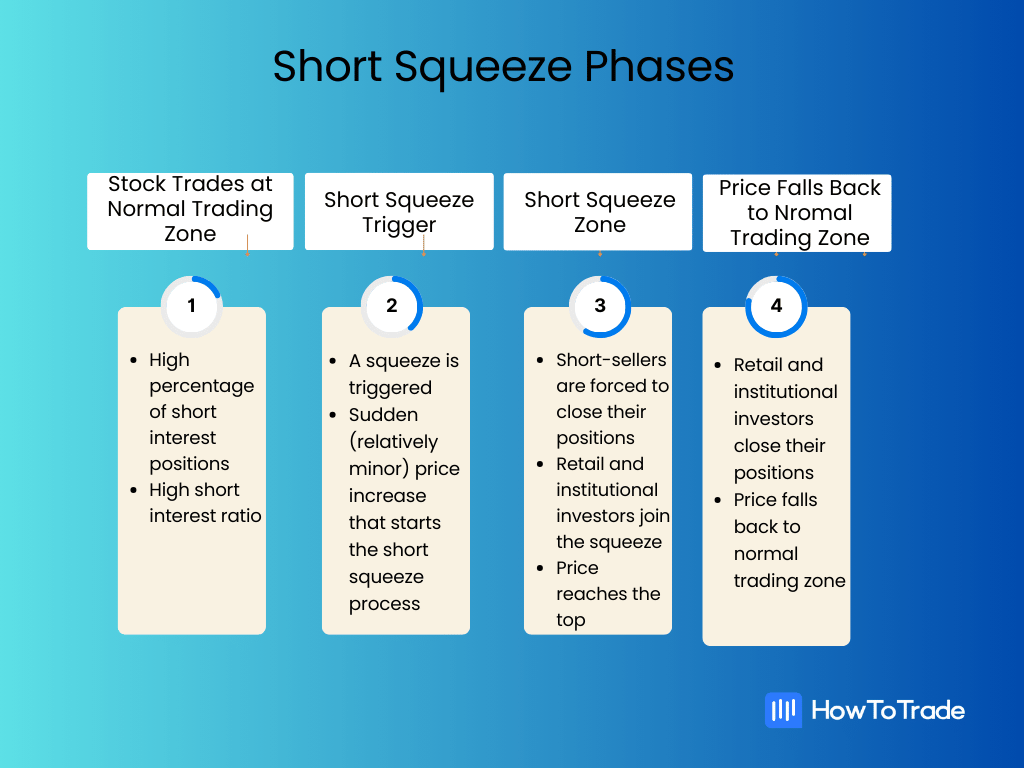

A short squeeze has a very short cycle of, normally, several days (depending on the short interest ratio). It has a shape of a narrow bell curve or, some might say, a rocket. To identify a short squeeze, you must first be familiar with the short squeeze phases:

1: The stock is trading at a normal trading zone with high short interest and a high (or increasing) short interest ratio.

2: A squeeze is triggered and characterized by a sudden (relatively minor) price increase.

3: This increase forces short-sellers to close their positions, which drastically pushes the price higher. Retail and institutional investors typically join the squeeze to exploit the sudden price increase. At this stage, the price reaches its short-squeeze top.

4. Finally, short sellers, along with retail and institutional investors, close their positions. The price falls back to its normal trading zone.

Now, let’s see the cycle using a real live example. In the chart below, you can see a chart from January 2021 of the last major short squeeze of GameStop stock. This squeeze, which was initially triggered by users on Reddit, pushed the price from $4.31 to $120.75, an increase of over 2700%, marking one of the most famous short squeezes in history.

How To Analyze a Short Squeeze

To analyze a short-squeeze stock, you must first find companies with a high short interest percentage relative to the floating shares available to the public. Generally, any figure higher than 10% is considered an indication of a negative trend in investors’ sentiment, meaning that a short squeeze might be coming.

But that’s not enough. You also must take into consideration the average daily volume. Technically, this ratio represents the number of days it would take sellers to cover their positions. Going back to our example, let’s say company X has 200 shorted shares out of its total 1000 floating shares, but the average daily stock volume stands at 50. This means it would take four days for short sellers to cover their short positions. This metric can be identified using the short-interest ratio. As a rule of thumb, the higher the ratio, the greater the chances for a stock short-squeeze.

In addition to that, in order for short-squeeze to be valid, short-interest positions must increase over time. This also indicates that a squeeze might be near the corner.

Finally, another metric you must check is the floating shares. Low-float stocks have fewer shares available in the open market, which can increase the buying pressures if a squeeze starts.

