Trading can appear to be a little tough, especially when you’re just getting started. With countless strategies to choose from, it’s easy to get overwhelmed. However, one approach that stands out for its simplicity and effectiveness is the Break and Retest Trading Strategy.

In this article, we’ll walk you through everything you need to know about trading the Break and Retest so you can add this powerful tool to your trading arsenal.

- The Break and Retest strategy transforms market breakouts into reliable trading opportunities by waiting for a retest of key levels before entering a trade.

- It provides traders with a high-probability entry point, reducing the risk of getting caught in false breakouts.

- The strategy is simple to recognize, making it accessible for both beginners and experienced traders alike.

Here’s what we’ll cover on this page:

Table of Contents

Table of Contents

- What is the Break and Retest Trading Strategy?

- How to Trade the Break and Retest Strategy?

- Risk Management Techniques for the Break and Retest Strategy

- The Break and Retest Strategy Free PDF Download

- Benefits and Limitations of Using the Break and Retest Trading Strategy

- Is the Break and Retest a Profitable Trading Strategy?

- Frequently Asked Questions

What is the Break and Retest Trading Strategy?

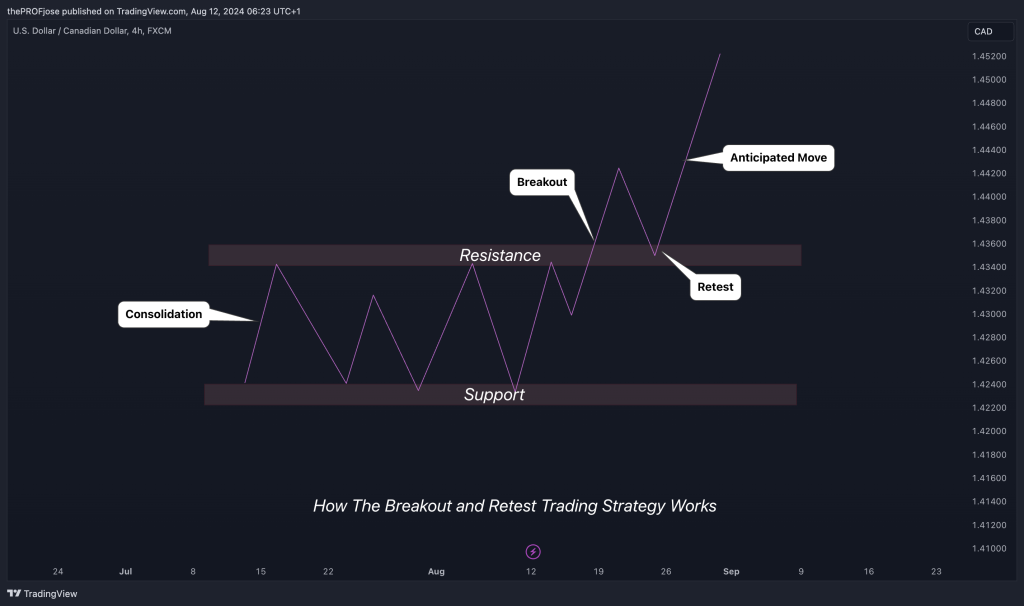

The Break and Retest Strategy is a technical analysis approach that capitalizes on a breakout in the market. It’s closely related to the breakout trading strategy, which involves identifying key levels of support or resistance and trading breakouts. However, the Break and Retest strategy takes it a step further by waiting for the market to come back and “retest” the broken level before making your move.

Here’s how it works: imagine the price of an asset has been hovering around a resistance level, unable to break through. Finally, the price surges, breaking through the resistance to form a bullish breakout. Instead of jumping in immediately, a trader using the Break and Retest strategy waits for the price to come back down and retest the old resistance level, which has now become a new support level. If the price holds at this level, it’s often seen as confirmation that the breakout was legitimate, offering a high probability entry point.

Why wait for the retest? Patience pays off in trading. By waiting for the retest, you can avoid false breakouts—situations where the price temporarily breaches a level only to reverse direction. This strategy offers a more conservative entry, reducing the risk of getting caught in a failed breakout.

