Key Points

- US NFP came in at 272,000, well above the 182,000 expected. However, the Unemployment Rate rose to 4.0%.

- The odds of a September rate cut are now near 50/50, according to the CME FedWatch Index.

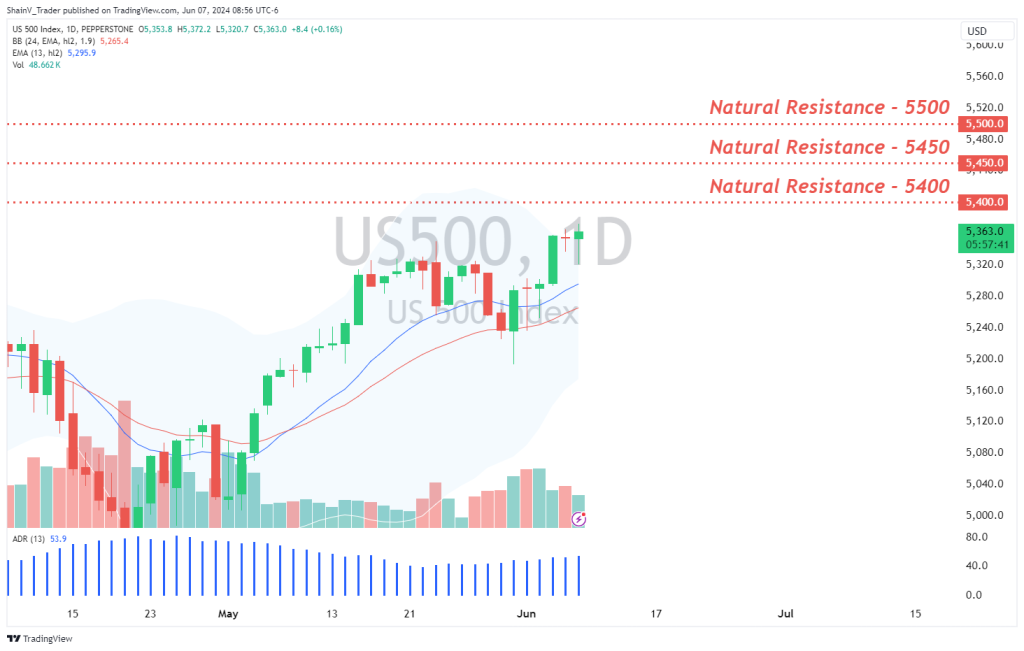

- Natural resistance is present at 5400, 5450, and 5500 for the US500. Daily pullback buys are an ideal way to join the trend.

Market Overview

The US Nonfarm Payrolls report for May is in. What is next? More uncertainty. At the moment, there is a voracious debate on Wall Street regarding interest rates. Some believe today’s NFP report will delay the estimated September rate cuts. Others say that unemployment rates will force the Fed’s hand. One thing is for sure — the S&P 500 is in the green as traders price their opinions.

NFP Shatters Expectations

During Friday’s pre-US cash open, US Nonfarm Payrolls (NFP) for May was released to the public. NFP came in at 272,000, well above the 182,000 expected. This figure is being lauded as a robust jobs number and evidence that the US economy remains robust.

However, the NFP report was not a complete trend buster. The US Unemployment Rate ticked higher to 4.0% from 3.9% previously. Also, Average Hourly Earnings rose to 0.4% from 0.2%, well above projections of 0.3%. Given this inflationary cycle, wage growth is certainly a welcomed sight to economists.

At press time, the bullish argument for this NFP release is winning the day. The USD Index has moved nearly 0.75% higher, illustrating dollar strength. Further, the CME FedWatch Index has relaxed its pricing of a ¼ point rate cut in September. The odds now stand at near 50/50.

US500 Technical Outlook

The US indices have rallied in the hours since NFP. For the US500, prices are in the green and near all-time highs.

Anytime a market is trending near all-time highs, finding relevant technicals is challenging. Often, big round numbers are the only thing traders can rely on. In the case of the US500, natural resistance is likely present at 5400, 5450, and 5500. Be on the lookout for short-term selling just below these levels.

Of course, it’s important to remember that the trend is our friend! Pullback buys from the Daily 38% and 62% retracements are also strong ways to trade the US500. To execute these trades, a valid daily swing high will have to set up either today or early next week.

Next week will be a big one on the financial markets. CPI, PPI, FOMC Announcements, and the Bank of Japan will headline the action. It will be a great time to trade nearly every asset class, including the S&P 500.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.