The straddle trading strategy is a powerful tool for traders looking to profit from market volatility without having to predict price direction.

- The straddle trading strategy involves buying a call and a put option with the same strike price and expiration date on the same underlying security. This allows traders to profit from significant price movements in either direction.

- This strategy is ideal during periods of high volatility or major market events when predicting price direction is challenging.

- While the straddle strategy offers the advantage of hedging against directional risk, it comes with high upfront costs due to option premiums and potential losses if the price movement is insufficient.

Whether you are new to options trading or seeking to enhance your strategies, this guide comprehensively explores the straddle strategy. From understanding its mechanics to learning how to execute it effectively, we explore how you can make the strategy work for you.

Table of Contents

Table of Contents

What is the Straddle Trading Strategy?

The straddle trading strategy is a unique approach designed for situations where you expect a significant price movement in an asset but are unsure of the direction. Have you ever considered a market event and thought, “Something big is going to happen, but I don’t know if prices will rise or fall”? The straddle strategy is built for moments like these.

The straddle strategy is an options trading technique designed for highly volatile markets. It involves buying both a call option (betting on a price increase) and a put option (betting on a price decrease) for the same underlying asset, strike price, and the same expiration date. You aren’t trying to predict the price direction; instead, you’re positioning yourself to profit from the magnitude of the move.

This strategy shines during earnings announcements, macroeconomic reports, or any event that could trigger significant price swings. Your objective is clear: leverage the inevitable market shake-up, regardless of whether prices skyrocket or plummet.

How the Straddle Strategy Works

Suppose you’ve identified an asset poised for a major price move. You’re not sure if it will rise or fall, but you know something big is about to happen. Here’s how you put the straddle strategy into action:

- Buy Two Options: Purchase a call and put options for the same asset. Ensure they have the same strike price and expiration date. These options are your tools to profit from any significant price movement.

- Understand the Scenarios:

- If the price of the underlying stock rises significantly, the call option becomes more valuable. While the put option loses value, the gains from the call option outweigh those losses.

- If the price drops significantly, the put option gains value as the price falls. The call option may lose value, but the profit from the put option compensates for it.

- Calculate Your Breakeven Points: To succeed, the price must move enough to cover the cost of both options (the premium). You calculate these breakeven points as follows:

- Upper Breakeven: Strike Price + Total Premium Paid

- Lower Breakeven: Strike Price – Total Premium Paid

- Monitor the Price Movement: Once the asset moves significantly in either direction, you sell the profitable option and lock in your gains.

The beauty of the straddle strategy lies in its adaptability. Instead of predicting the price direction, you position yourself to profit from the magnitude of the move. This makes it an excellent choice for traders during periods of high uncertainty or impending volatility.

How to Use The Straddle Strategy in Trading

Ready to apply the straddle trading strategy? Here’s a step-by-step guide to help you navigate the process effectively:

1. Identify a Volatile Event

Look for events that could shake the market. Think about earnings announcements, government policy decisions, or economic reports. Choose an asset likely to react strongly to the news.

2. Research Historical Volatility

Study how the asset has behaved during similar past events. Was there a significant price movement? Assets with a history of sharp swings are better suited for the straddle strategy.

3. Assess Option Costs

Calculate the total premium for the call and put options. Ask yourself: “Will the expected price movement justify the cost of these options?” Only proceed if the potential profit outweighs the cost.

4. Execute the Trade

Purchase a call and a put option simultaneously with the same strike price and expiration date. Ensure the strike price aligns closely with the current market price to maximize your opportunity.

5. Monitor and Adjust

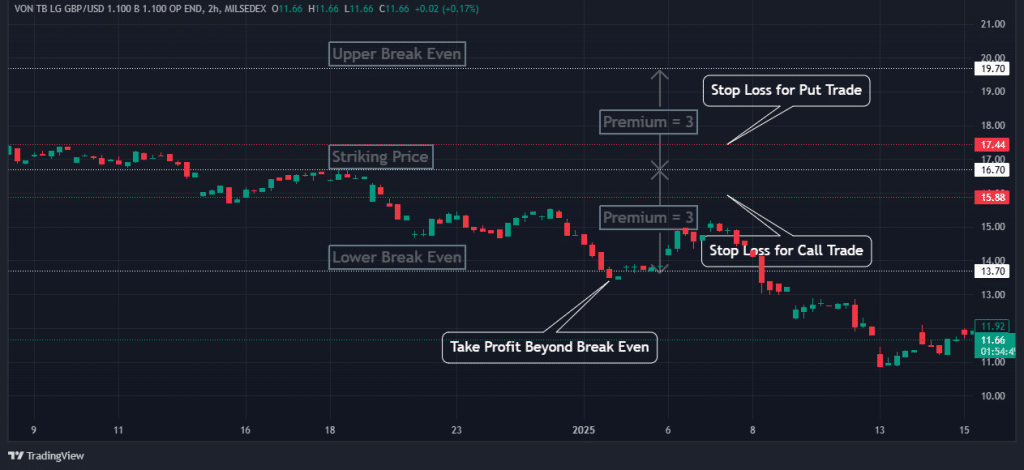

Keep an eye on the asset’s movement. If the price breaks beyond your breakeven points, close the profitable option to secure your gains. Be ready to act quickly as market conditions evolve.

