Key Points

- The ECB cut rates by ¼ point for the first time since 2019.

- Friday’s US NFP report will be a premier market driver for the EUR/USD.

- The EUR/USD has traded in a whipsaw fashion since the ECB release.

Market Overview

By nature, the EUR/USD is a rotational market. Trends, although they may be severe, are somewhat rare. That’s been the story today — huge fundamental events and whipsaw price action.

ECB Policy

For the first time since 2019, the European Central Bank (ECB) has cut interest rates. At 8:15 AM EST, the ECB announced that interest rates would be cut from 4.50% to 4.25%. The ¼ point rate cut was the first since the pre-COVID era and the second from a G7 nation in 24 hours. Wednesday, the Bank of Canada (BoC) lowered its interest rate by ¼ point.

The ECB summed up its position via this official statement:

“Based on an updated assessment of the inflation outlook, the dynamics of underlying inflation, and the strength of monetary policy transmission, it is now appropriate to moderate the degree of monetary policy restriction after nine months of holding rates steady.”

The ECB also raised its 2025 inflation forecast to 2.2% from 2%. However, the 2026 projections were held firm at 1.9%. Analysts estimate that the ECB will likely cut rates twice more this year.

Today’s rate cut from the ECB was widely expected by the markets. But, one has to wonder why. Inflation remains high; are the world’s central bankers preparing to slash rates to ward off recession? Possibly. We’ll learn more next Wednesday when J. Powell and the Fed take center stage.

US Non-Farm Payrolls (NFP)

The ECB is certainly a primary driver of the euro’s performance. However, if you’re trading the EUR/USD, US Non-Farm Payrolls (NFP) is poised to drive the market directional.

Friday’s US NFP report (8:30 AM EST) is being dubbed one of the biggest releases in recent memory. It will provide insights into the US labor market performance amid underperforming GDP.

Analysts expect NFP to grow to 186,000 from 175,000. US Unemployment is to remain unchanged at 3.9%. Traders will be watching this report closely for hints on the state of the US economy. If NFP misses to the downside, the calls for rate cuts will grow even louder; if it comes in above expectations, it will be business as usual.

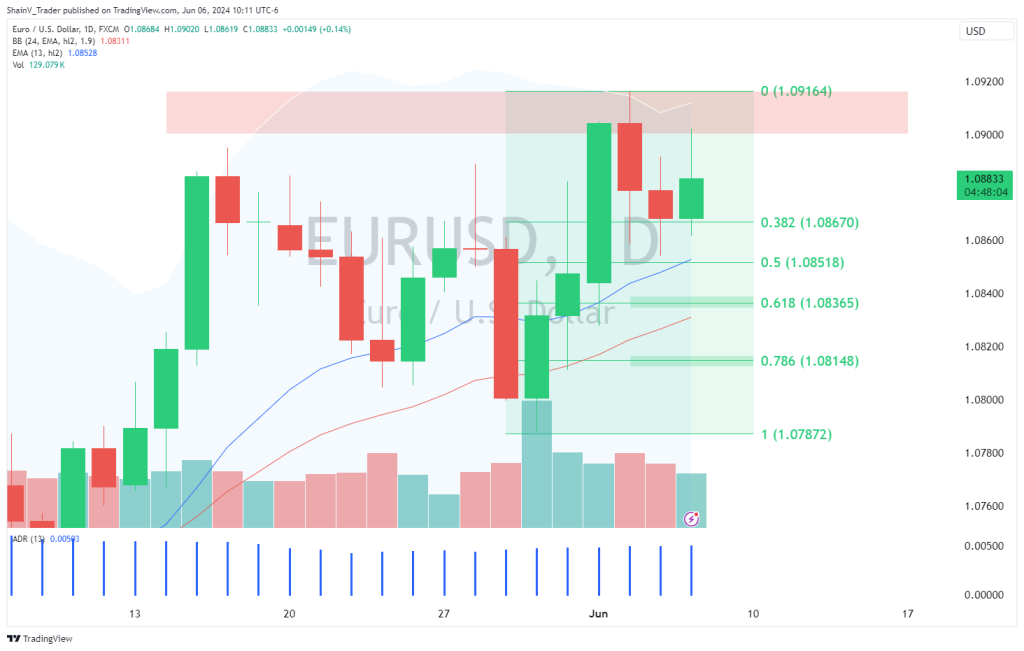

EUR/USD Technical Outlook

With under 24 hours until NFP, the EUR/USD market is tight. Today’s range is a modest 40 pips, with price up 0.12%.

Until the end of the week, there are a few key levels to watch for this pair. Pullback bids from the Daily 62% retracement (1.0836) and Daily 78% retracement (1.0814) are solid entries to the bull. It’s also worth noting that the EUR/USD has tested the 1.0900 – 1.0925 area several times and failed. This is an area of natural resistance.

The coming 18 hours will be huge for the EUR/USD. If you’re in this market, be sure to have your stops down and leverage in check ahead of Friday’s NFP report at 8:30 AM EST. Volatility will be heavy around this event; it will pay to have your risk exposure dialed in well ahead of time.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.