The Japanese Yen suffered a fifth consecutive losing day against the dollar on Tuesday as US Fed Chair Powell maintained a hawkish stance. Investors will look to the BoJ for any form of intervention.

Key Points

- The greenback maintains its edge over the Yen due to Fed Chir Powell’s hawkish stance.

- Investors will be looking to see what the BoJ does to cull this rally.

- The key levels for the pair are the 154.788 resistance and 154.451 support level.

USD/JPY Daily Price Analysis – 17/04/2024

The Greenback continued its five-day winning streak against the Japanese Yen after it gained another 0.3% on Tuesday.

The latest upward march of the Greenback against the Yen can be traced to Fed Chair Powell’s speech on Tuesday, in which he said the financial policies are likely to remain unchanged until the 2% rate target gets closer. Before then, the Retail Sales report released on Monday showed that consumer spending in the United States for the month of March was stronger than what it was the previous month. The market reacted in favor of the USD.

There were expectations that the Japanese central Bank would step in to cull any further decline of the JPY against the USD when the price hit 152. BoJ governor, emphasized that they were keeping close tabs on the price and were willing to do anything necessary to stop the decline. The pair currently trades above the 154 price level, but we’re yet to see much from the BoJ.

Additionally, the geopolitical unrest in the Middle East might cap the growth of the USD, as the United States has a higher stake in the situation than Japan does.

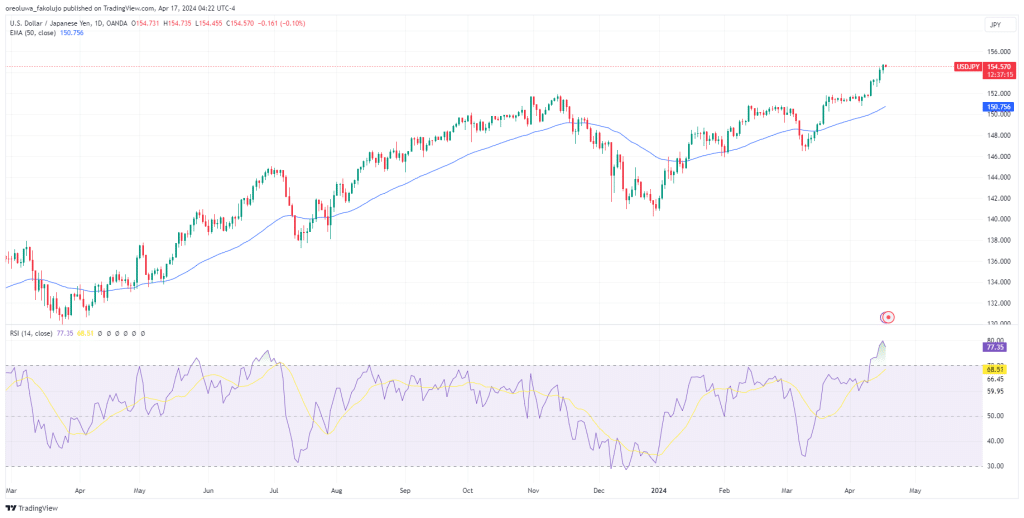

Technically, the RSI is so far up the bullish side of the range that it has edged into the overbought zone. And the 50-day EMA looks farther away from the price than it’s ever been since the price broke the line to the upside on the 15th of March.

USD/JPY Intraday Technical Analysis – 17/04/2024

The major USD/JPY pair continues to march into price levels it has not reached for over three decades. Bar any intervention from the BoJ, we might see a continuation of this rally as the price breaks past the 154.788 swing high and resistance level. Beyond that, the next notable daily resistance level is 155.792.

If we begin to see a pullback, though, the price may break below the immediate 154.451 support level before potentially falling to 153.803 and 153.323.

Key Economic Data and News to Be Released Today

A few notable members of the FOMC will have a thing or two to say today, and investors will be monitoring them closely. But even more closely, investors will watch BoJ member Noguchi speak later today to get insights into their reaction to the fall of their currency against the dollar.

USD/JPY Key Pivot Point Levels 17/04/2024

Based on the 1hr chart, the key pivot point levels for USDJPY are these:

- P: 152.757

- R1: 153.942

- S1: 152.127

- R2: 154.572

- S2: 150.942

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.