- There are two ways to become a prop trader—the interview route and the evaluation/challenge route.

- The interview route involves formal applications and the interviewing process, just like any other job. The evaluation/challenge route involves taking trading challenges to prove you’re a profitable trader.

- Before joining any prop trader, consider their monthly fees, profit split, trading rules and conditions, credibility, and scaling plan.

Building a prop trading career is more easily attainable than you might expect, especially today. Many prop trading firms offer beginner and experienced traders an opportunity to trade the markets with the firm’s capital and receive a share of the profits.

Getting a funded trading account from a prop trading firm is straightforward. Anyone interested can apply to work as a proprietary trader and get the opportunity to trade with a funded account.

In this article, you’ll learn:

- How to kickstart your prop firm trading journey by becoming a prop trader.

- How to build a career as a prop firm trader

- You’ll also see the benefits and limitations of being a prop trader.

Table of Contents

Table of Contents

- What is a Prop Trader?

- How Can You Become a Funded Trader?

- How Much Do Prop Traders Make?

- Ways to Build a Career as a Proprietary Trader

- 7 Things to Consider Before Becoming a Proprietary Trader

- Becoming a Prop Trader – Pros and Cons

- Do You Need Qualifications to Become a Proprietary Trader?

- How Do You Get Into Prop Trading?

- What is the Purpose of Proprietary Trading?

- Final Thoughts

What is a Prop Trader?

At its basic level, a Prop Trader is any individual who trades the financial markets with a financial firm’s capital or other people’s money. Prop trading firms allow proprietary traders to use the firm’s capital to make profits and share the profit with the company based on a predefined arrangement.

Prop traders typically focus on one market or asset—stocks, options, ETFs, commodities, FX currency pairs, and futures contracts. Using the firm’s capital and various trading tools and services, their goal is to develop a structure and profitable trading strategies to receive a share of the earnings they generate from their trading.

Usually, prop trading firms do not pay their contractors a base salary. However, some proprietary trading firms pay a minimal monthly salary to help their prop traders solely focus on getting the best trading results.

That said, you will have a predetermined share profit from your monthly earnings. In that aspect, most prop trading firms offer a split profit percentage of around 25%-50%, although some firms have a higher profit distribution of up to 75%.

How Can You Become a Funded Trader?

Nowadays, getting into prop trading is easier and more affordable than ever. Many remote trading firms have been offering services to online traders who can trade from any location using their tools and rules. Depending on the prop firm you’re trading with, there are two major ways to become a prop firm trader. These two methods are:

- Through the interview process

- Through the evaluation/challenge process

1. Interview Process

To become a funded trader through the interview process, you must apply for a funded trading program by filling out a form and informing the prop firm about your background, education level, and trading experience. Depending on the prospective prop firm, you might have to go through an interview process to discuss your trading skills, experience, the market you prefer to trade in, and the trading strategy you wish to use.

Once you have completed the application process and the prop firm has accepted you, you can start your evaluation period, which ranges between 30-60 days on most online proprietary trading firms. In this period, prop traders must prove their ability to generate profits and meet the company’s requirements to continue to the next level.

2. Evaluation/Challenge Process

To become a prop firm trader through the evaluation process, you only need to prove to your prop firm that you can be profitable by taking some trading challenges. In these challenges, the prop firm gives you a demo account where you must trade and achieve a profit target within a specific period while adhering to the firm’s rules.

For instance, a prop firm may offer a challenge to hit an 8% profit target within 60 days without losing 5% of your capital in a single trading day (max daily drawdown) or 10% of your capital altogether (max drawdown). You can access these challenges by buying them from the prop firm.

If you pass the challenges, you get a funded account where you can start trading, and your trading profits are split between you and the prop firm. Many prop firms do 70/30, where you keep 70 while they keep 30. But if you fail the challenge, you forfeit the amount you used to purchase your challenge account.

Thanks to this route, profitable traders who don’t have the capital and the resume can still get funded capital access.

Depending on the amount of prop firm equity you want to trade, the challenge cost varies. For instance, if you want to trade a $5000 prop firm account, many prop firms sell the challenge for $35-$50. And if you want to trade a $100,000 prop firm account, many prop firms sell the challenge for $400-$600.