The key to success is preparation. By planning your trades around significant events, you maximize your chances of turning market uncertainty into profitable opportunities.

How to Trade Financial Assets Using the Straddle Trading Strategy

Let’s see the straddle strategy in action. Suppose you’re trading a stock, Stock XYZ, currently priced at $100. You anticipate a major event, a product launch or a quarterly earnings report that could trigger a big price swing. Here’s how you execute the strategy:

1. Purchase the Options

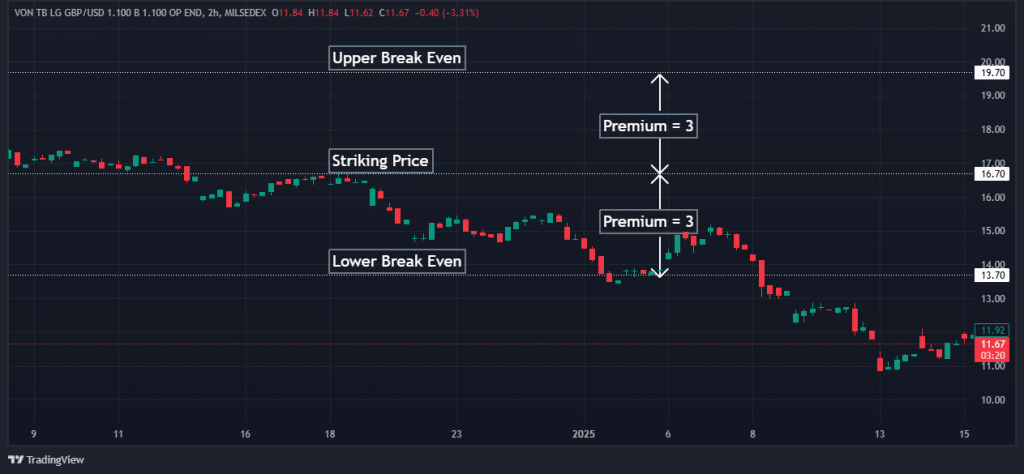

Buy at $16.70 call option and a $16.70 put option, each expiring in two weeks. Assume the call option costs $1 and the put option costs $2, for a total premium of $3.

2. Calculate Breakeven Points

Determine where the price needs to move for the trade to be profitable.

- Upper Breakeven = Strike Price + Premium = $16.70 + $3 = $19.70

- Lower Breakeven = Strike Price – Premium = $16.70 – $3 = $13.70

3. Wait for the Market Reaction

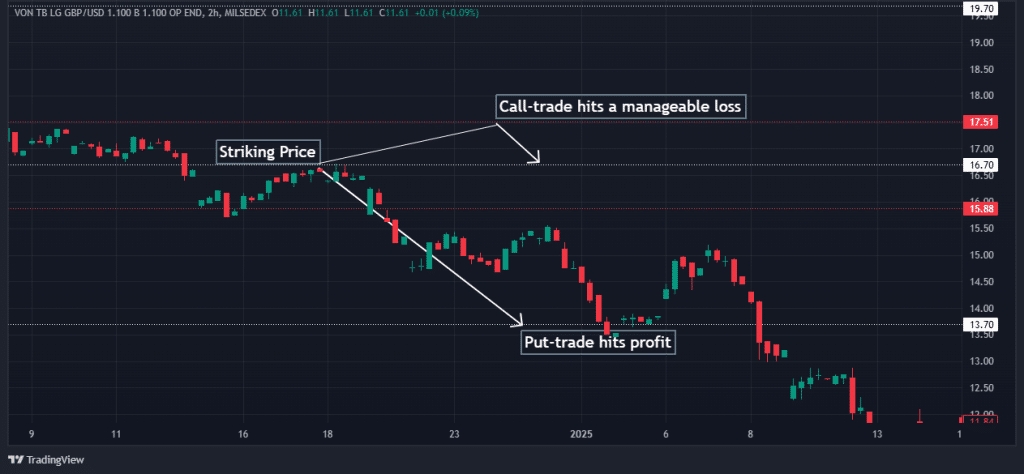

After the event, the stock price moves dramatically. Let’s say it drops to $12. Your put option gains substantial value, while the call option loses value but remains manageable by the call stop-loss.