How to Trade the Break and Retest Strategy?

Let’s dive into a step-by-step example to see the Break and Retest strategy in action. This will help you understand how to apply the concepts we’ve discussed and give you a clearer picture of how to execute this strategy in real-time.

Step 1: Identify a Key Support or Resistance Level

First, we need to spot a significant support or resistance level on the chart. Considering the EURGBP chart above, it’s easy to see a strong support level where the price has struggled to break above multiple times. Let’s mark this zone out and see how the price reacts to it.

Step 2: Wait for a Breakout

After a while, the price finally formed a bearish breakout. This indicates that the market sentiment is bearish, and sellers are gaining control, and the price may continue to fall.

Step 3: Wait for the Retest

Instead of entering the trade immediately after the breakout, you wait for the market to retest the broken support level. This retest phase is a crucial step in the strategy. The idea is that the previous support now acts as a new resistance level. When the price comes back to this level, you look for signs that it will hold as resistance.

Step 4: Confirm the Retest

As the price approaches the retested level, watch for confirmation signals. These can include bearish candlestick patterns like a hammer or a bearish engulfing pattern or perhaps any indicator like the RSI showing oversold conditions. These signals suggest that the new support level is likely to hold, providing a safer entry point.

In our case, the price formed a clear bearish engulfing pattern.

Step 5: Enter the Trade

Once you’re confident that the retest is successful and the new resistance is holding, it’s time to enter the trade. Open a SELL position immediately after the engulfing pattern closes. This way, if the price continues to fall, you’ll capture the downward momentum.

Risk management is key. Place your stop loss just above the new resistance level to protect your trade if the market moves against you. For your take profit, consider setting it at a swing low or use a Fibonacci extension tool to project a potential target.

Once your trade is active, keep an eye on it, but avoid the temptation to micromanage. Stick to your trading plan. If the market moves as expected, you can consider moving your stop loss to breakeven or trailing it to lock in profits as the price progresses.

There’s so much you can do to make your break and restest strategy even better. For instance, you can incorpoate additional indicators to confirm your signals. A volume indicator can also help you confirm the strength of the breakout.

Multi-timeframe analysis can also help you add confluence to your strategy. If the higher timeframe is bullish, for instance, and you get a bullish breakout and retest signal on the lower timeframe, your chances of success become better.

Risk Management Techniques for the Break and Retest Strategy

Now that you’re familiar with the Break and Retest Trading Strategy, you have to learn how to practice proper risk management. After all, even the most effective strategy can fall apart without a solid plan to manage your risk. Here are some essential techniques to keep your trading account safe while you master the Break and Retest strategy.

First and foremost, always set a stop-loss. When trading the Break and Retest strategy, place your stop-loss just below the retested support level (in an uptrend) or above the resistance level (in a downtrend). This ensures that if the retest fails, you’re not caught holding a losing trade. Remember, this strategy is not a holy grail, and you don’t want a single trade to wipe off all your money.

Position sizing is closely tied to risk management. Position sizing refers to determining how much of your trading account to risk on a single trade. A common rule of thumb is to risk no more than 1-2% of your account on any given trade. This way, even if the market moves against you, the loss won’t be catastrophic.

Another key technique is to avoid over-leveraging. When trading the Break and Retest strategy, stick to moderate leverage levels that you’re comfortable with. Be at home making a regular, consistent profit rather than trying to force a home run out of every trade. Over-leveraging can quickly turn a small loss into a big one, so it’s vital to tread carefully.

The right risk management techniques will help you trade the markets more confidently and keep your trading account on the right track. Remember, the best traders aren’t just those who win big—they’re the ones who protect their capital and live to trade another day.

The Break and Retest Strategy Free PDF Download

If you need a handy PDF to easily refer to for the break and retest strategy, we’ve got you covered here:

The Break and Retest Strategy Free PDF Download

Benefits and Limitations of Using the Break and Retest Trading Strategy

The Break and Retest Trading Strategy has its fair share of fans, and for good reason. But like any strategy, it’s not without its challenges. Before you dive in, it’s essential to weigh the pros and cons to see if this approach fits your trading style.

