- The ICT Silver Bullet trading strategy is a time-based algorithmic trading strategy that relies on Fair Value Gaps and Liquidity.

- The key timings to look for trade setups using the Silver Bullet strategy are the London Open (3 AM to 4 AM), New York AM Session (10 AM to 11 AM), and New York PM Session (2 PM and 3 PM).

- The primary goal of the ICT silver bullet strategy is to capture short-term price movements, making it an ideal strategy for intraday trading.

“To quit your job, you need something that repeats every day and yields five handles.” That was what the man behind the ICT trading method, Michael J. Huddleston, said about the ICT Silver Bullet trading strategy. If this strategy is effective enough to cause you to help you make consistent profits in trading, you’ll likely want to know more about it. So, what is this trading strategy? Can it help in making consistent profits in trading?

The rest of this piece explains the Silver Bullet trading strategy and how to trade it.

Table of Contents

Table of Contents

- What is the ICT Silver Bullet Strategy

- Key Concepts in the ICT Silver Bullet Trading Strategy

- Key Timings for the ICT Silver Bullet Strategy

- The ICT Silver Bullet Strategy – Trade Example

- The Ideal ICT Silver Bullet Trading Strategy Framework

- The ICT Silver Bullet Strategy PDF

- What is the Best Time Frame for the ICT Silver Bullet Trading Strategy?

- Is the ICT Silver Bullet a Profitable Trading Strategy?

- Frequently Asked Questions

What is the ICT Silver Bullet Strategy?

The ICT Silver Bullet trading strategy is a time-based algorithmic model that involves catching trade entries within specific one-hour intervals during the trading day using Smart Money Concepts like liquidity and fair value gaps. The strategy, which is part of the Inner Circle Trader strategy, hinges on the idea that the price tends to hunt for areas of liquidity during these 1 hour time intervals.

On a price chart, the ICT silver bullet looks like that:

The general idea of the silver bullet is to exploit price changes using key trading windows when different markets open. As such, it is an ideal technique that may work perfectly with the Opening Range Breakout strategy.

Key Concepts in the ICT Silver Bullet Trading Strategy

The Silver Bullet relies on two significant components under the ICT concept umbrella: fair value gaps and liquidity zones.

Fair Value Gaps

Fair Value Gaps (FVGs) in trading refer to imbalances in price action, where the market moves so rapidly in one direction that it leaves behind a gap between consecutive candlesticks. On the chart, it’s that gap on the middle candlestick created when the wicks of the first and third candlesticks don’t connect.

The Fair Value Gap is an ICT concept that deserves its own piece, and we hae it here:

Liquidity Zones

Liquidity zones are those areas that have a lot of pending stop orders. The idea is that big market players often drive the price to trigger these stop orders to generate enough liquidity for their big moves. Common areas of liquidity include daily highs and lows, weekly highs and lows, and session highs and lows.

If you’re struggling with the concpet of liquidity in trading, we have just the perfect solutions for that:

Key Timings for the ICT Silver Bullet Strategy

There are many tweaks and adjustments that have been made to the ICT Silver Bullet strategy. Regardless of these tweaks, though, one thing that has mostly remained unchanged across the board is that the strategy only offers opportunities within specific one-hour trading intervals that occur three times in a trading day. We call these the key timings for the ICT Silver Bullet strategy.

| Session | Time (New York Time) |

| London Open | 3 AM to 4 AM |

| New York AM Session | 10 AM to 11 AM |

| New York PM Session | 2 PM to 3 PM |

Based on these key timings, traders exploit the high liquidity, and a potential market structure shift around these hours to make short-term intraday trades. Your trade setup and trade entry must happen within any of these intervals before you can consider it the Silver Bullet. But once you get an entry, you can hold your trade beyond the interval.

The ICT Silver Bullet trading strategy is a time-based algorithmic model that involves catching trade entries within specific one-hour intervals during the trading day using Smart Money Concepts like liquidity and fair value gaps.

The ICT Silver Bullet Strategy – Trade Example

As mentioned before, there are many variations of the Silver Bullet Trading Strategy out there, and you’ll find many of those on YouTube. However, the simple Silver Bullet trading strategy, as described by the ICT developer, is what we’ll be describing here.

