- Tick scalping is a high-frequency trading strategy involving numerous trades over a short period, focusing on capitalizing on the bid-ask spread in order to capture a tick in every trade.

- Tick scalping strategies are applicable across various markets, including futures contracts, forex, and CFDs, and relies on access to level 2 trading data for better market insights.

- Successful tick scalping requires speed and precision, often utilizing advanced trading platforms and automated systems for rapid trade execution and minimal human intervention.

If you’ve ever heard of high-frequency trading, tick scalping is somewhat similar to that. It operates on the premise of making swift, numerous trades to capitalize on small price changes.

In this article, we’ll delve into the core ideas of tick scalping, its application in various market contexts, and the advanced tools that can help you harness the full potential of this trading strategy.

Table of Contents

Table of Contents

What Is Tick Scalping In Trading?

As the name suggests, the tick scalping strategy revolves around the goal of capturing one tick in a trade. Then, once a trader successfully develops a technique to capture a small number of ticks in each trade, the next step is to take a large number of trades in a trading session to accumulate these ticks. That’s the basic idea of the tick scalping strategy.

As a trading strategy, tick scalping encompasses two fast-paced systems; there is scalping, but at the same time, it is happening on a tick level. It is a high-frequency trading strategy that involves placing many trades in a short time frame just to capture one (or a bit more than one) tick in a trade. Traders using this strategy typically hold positions for a few seconds or minutes, aiming to make small profits on each trade by capturing small price movements. While the profits may be small, the cumulative effect of multiple trades can be significant.

Ultimately, tick scalping is an effective risk management strategy where traders minimize their risk and rely on a statistical formula to succeed.

What is the Difference Between a Tick Chart and a Time Chart?

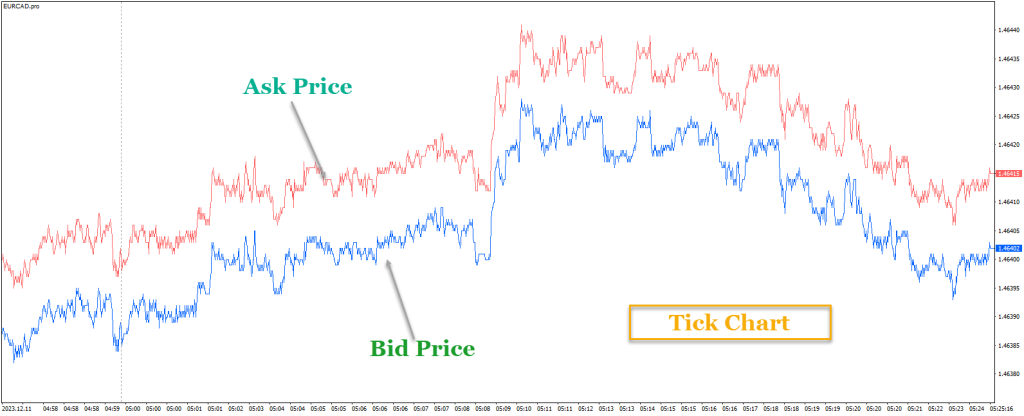

One key tool used by many tick scalping traders is a tick chart. But what is a tick chart, and how is it different from a time chart?

In terms of visualization, a tick chart looks pretty much the same as a regular bar or candlestick chart. The difference between the two is the way of measurement – standard charts, also known as time charts, measure time, which means the bar or candle changes in each predefined period (i.e. 5 minutes, 15 minutes, 1 hour, etc). On the other hand, a tick chart represents a certain number of ticks. Many traders prefer tick charts as it provides them with a more profound grasp of market dynamics.

Technically, a new candlestick or bar has been generated in tick charts after a particular amount of trades have occurred, regardless of time. In a 100-tick chart, for example, a new bar becomes established after every 100 deals (instead of minutes, hours, days, or months in a time chart). During periods of high volatility, this strategy provides an even more granular view of market activity as well as minimizes the number of bars during periods of low activity. Picking out time disparity on a tick chart can give a lowdown on the pace of the market.