4. Close the Trade

Sell the put option at its peak value. The profit from the put option surpasses the combined premium you paid, making the trade successful.

5. Alternative Outcome

If the price had jumped to $20 instead, your call option would have gained value. You’d sell the call option and achieve a similar profit.

The straddle strategy is versatile and adaptable across various markets, including stocks, forex, and cryptocurrencies. By following these steps, you position yourself to profit from market volatility while minimizing directional risk.

Interested in exploring other trading methods? Check out these Most Popular Trading Strategies for Every Trader.

Straddle Trading Strategy PDF Download

You can download our Straddle Options Strategy PDF file below and all the material needed to use it successfully.

Benefits and Limitations of the Straddle Trading Strategy

The straddle trading strategy is a powerful tool for traders seeking to capitalize on market volatility. However, like any strategy, it has its strengths and limitations. Understanding these can help determine whether it fits your trading goals and risk tolerance. Let’s dive into the pros and cons of the straddle options strategy to give you a complete picture.

Benefits of the Straddle Trading Strategy

The straddle strategy offers unique advantages, making it a popular choice for traders during uncertain market conditions. Here’s why:

- Profit from Volatility Without Predicting Direction: One of the biggest strengths of the straddle strategy is its ability to generate profits regardless of whether the market moves up or down. As long as there is sufficient volatility, you can benefit without needing to predict the direction of the move.

- Versatility Across Markets: This strategy works in various financial markets, including stocks, forex, and cryptocurrencies. Its flexibility allows traders to apply it to assets prone to significant price swings during specific events.

- Risk Mitigation in Uncertain Markets: The straddle reduces exposure to directional risk by hedging both sides of the price spectrum. Instead of betting on whether the market will go up or down, you prepare for either scenario, providing peace of mind during volatile periods.

- Potential for High Returns: The straddle can deliver substantial returns during extreme price movements. Events like earnings announcements, geopolitical developments, or unexpected news often create the perfect conditions for this strategy to shine.

Limitations of the Straddle Trading Strategy

While the straddle strategy has its strengths, it has challenges. Understanding these drawbacks can help you make informed trading decisions.

- High Upfront Costs: The combined premiums for the call and put options can be expensive, especially during periods of high implied volatility. This upfront cost creates a breakeven hurdle that the price movement must overcome before you start making a profit.

- Risk of Limited Movement: You may incur a loss if the price does not move significantly in either direction. Small or stagnant price changes can cause both options to lose value, leaving you with no opportunity to recover your premium.

- Time Decay Impact: Options lose value as they approach expiration due to time decay. This can erode the value of your positions, especially if the market takes too long to make a significant move.

- Complexity for Beginners: Managing a straddle requires understanding options trading, including calculating breakeven points and timing your exits. This complexity can be intimidating for novice traders.

You can decide if the straddle strategy aligns with your trading style and market outlook by weighing these pros and cons. While it offers exciting opportunities to profit from volatility, it requires careful planning and an awareness of its limitations.

To learn how to create a strategy tailored to your needs, read our Step-by-Step Guide on Developing a Trading Strategy.

Frequently Asked Questions About the Straddle Trading Strategy

The following are some of the most frequently asked questions about the Straddle Trading Strategy.

Is Straddle a Good Strategy?

The straddle Options strategy can be a good choice, but its effectiveness depends on the trader’s goals and the market conditions. It shines during periods of high volatility, where significant price movements are expected, but the direction is uncertain.

Traders who use the straddle strategy appreciate its versatility and ability to profit from market swings regardless of the direction. However, the strategy can be costly due to the high premiums for buying both a call and a put option, especially in volatile markets. To determine if it’s a good fit, consider your risk tolerance, ability to assess market volatility, and willingness to manage the associated costs.

Can You Make Money on Straddles?

Yes, you can make money on straddles, but success relies heavily on timing and volatility. The strategy is profitable when the underlying asset’s price moves far enough in either direction to exceed the total premiums paid for the options.

For example, large price swings can create lucrative opportunities for straddle traders during major events like earnings announcements or economic reports. However, small price movements or stagnant markets can result in losses, as neither option gains enough value to offset the premium cost. To maximize profitability, choosing assets with a high likelihood of volatility and exiting positions at the right time is crucial.

What is the 1% Straddle Strategy?

The 1% straddle strategy targets modest but consistent returns by trading on smaller, predictable price movements. Traders using this approach aim to profit when an asset’s price moves by at least 1% in either direction relative to the total premium paid for the call and put options.

This method requires careful selection of assets with a history of moderate volatility and low option premiums. While the gains per trade may be smaller than traditional straddle strategies, the 1% straddle strategy appeals to those looking for steadier and more frequent returns. It demands disciplined risk management and precise market analysis to identify opportunities that meet these criteria.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.