However, there’s no difference between a $5000 challenge and a $100,000 challenge beyond the cost of acquiring them. For both challenges, you prove your trading expertise through demo/paper trading.

How Much Do Prop Traders Make?

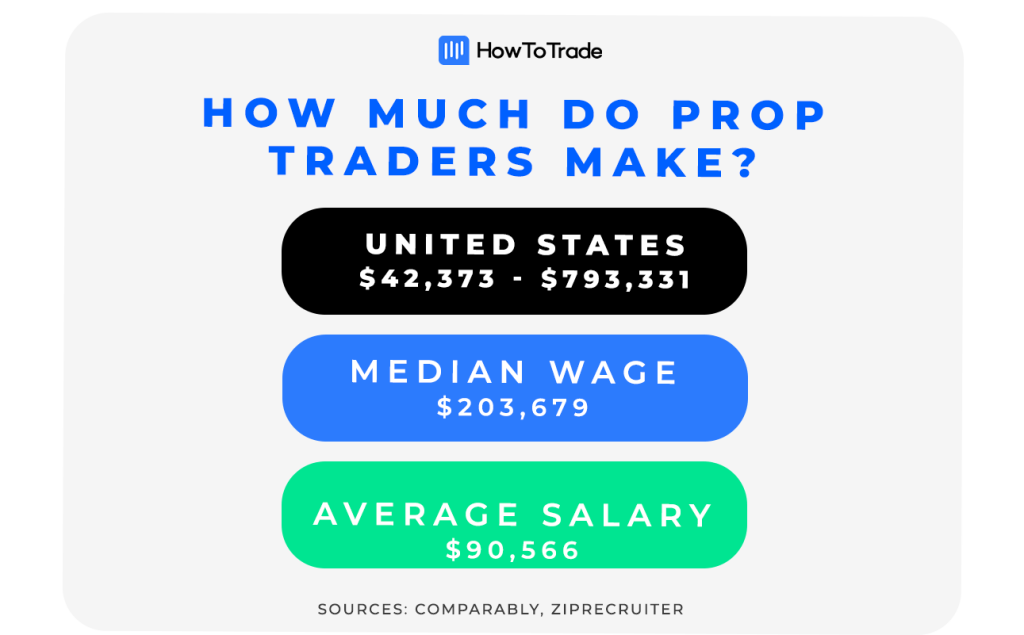

So, the big question is how much you can make as a prop trader, right? Salaries for prop traders vary across countries and are mostly based on your trading performance.

In prop trading, bonuses are everything. As prop traders get paid by splitting their profits with the prop firm, they theoretically have unlimited profit potential. According to Comparably, prop traders’ salaries in the United States range from $42,373 to $793,331. The median wage of a prop trader is $203,679. According to ZipRecruiter, the average proprietary trader salary stands at $90,566 per year.

3 Ways to Build a Career as a Proprietary Trader

Some proprietary traders use a bachelor’s degree and take the regular route to enter the field; however, this is not necessarily required. There are different ways to get into the prop trading field, especially with the rise of remote work. These include:

1. Funded Trading Account – Becoming a Funded Trader

Over the last years, many trading programs have been designed to offer traders an online funded trading account. By applying to one of these programs, a funded trader can potentially receive a proprietary-funded account with the company’s capital.

Once the prospective trader is qualified and meets all the prop firm’s requirements, they get access to a fully funded account with a specific account size and the company’s resources. Next, prop traders have an evaluation period during which they must follow certain predetermined conditions and risk management rules and guidelines.

While there are crucial factors to consider before applying to a funded trading program, funded trading is one of the best options for starting a career in trading. It enables you to enter the markets immediately without taking any risk of capital while keeping a large share of the profits for yourself.

2. Proprietary Trading Firm

The most conventional way to become a prop trader is to earn a bachelor’s degree, search for a top legitimate trading firm or an investment bank with positive reviews, and start the application process.

Top prop trading firms usually have an internship period of 6-12 months; during this time, they provide training and mentoring. Through this mentoring, you can learn new trading strategies and trading styles, and so much more. Additionally, during the training period, traders are not required to maintain a profitable account balance.

