The DAX 40 climbed about 1% in today’s morning session to reach 18,100, recovering from a slight decline the previous Friday.

Key Points

- Reduced Middle East tensions boosted market sentiment.

- ECB’s Simkus hinted at possible rate cuts starting mid-year.

- Adidas jumped 4% after an upgrade by Morgan Stanley.

DAX 40 Daily Price Analysis – 15/04/2024

The Frankfurt DAX 40 witnessed a notable rise in today’s trading session, climbing approximately 1% to reach the 18,100 level. This surge came after a somewhat subdued close on Friday, where the index dipped by 0.13%, closing at 17,930.32 from an opening of 17,965.95.

The improvement in investor sentiment on Monday can be attributed to geopolitical developments and anticipatory moves ahead of significant economic disclosures.

Over the weekend, easing tensions in the Middle East following Israel’s successful defense against an Iranian air assault buoyed market sentiments. The U.S. commitment to avoiding further escalation in the conflict has provided some relief to the markets, which had been shadowed by geopolitical concerns.

The VIX, often referred to as the “fear index,” has declined by 1.10%, signaling a decrease in market volatility and a potential stabilization of investor nerves. This reduction in the VIX indicates that despite the ongoing geopolitical concerns, investors might be feeling more confident about the current economic environment and less fearful of immediate market downturns.

In Europe, remarks from ECB policymaker Gediminas Simkus hinted at possible interest rate cuts in the coming months, injecting a sense of optimism. Simkus suggested a probability of more than 50% for multiple rate cuts this year, starting as soon as June and July. This news has likely contributed to the bullish sentiment in the DAX despite the index still grappling with an overarching bearish outlook.

Notably, individual stock movements have also influenced the index’s performance. Adidas, for instance, saw a significant jump of 4% after an upgrade by Morgan Stanley from “underweight” to “overweight,” making it a standout performer on Monday.

Key Economic Data and News to Be Released Today

In the absence of German-specific economic data releases today, investors will be closely monitoring the speeches from Federal Reserve officials for any indications of shifts in U.S. monetary policy, particularly in response to ongoing inflation concerns and the economic recovery pace.

Also, investors will closely monitor the US retail sales and manufacturing index data as these insights will be crucial for setting the tone in equity markets globally, including the DAX 40.

DAX 40 Technical Analysis – 15/04/2024

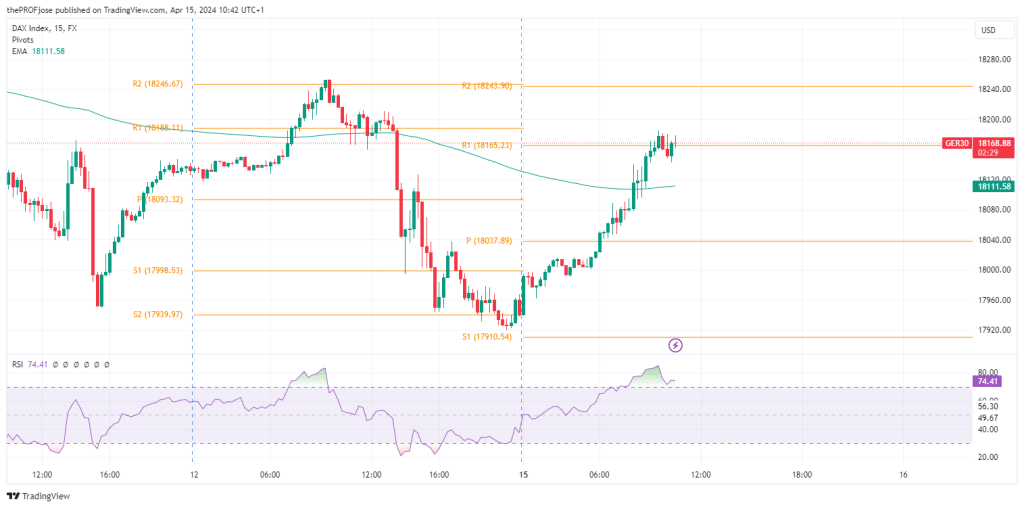

On the technical side, the Dax 40 had risen above the 200 EMA today, signifying a bullish sentiment. Following this hint, we may expect the price to keep breaking and closing above resistance levels while respecting support levels.

Although our short-term outlook is bullish, it’s important to note that the RSI suggests that the index is overbought, so we may be expecting a brief retracement. However, we may change our bullish outlook if the price closes below the S2 Support level.

DAX 40 Fibonacci Key Price Levels 15/04/2024

Short-term traders planning to invest in Dax 40 today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 17910.54 | 18165.23 |

| 17831.87 | 18243.90 |

| 17704.53 | 18371.25 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.