Benefits of Trading the Breakout and Retest Strategy

One of the biggest advantages of the Break and Retest strategy is that it can be highly profitable. When executed correctly, this strategy allows traders to enter the market at an optimal point—right after a breakout has been confirmed by a retest. This increases the probability of the trade moving in your favor, as you’re essentially following the market’s lead rather than trying to predict its next move.

Here are some other advantages of trading the breakout and retest strategy:

- Easy to recognize: The visual nature of the pattern makes it straightforward to identify.

- Reduces false breakout risks: Waiting for a retest helps confirm the breakout’s validity.

- Works across multiple timeframes: Can be applied to various markets and timeframes, from intraday to long-term trading.

- Adaptable: Can be combined with other strategies and technical indicators for enhanced effectiveness.

Limitations of Trading the Breakout and Retest Strategy

However, the strategy isn’t without its downsides. One of the primary challenges is dealing with high volatility. Breakouts can occur in highly volatile markets, making it difficult to determine whether a retest is genuine or just market noise. This can lead to false signals, where the market briefly retests a level before reversing, trapping traders in losing positions.

These are a few of the drawbacks of the breakout and retest strategy:

- Traders must wait for the retest, which may delay entry and result in missed opportunities.

- The strategy doesn’t guarantee success; unexpected market movements can still result in losses.

- It’s most effective when used alongside other tools or analysis techniques.

- Waiting for the right setup and retest can be time-intensive, especially in slower markets.

Is the Break and Retest a Profitable Trading Strategy?

So, is the Break and Retest strategy a profitable way to trade? The answer is: it can be, but like any trading approach, its success largely depends on how you use it.

Waiting for a retest after a breakout adds an extra layer of confirmation before entering the market. This reduces the chances of falling victim to false breakouts, which can often lead to unnecessary losses. For traders who prefer a more methodical approach, this strategy sits at the sweet spot.

However, it’s important to remember that no trading strategy is foolproof.

The Break and Retest method should be viewed as one part of a broader trading plan, not a standalone solution. It’s most effective when combined with other techniques like technical indicators or fundamental analysis.

Remember that while it’s tempting to jump into a trade at the first sign of a breakout, waiting for the retest can often mean the difference between a profitable trade and a loss. In volatile markets, this patience can be particularly rewarding.

Frequently Asked Questions About the Break and Retest Trading Strategy

Before we wrap things up, let’s address some of the most common questions traders have about the Break and Retest strategy. These FAQs will help clarify some key points and ensure you’re fully equipped to implement this strategy effectively.

What is the win rate of the Break and Retest strategy?

The win rate of the Break and Retest strategy can vary depending on how it’s implemented and the market conditions. On average, traders who use this strategy effectively might see a win rate of around 60-70%.

However, it’s important to note that the win rate alone doesn’t determine profitability. Combining a decent win rate with a strong risk-reward ratio is what truly leads to success. For example, even if your win rate is 50%, you can still be profitable if your winning trades are significantly larger than your losing ones.

Why do market retests happen?

Market retests occur due to the psychological nature of trading. When the price breaks through a key level of support or resistance, it often revisits that level as traders test its validity. This retest happens because traders who missed the initial breakout see an opportunity to enter the market while others take profits or reassess their positions. The retest essentially acts as a confirmation of the breakout, as the market is checking whether the new support or resistance will hold. If it does, it can provide a strong signal that the trend will continue.

What is a good day trading timeframe to use for the Break and Retest strategy?

When it comes to day trading, the Break and Retest strategy and the 15-minute and 1-hour timeframes are popular choices among traders. These timeframes offer a good balance between speed and reliability.

The 15-minute chart allows traders to spot breakouts and retests relatively quickly, making it ideal for those who want to capitalize on shorter-term movements.

Meanwhile, the 1-hour chart provides a bit more context and helps filter out some of the market noise, which can be useful for confirming setups before entering a trade. Ultimately, the best timeframe depends on your trading style and how much time you can dedicate to monitoring the markets.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.