Instead, they must learn risk management rules the prop trading firm sets, get all the expertise needed to master a certain market and develop a trading strategy and style. Typically, professional trading firms expect their prop traders to become profitable six months after starting their internship.

3. Find Investors and Get Trading Capital

Finally, another way to become a prop trader is to search for investors willing to fund your account independently.

Usually, to do that, you need a proven trading track record to show your potential investors you can generate profits for them. Further, this method requires connecting with large investors or hedge funds and getting capital via different networks.

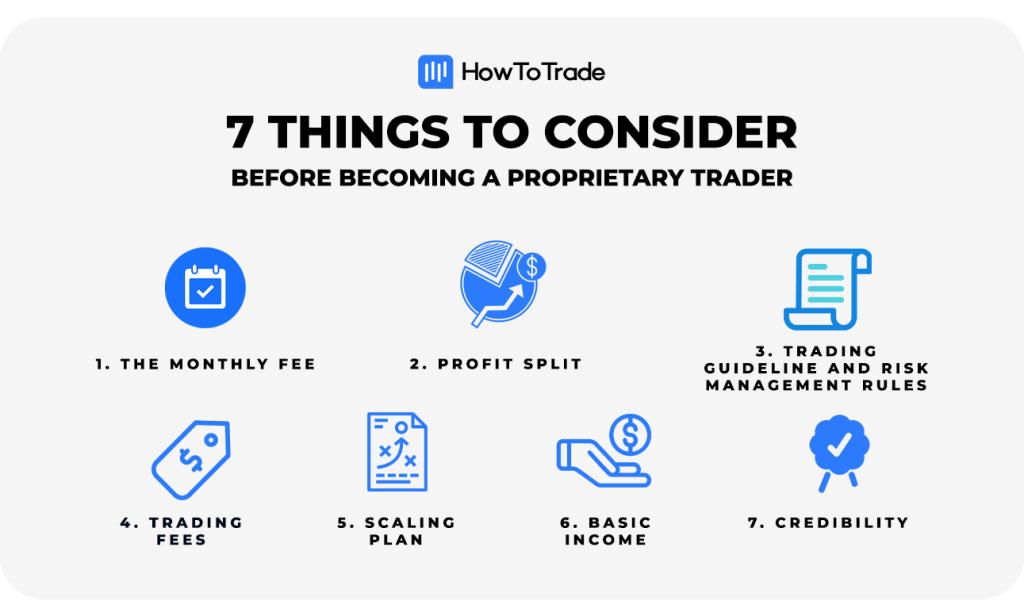

7 Things to Consider Before Becoming a Proprietary Trader

If you are keen to start your career as a prop trader and you have found the way that is best for your trading needs, you need to take into account the following factors:

1. The Monthly Fee

Most prop trading firms charge a monthly fee for offering a funded trading account. After all, they take a huge risk by allowing other traders to use their capital, so the monthly fee balances their risk.

Typically, the participation fee on most platforms ranges from $100-$150 per month for using the firm’s capital and accessing its platforms and real-time data. In addition, some of these platforms also charge a one-time payment of $100-$1000.

2. Profit Split

Prospective proprietary traders are usually curious about the profit split percentage. Most prop trading firms in the industry offer a 50%-50% profit split.

However, some companies even offer a higher share profit percentage of up to 75%, which is the ideal profit split rate for a funded trading account.

3. Trading Guideline and Risk Management Rules

Every trading firm has different trading guidelines and risk management rules. This includes the maximum daily drawdown (daily stop-loss), overall drawdown, maximum daily transactions, daily and overall profit target levels, trade restrictions per market or asset, and many more.

As an experienced trader, you should carefully examine the trading guidelines to determine whether they match your trading strategy. If you are a new trader, we advise you to contact other traders who use the company’s services to confirm it is doable to make profits with the terms and conditions offered by the prop firm.

4. Trading Fees

Another crucial factor you need to consider is the trading fees and costs charged by the prop firm. Trading fees are a big deal for day traders who make 100-500 transactions in one trading day. In some scenarios, you may have a winning trading day, but you’ll end the day with a loss due to the fees you must pay.