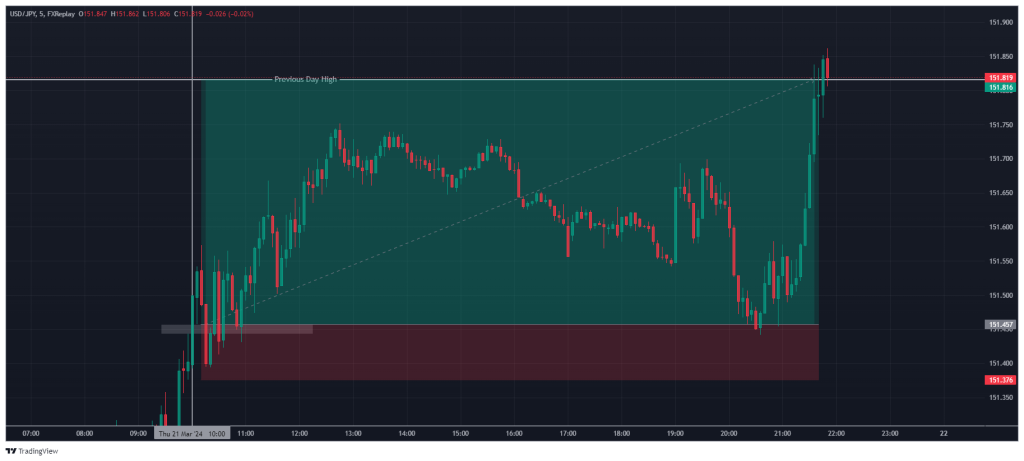

In this example, we’ll be trading the USD/JPY pair. Here it goes:

1. Wait for Your Trade Time

The Silver Bullet strategy should not be traded at any time and anyhow. The approach involves a combination of time and price. In this example, we’ll trade the 10 AM to 11 AM (New York time) interval.

2. Determine the Overall Market Direction

Once you get into your session, zoom out into the 15-minute, hourly, or 4-hour chart. At this point, you’re looking for the overall market direction because that’s the direction you want to trade in. Now, this skill takes a lot of practice to master and can be quite tricky, even for professional traders. So, take your time practicing it.

In the example below, notice how the price is on an upward incline in the 15-minute timeframe. The same goes for the 1-hour timeframe, suggesting that the market’s overall direction is bullish. That is why we’ll only be scouting for bullish positions in the 5-minute timeframe.

Note that sometimes, you may need to go higher than the 1-hour timeframe to grasp the daily bias of the price action. Understanding where the market is going is important in helping you take only the high-probability setups.

3. Mark Out Your Liquidity

While you’re on the higher timeframe, mark out the liquidity, which can take any of the following forms:

- The previous session’s high or low

- The Previous day’s high or low

- The Previous week’s high or low.

In our example, we marked out the previous day’s high and low as the two liquidity areas we’ll be targeting.

Other forms of Liquidity in the ICT Silver Bullet strategy include the following:

- Return to current or old week opening gap

- Expansion away from current or old week opening gap.

- Classic ICT optimal trade entry (OTE).

- Confluence of ICT 2022 mentorship Model.

4. Trade Entry

Next, wait for the formation of the first fair value gap in the direction of the overall market trend. This FVG forms the basis of your trade entry.

Place your limit order at the edge of the FVG closest to your trade direction. For instance, if you’re going long, place your buy limit at the top of your FVG. And if you’re going short, place your sell limit at the bottom of your FVG.

Continuing with our example, our high timeframe bias is bullish. So, our entry will be on the first FVG that forms in the bullish direction. And don’t forget, it must fall within the 10 AM to the 11 AM interval.

5. Stop Loss and Take Profit

There are many ways to manage your risk using this strategy. For your stop loss, place it at the bottom of the first candlestick of your FVG formation in a bullish trade and at the top of the first candlestick of your FVG formation in a bearish trade.

Another way to set stop losses is to place them below the most recent swing low in a bullish trade or above the most recent swing high in a bearish trade.

For your take-profit target, you can target a 1 to 2 risk-to-reward ratio. In other words, for every percentage of your account you risk, your target is double that.

Alternatively, you can set your take profit to target the next liquidity. For instance, you target the next buy-side liquidity for long trades and the next sell-side liquidity for short trades.