Taking the above into consideration, it is pivotal at this point to look at the main features of each type of chart – time vs. tick chart:

| Tick Chart | Time Chart | |

| Measures | A predefined number of ticks | Intervals of time |

| Availability | Not available in all platforms and markets | Available in all trading platforms and markets |

| Key Feature | Provides more information, particularly to identify market trends and capture ticks | Since it’s often used by many traders, it is the standard form of analysis. Thus, it provides a more reliable way of market trading system |

| Best for: | Intraday trading | Long-term trading strategies |

What is the Idea of the Tick Scalping Strategy?

The idea behind the tick scalping strategy is very simple: capitalizing on the smallest change in transaction prices. It’s easier to capture one tick than to catch a big market trend.

To do this, traders are not looking to capture long market trends. Instead, they are looking for… one tick in a trade. But, to make consistent profits using the tick scalping strategy, tick scalpers often make hundreds of trades in a day.

As a result, fundamentally, the ideal market environment for utilizing the tick scalping strategy is a sideways market condition with low volatility. However, there’s a catch here. Markets with low volatility often come with wide buy and sell spreads, which makes it impossible to successfully capture ticks.

So, to tick scalping, you must find a calm market with tight spreads. This is normally available in the futures market or the forex market. For example, some of the best products for the tick scalping strategy are commodities such as grains (corn, wheat, soybeans, etc.), FX currency pairs, and stock market indices.

In the end, you want to collect as many ticks as possible during the trading day. That’s the idea of the tick scalping strategy – to capture a tick in each trade and make hundreds of trades in one day. And you must ensure that statistics is on your side. Remember, when you use the tick scalping strategy, you’ll lose more than one trade in a day. But if, for example, you take 100 trades in a day, and 60 of them are profitable, then you are a good tick scalp trader.

The idea behind the tick scalping strategy is very simple: capitalizing on the smallest change in transaction prices. Obviously, it’s easier to capture one tick than to catch a big market trend.

Tick Scalping Strategies

Like every other form of trading, tick scalping is a strategy that has other forms or ways embedded in it. There are certain ways to use the tick scalping strategy, and we will delve into two techniques to do that:

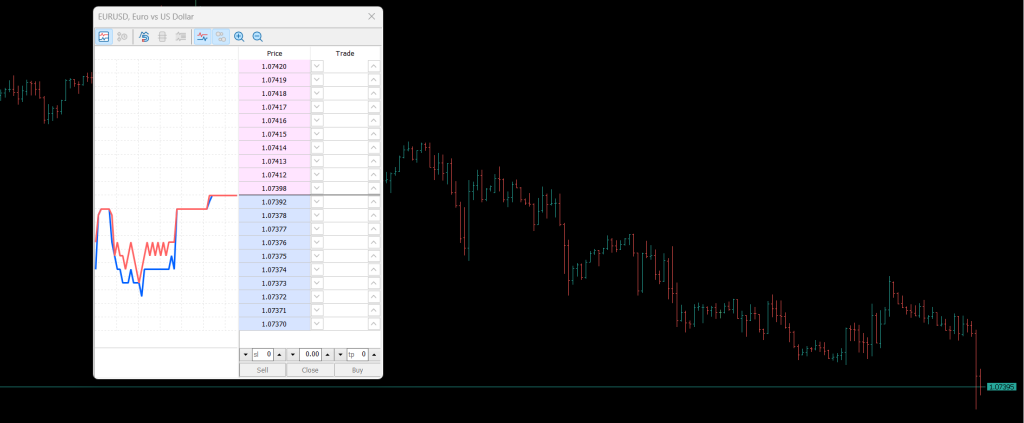

Tick Scalping with the Level 2 Market Data

Tick scalping is best paired with level 2 market data. As a trader, you can easily get blindsided if you only trade with level 1 data. Luckily, we have all the juice on level 2 trading, which gives you better insight into planning your trade, like the highest bid price, bid sizes, lowest ask prices, and ask sizes. The more information you have, the better you can plan your trade and stack your edge.

Now, when using level 2 market data, tick scalpers often place orders on one side and immediately try to close the position by placing an order on the other side. It is a very simple yet nerve-racking strategy.