To solve this problem, ask the prop trading firm what the platform fee is, the trading fees for the chosen market you are going to trade on, and if there are any hidden fees or costs you need to know about (withdrawal fees, for example). Additionally, we suggest you ask your prop firm if they have a rebate trading program.

5. Scaling Plan

Prop trading firms usually offer a scaling plan to enable the trader to grow and increase the account size based on the trader’s success. For example, a prop trading firm can offer an initial account size of $50,000 and allow you to increase your account balance as part of its program. If the trader succeeds in finishing the first evaluation period in profit, the prop firm gives the investor the option to scale to the next level with a larger account size.

6. Basic Income

As previously mentioned, some prop trading firms offer a base monthly salary, though it tends to be relatively low and can affect your profit-sharing agreement. These base salaries are generally provided to cover traders’ basic costs and help them focus on their trading success.

Still, it is very unlikely to find a remote prop trading firm offering a base salary. So, if you insist on getting a stable income, you will need to get accepted to one of the biggest prop trading firms in the industry, choose the traditional way of going to the office, and work alongside other traders and managers.

7. Credibility

Last but most importantly, ensure the prop trading firm has good user reviews and a positive reputation. Visit the company’s website to check its terms and conditions page and the trading agreement. Also, look at TrustPilot and other trading forums and websites to get an insight into the company and its services.

What are the Benefits and Limitations of Becoming a Prop Trader?

Like any other profession, there are advantages and disadvantages to choosing a professional prop trader career. Knowing the highs and lows of proprietary trading can be valuable for making a decision and help you make a smooth entrance to the field if you decide to take this path.

So, here are some of the main pros and cons you need to consider.

Pros

- Easy entry requirements

- Offers high earnings potential

- Exciting job

- Access to a large sum of capital, technological resources, and financial services

- A trader has no risk of capital

- Low trading fees

- You gain trading skills and learn your psychological strengths and weaknesses

- Many prop trading firms offer rebate programs

Cons

- High level of competition

- Usually, there is no basic income

- Prop trading is a highly stressful job

- Proprietary trading has become much more challenging due to automated trading machines and high-frequency trading (HFT)

- Some trading firms charge a high monthly fee

Do You Need Qualifications to Become a Proprietary Trader?

Generally, you do not need a college degree or particular qualifications to become a prop trader. Proprietary trading firms normally do not have strict requirements regarding paper qualifications. Instead, they are looking for diversity on a team, and very often, each individual has a different background and experience.

How Do You Get Into Prop Trading?

There are several ways to get into prop trading. The first option is to search for a reputable prop trading firm, apply for a job, and start an internship if accepted. Otherwise, you can use a legitimate online proprietary trading service to get a funded trading account.

What is the Purpose of Proprietary Trading?

For financial firms, hedge funds, and individual investors, the essence of proprietary trading is to utilize the company’s capital and other technological resources to execute an overall profitable balance sheet. They do not have any clients, and their only goal is to generate profits.

From the perspective of exchanges and financial market regulators, proprietary trading aims to add liquidity to the markets and develop a functioning market. Therefore, many prop trading firms receive monthly rebates from exchanges, which are proportionally given to their prop traders in return for adding liquidity to the market.

What is the Difference Between a Hedge Fund and a Proprietary Trading Firm?

The key difference between a hedge fund and a proprietary trading firm is that the former uses investors’ capital to generate profits. At the same time, the latter has its own capital to trade and invest.

Final Thoughts

In conclusion, becoming a prop trader is a reasonably simple process. All you need to do is find a reliable prop trading firm offering a funded trading account and start your application. Through this process, you need to consider several factors, such as the size of the account, the profit split percentage, the trading platforms and tools provided by the firm, and the monthly cost charged by the prop firm.

Once you do that, you can entirely focus on improving your trading skills with the support you receive from the firm’s mentors. Trading is hard, and it might take months or even years to become a consistently profitable prop trader. However, getting access to a funded trading account is perhaps the most accessible way to become a professional trader and build a career as a trader.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.