All in all, here are some basic rules you need to remember to identify a short squeeze:

- The short interest percentage should be greater than 10%

- The number of shares being shorted is increasing

- The short-interest ratio should be above 4

- Check the float shares available in the open market

- The stock’s daily trading volume should be rising

How to Find Short Squeeze Stocks

The key question is, how do you find short-squeeze stocks?

Generally, we can say that a short squeeze is a rare market condition. However, when it does happen, it typically can provide an opportunity for a major price movement in a stock price. And to win the lottery, you have to buy a ticket. So, the first thing you need to do is to learn how to find short-squeeze stocks.

There are various methods to do that; let’s cover some of the different ways you can spot short-squeeze stocks:

Directly Find Stocks with High Short Interest

The first method is pretty intuitive. Basically, you need to naturally look for stocks with a high short-interest ratio. This could be done by searching for stocks that have experienced a significant decline and have the potential for a short squeeze. You can also look for articles from trading experts about top short-squeeze stocks.

Once you monitor the markets and notice a stock that is heavily shorted, you can look for the required metrics to validate that the chances for an upcoming short squeeze are high. Then, you need to wait for something that might trigger the squeeze in a stock.

Use Short Squeeze Scanners

If you are keen to find short-squeeze stocks, then using a short-squeeze scanner might be the best method for that. There are plenty of screeners you can find online, with some charging a small fee for this service while others are offered for free.

Those who are interested in that service are advised to check the features provided by paid services.

Look for High Short Interest Stocks on Leading Financial Portals

Finally, another way to find short-squeeze stocks is to look for stocks with high short interest on leading financial portals.

Free-to-use websites like MarketWatch, Yahoo.finance, and NASDAQ.com – all have a screener with the most shorted stocks. However, unlike paid services that offer a short-squeeze screener with valuable data, here, you get the most basic information regarding short-squeeze stocks.

Generally, we can say that a short squeeze is a rare market condition. However, when it does happen, it typically can provide an opportunity for a major price movement in a stock price. And to win the lottery, you have to buy a ticket.

When to Buy a Short Squeeze Stock?

The fact that a certain stock has a high short interest does not necessarily mean that you should instantly buy it. As a matter of fact, a stock with high short interest is an extremely risky investment, and the chances for bankruptcy or Chapter 11 are even higher than a squeeze. So, in case you spot a stock with a high short interest percentage, what are the next metrics you need to check before you buy a short-squeeze stock?

The first metric you need to consider is the short-interest ratio. This metric, however, should not be confused with short interest. While short interest represents the percentage of shorted positions of the total floating shares, the short-interest ratio measures the number of ‘days to cover’ it would take investors to close their short positions.

Unfortunately, there’s some kind of unclarity among traders regarding what is considered a high short-interest ratio. Yet, there are some rules of thumb that can help you to evaluate the probability of a short squeeze:

- The higher the ratio, the greater the chance for a short squeeze

- A short interest ratio above five indicates that a short squeeze is looming

- A ratio below 2-3 usually indicates that a squeeze is not likely to occur

The second thing you need to look for is trading volume. Remember that short squeezes typically occur in low-volume stocks that are not widely covered in the news. Therefore, the best indication for the beginning of a short squeeze is by recognizing an increase in trading volume. For that purpose, we suggest using one of the best indicators to measure the stock volume.

Lastly, you need to follow the news; this is where fundamental analysis comes into play. When a short squeeze begins, it is likely to be covered in the news or in financial forums. A short squeeze is not a scenario that happens every day, so when it happens, you can validate that by finding some market noise in news channels.

What is the Best Indicator for Identifying a Short Squeeze?

Investors can also use technical indicators to spot early movements of a short squeeze. Since short squeeze traders look for overbought and oversold areas, momentum indicators like the Relative Strength Index (RSI), Oscillator, and MACD indicator can be valuable tools to identify a squeeze.

However, one indicator that stands above the rest is the Short Interest Ratio indicator. This indicator measures the number of days it would take short sellers to repurchase borrowed shares in the market. Typically, if the indicator’s value is rising above 4, then a strong signal for a squeeze is given.

Once again, let’s take a look at GME stock price performance at the time of the squeeze in 2021.

As you can see in the chart above, when the value of the Short Interest Ratio indicator rises above 4, the short squeeze occurs, and the price of the stock moves sharply higher.

Final Word

To sum up, a short squeeze in stocks (or any other instrument) can potentially trigger sudden upward price movements, providing investors with high-rewarding trading opportunities. In that sense, buying short-squeeze stocks is an entirely different story when compared to many other trading strategies. With this technique, traders look for one big profit instead of collecting many small profits.

And history tells us that it could happen again. Well, in that case, the phrase about history repeats itself is not that bad… if it happened before, it will happen again. You just need to find those short-squeeze stocks and learn how to analyze them correctly. Then, HOLD the squeeze.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.