Corporate earnings impacted the DAX, with Bayer, Hannover Rueck, and Rheinmetall experiencing declines, while BMW and Delivery Hero saw modest gains.

Key Points

- The DAX 40 closed yesterday at 18,763.17, down 0.21%, reflecting cautious market sentiment ahead of key US inflation reports.

- Today, the DAX opened at 18,763.17 and fell to 18,736.71, continuing yesterday’s cautious trend.

- Key US inflation data and European economic indicators, including industrial production and the ZEW Economic Sentiment Index, are expected to influence market sentiment today.

DAX 40 Daily Price Analysis – 14/05/2024

The DAX 40 closed yesterday at 18,763.17, down from an opening price of 18,801.96, marking a 0.21% decline. The market exhibited a cautious sentiment amidst ongoing anticipation of key US inflation reports, which investors are closely watching for indications of the Federal Reserve’s next moves regarding interest rates.

Several corporate earnings reports and news also influenced the DAX’s performance. Notably, Bayer saw a 1.4% drop despite surpassing earnings expectations. Hannover Rueck experienced a sharper decline of almost 3%, and Rheinmetall tumbled around 6% following disappointing sales and earnings reports. Conversely, BMW recorded a 1% gain, and Delivery Hero’s shares surged over 20% following the announcement that Uber would acquire its foodpanda delivery business in Taiwan for $950 million in cash. Bayer also saw a 2% gain after reporting strong earnings.

Today, the DAX 40 opened at 18,763.17 and has edged down to 18,736.71, reflecting a modest decline of 0.15%. This morning’s movements reflect the market’s cautious stance, with investors processing mixed corporate earnings and awaiting significant economic data. The early trading hours indicate a continuation of the previous day’s cautious mood, with minor fluctuations as traders respond to ongoing corporate news and economic indicators.

Key Economic Data and News to Be Released Today

Today, key economic data releases, particularly the US inflation reports, are expected to play a crucial role in shaping market sentiment. These reports will provide critical insights into the inflationary pressures in the US economy, which could influence the Federal Reserve’s decisions on interest rates. A lower-than-expected inflation reading could bolster the DAX by easing fears of aggressive rate hikes, while a higher-than-expected reading could exert downward pressure.

Additionally, European economic indicators will be closely watched, including industrial production data and the ZEW Economic Sentiment Index. Positive data could support a recovery in the DAX, while negative surprises may add to the market’s cautious tone. Corporate earnings reports will continue to be a significant driver of individual stock movements, contributing to the overall market direction.

DAX 40 Technical Analysis – 14/05/2024

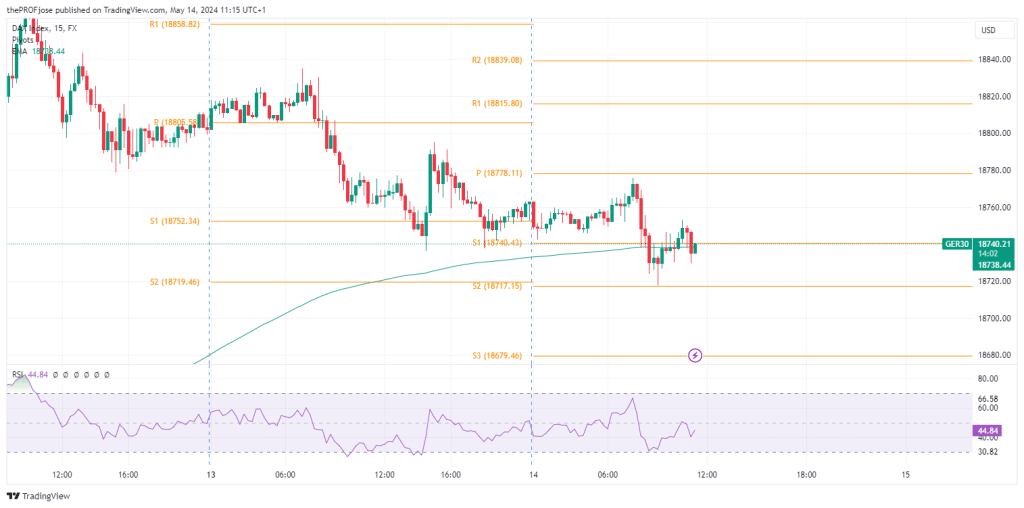

The DAX 40 is exhibiting overbought conditions on the higher timeframe, suggesting that a deeper pullback might be on the horizon. On the M15 chart, the RSI indicates overbought levels, increasing the likelihood of a short-term correction.

For traders considering short positions, it is advisable to watch for a convincing close below the low established earlier today. This would signal a potential entry point for a short trade, aligning with the expectation of a pullback until the RSI reaches oversold territory.

DAX 40 Fibonacci Key Price Levels – 14/05/2024

Short-term traders planning to invest in Dax 40 today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 18740.43 | 18815.80 |

| 18717.15 | 18839.08 |

| 18679.46 | 18876.76 |

Related Articles:

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.