- Liquidity in forex allows easy trading without significant price impact, powered by continuous operations and high volumes due to global trading centers.

- It enhances trading by ensuring quick executions, reducing costs, stabilizing prices, minimizing slippage, and offering better profit opportunities.

- Market hours, central bank activities, economic indicators, geopolitical events, and overall market sentiment influence forex liquidity.

Every experienced forex trader will tell you that liquidity is a crucial part of forex trading. But what exactly does liquidity in forex trading mean, and why does it matter? Well, high liquidity means smoother transactions, less slippage, and lower transaction costs, which can enhance profitability and trading efficiency.

In this article, we’ll explore liquidity in forex trading, starting with its definition and importance, and then explore the factors that affect market liquidity, like central bank actions and market sentiment. Finally, we’ll outline effective tools, forex trading strategies, and techniques for identifying liquidity and provide insights into the most liquid currency pairs you can start trading in 2024.

Table of Contents

Table of Contents

What is Liquidity in the Forex Market?

Liquidity in forex refers to the ease with which assets can be bought or sold without causing a significant change in their price. In financial markets, many active participants, financial institutions, investment banks, and a high volume of trades drive this characteristic. In other words, liquidity refers to the volume of transactions of a particular currency pair.

Crucially, the foreign exchange market, unlike other markets, is known for its exceptional liquidity because it operates 24 hours a day during weekdays, allowing continuous trading across global financial centers. This constant activity results in generally high trading volumes, making forex one of the most liquid markets in the world. This is key for executing trading strategies, particularly short-term strategies, such as day trading and scalping.

For instance, when trading stocks or futures, you might find yourself in a position where you can’t get out of a position due to illiquidity. This is something that typically cannot happen in the forex market. You may enter a position when there’s a widespread, but there are always buyers and sellers in any FX market.

Check out our daily market analysis page for insights about leading FX pairs, global indices, and commodities.

Why is Liquidity Important in Forex Trading?

Liquidity is a fundamental aspect of forex trading, offering several key advantages that can enhance the trading experience and profitability. Here’s why liquidity is crucial in forex trading:

Smooth Execution of Trades

High liquidity means that large volumes of trades can be executed quickly and at close to the desired prices. This rapid execution is vital for traders who need to enter or exit the market swiftly, such as day traders and scalpers.

Reduced Transaction Costs

Liquid markets typically feature tighter bid-ask spreads, which are the difference between the selling price and the buying price. A narrower spread reduces transaction costs for traders, making it more economical to trade frequently. If you are keen to find a low-spread brokerage firm, we suggest visiting our real-time broker spread comparison page.

Price Stability

Highly liquid markets tend to have more stable prices, which move in smaller, more predictable increments. This stability helps traders avoid the pitfalls of sudden price swings and volatility, which are more common in less liquid markets.

Lower Slippage

Slippage occurs when there is a difference between the expected price of a trade and the price at which the trade is executed. High liquidity reduces the likelihood and extent of slippage, ensuring that trades are executed at prices very close to those intended. For that matter, many Forex traders use Forex VPS service to avoid slippage and disconnections.

Better Opportunities for Profit

A liquid market provides more trading opportunities as the constant flow of buyers and sellers facilitates better price discovery and allows traders to capitalize on small price movements.

What Factors Affect the Forex Market Liquidity

Various factors that can significantly affect trading conditions influence liquidity in the forex market. Here are some of the primary factors that affect forex liquidity:

Market Hours

The forex market operates 24/5 across different global markets, leading to variations in liquidity at different times. Liquidity typically peaks during the overlap of the London and New York trading sessions due to the high volume of transactions.

Central Banks

Actions by central banks, such as adjusting interest rates or engaging in market interventions, can significantly influence forex liquidity. Their policies affect investor interest in currency markets and can rapidly change the liquidity landscape.

