Key Points

- EURUSD has suffered its worst daily performance for nearly three weeks.

- Traders eye crucial Fed day.

- Market volatility is rising ahead of a busy weekend.

- 1.05800, a key support area for EURUSD.

Market Overview

EURUSD has started the year firmly on the back foot, with a performance of -3.5% so far. This has largely been down to market expectations of an interest rate cut constantly being pushed back. The markets are now slowly pricing out rate cuts for September’s meeting, which seemed nailed on just a few months ago. Stubborn inflation, strong jobs reports, and, as a result, a more hawkish Federal Reserve is to blame for this.

Tuesday’s session may be a sign of things to come as EURUSD suffered its worst daily performance in nearly three weeks. Where could it go from here?

Will Jerome Powell Hint At Cuts?

The main event today is undoubtedly the Federal Reserve interest rate decision at 7:00 p.m. (GMT). It is almost nailed on that interest rates will be held at the 5.5% level, but the communication around the future trajectory of interest rates in either the press conference or statement will move the markets.

Inflation has been above expectations in the last three reports, which will alarm Jerome Powell, even if he doesn’t show it. As a result, FOMC members have recently been talking a hawkish game and pushing back aggressively on any future cuts. At the start of the year, the market priced in as many as six rate cuts. This now sits at just one, which could be argued is now priced in. If the Federal Reserve starts to squash the idea of any this year, you could expect more dollar strength. However, with the expectation of a very hawkish statement, the smart play could be on a data-dependent Fed to cause a reversal of the recent trends we have been seeing. Either way, volatility is rising and expected to stay in the markets throughout the rest of the week, with US Non-Farm Payrolls just around the corner.

EUR/USD Approaching Key Support Area

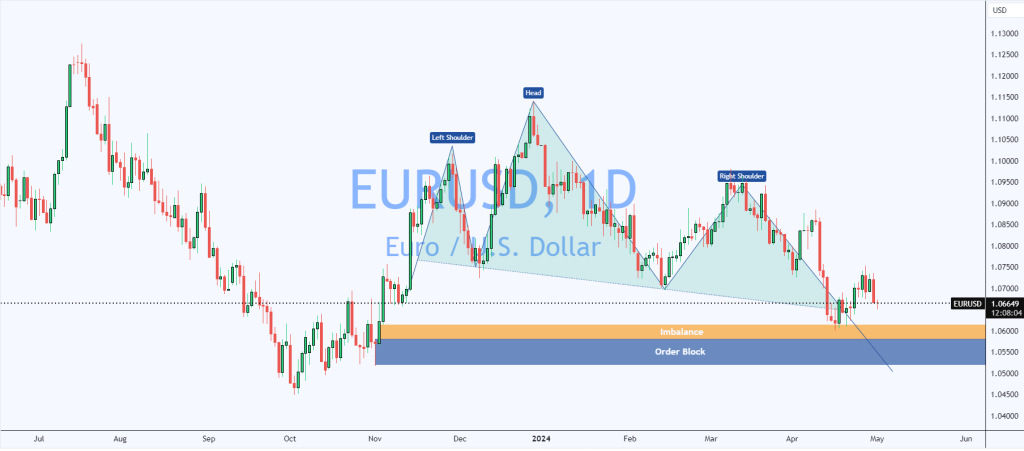

The chart below shows a daily pattern of head-and-shoulders in EURUSD. The bear case here is that if this pattern plays out well, the market could be pushed down to the swing low at 1.04500. In fact, you can see the price has already broken the neckline at 1.06474 but then reacted from the daily imbalance area. With yesterday’s bearish engulfing candle, we could be setting up for a bearish week.

The Bulls may look at a huge daily support area at 1.05740. This is because there is a daily order block here, which caused the trend shift seen in October 2023. Traders may look for this area to act as immediate support or wait for a lower time frame break of structure to confirm the support. From there, we could see a move back up the neckline of the daily head and shoulders.

Related Articles:

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.