Key Points

- Markets are to experience greater volatility this week.

- The data from the UK has been positive.

- Dollar reacts from key order block.

- GBPUSD to break out of range?

Key Events This Week

Last week can only be described as a pause week, with a lack of economic drivers in the calendar suppressing volatility in the forex world. Traders witnessed the most significant moves in Gold, which showed another wave of strength.

This week is all about US Inflation, due out on Wednesday. This is expected to drive most of the volatility, and many of the major FX pairs could break free from the ranges formed last week. The headline inflation figure has been creeping higher this year, and another higher print this week would put pressure on GBPUSD.

Positive UK News Surprises Traders

The data coming out of the UK has been unusually positive in recent weeks. Inflation has fallen to 3.2% from 4% this year, and last week’s Gross Domestic Product report saw the UK officially exit a recession. The month-on-month GDP figure surprised significantly to the upside at 0.4%, compared to a forecast of 0.1%. In an additional boost to UK economic prospects, the communication around interest rate cuts grows louder by the month. As a result, the FTSE100 has been surging, and the Pound has recovered from its lows against the US Dollar.

DXY Reacts From Key Order Block

The dollar’s performance has been relatively muted, but last week, it ticked slightly higher from the lows created towards the end of April. The price ran into a bearish order block at 105.740 and immediately retreated.

The price is hovering around a minor H4 order block, and we are now in critical times for the dollar. If the price breaks below this minor order block and below the low at 105, then there could be another wave of dollar weakness.

However, if inflation proves once again to be strong in the US, the price may break higher above the bearish order block and then move to 106.000, and the bulls will then be back in control.

GBP/USD To Break Out Of Range?

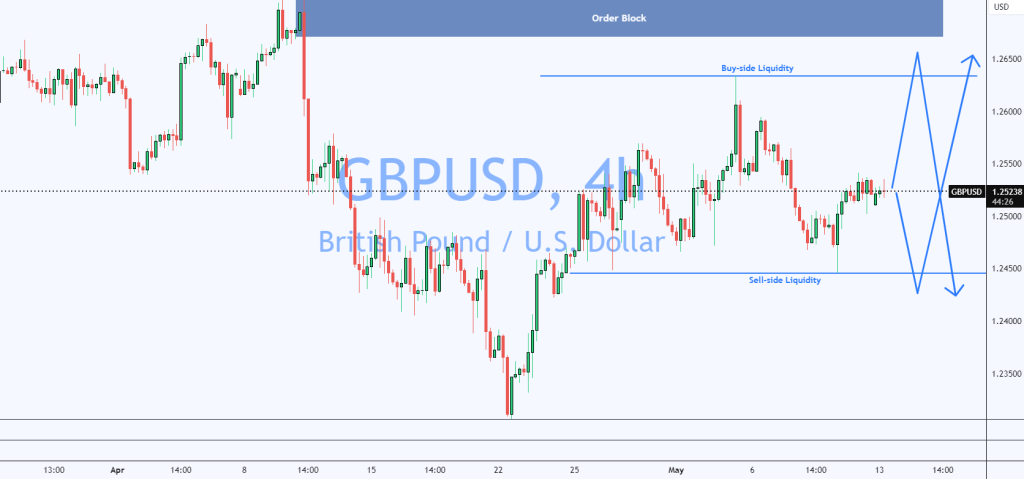

As for GBPUSD, the price is currently stuck between 1.24400 and 1.24600. Although there are plenty of pips to be made between the range, it may be wise not to trade this while it is stuck in the middle.

The high and low of this range represent buy-side and sell-side liquidity, respectively, and traders could wait for a fakeout of these levels to trade the price back to the middle of the range. However, should any of these structures break, this is likely to be the prominent factor in determining where GBPUSD is headed next. With a key order block at 1.26727, the bears remain in control overall.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.