Economic Indicators

Economic reports like GDP, unemployment rates, and inflation data influence market expectations and liquidity. These indicators, which are published on a daily basis on an economic calendar, reflect a nation’s economic health and can substantially sway trader sentiment and market participation.

Geopolitical Events

Political stability, elections, and geopolitical conflicts can cause shifts in market liquidity. Traders often react to uncertainty by reducing their market activity, which decreases liquidity. Conversely, positive developments can increase trader confidence and market participation.

Market Sentiment

General market sentiment, driven by various factors, including economic data and geopolitical events, also plays a crucial role. Optimism can boost liquidity as more traders participate, while pessimism or uncertainty can diminish as traders hold off on making moves.

3 Effective Tools to Identify Liquidity in Forex Trading

To effectively identify liquidity in forex trading, you can use several tools that provide insights into what’s happening in the market. Here’s how you can leverage these tools:

1. Level 1 Bid and Ask Spreads

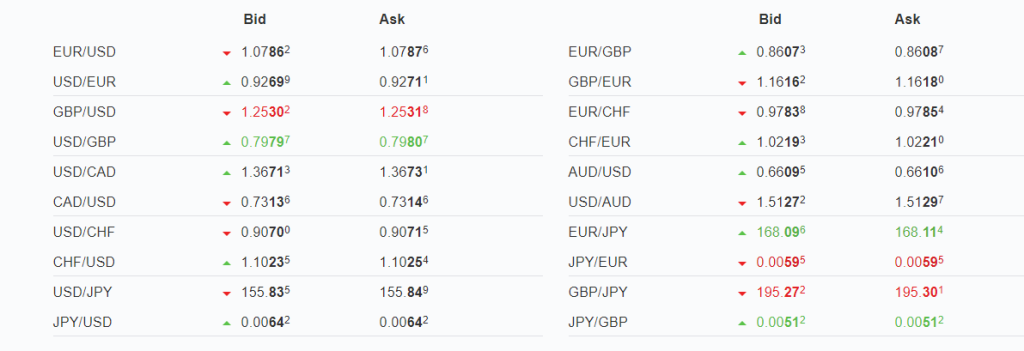

The bid-ask spread is a direct measure of market liquidity and is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). In highly liquid markets, such as the major currency pairs like EUR/USD, spreads are typically narrow, reflecting the ease with which trades can be executed. This narrow spread indicates a healthy level of buyers and sellers, facilitating smoother and more cost-effective trades. For example, a typical spread for EUR/USD is only 0.6-2 pips under normal market conditions, indicating strong liquidity.

On the other hand, exotic currency pairs, like EUR/TRY, usually exhibit wider spreads due to fewer participants in the market, indicating lower liquidity. These wider spreads mean that trading costs are higher, and entering or exiting positions can result in significant price slippage, potentially affecting trade profitability. Understanding these dynamics helps traders choose the right times and pairs to trade, maximizing efficiency while minimizing costs associated with low liquidity.

As you can see in the image below, major pairs have tighter spreads, while minors and exotic pairs often have a wider bid and ask spread.

2. Level 2 Market Data

Level 2 Market Data provides a deeper insight into the forex market by displaying real-time bids and offers at different price levels beyond the best available. This data, also known as market depth, includes information about the size of the orders, which can help traders gauge the depth of the market at various price points.

For example, substantial orders are well beyond the top quoted price. In that case, it indicates a strong support or resistance level, suggesting that the market has robust liquidity and can absorb large trades without significant price shifts.

This tool is handy for traders looking to execute large orders. By analyzing the depth of the market, traders can strategize their entry and exit to minimize impact cost and slippage. Moreover, observing how these orders change in real time can provide insights into market sentiment and potential shifts in liquidity, enabling more informed trading decisions. Using Level 2 data, traders can spot liquidity and potential price manipulations or imbalances in buy and sell orders, which could indicate upcoming price movements.