Take note that Level II costs more than Level I for stocks and futures. Some brokers may provide all of the data feeds for free, but they typically charge higher commissions to compensate. At the same time, some forex brokers that provide Level II data usually don’t charge for it. All of this information is available in your order book.

Bear in mind, however, that the majority of forex and CFD brokers offer level 1 market data, which can also be used to utilize the tick scalping strategy. Here’s what it looks like on MT4:

As you can see, you can certainly use level 1 market data to capture ticks in forex trading and other financial instruments. However, to be on the safer side, you better combine the level 2 market data with tick charts. This is because some institutional traders can hide their position sizes using undisclosed quantities or create dummy orders to place large order blocks. The true situation of the market shows up on the charts.

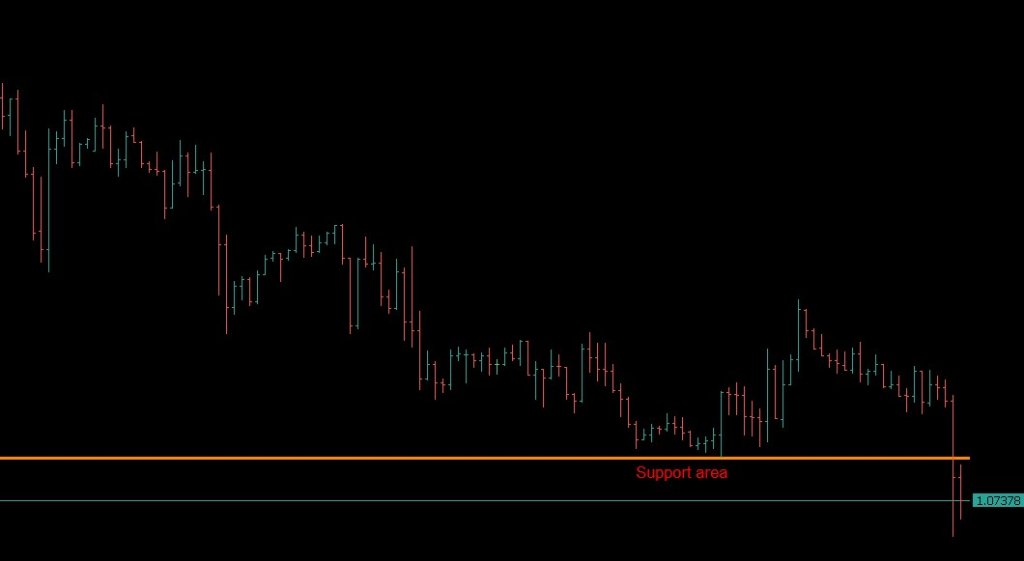

Tick Scalping with Tick Charts

If you can’t use level 2 market data, you can also utilize the tick scalping strategy with tick charts. This strategy form focuses on the charts without giving recourse to other supporting market data. With this technique, your intent is not to trade against the market data, but it is chart-focused and only analyzes other market data as a secondary source. Meaning you primarily rely on technical analysis charts.

Take note, however, that to succeed using this singular strategy, speed of execution is key. Scalpers often employ advanced trading platforms and direct market access (DMA) to ensure speedy order execution, minimizing the time lag between identifying a trading opportunity and entering a trade. It is also extremely recommended to use VPS service to reduce the latency and avoid disconnections and slippages.

Should You Use the Tick Scalping Strategy?

The tick scalping strategy can come in handy for those who have developed the systems for it; auto trading algorithms, or other levels of expertise with level 2 trading and tick charts. Tick scalping has its pros and cons; however, with reduced exposure to overnight risk, as all trades are closed before the end of trading day, it can be a good mix for day traders. What’s more, tick scalping reduces the exposure to market volatility.

Personally, as someone who extensively utilized the tick scalping trading style, I can tell you it works. This is especially true when the markets are not volatile, and there’s not much movement in the market. Ultimately, this strategy is all about statistics and developing a positive win-to-loss ratio over the long run. If you can do that, then you are the robot; you are the money-making machine. And from that point, the only challenge is to gradually increase your position size.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.