The USD sustained its rally against the JPY on Tuesday after the release of a higher-than-expected PPI report. The Greenback will have another opportunity to extend the gap with the release of the CPI data today. But later in the day, the JPY will have an opportunity to respond with key economic data of its own: the QoQ GDP.

Key Points

- The pair continues to rally after Tuesday’s PPI.

- The focus now shifts to the US CPI in the New York session, and the JPY’s GDP report is late in the day.

- The key levels for the price today are the 155.069 support and the 156.062 resistance.

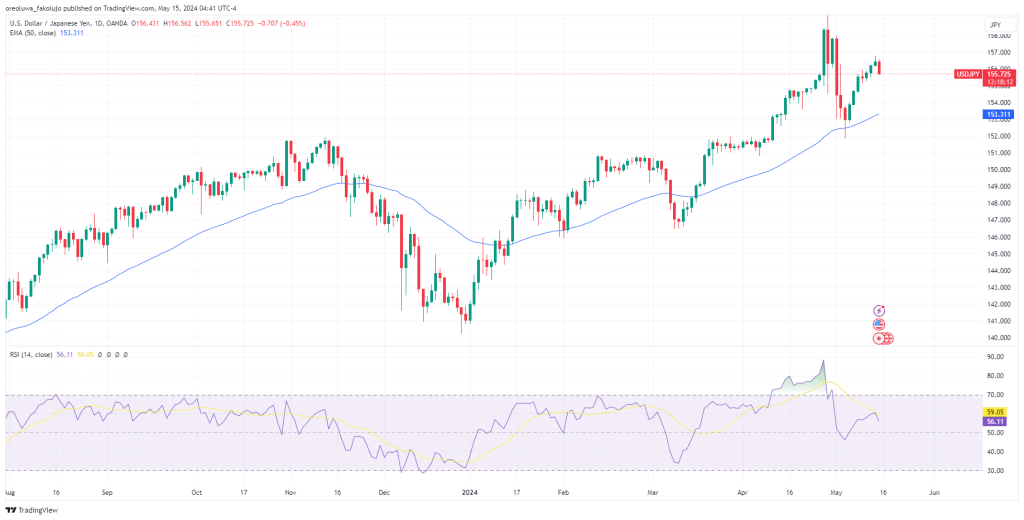

USD/JPY Daily Price Analysis – 15/05/2024

After Tuesday’s trading session, the Greenback recorded another win against the Japanese Yen, rising by 0.13% and bringing the recent rally up by a total of 2.25%. The JPY looks to be mounting some resistance in Wednesday’s Asian and London sessions, though, clawing back 0.44% as of the time of writing.

After the PPI result yesterday, the pair no longer needed the interest rate differential as a catalyst. The data came in at 0.5, higher than the forecasted 0.3. This higher-than-expected figure suggests that the Feds may keep the interest rate higher for longer.

The US CPI is set to be released today. Should we have another hotter than expected figure, this could sustain the rally even further. And if this happens, rumors about another BoJ intervention are bound to sprout.

The JPY will also have an opportunity to respond to the United States’s economic data onslaught with important economic data of its own: QoQ GDP. The Yen will be desperate for any signs of positiveness from this report to lend it some strength in its losing tussle against the Greenback.

According to the EMA and the RSI, the pair’s technical outlook remains bullish. The 50 EMA line sits far below the price, and the RSI rests solidly in the bullish half.

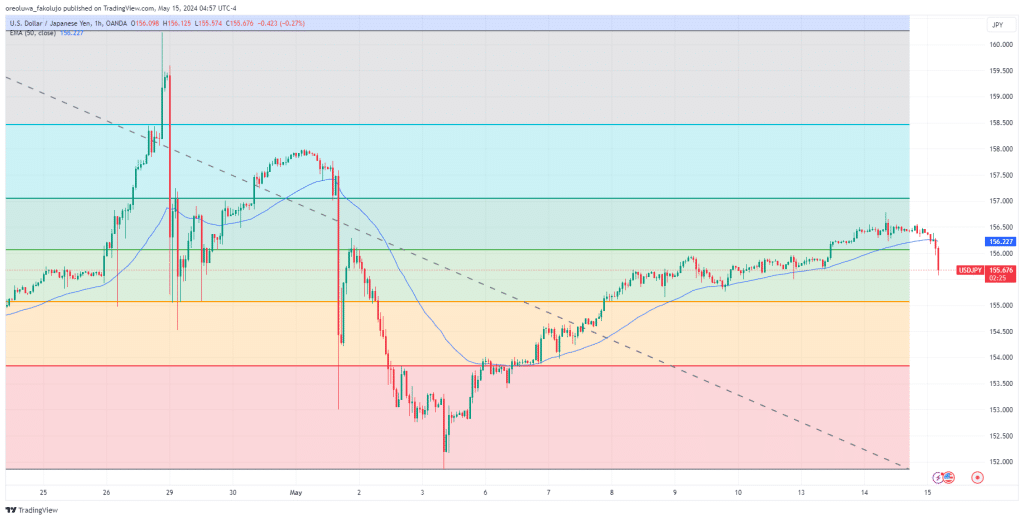

USD/JPY Intraday Technical Analysis – 15/05/2024

To measure the strength of the rally that has recently engulfed the pair, we draw the Fibonacci Retracement tool from the 160.23 swing high to the 151.85 swing low.

You’ll see the price has covered more than half of the distance from its last Monday low to the swing high with a close above the 0.5 (156.062) fib level on Tuesday. However, the JPY opened Wednesday’s session with all guns blazing, bringing the price back down below 0.5 (156.062) fib level and above the 0.382 (155.069) fib level. If this rally is to continue, yesterday’s 156.78 high must be challenged, followed by another challenge on the 0.618 (157.054) fib retracement level. Further above is the 0.786 (158.466) fib resistance level.

On the support side, the most immediate support is at the 0.382 (155.069) fib level. Should the JPY continue its show of strength, the price could fall further to 0.236 (153.842) before finally having a shot at the 151.858 swing low.

Key Economic Data and News to Be Released Today

First on the list is the United States CPI. A hotter-than-expected figure could improve the USD’s chances of sustaining the rally, as the Fed will be forced to keep interest rates higher for longer. However, late in the day, the Yen will have an opportunity to respond with the release of its GDP data. If this figure comes out strong, it may lend some strength to the JPY in its tussle against the dollar.

USD/JPY Key Fibonacci Price Levels – 15/05/2024

Based on the 1hr chart, the key Fibonacci price levels for USDJPY are these:

| Support | Resistance |

| 155.069 | 156.062 |

| 153.842 | 157.054 |

| 151.858 | 158.466 |

| 160.265 |

Related Articles:

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.