3. Volume Indicators

Volume indicators like On-Balance Volume (OBV), Volume Oscillator, and Money Flow Index (MFI) are critical for analyzing the liquidity and strength of price movements. These tools assess how volume correlates with price changes, helping traders determine whether a price move is supported by substantial trading volume, which suggests higher liquidity. For instance, an increasing Volume in the chart below suggests that substantial moves can be expected on the GBPUSD chart:

On the other hand, low volume, as seen in the USDTRY chart below, suggests low volatility, hence an unsuitable trading environment, especially for day traders:

The Volume Oscillator measures the difference between a fast and slow volume moving average, indicating whether overall trading volume is increasing or decreasing. This can help traders identify whether the market is gaining or losing momentum and liquidity. The Money Flow Index indicator combines price and volume to measure buying and selling pressure, helping to confirm whether price changes are likely to continue or reverse based on the market’s liquidity.

Utilizing these volume indicators effectively can help traders better understand market conditions and utilize different volume trading strategies. They can identify periods of high liquidity that are optimal for trading and avoid times of low liquidity, which could result in unfavorable trading conditions such as increased slippage and wider spreads.

Most Liquid FX Currency Pairs in 2024

When discussing the most liquid FX currency pairs in 2024, certain pairs consistently show higher trading volumes due to their economic significance and the large number of market participants involved. Here’s a detailed look at some of the most liquid currency pairs as of 2024:

| Currency Pair | Common Name | Market Share | Average Spread (pips) | Key Influences | Uniqueness |

| EUR/USD | The Fiber | 28% | 0.6 – 2 | Political and economic events in the US and Japan | Benchmark for global economic health, used in financial forecasting |

| USD/JPY | The Gopher | 13% | 0.7 – 2 | Oil prices, the economic health of North America | Correlates with Japanese industrial exports and overall market risk |

| AUD/USD | The Aussie | 6.8% | 0.6 – 1.9 | Commodity prices (gold, iron ore) | Proxy for global economic health, especially within Asia and the commodities market |

| USD/CAD | The Loonie | 4.4% | 0.7 – 2.0 | Economic disparities between the UK and Japan | Indicator of economic relations between the US and Canada, oil prices impact |

| GBP/USD | Cable | 9.6% | 0.8 – 2 | UK economic events, Brexit, US data | Known for volatility, offers speculative opportunities |

| NZD/USD | The Kiwi | 4.1% | 1.2 – 2.5 | New Zealand’s agricultural exports | Measures global risk sentiment, reflects Asia-Pacific economic conditions |

| GBP/JPY | The Dragon | Less Known | 2 – 4 | Economic disparities between UK and Japan | High volatility, rapid price movements, high-risk trading |

| EUR/JPY | 3.2% | 1 – 2 | Economic activities in Europe and Japan | Used as a cross pair for avoiding USD, reflects Euro-Asian economic stability | |

| AUD/JPY | Less Known | 1 – 3 | Australian commodity exports, Japanese investment flows | Barometer for Asia-Pacific economic health, sensitive to market shifts |

How Can Liquidity in Forex Affect Your Trading Success?

In sum, liquidity in forex trading is similar to the oil that greases the wheels of the market, facilitating smoother transactions and ensuring that traders can execute orders with minimal cost and delay. High liquidity equates to narrower spreads and reduced slippage, allowing trades to be executed at prices close to those seen on screens, thus upholding the sanctity of planned strategies. This consistency is crucial for traders who rely on precise entry and exit points to maximize gains and minimize losses.

Moreover, when you are trading financial markets, a liquid market is a synonym for stability and efficiency, which ultimately can help you achieve consistency in trading. Prices reflect a true consensus of value among participants, reducing the likelihood of price manipulation and providing a more fertile ground for the application of technical analysis. For traders, operating in such an environment means access to fair pricing and the ability to act on reliable market data.

Therefore, understanding and leveraging liquidity can profoundly influence your forex trading success, whether one’s strategy hinges on quick scalp trades or long-term positioning.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.