The Greenback received a boost yesterday when the Retail Sales report showed signs of strong consumer spending, forcing the EURUSD a little lower. In the medium term, investors will keep close tabs on the developments of the geopolitical unrest in the Middle East.

Key Points

- Retail sales reports from the US showed signs of strong consumer spending in March.

- Notable speakers from either side of the pair speak today, and investors will keep a close watch for financial policy hints.

- The price currently ranges between the 1.06154 support and 1.06591 resistance.

EUR/USD Daily Price Analysis – 16/04/2024

The EURUSD ended Monday with a 0.16% loss, closing at 1.06333. As of the time of writing, it is currently down by 0.3% from yesterday’s close.

For the Greenback, yesterday’s retail sales report showed that consumers were on a spending spree in March, which is a positive sign from the US’s perspective. Coupled with the most recent CPI data, which makes it all but certain that the June rate cut is highly unlikely, only a slightly hawkish position by Fed Chair Powell today could strengthen the greenback against its counterpart. In the Eurozone, there are still expectations for as many as three rate cuts before the end of this year.

Additionally, investors will keep a close watch on the situation in the Middle East, which may taint this trading week with some hesitancy.

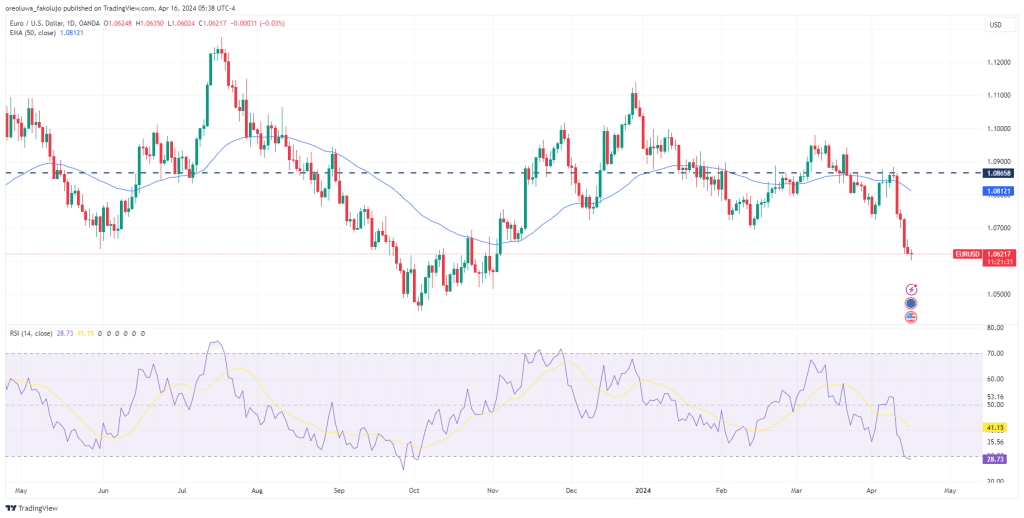

From the technical perspective, the EMA paints a bearish outlook for the pair as the price falls farther beneath the EMA line. The RSI echoes this outlook, even slightly dipping into the oversold region.

EUR/USD Intraday Price Analysis – 16/04/2024

After a huge descent, the pair has come to rest between the 1.06154 support and 1.06591 resistance after briefly dipping below the support on Monday. The peak of this descent can be traced as far back as the 9th of April. Since the fall, the price has broken through several support levels, leaving them behind as resistances, including the most immediate 1.06591 resistance, 1.07270, and 1.07999.

If the bearish sentiment continues, however, the 1.06154, 1.05674, and 1.05218 support levels await the price.

Key Economic Data for the EUR/USD Pair – 16/04/2024

Apart from Fed Chair Powell’s and German Buba president Nagel’s speeches later today and the US Industrial production reports, not much is expected to happen today. As a result, investors will be closely monitoring the two speakers today to get hits about financial policies that might impact the market.

EUR/USD Key Pivot Point Price Levels 16/04/2024

Based on the 1hr chart, the key Pivot Point price levels for EUR/USD are these:

- P: 1.07165

- R1: 1.08103

- S1: 1.05480

- S2: 1.04542

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.