Looking at our example, you’ll notice that we targeted the previous day’s high as our take profit and placed our stop loss right underneath the first candlestick of the FVG formation. See how the trade turns out here:

The ICT Silver Bullet Strategy PDF

Here, you can download the ICT Silver Bullet Strategy PDF for free so that you can easily refer to it whenever you need to:

The Free ICT Silver Bullet Strategy PDF

The Ideal ICT Silver Bullet Trading Strategy Framework

Now that you’ve seen the typical ICT trading strategy at work, it’s worth mentioning that not all entries are worth taking. This is where the Silver Buller framework comes into place. When using the ICT silver bullet strategy, you should have a target in mind to enter a trade.

So, the Ideal Silver Bullet framework defines the minimum distance between the entry and your closing liquidity for the best-case price delivery. In other words, if everything were perfect, this framework defines the minimum amount of pip or ticks or points your entry must be from the exit liquidity.

For example, when trading forex pairs, the minimum trade framework is 15 pips. For indices or index futures, you can aim for 10 points. So, suppose the EUR/USD move you’re trying to catch using the Silver Bullet trading strategy is about 20 pips from your entry to your target liquidity. In that case, you’re still within the ideal ICT Silver Bullet trading framework.

What is the Best Time Frame for the ICT Silver Bullet Trading Strategy?

One key question that comes to mind of many traders is what the ideal timeframe to use when utilizing the ICT silver bullet strategy is. So, since the strategy is mostly regarded as scalping or day trading, the best timeframe for the ICT Silver Bullet Strategy is any timeframe lower than the 15-minute timeframe. The reason for this is that, as we mentioned up there, the strategy only appears within specific timings that are only one hour long. There can only be four 15-minute candlesticks within an hour, which doesn’t leave much space for taking entries. So, lower timeframes are best for the ICT Silver Bullet trading strategy.

You could trade the strategy on the 5-minute timeframe or the 1-minute timeframe. ICT founder himself used the 5-minute, 3-minute, and 1-minute timeframes. For that matter, it could be useful to use the multiple time frame analysis technique, which enables traders to view several time frame charts on one or more screens.

If you’re new to this strategy, we recommend starting with the 5-minute timeframe. You’ll have more time to analyze the chart and place your entries in the 5-minute timeframe. The downside, however, is that you might miss some trading opportunities. As you get better with the strategy, you can move to the 3-minute and the 1-minute timeframes.

However, this is not to say that you can’t use the higher timeframes to get a broader market perspective. Many traders who claim to have used the Silver Bullet strategy successfully have added something called “high-timeframe bias,” which is just another way of saying they try to see the overall market trend on the higher timeframe before going into the smaller timeframes to scout entries.

Is the ICT Silver Bullet a Profitable Trading Strategy?

The ICT Silver Bullet strategy is selectively profitable. From our backtests, we found that some months were exceptional for trading this strategy, while some were abysmal. July 2023, for instance, was a great month for this strategy on the NAS100 index based on our backtesting results, but it was quite hard to replicate that result with other months.

Like many other trading strategies, the Silver Bullet strategy is effective, but it needs a lot of practice and work from the trader. As a result, you may not hit profit as quickly as you might have anticipated using this strategy. Like any other strategy, it takes time and effort to master this strategy. But once you find that you’re comfortable with it, trade it until you’re profitable. All in all, it’s a very simple strategy and one that has gained lots of good reviews from many who used it.

FAQs

What are the best forex pairs for the ICT Silver Bullet trading strategy?

While you can try out the Silver Bullet strategy on any forex pair of your choice, major forex pairs like the EUR/USD, GBP/USD, and USD/JPY seem to be the most common forex pairs for the Silver Bullet strategy. That is largely because these forex pairs have enough liquidity to provide the ideal conditions for the ICT silver bullet strategy. Additionally, the ICT silver bullet can only work with low-spread instruments, which means you also need to search for brokers that offer competitive spreads.

How can you learn the ICT Silver Bullet strategy?

This article explains the ICT Silver Bullet strategy without fuss or complications. However, you can check out other variations of the Silver Bullet Strategy on YouTube. And if you want to see the original ICT video where Michael J. Huddleston introduces the Silver Bullet, you can find it here.

What is the success rate of the ICT Silver Bullet strategy?

The success rate of the Silver Bullet strategy varies widely, depending on the trader, the market conditions, and the trading conditions. It is common for the strategy to perform exceptionally well in one month, be completely disastrous in another, and be simply average in others. Also, you’ll notice that if you backtest the Silver Bullet strategy as far back as before 2023, the results vary widely from the 2023 results. Having said that, it is said that the ICT silver bullet strategy has a win rate of around 70%-80% if, of course, used properly.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.